Potential Multibagger Stocks – 2020 year was a year of rise and fall for the stock market investors. In march 2020 Sensex has crashed and touched 25918 level due to COVID-19 pandemic. From that level Sensex skyrocketed and touched 46960. This means Sensex bounced back and gained 82% in the 9 months of a short interval.

Despite of high volatility due to COVID-19 pandemic, Sensex was able to recover faster due to several positive news such as economic recovery, stimulus announcement, and vaccine news. Perhaps this is the best performance of Sensex in history. Of course, this year was the year of Multibaggers. Many stocks turned out as multibagger stocks. Here is a list of Multibagger Stocks of 2020 & Potential Multibagger stocks of 2021.

Multibagger Stocks

Multibagger stocks are stocks that give returns multiple times higher compared to their purchase cost. If the stock value (price) on which stock is purchased is doubled is called one bagger stocks.

The term multibagger was first coined by Peter Lynch in his book “One Up on Wall Street”.

Let’s try to understand this concept by practical example. The stock of MRF was trading at a value of Rs.38000 in December 2014. In December 2020, the stock of MRF is sold at Rs.76000. This means the stock of MRF has given 100% return (1 Bagger stock) in six years.

Mulibagger stocks are stocks of the company with high growth potential, scalable business model, sound management, strong market presence, and demand in the market.

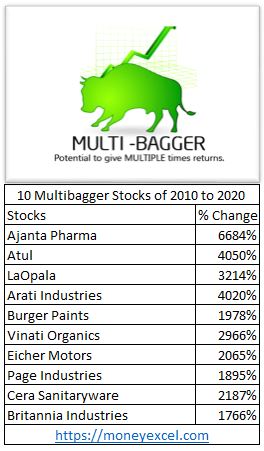

10 Multibagger Stocks of 2010 to 2020

Here is a list of 10 Multibagger Stocks of 2010 to 2020

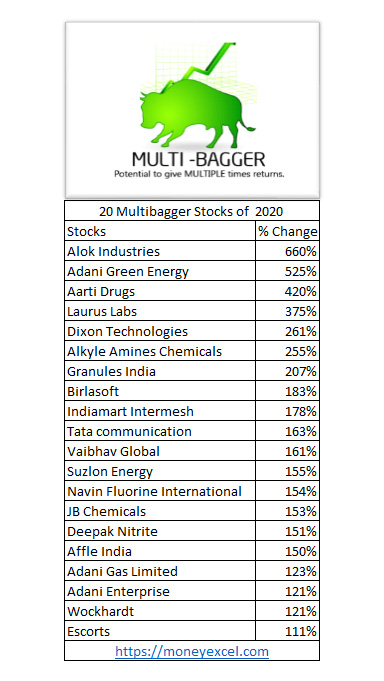

20 Multibagger Stocks of 2020

The list of 20 Multibagger stocks of 2020 is given below.

How to find Potential Multibagger Stocks?

How to find Potential Multibagger Stocks?

I have analyzed multiple stocks and conclude that Multibagger stocks have usually had the following characteristics.

- The strong and scalable business model with very good financials.

- Strong Cashflow, low debt and short cycle of receivable.

- High profitability due to unique or monopoly products

- High earning growth rate

- Strong market presence and market demand

To find out stocks with the above characteristic you need to do the analysis of stocks by making use of market capitalization and financial ratios.

Also Read – Multibagger Stocks of Rakesh Jhunjhunwala in 2020-21

Return on Equity – Return on equity is used for comparing company performance. ROE indicates the capability of the management to generate income from available equity. ROE from 15-20% is considered as good.

Free Cash Flow – Free Cash Flow means cash left after deducting operating expense and capital expenditure.

Debt to Equity Ratio – Debt to equity is company total liability by shareholder equity. This ratio is used to find out finance leverage of the company. Debt to equity ratio should be less than 1.

Interest Coverage – Interest coverage ratio means how many times company can cover its current interest payment with available earnings.

Sales Growth – Sales growth means growth in the sales by the company. This parameter is used to compare sales growth quarter to quarter.

Profit Growth – Profit growth means a combination of profit and growth. It is important to check the profitability and growth of the company while evaluating.

Now, in order to find out stocks that are fitting with above characteristics and financial ratio, I made use of the screener (Stock screener website).

This screener website provides the facility to screen stock by writing a customized query. I have made the following query to identify potential multibagger stocks. You can customize this query and get your result with a click of a button.

Market Capitalization > 200 AND Return on equity > 20 AND Free cash flow 5years > 0 AND Free cash flow 10years > 0 AND Debt to equity < 1 AND Interest Coverage Ratio > 3.5 AND Return over 1year > 0 AND Return over 5years >10 AND Promoter holding >35 AND Sales growth 10Years > 7.5 AND Sales growth 5Years > 7.5 AND Profit growth 10Years >15 AND Profit growth 5Years >17.5 AND Profit growth 3Years >10 AND Profit growth >0

Based on above query potential multibagger stocks of 2021-22 are given in the image below.

Potential Multibagger Stocks of 2021-22

Over to you

In this post, I have shared my method to identify potential multibagger stocks including stocks detail. You should not consider this financial advice for investment. Please do your own research to find out stock for investment. If required take help from the stock market expert.

Which method did you use for finding potential multibagger stocks?

Do you think the above stocks will generate good returns for the investors in the future?

If you like this post, do share it with your friends and relatives on Facebook and WhatsApp.

Leave a Reply