Do you file Forms 1099-MISC or 1099-NEC? If so, you might wind up mixing up the forms, entering incorrect information, or using a form from the wrong tax year. And if you make a mistake on either form, you may need to issue a corrected 1099.

“Mistake” is the last word you want to hear in business. But, it’s not the end of the world. Learn how to avoid 1099 mistakes and how to correct a 1099 if you make one.

What you need to know about 1099 forms

Forms 1099 are information returns that businesses use to report certain payments. There are two types of 1099 forms: Form 1099-MISC and Form 1099-NEC. Between 1982 – 2020, businesses used Form 1099-MISC for all 1099 reporting. But in 2020, the IRS revived Form 1099-NEC.

So, what’s the difference? And how can not knowing the difference lead to mistakes?

Form 1099-MISC, Miscellaneous Income, is for reporting certain payments made to 1099 vendors, like royalties and rent.

On the other hand, Form 1099-NEC, Nonemployee Compensation, is solely for reporting payments to independent contractors. This form works similarly to Form W-2. Independent contractors can use Form 1099-NEC to get the necessary information to file their personal tax returns.

Who gets Forms 1099-MISC and NEC?

There are several copies of Forms 1099 you need to handle. Both Form 1099-MISC and 1099-NEC have five copies, each going to the same parties. Send the copies as follows:

- Copy A: IRS

- Copy 1: State tax department (if applicable)

- Copy B: Contractor / Vendor

- Copy 2: Contractor / Vendor

- Copy C: Your records

When you file Forms 1099-MISC or 1099-NEC with the IRS, you must also send Form 1096, Annual Summary and Transmittal of U.S. Information Return. There is only one 1096. Form 1096 has a section where you must mark the type of form being filled.

If you’re sending both Form 1099-MISC and Form 1099-NEC, you need two separate Forms 1096 (one to accompany each form).

Common 1099 errors that require a 1099 correction

First and foremost, you only need to issue a corrected 1099 to the IRS if you already submitted an incorrect form to the IRS. Otherwise, you can simply void it (which we’ll get to later). And, don’t send corrected returns to the IRS if you are only correcting state or local information.

So, what are some of the errors that require an amended 1099? You need to know how to file a corrected 1099 if you make one of the following mistakes:

- Use the wrong type of return form (e.g., a Form 1099-MISC when you should have used Form 1099-NEC)

- Enter incorrect money amounts or codes

- Mark the wrong checkbox

- File a return when you shouldn’t have

- Make a mistake with the payee’s taxpayer identification number (TIN) or name

Keep in mind that there are other errors that can lead to penalties, but don’t require you to file a corrected Form 1099, such as failing to file by the deadline.

As far as a corrected 1099 deadline, the IRS doesn’t set a hard date. According to the IRS, you should generally submit corrected returns for returns filed within the last three calendar years.

What if you make a mistake entering your name, TIN, or both?

If you made a mistake in reporting your name, TIN, or both, you do not need to file a corrected 1099. This applies to both paper and electronic corrections.

Instead, write a letter to the IRS. Include your:

- Name and address

- Type of error

- Tax year

- TIN

- Transmitter Control Code

- Type of return

- Number of payees

- Filing method

- Whether federal income tax was withheld

Mail the letter to:

Internal Revenue Service

Information Returns Branch

230 Murall Drive, Mail Stop 4360

Kearneysville, WV 25430

How to issue a corrected 1099 (paper)

Unlike Form W-2’s correction form, Form W-2c, there is not a separate 1099 correction form. The 1099 correction form is the same as the original form.

You must use a regular copy of Form 1099 (either NEC or MISC) and mark the box next to “CORRECTED” at the top.

Send corrected Forms 1099 to the IRS, contractor or vendor, and state agencies (if applicable). And, be ready to file a corrected Form 1096 to accompany the return you’re correcting. Do not include a copy of the original return you filed incorrectly.

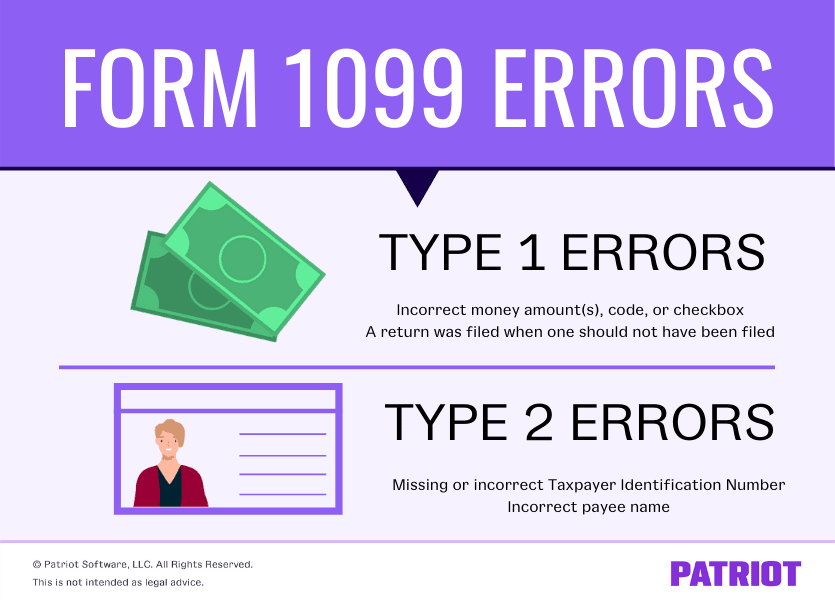

How you issue a 1099 correction depends on the type of error. The IRS splits errors into two categories, Type 1 and Type 2.

Type 1 Errors

If your original form has an incorrect money amount, code, or checkbox, or if you filed a return when you should not have filed it, you made a Type 1 Error.

To correct a Type 1 Error, you must:

- Prepare a new Form 1099

- Enter an X in the “CORRECTED” box

- Include the correct information (money amount, code, or checkbox). Report other information like you did in the original return

- Prepare a new Form 1096 with corrected information (to send with Copy A to the IRS)

- Mail the corrected Form 1099 to the independent contractor or vendor, IRS, and any required state tax departments

Type 2 Errors

Type 2 Errors occur when taxpayer identification numbers are missing or incorrect, or when the payee’s name is incorrect.

You need to do the following to correct a Type 2 Error. Type 2 Errors are broken down into two steps.

Step 1: Identify the incorrect return submitted:

- Prepare a new Form 1099

- Enter an X in the “CORRECTED” box

- Enter the payer, recipient, and account number information exactly as it appeared on the original incorrect return

- Enter “0” for all money amounts

Step 2: Report the correct information:

- Prepare a new information return

- Do not enter an X in the “CORRECTED” box

- Include all the correct information

- Prepare a new Form 1096 with corrected information (to send with Copy A to the IRS)

- Include one of the following phrases in the bottom margin of Form 1096: “Filed To Correct TIN,” “Filed To Correct Name,” or “Filed To Correct Return”

- Mail the corrected Form 1099 to the independent contractor or vendor, IRS, and any required state tax departments

How to file corrected 1099 online

If you have 250 or more 1099s you need to correct, you must file the corrected forms electronically.

Like paper returns, there are two types of errors. When filing electronically, these are known as One-transaction Correction and Two-transaction Correction errors.

Keep in mind that your electronic correction process may vary if you use software, so be sure to consult your provider for more information.

For help correcting returns electronically according to the IRS’s FIRE (Filing Information Returns Electronically) process, view Publication 1220.

How to void 1099 (and when you should)

If you have mistakes on a completed or partially completed 1099 and haven’t submitted it to the IRS, you can void it. To void a 1099, enter an “X” in the “VOID” box, which is next to the “CORRECTED” box.

So, why would you want to void a 1099? Voiding lets you cancel out a form that is printed on the same sheet of paper as other forms (without having to redo everything).

When you void something, the IRS disregards it. Simply start a new form with the correct information to make up for the voided one. Do not put an “X” in the “CORRECTED” box.

We get it—the last thing you want to do is pour time into creating Forms 1099 … only to have to redo them. Why not simplify your responsibilities? Patriot’s online accounting software makes it easy to create and print unlimited Forms 1099 and 1096. Get your free trial now!

This article has been updated from its original publication date of 1/8/2013.

This is not intended as legal advice; for more information, please click here.

Leave a Reply