In business, you must keep records of your transactions in your books. Your accounting books provide a place for you to review your business’s income and expenses and see where you stand financially. By keeping your books organized and up-to-date, you can take control of your finances and make smart business decisions. But before you can do any of that, you need to learn how to set up accounting books for small business.

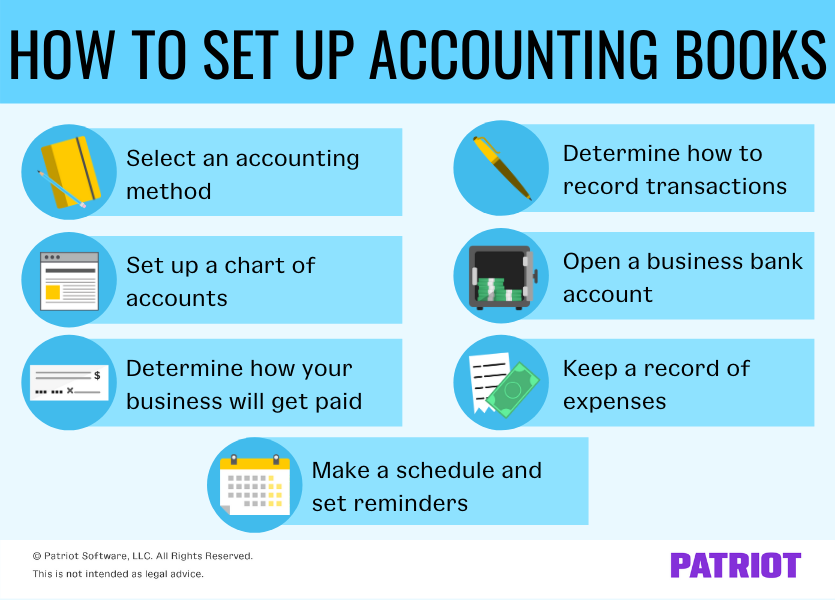

How to set up accounting books for small business: 7 steps

The thought of recording all of your business transactions may seem daunting. But, recording transactions doesn’t have to be a difficult task. The more you prepare your books, the easier recordkeeping will be.

To help ensure your recordkeeping goes smoothly and your books are in shipshape, follow these seven steps for setting up accounting books for small business.

1. Select an accounting method

First order of business when setting up your books is to choose an accounting method. Here are the accounting methods you can choose from:

- Cash-basis: Least difficult accounting method

- Accrual: Most difficult accounting method

- Modified cash-basis: Mixture of cash-basis and accrual

Cash-basis accounting does not require extensive accounting knowledge. With this method, record the transaction when money changes hands. That means you record income when you receive payment. The cash-basis method only uses cash accounts (e.g., expense, income, etc.).

Accrual accounting requires the most accounting knowledge and is more time consuming for small business owners. With accrual, you must record income when your transaction takes place, with or without the transfer of money. And, record expenses when you’re billed. The accrual method uses more advanced accounts and allows you to record long-term liabilities.

Modified cash-basis, or hybrid accounting, is a mixture of accrual and cash-basis accounting. Like the cash-basis method, you record income when you receive it, and record an expense when you make a payment. Modified cash-basis accounting uses both cash and accrual accounts.

2. Determine how you will record transactions

How do you plan on recording transactions in your books? Maybe you’re considering:

- Recording transactions by hand (e.g., spreadsheet)

- Hiring an accountant

- Using accounting software

Manually recording transactions by hand is the most time-consuming option for recording transactions. However, it is the cheapest solution for small business owners. When you record transactions by hand, manually account for each transaction and calculate totals.

Hiring an accountant frees you from managing your own books and making common accounting errors. It is the least time-consuming option but also the most expensive. If you hire an accountant, they will compile financial statements and calculate totals for you.

Accounting software is the best of both worlds when it comes to difficulty and cost. Accounting software is a good option if you want to streamline accounting processes and save time without having to pay the price of having an accountant do everything for you. Not to mention, you don’t have to worry about calculating totals yourself since the software handles it for you.

3. Set up a chart of accounts

Your chart of accounts, or COA, lists all of the accounts in your financial statements and breaks your money down into certain categories. A COA shows you all of the money going into your business as well as all of the money going out.

Your chart of accounts consists of these five sections:

- Assets

- Liabilities

- Equity

- Revenues

- Expenses

To break down accounts even further, you can use sub-accounts (e.g., Product Sales) to organize transactions. As your business grows, you can add other sub-accounts to your COA.

4. Open a business bank account

Mixing personal and business funds is a huge no-no. To steer clear of accounting blunders, inaccurate tax filings, and overspending, open a separate bank account for business.

Opening a business bank account not only helps you keep your records organized, but it also can create a clear audit trail for your company.

To open a business bank account, you typically need the following information:

- Social Security number

- Employer Identification Number (EIN)

- Business name

- Business license

- Organizing documents (e.g., articles of organization)

Check with your banking institution to find out what documentation you need to provide to open a business bank account.

5. Determine how your business will get paid

Your business can’t grow if your customers don’t pay you. To ensure you get paid for your products or services, establish a clear customer payment policy.

Determine what kinds of payments you will accept from your customers. This may include:

If you sell to customers on credit, you’ll need to send out invoices at a later date after providing your goods or services. And, determine invoice payment terms, such as forms of acceptable payment, when payments are due, where to send the payment, and late fees.

6. Keep a record of expenses

Tracking expenses is a crucial part of accounting. It helps you keep your books in order. Plus, you’ll thank yourself for keeping track of expenses come tax time.

When keeping a record of your expenses, be sure to hang onto the following:

- Receipts

- Bank and credit card statements

- Invoices

- Bills

- Canceled checks

- Proof of payments

- Previous tax returns

- Forms W-2, 1099-MISC, and 1099-NEC

The more documentation you keep in your records, the better off your business and books will be.

7. Make a schedule and set reminders

The last thing you want to do is put off recording transactions in your books. Letting transactions pile up can lead to disorganized records, mistakes, and a whole lot of unnecessary stress.

To simplify your bookkeeping responsibilities, create and stick to a schedule or accounting cycle. Your schedule begins with your starting account balances and ends when you close your books.

Write out the steps to your schedule or cycle and set time aside each week, month, etc. to go through them and update your records. To take things a step further, consider setting reminders for yourself so you know when you need to go through your cycle and update your books.

Tips for keeping your books organized

If you want your business accounting books to be accurate, keep them organized and up-to-date.

Not the most organized person? No worries. Use these tips to keep your books in tip-top shape:

- Have a basic understanding of accounting before recording transactions in your books

- Take advantage of accounting software to streamline processes

- Keep business and personal finances separate

- Track all transactions as soon as possible or on a regular basis (e.g., once per week)

- Find a way to organize accounting receipts and other documents

- Review your books often to stay up-to-date on finances

- Don’t put off recording transactions to the last minute

Do you dread the thought of having to set up your business books? If so, we have a great solution for you. Patriot’s online accounting makes it a breeze to get your company’s books up and running. Streamline the way you record your transactions by starting a free trial of Patriot’s accounting software today!

This article has been updated from its original publication date of February 14, 2017.

This is not intended as legal advice; for more information, please click here.

Leave a Reply