One of the largest independent broker-dealers is diving into rival-infested waters to compete for breakaway advisors, armed with a new specialty suite of services.

Commonwealth Financial Network launched its Business Consulting Services unit on Jan. 20 with an eye toward attracting 15 to 20 ex-employee teams this year, says Matt Chisholm, senior vice president of RIA services and practice management.

Competitors like LPL Financial and Kestra Private Wealth Services have launched similar breakaway channels in recent years.

Additional rivals among RIA platform providers and consolidators, as well as technology and compliance vendors, are also angling for business in a sea that spans an estimated 6,850 advisors who go independent from wirehouses and regional BDs each year.

“They’re all trying to do the same thing,” says business consultant Jennifer Goldman. “We’ve got you in the back office. We’ve got you on the people management side. Now be the advisor you always wanted to be.”

Indeed, two firms unveiled their own specialty services in consecutive days after Commonwealth’s announcement: Governance, risk management and compliance firm Foreside Financial Group and tech-enabled fiduciary services firm Orion Advisor Solutions announced their own new offerings.

More than 3,050 advisors leave wirehouses each year and nearly 3,800 exit regional BDs, according to data from research firm Cerulli Associates cited in a November report by Fidelity Institutional.

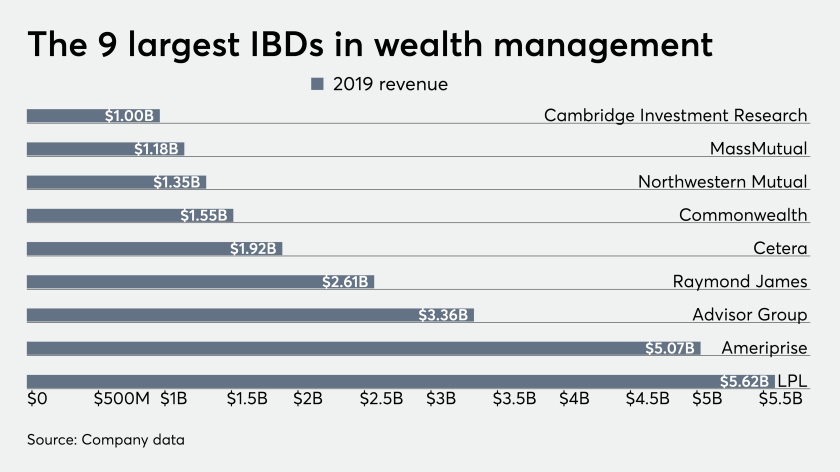

Waltham, Massachusetts-based Commonwealth hasn’t been struggling amid the larger wealth management landscape — it’s one of nine IBDs with more than $1 billion in annual revenue. Still, Chisholm says, the new unit signals a shift into “faster-moving waters than just the traditional movement” between IBDs, Chisholm says.

A six-member team at the corporate office will work directly with breakaway teams before and after their moves. In addition, Commonwealth will provide services like human resources, real estate, outsourced chief investment officers, virtual assistants, marketing, compliance, CFO services, succession planning and other business consulting needs, according to Chisholm.

The comprehensive menu of services reflects the breadth of resources needed these days by breakaway teams, he says.

“The types of advisors that we are targeting probably are a larger size,” Chisholm says. “It’s the recognition of the complexity of those businesses….The biggest challenge for these teams to break is inertia and — ‘How am I going to do this?’ — the fear of the unknown.”

News of Commonwealth’s breakaway channel was first reported by the website ThinkAdvisor in November, when the firm discussed the new services at its annual conference.

Chisholm declined to share details of the company’s recruiting offers and compensation, which he says includes a payout model and extra fees for certain services.

The payout level likely falls somewhere between 60% to 75%, according to IBD recruiter Jon Henschen of Henschen & Associates. Firms usually offer breakaways transition assistance on two tiers, Henschen says, meaning an upfront bonus ahead of the move and another one six or more months afterward based on retention of clients and assets.

“The wirehouse reps, they tend to gravitate toward name branding,” he says. “It’s kind of like an exclusive country club in joining that firm. They have a pretty rigorous screening process.”

Commonwealth had more traditionally focused on recruiting from its IBD rivals, Henschen and fellow recruiter Jodie Papike of Cross-Search agree. Working from home during the pandemic is feeding the continuing trend among advisors toward independence, Papike says.

“They go into a turnkey location and everything is set up for them and they really don’t have to think,” she says. “I’ve talked to several advisors [who were open to] the idea of being on their own and maybe not needing the infrastructure. Do I really need to be giving away so much of my compensation for these things that I could put together on my own?”

Compliance consultancy MarketCounsel is a “huge advocate” of advisors going full RIA, according to General Manager Ryan Marcus. However, he notes IBDs like Commonwealth could increase margin and retention with their breakaway channels.

“Independent broker-dealers no longer want to be that stopping ground on the way to independence,” Marcus says. “It’s smart for them because they want to mitigate the opportunity for an advisor at some point to say, ‘There’s still something missing here.’”

Commonwealth aims to cater to full RIA advisors by offering a “quickstart guide” and other services meant to provide what Chisholm calls a glide path to ensure advisors can move at varying speeds and stages during their transitions.

“We think that, because we can handle all of that in-house, it eliminates some of the decisions early on,” he says, noting that some issues are easier solved down the line. “Bring them on and then we’ll get to that at the pace it makes sense for you and your clients.”

Leave a Reply