This is a repeated theme I come back to time and again. Who are you listening to? Not who as in what is their intelligence level or what is their pedigree – who as in what are the incentives that drive their commentary? Are they investors answering to clients or just guys doing newsletters, with no skin in the game and no accountability for their extreme opinions?

If you don’t face investors who reap the rewards or consequences for the s*** you’re saying, you can say much more outrageous things and scare people for attention. But if you actually have to talk to clients and answer for performance, your opinions are likely to be more humble, restrained and realistic. Because there’s a cost attached to them.

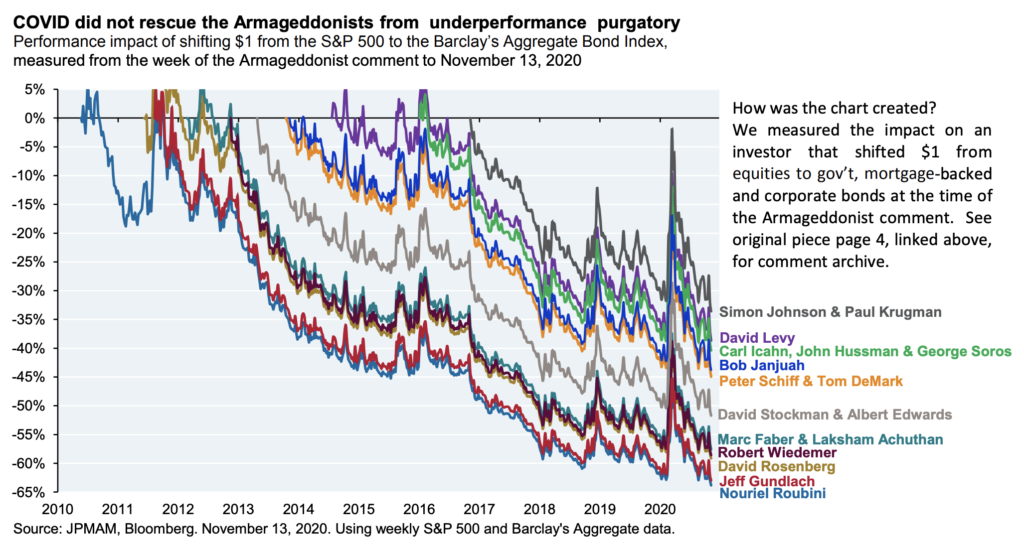

Here’s Michael Cembalest at JP Morgan yanking the trophy away from “the Armageddonists” who may have thought they’d be doing a victory lap after COVID-19 turned the world upside down earlier this year.

Nope. Stocks are back at all time highs and the penalties for having “gone to cash” over the last decade continue to pile up.

Talking people out of investing for their future because of this or that macro concern will always be a long-term loser, even if there are moments along the way where it looks temporarily smart. Everyone understands that there are potential drawdowns and negative developments that could occur. It doesn’t take talent to continuously harp on them. It takes talent to say “Yes, I understand these problems, but I’m going to push on through regardless.”

Smart people allocate assets, take appropriate risks and accept the uncertainty that comes along with the territory – they don’t twitch like squirrels every time someone snaps a twig in the forest.

Investing requires courage and the belief that, even if it takes awhile, things will work out and risk will be rewarded.

So I ask you again – Who are you listening to?

Source:

Thanksgiving Eye on the Market

JP Morgan – November 18th, 2020

Leave a Reply