As we head into the holiday season after a year unlike any other on record, it’s clear that small business performance will continue to feel the effects of COVID-19 for a long time to come.

In Melbourne, we’ve been lucky to return to some sense of normalcy recently, only to see a cluster emerge in South Australia, prompting a three-day lockdown. Around the world, we’ve unfortunately seen most of the UK go back into lockdown after a promising summer. While New Zealand continues to enjoy relative freedom, with mandated masks on public transport in Auckland and all domestic flights the only major constraints aside from border restrictions.

Looking ahead to our November Xero Small Business Insights (XSBI), it will be interesting to see the impact of the upcoming Christmas period on small business jobs and revenues. We have seen a global push towards ‘buying local’ which may positively impact these figures, however it’s wise to expect recovery to continue to be bumpy as small businesses adjust to the ‘new normal’.

Supporting small business over the holidays

It’s because of uncertainty around the ‘new normal’ that small businesses need our support now, perhaps more than ever. As we approach the holiday season, there are two key steps we can take to support small businesses.

The first is to keep small business front of mind as you prepare for the holidays. Whether it’s doing your grocery shopping at the local butcher and fruit and veggie shops, grabbing last minute supplies from your corner store, or buying gifts from an online boutique, thinking ‘small’ will have a huge impact on the livelihoods of these small business owners. It will ensure they’re able to keep employing staff, support their families, and contribute to the economy.

The second step is to ensure you have met your obligations to small businesses before the holiday shutdown period. Getting paid is one of the biggest struggles that small businesses face, and times are even tougher than usual at the moment. So, if you’ve been deferring paying a small business that has provided you with goods and services – whether it’s a fortnightly lawn mow, repairs to your car, a visit to the physio – please make it a priority to square up those bills before you close out the year.

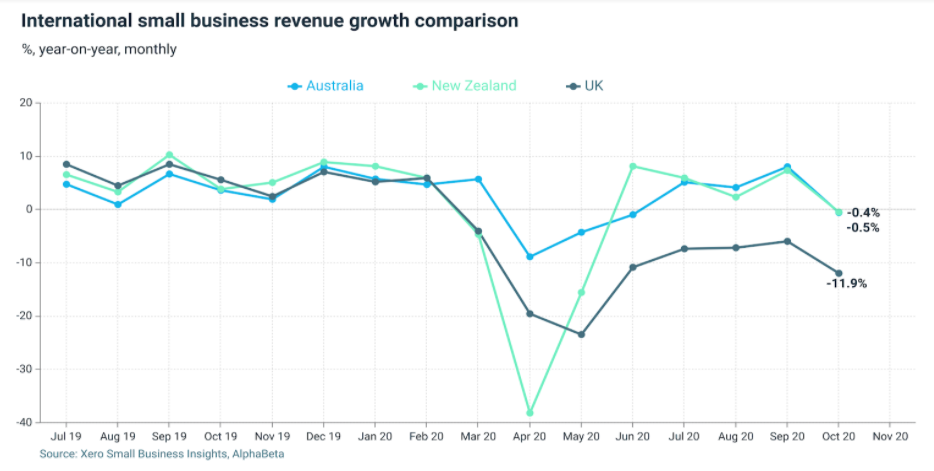

Our October XSBI metrics highlight the bumpy road small businesses are facing. We saw job gains across the board, despite wage subsidy transitions. However, revenues fell as government support was wound back and lockdowns returned in some areas.

Small business job numbers up in all three regions, despite wage subsidies easing

It’s somewhat surprising, and encouraging, to see that all three regions (Australia, New Zealand and the UK) recorded small job gains year-on-year (y/y). The fact that these gains were despite the ongoing transition to reduced wage subsidies is really positive – in New Zealand the wage subsidy was phased out completely and changes to Australia’s JobKeeper program means less businesses qualify. And after several wage subsidy announcements in the UK in October, small businesses have some certainty with the announcement on 5 November that the region would go back to an 80% wage replacement furlough until March 2021.

But revenues fell in all three regions

While it was good news for jobs, the news was less positive for revenues, with all three regions recording a y/y fall in revenue in October. But it’s not all doom and gloom – the fall is likely to be at least partly due to the ending or tapering of government stimulus packages as mentioned above. And on a positive note, the fact that revenues in Australia and New Zealand were essentially the same in October 2020 as October 2019 is really quite impressive given the size of the economic shock the initial lockdowns caused.

October’s key findings

In New Zealand, small business jobs rose 1.4% in October, slightly above where they were in early March 2020. Revenue was 0.4% lower than in October 2019, compared to a strong 7.4% (y/y) rise in September.

Australia recorded a 0.9% monthly rise in small business jobs. This continues the pattern of steady jobs recovery, after it recorded the largest fall in jobs (12%) of the three countries when the crisis hit. However, revenue fell 0.5% y/y after an extremely strong 8.1% y/y rise in September.

In the UK, small business jobs rose 1.3%. This result is only the second month of positive jobs growth since the initial national lockdown began in March. Revenue was 11.9% lower than October 2019 levels, after being down 5.9% (y/y) in September.

Read more about our monthly metrics for October in our XSBI updates:

Or, visit the XSBI page.

Leave a Reply