The private equity investors fueling record consolidation in wealth management are seeking out firms at the industry’s intersection with related professional services.

In separate deals announced on consecutive days this week, PE-backed buyers respectively purchased Truist Financial’s $10-billion 401(k) plan advisory business and a wealth management and tax consulting practice with $3.29 billion in assets under management.

OneDigital — a health, wealth and human resources firm that made its first major deal in the sector last year by acquiring a massive hybrid RIA — bought the Truist book on Dec. 31, according to the firms. The parties didn’t disclose the terms of the transaction.

In the other deal, RIA consolidator Captrust bought MRA Associates, a fee-only firm with 59 advisors and other staff members. The sale closed in November, according to Captrust, which received its first PE infusion when GTCR bought a 25% stake at a $1.3-billion valuation in June.

Captrust’s 44th deal since 2006 will enable the firm’s 330 institutional and wealth advisors to offer new tax services for income and estate planning. For Atlanta-based OneDigital, which is majority owned by New Mountain Capital, its earlier purchase of Resources Investment Advisors opened the way for potential wealth management business in the Truist book.

“We see those [plan] participants really wanting advice, and primarily they want advice through their employer,” says Vince Morris, president of the newly named OneDigital Investment Advisors. “The employer offers this benefit, but ultimately it’s for the benefit of the employee, so how do we engage the employee in a holistic fashion?”

Truist’s 401(k) investment advisory relationships span 1,200 plans with 200,000 participants, adding to Investment Advisors’ $74 billion in assets under administration and $4 billion in wealth management AUM among 228 advisors. OneDigital completed 37 acquisitions in 2020.

Captrust has more than $50 billion in AUM and $409 billion in assets under advisement. Its latest pickup is a 29-year-old practice with locations in Phoenix, Las Vegas and Wayzata, Minnesota. Besides CEO Mark Feldman, the executive leadership team consists of managing partners Brad Lemon, Christina Burroughs and Mike Hirte.

“Over the years, we’ve seen a number of RIAs with tax practices that consisted only of a single employee who did returns seasonally,” Rush Benton, Captrust’s senior director of strategic growth, said in a statement. Benton praised the “sophistication” of MRA’s tax services and “their ability to integrate their tax planning into their holistic wealth management process.”

Regional bank Truist found three suitors eager to find integrations with its institutional retirement business. BB&T and SunTrust merged to form Truist in December 2019. In addition to the OneDigital deal, Ascensus is buying the former BB&T 401(k) recordkeeping business and Empower Retirement is purchasing the legacy SunTrust 401(k) recordkeeping book.

“The institutional 401(k) industry has experienced significant consolidation, and Ascensus, Empower and OneDigital are well-positioned to provide scale and expertise for our plan sponsor clients and their plan participants,” Joe Thompson, Truist’s head of wealth, said in a statement.

Retirement plan consolidation and minority investments by PE firms accelerated in 2020 through deals like GTCR’s growth investment in Captrust, according to data from investment bank and consulting firm Echelon Partners. Insurer-owned Empower purchased businesses with $180 billion in AUM through deals with MassMutual, Personal Capital and Fifth Third Bank.

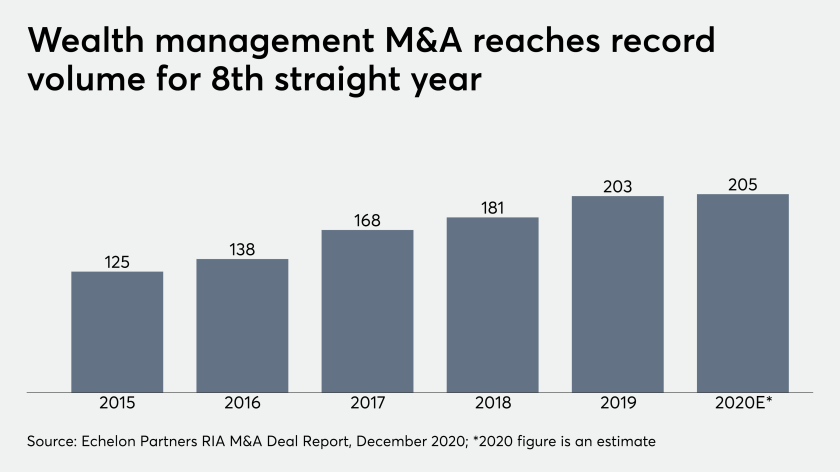

Despite M&A slowing in the first two quarters of 2020 to a pace that would have marked a four-year low had it continued, the last two quarters clocked in with the largest-ever volume of deals, pushing the year-end total to 205 — a new high for the eighth consecutive year.

“2020 deal volume reached its lowest point during Q2, corresponding with the peak of the COVID-19-driven market downturn,” according to Echelon. “Since then, the quarterly deal count rebounded rapidly.”

Leave a Reply