There’s a lot that goes into filing your small business tax return. You can’t just take a shot in the dark and hope for the best—you need to prepare, follow best practices, and keep good records year-round. And if you don’t, you could wind up making tax return errors.

We know you have a lot on your plate. That’s why we’ve compiled this list of the most common mistakes on tax returns that business owners make.

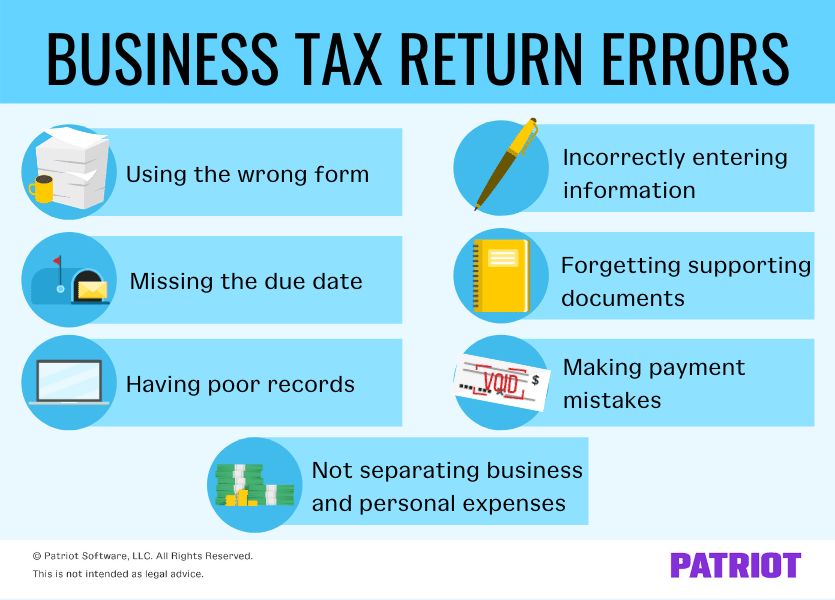

Common business tax return errors

Step one of not making a mistake is knowing what mistake not to make. Confusing way to put it? Yes. True? Yes.

Take a look at some of the most common tax filing mistakes to avoid.

1. Using the wrong tax form

Unlike the individual tax return, Form 1040, business tax return forms vary based on your legal structure.

Take a look at the tax return form you need to file based on your business structure:

- Sole proprietorships and single-member LLCs: Schedule C

- Partnerships and multi-member LLCs: Form 1065 and Schedule K-1

- Corporations and LLCs taxed as corporations: Form 1120

- S Corps: Form 1120-S

Start your tax return process on the right foot by using the right form.

2. Failing to file by the due date

One of the top tax return errors is filing your tax return late. And whenever something is late, you know there’s a penalty coming your way. Dun, dun, dun!

If you want to avoid this faux pas, keep your due date at the front of your mind. Set reminders, too, to help you remember.

Your business tax due date depends on the form you’re filing:

- March 15: Form 1065 and Schedule K-1; Form 1120-S

- April 15: Schedule C; Form 1120 (corporations that end the year on December 31)

- 15th day of the 4th month after the end of your tax year: Form 1120 (corporations whose tax year ends on a date other than December 31)

- 15th day of the 3rd month after the end of your tax year: Form 1120 (corporations whose fiscal year ends on June 30)

If you need more time, you can file a business tax extension. And if you don’t have enough money to pay your business taxes, you can apply for a payment arrangement with the IRS.

3. Not keeping records throughout the year

How do your books look throughout the year? A little sparse? If it’s been a few weeks (or months) since you’ve updated your accounting records, you may be guilty of this tax return mistake.

Not keeping records throughout the year can lead to some tax filing mistakes such as:

- Failing to report the accurate amount for your business income and/or expenses

- Incorrectly claiming business tax credits and deductions

Failing to update your accounting records throughout the year could cause you to estimate on your tax form. And unfortunately, estimating is never good when it comes to reporting your business’s income and expenses.

Consider signing up for basic accounting software to streamline the way you track your business’s money and avoid this costly tax return error.

4. Incorrectly entering information

When you’re writing or typing numbers and letters, you could accidentally misenter information. Or, maybe you’re using documents that have incorrect information. Whatever the case may be, incorrectly entering information is a top tax return error.

Here are some things you could misenter on your business tax return:

- Taxpayer identification number (e.g., EIN)

- Numbers

- Names

You could put the wrong number when writing in your taxpayer identification number. Or, you could make a transposition error when entering your business’s income or expenses (e.g., 18 vs. 81). And if you’re in a rush, you could misspell your business’s name.

To help you avoid this error, double and triple check your tax return. Compare it to your documents to make sure you’re pulling the correct information. And, compare your documents to other documents to ensure they’re right.

You might also consider asking an accountant for help to make sure your tax return information is pristine.

5. Forgetting to include supporting documents

Claiming tax credits or deductions? Don’t forget to attach the schedules and forms to prove you can claim them. For example, attach Form 8829 to Schedule C if you’re claiming the home office deduction.

Forgetting to include supporting documents could lead to the IRS second guessing your claims, which is why it’s oh-so important when filing your tax return.

And while we’re at it, let’s not forget another supporting document that could make all the difference between your paper tax return being on time and late: the all-important postage stamp. But of course, if you’re e-Filing, you can skip the stamp—and the entire process of mailing your tax return.

6. Making payment mistakes

Whether you’re mailing a check that isn’t fully filled out, underpaying estimated taxes, or sending the wrong amount to the IRS, the possibility of payment mistakes is out there.

Follow the IRS’s instructions for making estimated tax payments and filling out checks. Or, you can opt to use the IRS’s Electronic Federal Tax Payment System (EFTPS).

And, triple-check that the amount you’re sending to the IRS matches your tax payment liability.

7. Not separating business and personal expenses

The dreaded blob that is mixed business and personal expenses. In business, accurate recordkeeping is a must. And if you want that to be possible, you need to separate your personal expenses from your business expenses.

Otherwise, you could open the door to an IRS audit. And nobody wants that, right?

To make your separation of funds easier, open a business bank account and—you guessed it—only use it for business-related transactions.

Tracking information can be a pain. But, not doing it can be costly. Patriot’s accounting software makes it easier for you to track and manage your business’s money. All gain—without the pain. And with a free trial, what do you have to lose? Get started now!

This is not intended as legal advice; for more information, please click here.

Leave a Reply