You know that little line at the bottom of your receipts and invoices that says Sales Tax? As a business owner, it’s not your responsibility to pay it out of pocket. But it is your responsibility to collect and remit sales tax. If you don’t know how to pay sales tax for small business to the state, you could wind up with penalties and interest.

And who wants that?

Nobody. So, read on to learn the ins and outs of collecting and remitting sales tax to the proper state tax agency.

How to pay sales tax for small business

Sales tax is a pass-through tax that most businesses must charge and collect from customers at the point of sale. The majority of states levy sales tax on products and services. Counties can also require businesses to collect sales tax.

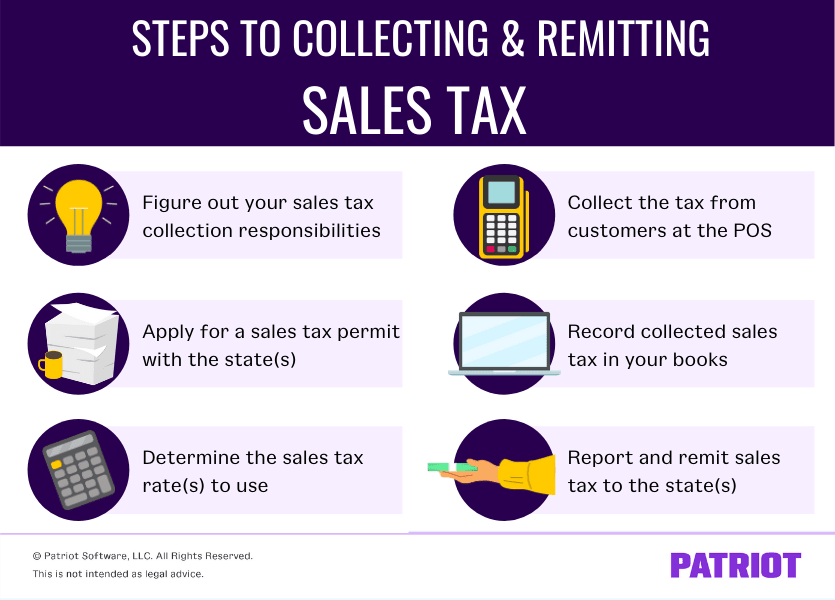

Collecting and remitting sales tax requires you to do a little footwork first. To stay compliant with sales tax laws, you must:

- Figure out your sales tax collection responsibilities

- Apply for a sales tax permit with the appropriate state(s)

- Determine the sales tax rate(s) to use

- Collect the tax from customers at the point of sale

- Record collected sales tax in your accounting books

- Report and remit sales tax to the appropriate states (aka time to pay)

Whether you make sales out of your brick-and-mortar, sell online, or both, chances are you need to know about sales tax collections and remittance.

Luckily, that’s just what this article will guide you through.

1. Figure out your sales tax collection responsibilities

Your first step in collecting and remitting sales tax is figuring out your responsibilities. Ask yourself questions like:

A. Does the state I sell in have a sales tax law?

Not all states have sales tax laws. Alaska, Delaware, Montana, New Hampshire, and Oregon do not have sales tax. However, Alaska does have local sales tax laws that might impact you.

Hawaii also does not have a sales tax. Instead, the state has a general excise tax (GET) that businesses pay. Businesses typically pass on the GET to their customers like sales tax, though.

New Mexico has a gross receipts tax (GRT) instead of a sales tax. The gross receipts tax is imposed on business owners. But, most businesses pass this on to customers.

B. Do I have sales tax nexus in another state?

Sales tax nexus is, in a word, confusing. But, understanding how sales tax nexus works is key to figuring out your responsibilities. If your business has sales tax nexus, or presence, in a location, you must collect sales tax. State nexus laws vary, but factors such as having a warehouse or employees working in a state could result in you having nexus there.

Also keep in mind that online sales have economic nexus. If you earn above a sales threshold in a state you sell to, you may have economic nexus. Economic nexus requires you to collect sales tax in the state.

C. Does the state law apply sales tax to the products or services I sell?

Not all products and services are subject to sales tax laws. Your state may have a list of products and services that you do not collect sales tax on. For example, prescription drugs are sales tax exempt in most states.

D. Am I selling goods for resale?

Businesses that purchase goods for resale might not need to pay sales tax at the point of sale. If you sell to someone who has a resale certificate, you do not need to collect sales tax from them.

2. Apply for a sales tax permit with the appropriate state(s)

Before you can start making sales, you need to apply for a sales tax permit. This license indicates that your business can legally collect sales tax in the state.

Generally, you can apply for a sales tax permit online or through the mail. However, some states have moved completely online and require you to apply electronically.

Once you receive your license, keep your seller permit number in a secure location. You need it to remit and report sales tax to the state.

To apply for a sales tax permit, you must:

- Gather business information (e.g., EIN)

- Go to your state’s website

- Register electronically or mail in a paper form

- Pay a fee, if applicable

3. Determine the sales tax rate(s) to use

There is not a standard sales tax rate that all states and counties use. Each tax agency sets its own rate, which is a percentage of a taxable product or service.

As the sales tax collector, you need to know how much the sales tax rate is in the state and/or county you’re collecting for.

To do this, head over to your state website and look into:

- State sales tax rates

- County sales tax rates

Again, pay attention to the goods and/or services that are exempt from sales tax while you’re on your state’s sales tax web pages.

4. Collect the tax from customers at the point of sale

Once you know the tax rate(s) you need to collect, you can calculate sales tax on taxable items at the point of sale.

To determine how much sales tax to collect, multiply the price of the taxable items by the sales tax rate. Remember to exclude tax-exempt items and services, including resale products, from your calculation.

Include the sales tax amount on the customer’s receipt or invoice on a separate line. That way, they know where the extra charge is coming from.

Reminder! Do not collect sales tax from customers on tax-free items over a sales tax holiday.

5. Record collected sales tax in your accounting books

After collecting sales tax from customers, set it aside until the time comes to remit it to the state. Sales tax accounting can help you keep your collected and remitted sales tax records straight.

In sales tax accounting, you create journal entries when you collect sales tax from customers. The journal entry should show how much total money you received from the customer. Also break down how much of that incoming money is for the sale and how much is for sales tax.

Collected sales tax that you haven’t yet remitted is known as “Sales Tax Payable” because it’s money you owe to the state. Your journal entry would look something like this:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| XX/XX/XXXX | Cash | Collected sales tax | X | |

| Sales Revenue | X | |||

| Sales Tax Payable | X |

When you remit it to the state, create a journal entry to reverse the initial record and decrease your Sales Tax Payable account.

Without accurate and detailed records, you could lose track of how much money you owe the state, which could lead to overpaying or underpaying.

6. Report and remit sales tax to the appropriate states

Now we’re onto the promised part: how to pay sales tax for small business. Finally!

When it comes to reporting and remitting sales tax, there are a number of variables by state, such as:

- Due dates (e.g., monthly, quarterly, semi-annually, annually)

- Payment methods (e.g., ACH debit, credit card)

- Filing methods (e.g., electronically, over the phone, via mail)

- Sales tax report (you can get this from your state department of revenue)

In many cases, how often you report and pay sales tax depends on how long you’ve been in business and how much sales tax you collect. And, the amount of sales tax you collect may determine how you file and pay (e.g., electronically).

You may need to file a return even if you didn’t collect any sales tax during a period. Consult your state for more information.

Failing to file your report and remit your payment on time could result in penalties that range from 1% – 30% of the owed tax.

Use the following chart to get links to your state’s sales tax page and find out when the return and payment frequency is.

| State | Return & Payment Frequency |

|---|---|

| Alabama | Monthly |

| Alaska | N/A |

| Arizona | Monthly, quarterly, seasonal, or annually; based on tax liability |

| Arkansas | Monthly, quarterly, or annually |

| California | Quarterly, monthly, fiscal yearly, or yearly |

| Colorado | Monthly, quarterly, or annually |

| Connecticut | Monthly, quarterly, or annually |

| D.C. | Monthly, quarterly, or annually |

| Delaware | N/A |

| Florida | Monthly |

| Georgia | Monthly, quarterly, or annually |

| Hawaii | Monthly, quarterly, or semi-annually |

| Idaho | Monthly, quarterly, or annually |

| Illinois | Monthly, quarterly, or annually |

| Indiana | Monthly |

| Iowa | Monthly or semi-monthly |

| Kansas | Monthly, quarterly, or annually |

| Kentucky | Monthly, quarterly, or annually |

| Louisiana | Monthly or quarterly |

| Maine | Monthly/seasonal, quarterly, semi-annually, or annually |

| Maryland | Quarterly |

| Massachusetts | Monthly, quarterly, or annually |

| Michigan | Monthly, quarterly, or annually |

| Minnesota | Monthly, quarterly, or annually |

| Mississippi | Monthly, quarterly, or annually |

| Missouri | Monthly, quarterly, or annually |

| Montana | N/A |

| Nebraska | Monthly, quarterly, or annually |

| Nevada | Monthly or quarterly |

| New Hampshire | N/A |

| New Jersey | Monthly or quarterly |

| New Mexico | Monthly, quarterly, or semi-annually |

| New York | Monthly, quarterly, or annually |

| North Carolina | Monthly or quarterly |

| North Dakota | Monthly, quarterly, semi-annually, or annually |

| Ohio | Monthly or semi-annually |

| Oklahoma | Monthly or semi-annually |

| Oregon | N/A |

| Pennsylvania | 1st year of business: Quarterly After 1st year of business: Semi-monthly, monthly, quarterly, or semi-annually |

| Rhode Island | Monthly or quarterly; all filers must also file an annual sales tax reconciliation |

| South Carolina | Monthly; quarterly and annually with approval |

| South Dakota | Monthly, quarterly, or annually |

| Tennessee | Monthly, quarterly, or annually |

| Texas | Monthly, quarterly, or annually |

| Utah | Monthly, quarterly, or annually |

| Vermont | Monthly, quarterly, or annually |

| Virginia | Monthly or quarterly |

| Washington | Monthly, quarterly, or annually |

| West Virginia | Monthly, quarterly, or annually |

| Wisconsin | Monthly, quarterly, or annually |

| Wyoming | Monthly, quarterly, or annually |

Need a better way to record your sales tax liability? Patriot’s accounting software makes it easy to manage your books and keep accurate records. You have enough on your hands—why not simplify your accounting responsibilities with a free trial?

This is not intended as legal advice; for more information, please click here.

Leave a Reply