Best ELSS 2021 – It’s the beginning of the new year 2021 and we have entered the last quarter (3 months) of the financial year. You might have completed tax planning and investment exercises. If not, it is the right time to make an investment and save tax.

There are many tax saving investment options available in India such as PPF, NPS, tax saving FD, ELSS under section 80C. Out of these options, ELSS is one of the best tax saving option. The benefit of ELSS compared to other tax saving options are given below.

ELSS Benefits

Lowest Lock-in Period

ELSS has the lowest lock-in period 3 years. Other investment options come with a higher lock-in period. Tax saving fixed deposit comes with 5 years lock-in period. PPF comes with a lock-in period of 15 years. NPS has a lock-in period up to retirement age. This means ELSS offers better liquidity among all other tax saving investment options.

SIP way of Investment

ELSS allows you to invest money in the lump sum way as well as SIP (Systematic Investment Plan) way. In SIP you can set the date and amount on which mutual funds investment takes place automatically. You will get the benefit of staggering investment in the mutual funds.

Potentially Higher Returns

ELSS returns are linked with the market. Other investment options such as PPF, FD offers fixed returns on the other hand ELSS has the potential to generate higher returns in a medium to the long term investment horizon.

Multiple Mutual Funds Options

There are multiple mutual fund options available in the market. You have the liberty to select mutual funds for investment. You can select a single mutual fund or multiple mutual funds while investing.

Better post tax Returns

You will get better post tax returns in ELSS. Long Term Capital Gains from ELSS are tax free up to limit of 1 Lakh. Gains over 1 Lakh attracts a tax rate of just 10%. You will get better post tax returns in the mutual funds.

Also Read – 21 Best Mutual Funds for Investment in 2021-22

Things to consider while investing in ELSS

You need to consider the following things while investing in ELSS.

Historic Fund Performance – You should consider fund performance (returns) over 3 to 5 years. The comparison should be done with benchmark and other competition funds. You should invest in a fund that provides consistent performance in the past.

Expense Ratio – Fund house need to carry out certain expenses for the management of fund that are known as the expense ratio. Lower expense ratio means a better fund for investment. This means you need to invest in a fund with a lower expense ratio.

Financial Parameters – You also need to consider various financial parameters such as standard deviation, sharp ratio, alpha and beta of the fund. Fund with higher standard deviation and beta is riskier compared to lower deviation and beta.

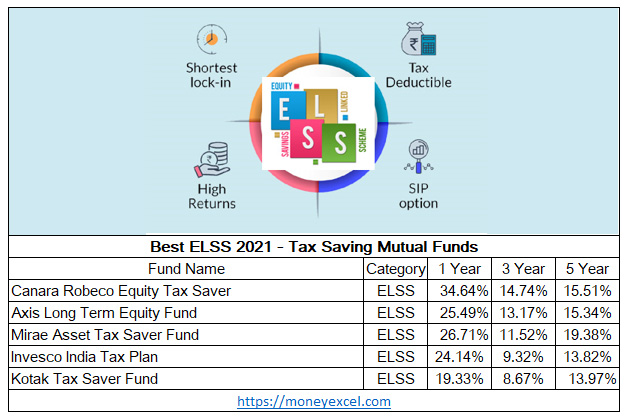

Best ELSS 2021 – Top ELSS Funds for Investment in 2021

Note – The returns shown above are annualized returns as on January,2021. The investor can select the funds as per their goals. Returns given above are subject to change.

#1 Canara Robeco Equity Tax Saver

Canara Robeco Equity Tax Saver is CRISIL five star rated fund with a moderately low ranking. This fund invests in large cap, mid cap as well as small cap stocks. This fund has consistently beaten the benchmark index and given a better performance. The expense ratio of this fund is slightly higher however, this fund has given very good performance over the past. It is one of the best ELSS funds for investment in 2021.

#2 Axis Long Term Equity Fund

Axis Long Term Equity Fund is second in the list of Best ELSS 2021 list. Axis Long Term Equity Fund is four star rated fund by CRISIL. The expense ratio is lower compared to other fund. This fund is moderately high risk fund. The past performance of this fund is very good. You can invest in this ELSS fund.

#3 Mirae Asset Tax Saver Fund

Mirae Asset Tax Saver Fund is one of the Best ELSS for 2021. Mirae Asset Tax Saver fund is a consistently performing fund. This fund has beaten the benchmark index in the last five years. The expense ratio of this fund is lower. Historically this fund has given very good returns to the investors.

#4 Invesco India Tax Plan

Invesco India Tax Plan is CRISIL four-star rated fund. This fund has given two-digit returns consistently in the last five years. This fund invests in large cap, small cap and mid cap funds. The expense ratio of this fund is slightly higher. You can invest in this fund for long term perspective.

#5 Kotak Tax Saver Fund

Kotak Tax Saver Fund has diversified fund investment with major investment in financial services. It is a moderately high risk fund. Kotak Tax Saver Fund is four star rated fund. This fund has given very good returns to the investors in the past.

Over to you

You can invest in ELSS fund for tax saving purpose.

Please note that If you are new investor and finding difficulty in identifying good ELSS fund for investment you should consult expert while selecting mutual fund for investment.

Leave a Reply