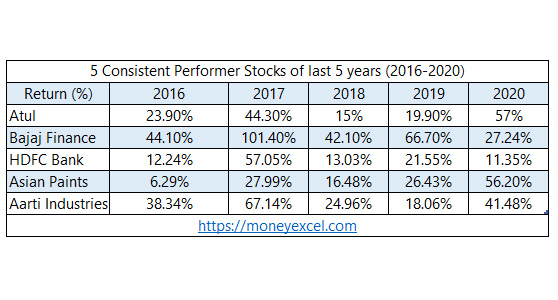

Stocks that are consistently performing and giving good returns are known as consistent performer stocks. These stocks give positive returns to investor every year. In the other word these stocks are bullet proof stocks that protects your portfolio from ups and downs.

As we know that stock market goes through various phases expansion, peak, recession and recovery. Almost every stock gets affected with stock market cycle. However, few stocks are non-cyclical. They are least impacted and likely to give positive returns to investors. As per me, these stocks are consistent performer stocks.

You should keep consistent performer stocks in your portfolio. If you are looking for consistent performer stocks, your search ends here. In this post, I will share 5 consistent performer stocks of past 5 years (20215-2020). In order to find out these type of stocks, I have analyzed past performance of various stocks from BSE. So, let’s take a look at 5 Consistent Performer stocks from 2015 to 2020.

5 Consistent Performer Stocks of 5 Years (2015-2020)

#1 Atul

Atul is one of the largest chemical companies of India. Atul has wide product range in aromatics, chemical, pharmaceutical and polymer. Atul has local as well as global present. The stock of Atul is consistently giving positive returns since last five years. In the last year 2020-21 (Jan 2020 to Dec 2020) this stock has delivered 57% returns to the investors.

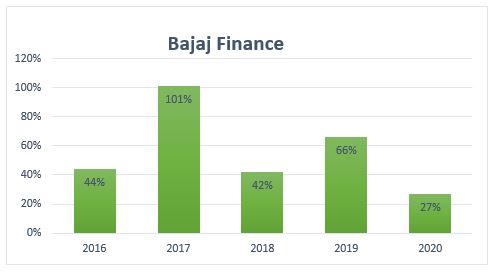

#2 Bajaj Finance

Bajaj Finance is financial service company instrumental in lending, asset management, wealth management and insurance. Bajaj Finance also offers personal loan, loan against securities etc. The company has delivered good profit growth of 42.44% over last 5 years. In last five years the stock of Bajaj Finance has consistently given positive returns. Every year this stock is delivering returns in two digits. In the year 2020-21 (Jan 2020 to Dec 2020) this stock has delivered 27.24% returns to the investors.

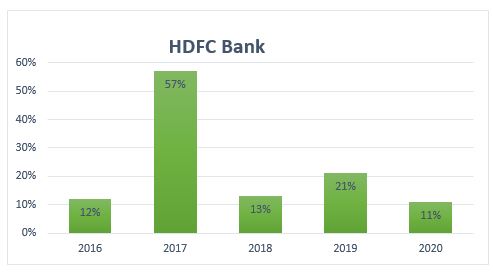

#3 HDFC Bank

HDFC Bank is one of my favorite stock. HDFC Bank is leading private sector bank that offers financial services to lot of customers. HDFC is growing consistently and delivering good returns to the investors. It is largest bank in India as per market capitalization. In 2020-21 (Jan 2020 to Dec 2020) HDFC Bank has delivered 11.34% returns for the investors.

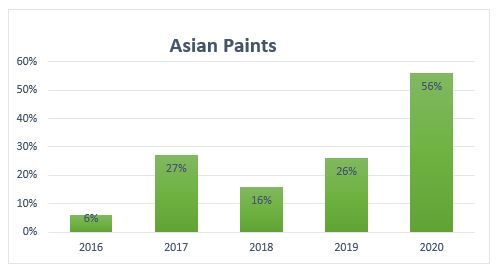

#4 Asian Paints

Asian Paints is engaged in the Business of Manufacture of paints, varnishes, enamels or lacquers, Manufacture of surfacing preparations; organic composite solvents and thinners, and other related product. Asian Paints has the highest market share in terms of paints and coating all over India. Company is debt free. Revenue and profit of the company are increasing YOY. The company has given consistent positive returns to the investors in last five years.

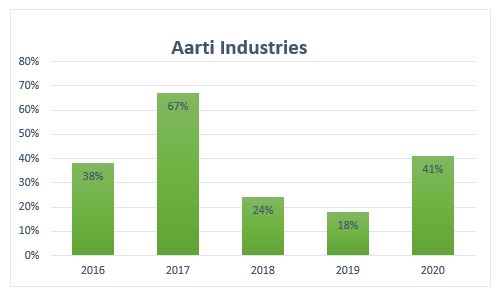

#5 Aarti Industries

Aarti Industries is engaged in manufacturing and dealing in Speciality Chemicals, Pharmaceuticals and Home & Personal Care intermediates. Aarti Industries supplies product to domestic as well as international market. They have very good R&D facilities. Company has delivered good profit growth over last 5 years. In the last year 2020-21 (Jan 2020 to Dec 2020) this stock has delivered 41% returns to the investors.

Over to you –

Do you think above stocks will deliver good returns in the future?

Which method do you use to identify the best stock for the investment?

Do share your views in the comment section given below.

Leave a Reply