Direct Mutual Funds – Mutual Funds companies offer two types of schemes direct mutual funds and regular mutual funds. Regular funds are funds where purchases take place by keeping agents in between. Agent charges commission on the invested amount. Direct mutual funds are funds where investment is allowed directly without any intervention of agents or middlemen. This means you need not pay any commission to invest in direct mutual funds. It is obvious that direct mutual funds are better and offer higher returns as no third person is involved in between.

In this post, we will get more insights about direct mutual funds including the method to invest in direct mutual funds and Best Direct Mutual Funds for Investment in 2021.

What are Direct Mutual Funds?

Direct Mutual Funds are special types of schemes that are offered to the customer directly without any intermediary. Direct mutual funds can be purchased directly from the AMC.

Direct mutual funds provide higher returns than regular funds. This is because a direct fund is bought from the AMC and selected online sites. The expense ratio of a direct mutual fund is slightly lower compared to regular mutual funds.

Key Features of Direct Mutual Funds

Key features of direct mutual funds are given below.

- No dependency on third party agents, brokers and professionals for buying mutual funds.

- Mutual funds can be directly purchased directly from AMC websites.

- Option to purchase online as well as offline.

- Expense ratio is lower as commission fee is not involved.

- Returns of this plan is higher compared to regular mutual funds.

- Separate NAV is declared for the direct mutual funds.

Difference Between Direct Mutual Funds and Regular Mutual Funds

The difference between Direct Mutual funds and Regular Mutual funds are given below.

| Direct Mutual Funds | Regular Mutual Funds |

| Invest without involving distributors or mutual fund brokers | Invest with the help of distributors or mutual fund brokers |

| Expense ratio lower as compared to regular plans | Expense ratio higher as compared to direct plans |

| Get higher returns compared to regular plans | Get lower returns compared to direct plans |

| Investors need to do their own analysis and select top performing mutual fund schemes | Brokers offer guidance and perform all the operational tasks on behalf of the investors |

| No commission paid to brokers | Hidden commission paid to brokers |

| NAV of direct plan is relatively higher | NAV of regular plan is relatively lower |

| Document and KYC needs to be submitted on your own | Advisor will collect KYC and other documents |

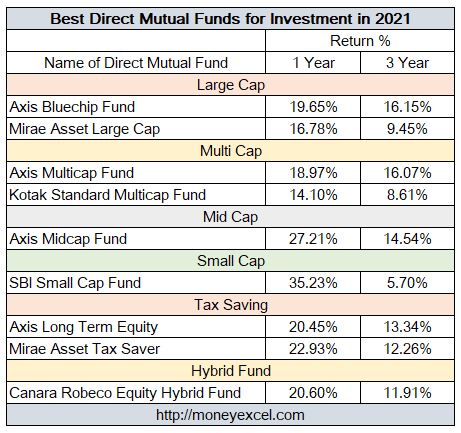

Best Direct Mutual Funds for Investment in 2021

The list of best direct mutual funds for investment in 2021 is given below.

Note – The returns are as on Jan 2021.

How to Invest in Direct Mutual Funds?

There are two ways to invest in direct mutual funds – Online & Offline.

Online

Fund house website

You can buy direct mutual funds via fund house website. Follow the steps given below.

Step-1 – Register to fund house website. You need to do this for every website individually.

Step -2 – Select old portfolio or register for new portfolio.

Step-3 – Select the scheme, amount and SIP details.

Step -4 – Transfer funds online via Netbanking, UPI or provide payment details.

Step-5 – Once fund transfer is done fund will be purchased and transaction details will be emailed to you.

In this process you need to visit multiple fund house websites. The process given here is time consuming and somewhat tedious. Keeping track is also difficult.

myCAMS is platform that allows an investor to invest in multiple mutual funds. Steps to purchase direct fund online via myCAMS is given below.

Step -1 – Visit www.camsonline.com and click on myCAMS link.

Step-2 – Register for new user id or login in account using existing id.

Step -3 – Select the scheme, amount and SIP details

Step -4 – Select payment method and purchase mutual funds online.

Offline

The steps to invest in direct mutual funds with offline method is given below.

Step 1 – Select the mutual funds in which you want to invest.

Step 2 – Visit the nearest branch of the fund house and submit the offline application.

Step 3 – Select the payment method and pay the amount for buying mutual funds online.

Over to you

If you are a beginner or if you are unable to select a scheme for an investment you should not opt for direct mutual funds.

Do you invest in direct mutual funds?

Do share your views in the comment section.

Leave a Reply