Executive Summary

The Registered Investment Adviser was established by the Investment Advisers Act of 1940, with an explicitly stated intention of separating “bona fide investment counselors” from the “unscrupulous tipsters and touts” trying to just sell the next hot investment scheme. Accordingly, from its very start, a key pillar in the regulation of investment advisers has been various prohibitions against any form of marketing or advertising that might be deemed ‘misleading’ to the public about the investment adviser’s anticipated investment returns. Which in 1961 was formally codified into an advertising rule that explicitly prohibited RIAs from using any form of client testimonial, under the auspices that the results and returns of any one client wouldn’t necessarily be representative of what any/all kinds could expect in the future… and that therefore testimonials were inherently misleading and a danger to the public.

In the years since, though, the world of marketing and advertising has evolved greatly, as have the services of RIAs themselves. As financial advisors expand into financial planning services beyond just portfolio management and are judged on the quality of their service beyond just the literal steps of managing the portfolio itself, it becomes harder and harder for consumers to evaluate an advisor’s quality and expertise with respect to the full breadth of their services. For which one of the most straightforward ways to assess is simply to ask other clients what their experience has been – a common approach in most industries that has led to a bonanza of various third-party review sites, from Google My Business to Yelp and more… but has remained remarkably absent from the realm of financial advisors due to the ongoing prohibition against client testimonials!

But now, the SEC has announced a new marketing rule – it’s first substantive refresh in nearly 60 years – which will, for the first time, allow financial advisors to proactively use testimonials (from clients), endorsements (from non-clients), and highlight their own ratings on various third-party review sites. Which means, simply put, that as the SEC’s new marketing rule takes effect in the coming months, it’s a new dawn for financial advisor marketing.

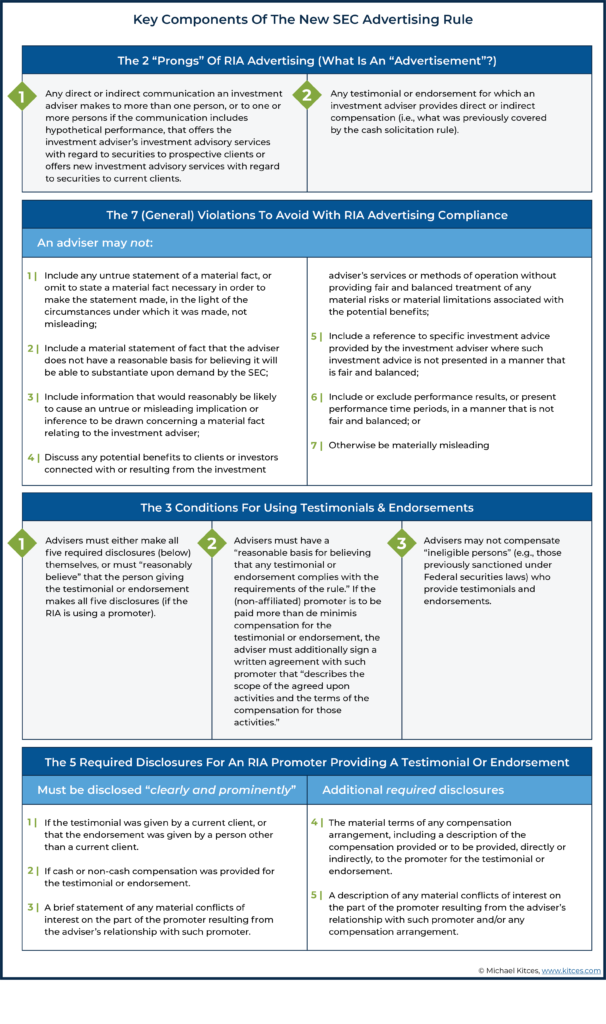

Not surprisingly, though, the SEC is not granting carte blanche permission for RIAs to use testimonials and endorsements however they wish. Instead, the new rules provide both a series of 7 general prohibitions that still apply to testimonials and endorsements (e.g., that they not be untrue or misleading regarding any material facts), a series of specific requirements that apply to testimonials and endorsements, from new required disclosures to additional oversight and compliance obligations regarding both the RIA and the “promoter” for the RIA, and certain limitations on who can even be a promoter providing an endorsement or testimonial in the first place.

In addition, the SEC’s new marketing rule provides additional clarity about when and how RIAs can leverage various third-party rating and review sites (e.g., Yelp, or various ‘Top Advisor’ lists), including a due diligence obligation (to affirm that the reviews had equal opportunity to be favorable or unfavorable) and additional disclosure requirements regarding the criteria used to determine the rating or review and what it actually pertains to (e.g., explicitly disclosing that a “Top Advisor” ranking is based on AUM alone doesn’t necessarily speak to the quality of the advisor’s advice).

Notably, though, the new marketing rule and its permissiveness of testimonials, endorsements, and the use of third-party review sites are technically only for SEC-registered investment advisers. Those RIAs that are registered at the state level will still need to conform to their state’s own marketing rules, which may or may not incorporate (or be updated for) the SEC’s new rule going forward. And FINRA-registered brokers are ultimately still subject to FINRA’s own rules on advertising and communications (not the SEC’s rules for RIAs).

Nonetheless, the reality is that the SEC’s new marketing rule represents a dramatic shift in the regulatory environment for RIAs when it comes to marketing and a recognition that when the business of advice goes far beyond just investment returns, testimonials and endorsements – and more generally, the perspective from those who have actually paid for and used the adviser’s services – can be an effective way to communicate the value the adviser brings to the marketplace. Albeit with the kind of (very reasonable) disclosures and compliance oversight that would still be expected to ensure that the adviser’s marketing is still reasonable and not misleading about the financial advisor’s services!

In the automotive industry, manufacturers use various tactics to keep their model lineups current from year to year. For certain model years, a particular model may receive a software update to its infotainment system, a refreshed headlight or taillight design, or new wheel and tire options. Less frequently, a model may receive new engine options, an overhauled suspension, or entirely new sheet metal to change its appearance. On very rare occasions, a manufacturer will do something as controversial and blasphemous as evolving a burly 2-door muscle car into an electric compact SUV variant (e.g., the Ford Mustang Mach-E).

With its recent new investment adviser marketing rule, the SEC took matters a bit further and effectively drove two of its current model year vehicles off a cliff and rebuilt a new, single vehicle from what little scrap metal remained of the wreckage. For decades, the former advertising rule (and related cash solicitation rule for paying referrers) had been chugging along with a patchwork of No-Action letters and interpretive guidance holding the entire chassis together – like Bondo over a rusted-out floorboard.

But since the original advertising rule’s adoption in 1961 and the original cash solicitation rule’s adoption in 1979, times have changed. Fuel injection has replaced carburation, collapsible steering columns no longer harpoon drivers in head-on collisions, and knobs and buttons have ceded to touchscreens (for better or worse). Investment advisory advertising and solicitation realities have also evolved. As the SEC itself notes in its Adopting Release, “the technology used for communications has advanced, the expectations of investors shopping for advisory services have changed, and the profiles of the investment advisory industry have diversified.”

The end result is a single, consolidated rule (referred to hereafter as the investment adviser “marketing rule”) that replaces and supersedes two very dated rules (the “advertising rule” and the “cash solicitation rule”) for RIAs. For those avid Nerd’s Eye View readers who may have read my previous article on the cash solicitation rule (Paying Cash for Client Referrals: The Patchwork of State & Federal Solicitor Rules), this means that much of that prior article’s content as it relates to the cash solicitation rule – at least at the federal level – will be rendered moot.

For purposes of this article, we’ll be exclusively focused on the parts of the new marketing rule that are likely of most interest and actionable for financial advisors themselves: the use of testimonials, endorsements, and third-party ratings. The other not-insignificant part of the marketing rule – related to how RIAs can (and cannot) advertise their portfolio performance results – will be left to another day. And though there are certain favorable indirect implications for FINRA-member broker-dealers, this article will instead focus on the direct implications for RIAs, as the marketing activities of FINRA-registered brokers will still principally be governed by applicable FINRA advertising and communication rules (are not directly affected by the new marketing rule).

Overview Of The SEC’s New Investment Adviser Marketing Rule

When it comes to the SEC’s new investment adviser marketing rule, it’s important to understand first and foremost the actual timeline for implementation, as while the final marketing rule has been published, it’s not actually effective yet (much less implemented where RIAs are expected to be in full compliance).

Technically, the marketing rule will become “effective” 60-days after publication in the Federal Register (i.e., the official publication of the federal government’s current regulations). As of the date of this article, the marketing rule has not yet been published in the Federal Register, and therefore the 60-day effectiveness clock has not yet started ticking. I’d ballpark Federal Register publication around late January or early February of 2021, which means the rule will be effective around the end of March or the beginning of April 2021.

However, the effective date still isn’t the end-point of the rollout of a new SEC rule. There is an 18-month transition period between the effective date, and what’s known as the “compliance date,” or the date by which advisers will be required to comply with the marketing rule’s requirements (which should be sometime around late September or early October of 2022). Whether advisers will have the option to comply with the marketing rule’s new requirements after the effective date but before the compliance date isn’t specifically stated; however, it is safe to say that early/voluntary compliance before the compliance date would certainly require full compliance with all new provisions (not just those provisions that are more permissive or more favorable to advisers).

Some other key points to note about the new investment adviser marketing rule include:

- Rule 206(4)-1 (“Advertisements by investment advisers”) will keep its numerical rule identifier as 206(4)-1, but its title will change to “Investment Adviser Marketing.”

- Rule 206(4)-3 (“Cash payments for client solicitations”) will be rescinded in its entirety, with certain conceptual elements folded into the surviving Rule 206(4)-1.

- The term “solicitor” (which has historically referred to those who engaged in compensated solicitation or referral activity with respect to advisers) is effectively out the window and replaced with the term “promoter.” Promoter is not defined in the marketing rule, but for the first time “testimonial” is defined, as is the related but distinct term “endorsement”. In this context, a promoter can be either an adviser’s client (for purposes of a testimonial) or a person other than a client (for purposes of an endorsement). More on this later, but the point is that there will be some new terminology to get used to.

- Certain historical “no-action” letters issued by SEC staff that relate to the former advertising and cash solicitation rules will be withdrawn, though which specific no-action letters are on the chopping block is not yet known (a list of such withdrawn no-action letters will apparently be made available on the SEC’s website). The withdrawal of some no-action letters will likely not be as impactful, since their respective tenets are codified in the new marketing rule, but the withdrawal of other no-action letters may leave a void and introduce new ‘question marks’ about implementing the new marketing rule that in turn will have to be satisfied by other guidance (or new no-action letters) from the SEC in the future.

It’s also important to note that while the new marketing rule itself will get most of the headlines, the SEC is also updating its Recordkeeping Rule (Rule 204-2: Books and records to be maintained by investment advisers), Form ADV Part 1, and the Form ADV Glossary of Terms, as part of its updates to the marketing rule. Again, mandatory compliance with such revisions will not be required until the expected Fall 2022 compliance date, but it is important not to lose sight of these related amendments.

Specifically, with respect to the Form ADV Part 1, there will be a new Item 5.L that asks a series of yes/no questions about the adviser’s marketing activities (e.g., whether the adviser’s advertisements include performance results, past specific advice, testimonials, endorsements, third-party ratings, hypothetical performance, predecessor performance, and the RIA’s compensation practices related to testimonials, endorsements, and third-party ratings). The answers to such additional ADV questions must be updated annually in connection with an adviser’s annual ADV amendment.

Finally, it’s crucial to recognize that the SEC’s new investment adviser marketing rule technically only applies to SEC-registered investment advisers, and not directly to FINRA-member broker-dealers, nor to state-registered advisers (or exempt reporting advisers, which are typically private or venture capital funds). States often have their own rules that apply to adviser marketing, some of which will be directly at odds with the new principles-based SEC framework.

While it may be true that some states effectively defer their advertising rules to the SEC (e.g., by a direct cross-reference to Rule 206(4)-1), and/or may update their state-level marketing rules to conform with the SEC’s new marketing rule, it’s important for state RIAs to query how the state(s) in which they are registered will interpret any deference/cross-reference to the soon-to-be rescinded Rule 206(4)-3 (the cash solicitation rule). For instance, Florida’s definition of an “associated person,” e.g., specifically carves out “any person acting in compliance with SEC Rule 206(4)-3.” Since it will be impossible to comply with a rule that no longer exists, such voids will likely have to be handled on a case-by-case basis at least during the period of time before states catch-up and re-codify any defunct cross-references (if they choose to do so at all).

Similarly, even though the SEC-related aspects of my previous article on the cash solicitation rule (Paying Cash for Client Referrals: The Patchwork of State & Federal Solicitor Rules) will be rendered moot, the state-by-state patchwork of qualification, licensing, and registration requirements at the state level will remain acutely relevant – especially for those who receive solicitor (now, promoter) payments. This means that advisers, both SEC-registered and state-registered, will still need to be mindful of many states’ requirements as they relate to the Series 65 and exam waivers, investment adviser representative status, and U4 filings when it comes to anyone they make payments to as a solicitor/promoter of their RIA.

The Importance of Marketing Rule Definitions – What Is An “Advertisement”?

As many financial advisors have probably heard or read already, testimonials, endorsements, and third-party ratings are all indeed permissible under the new marketing rule for RIAs. But, as one might imagine, there are a host of important clarifications, conditions, caveats, and carve-outs that are all vitally important to understand before opening the floodgates.

As a threshold matter, the two-pronged definition of “advertisement” will determine whether the investment adviser marketing rule is even applicable at all. The first prong covers the following:

“Any direct or indirect communication an investment adviser makes to more than one person, or to one or more persons if the communication includes hypothetical performance, that offers the investment adviser’s investment advisory services with regard to securities to prospective clients or investors in a private fund advised by the investment adviser or offers new investment advisory services with regard to securities to current clients or investors in a private fund advised by the investment adviser.”

Excluded from this first prong of “advertisements” are: (a) extemporaneous, live, oral communications, (b) information contained in a statutory or regulatory notice, filing, or other required communication, and (c) unsolicited information regarding hypothetical performance or one-one-one communications with private fund investors that includes hypothetical performance.

The second prong of what constitutes an advertisement covers any testimonial or endorsement for which an investment adviser provides direct or indirect compensation (i.e., what was previously covered by the cash solicitation rule). Information contained in a statutory or regulatory notice, filing, or other required communication is also excluded from the second prong.

In essence, think of the first prong as encompassing what has historically been considered advertising under the current advertising rule and related no-action letters, as well as uncompensated testimonials and endorsements, while the second prong encompasses what has historically been considered compensated solicitation activity. Communication falling within either prong will be considered an advertisement, and therefore subject to the marketing rule.

This is a nuanced definition of “advertisement”, and there are a number of caveats about what does (and does not) constitute an “advertisement” in practice.

Exceptions To An “Advertisement” Under The First Prong Of The SEC’s New Marketing Rule

When it comes to the first prong of the marketing rule and its test for what is (or is not) “advertising,” some key limitations and exceptions include:

- One-on-one communications with a single person (or household) are not an advertisement for purposes of the first prong, unless such communication includes hypothetical performance (though such communications are generally still subject to the standard Books and Records requirement to retain such communications). One-on-one communications that do include hypothetical performance will be deemed advertising, unless such communication was in response to an unsolicited prospective or current client (or an investor in a private fund advised by the adviser) who requested such information. Bulk emails, templates, and other communications that appear to be personalized (e.g., by changing the addressee’s name) are considered advertisements.

- To be considered an advertisement under the first prong, the communication must offer the adviser’s services with regard to securities. Communications including generic brand content, purely educational material, market commentary, and event sponsorship, by themselves, are not deemed to be an advertisement. In other words, it’s not an advertisement to “raise the profile of the adviser generally,” or to communicate “general information about investing, such as information about types of investment vehicles, asset classes, strategies, certain geographic regions, or commercial sectors.” However, such non-advertisements would at least partially become advertisements if the communication includes a description of how the adviser’s securities-related services can help the recipient of the communication.

Admittedly, the line between an advertisement that offers the adviser’s services with regard to securities and an advertisement that does not offer the adviser’s services with regard to securities seems a bit blurry to my eyes. For example, an astute observer may rightfully wonder whether the first prong would exclude advertisements that solely relate to financial planning services that are unrelated to securities. Based on the plain language of the rule and the Adopting Release, it appears that the answer is “yes” – that non-securities financial planning services should be excluded from the first prong of the definition of advertisement; however, this would be a classic “facts and circumstances” analysis. It would be helpful for the SEC to issue further guidance in this specific regard.

The takeaway here is to not muddy the waters by offering advisory services with regard to securities in communications that otherwise are intended to fall outside the definition of advertisement.

An advertisement may be made either directly by the adviser, or indirectly by a third-party. Whether a third-party communication will be deemed an advertisement of the adviser depends on the extent to which the adviser has adopted or entangled itself in the third-party communication. The degree of “adoption and entanglement” is a facts and circumstances analysis of “(i) whether the adviser has explicitly or implicitly endorsed or approved the information after its publication (adoption) or (ii) the extent to which the adviser has involved itself in the preparation of the information (entanglement).”

Nerd Note:

The phrase “facts and circumstances” appears 43 times in the Adopting Release. This is a natural byproduct of a flexible principles-based regulatory approach, as opposed to a prescriptive rules-based regulatory approach.

Adoption and entanglement is the primary framework through which the SEC will assess third-party communications about the adviser, such as a client smashing the “like” button on a social media site or leaving a review on Google Reviews. Adoption and entanglement will also be relevant for websites and content published by “find an advisor” portals that may be formed by groups of geographically, philosophically, or religiously aligned RIAs, as well as other common RIA listing and network platforms. Such third-party portals may not necessarily be automatically ascribed as an advertisement of a listed adviser if the adviser had no involvement in its listing; on the other hand, the more an adviser involves itself in the content, display, and overall presentation of its listing, the more likely such listing will become an advertisement of the adviser and therefore subject to the marketing rule.

It is worth directly quoting at length from the SEC release here, as this is where the rubber will start to hit the road for most financial advisors:

“Permitting all third parties to post public commentary to the adviser’s website or social media page would not, by itself, render such content attributable to the adviser, so long as the adviser does not selectively delete or alter the comments or their presentation and is not involved in the preparation of the content. […] If an adviser merely permits the use of “like,” “share,” or “endorse” features on a third-party website or social media platform, we would not interpret the adviser’s permission as implicating the final rule. […] With respect to social media postings to associated persons’ own accounts, it would be a facts and circumstances analysis relating to the adviser’s supervision and compliance efforts. If the adviser adopts and implements policies and procedures reasonably designed to prevent the use of an associated person’s social media accounts for marketing the adviser’s advisory services, we generally would not view such communication as the adviser marketing its advisory services.”

In a nutshell: don’t “adopt or entangle” yourself with third-party likes, reviews, or endorsements by authoring such communications, selectively deleting negative communications, or otherwise altering their content/appearance. Personal social media accounts will not be ascribed to the adviser if the adviser has policies and procedures in place to prevent such personal accounts from being used to promote the firm’s advisory services. Adoption and entanglement with third-party communications means that the communication may become an advertisement of the adviser, which means the adviser will become responsible for the communication’s compliance with the marketing rule (regardless of who creates or disseminates the communication).

- For the avoidance of doubt, the SEC includes a laundry list of communication channels that could be considered advertisements: “emails, text messages, instant messages, electronic presentations, videos, films, podcasts, digital audio or video files, blogs, billboards, and all manner of social media, as well as by paper, including in newspapers, magazines, and the mail.”

- Remember that uncompensated testimonials and endorsements may still be considered an advertisement under the first prong, as the promoter may effectively serve as the dissemination means of an adviser’s advertisement. To use the historical lingo, an uncompensated solicitor’s communications may still be considered an advertisement of the adviser. Compensated testimonials and endorsements would fall more squarely in (and be subject to the rules and requirements of) the second prong (as discussed further below).

- Communications designed to retain existing clients are not advertisements, even if sent to more than one existing client. However, communications designed to offer new advisory services to existing clients, if sent to more than one existing client, are advertisements.

- Extemporaneous, live, oral communications are excluded from the definition of advertisement under the first prong. Such communications would not be captured by the first prong “regardless of whether they are broadcast/webcast and regardless of whether they take place in a one-on-one context and involve discussion of hypothetical performance.” However, communications prepared in advance (such as prepared remarks, speeches, scripts, slides, etc.) are not excluded under this particular carve-out. Similarly, the dissemination of a recorded communication (like a recorded webinar, speech, etc.) will be an advertisement if it otherwise meets the definition of advertisement by relating to advisory services with regard to securities.

- Statutory notices, filings, and other required communications (such as Form ADV Part 2 or Form CRS) are not advertisements so long as they are reasonably designed to satisfy the requirements of the notice, filing, or other required communication.

Phew. That was only the first prong. Of one definition. Of a single rule. Released across 430 pages. Marching on…

Exceptions To An “Advertisement” Under The Second (Promoter) Prong Of The SEC’s New Marketing Rule

Even if a communication doesn’t meet the definition of advertisement under the first prong or is otherwise carved out from the first prong, a communication can still be deemed an advertisement if it falls within the second prong. This is where compensated testimonials and endorsements take center stage (i.e., “promoters”, previously known as solicitors), as both testimonials and endorsements are considered to be an advertisement subject to the marketing rule.

- The SEC has formally defined “testimonial”, along with its (new) counterpart “endorsement”. Until now, the SEC has never statutorily defined the term “testimonial,” even though it’s prohibited advisers from using testimonials for decades. But the new marketing rule formally defines both.Specifically, a testimonial is any statement by a current client (or private fund investor) “(i) about the client or investor’s experience with the investment adviser or its supervised persons [regardless of whether it specifically pertains to securities or investment advice, or any other service provided by the investment adviser or its supervised persons]; (ii) that directly or indirectly solicits any current or prospective client or investor to be a client of, or an investor in a private fund advised by, the investment adviser; or (iii) that refers any current or prospective client or investor to be a client of, or an investor in a private fund advised by, the investment adviser.”By contrast, an endorsement is any statement by a person other than a current client (or private fund investor) that: “(i) indicates approval, support, or recommendation of the investment adviser or its supervised persons or describes that person’s experience with the investment adviser or its supervised persons; (ii) directly or indirectly solicits any current or prospective client or investor to be a client of, or an investor in a private fund advised by, the investment adviser; or (iii) refers any current or prospective client or investor to be a client of, or an investor in a private fund advised by, the investment adviser.”In other words, testimonials are made by current clients, and endorsements are made by anyone else other than current clients. Testimonials and endorsements may be deemed to be made by entities, natural persons employed by such entities, or both.

- Testimonials and endorsements will be considered an advertisement if made orally or in writing, and regardless of whether made to just one person or to more than one person. This is a stark difference from the first prong, which specifically covers only written and not oral communications, and is thus broader in this respect. On the other hand, the promoter giving the testimonial or endorsement must be compensated to be swept in under this second prong.

- “Compensation” to a person giving a testimonial or endorsement is to be broadly construed, which is a stark departure from the rescinded cash solicitation rule, which technically only applied to cash compensation. Now, compensation specifically includes “fees based on a percentage of assets under management or amounts invested, flat fees, retainers, hourly fees, reduced advisory fees, fee waivers, and any other methods of cash compensation, and cash or non-cash rewards […], including referral and solicitation activities.” For example, a current client who refers a friend or family member in exchange for a reduced or temporarily waived advisory fee will be deemed a promoter who has given a testimonial (the SEC refers to this as a “refer-a-friend” program). Regular salaries/bonuses paid to an RIA’s own personnel for the rendering of advisory services are not to be considered compensation for this purpose.

- The SEC specifically calls out lead-generation firms, adviser referral networks, and model portfolio providers (what it terms “operators”), and states in no uncertain terms that the websites of such operators “likely” are an endorsement – primarily because such websites may “tout the advisers included in its network, and/or guarantee that the advisers meet the network’s eligibility criteria.” The Adopting Release goes on to say that “because operators typically offer to “match” an investor with one or more advisers compensating it to participate in the service, operators typically engage in solicitation or referral activities.” This stance could have monumental implications for investor-to-adviser match and referral services for both the operator and adviser alike, especially given the express nullification of various no-action letters that many such operators may have been relying on for years (see, e.g., National Football League Players Association, SEC Staff No-Action Letter (Jan. 25, 2002); Excellence in Advertising, Limited, SEC Staff No-Action Letter (Nov. 13, 1986); and International Association for Financial Planning, SEC Staff No-Action Letter (June 1, 1998)).It also brings to the forefront the specter of potential qualification, licensing, and registration requirements for such “Find An Advisor” platform operators effectively acting as promoters: “A promoter may, depending on the facts and circumstances, be acting as an investment adviser within the meaning of section 202(a)(11) of the [Advisers Act]. Investment adviser status and registration questions require an analysis of the applicable facts and circumstances, including, for example, whether a person is “advising” others within the meaning of section 202(a)(11) of the [Advisers Act]. […] A promoter also must determine whether it is subject to certain state law and certain FINRA rules, including any applicable state licensing requirements applicable to individuals.” In turn, RIAs listed on such sites would then need to ensure that appropriate disclosure has been made regarding the promoter relationship (as well as ensure compliance with the other applicable aspects of the marketing rule).Though there is no presumption that a promoter meets the definition of an investment adviser or associated person of an investment adviser under the Advisers Act, the SEC is signaling that this analysis should be carefully performed based on the facts and circumstances. The SEC Releases referenced in Footnote 171 will be helpful to scrutinize for this analysis. And – as a reminder – don’t forget the state-by-state element to this analysis as well (see Paying Cash for Client Referrals: The Patchwork of State & Federal Solicitor Rules).For RIAs that utilize such platform operators, the takeaway is that some such platform operators may ultimately elect to become (or will be required to become) independently registered as investment advisers themselves, and that RIAs will need to coordinate with such promoter / platform operators to ensure that they are in-sync with the various requirements imposed on testimonials and endorsements as further discussed below.

Unpacking the Marketing Rule’s Enumerated Prohibitions On RIA Advertising

The reason it’s necessary to delve into the definition of advertisement in such excruciating detail is because the SEC’s entire RIA marketing rule is structured as a series of enumerated prohibitions against the direct or indirect dissemination of certain types or forms of advertisement by an adviser. Thus, if a communication is deemed to be an advertisement, it is subject to such enumerated prohibitions. If a communication is not deemed to be an advertisement, it is not subject to such enumerated prohibitions. That doesn’t mean a non-advertisement isn’t subject to other scrutiny under the general anti-fraud statutes or through the framework of an adviser’s fiduciary duty, but determining status as an advertisement or not sets the stage for the specific applicability of the marketing rule.

The enumerated prohibitions encompass seven general prohibitions applicable to all advertisements, as well as three specific prohibitions applicable to testimonials and endorsements, third-party ratings, and performance. The latter three specific prohibitions all have conditional carve-outs that make an otherwise prohibited advertisement permissible, subject to the overarching and superseding seven general prohibitions. In other words, it will still be unlawful for an adviser to directly or indirectly disseminate an advertisement that violates any of the seven general prohibitions, even if it otherwise complies with the conditional carve-outs related to testimonials and endorsements, third-party ratings, or performance.

As a means of preventing “fraudulent, deceptive, or manipulative acts” by advisers, the marketing rule contains seven general prohibitions such that an adviser may not:

- Include any untrue statement of a material fact, or omit to state a material fact necessary in order to make the statement made, in the light of the circumstances under which it was made, not misleading;

- Include a material statement of fact that the adviser does not have a reasonable basis for believing it will be able to substantiate upon demand by the Commission;

- Include information that would reasonably be likely to cause an untrue or misleading implication or inference to be drawn concerning a material fact relating to the investment adviser;

- Discuss any potential benefits to clients or investors connected with or resulting from the investment adviser’s services or methods of operation without providing fair and balanced treatment of any material risks or material limitations associated with the potential benefits;

- Include a reference to specific investment advice provided by the investment adviser where such investment advice is not presented in a manner that is fair and balanced;

- Include or exclude performance results, or present performance time periods, in a manner that is not fair and balanced; or

- Otherwise be materially misleading.

While the Adopting Release goes into extensive detail about how these general prohibitions are applied, for the sake of ‘brevity’ – perhaps laughable at this point in the article! – below are some of the key highlights:

- “The nature of the audience to which the advertisement is directed is a key factor in determining how the general prohibitions should be applied.”

- Takeaway: an advertisement may violate a general prohibition with respect to a retail or “Main Street” investor, even as the same advertising is not a violation for a sophisticated or institutional investor. The intended audience of the advertisement becomes particularly relevant in the performance advertising context.

- “Material statements of fact [in an advertisement], as opposed to opinions, should be verifiable.” Advisers are required to have “a reasonable basis to believe that they can substantiate material claims of fact [made in an advertisement] upon demand.”

- Takeaway: don’t make statements in advertisements that aren’t (or can’t be) substantiated.

- The statement “more than a hundred clients that have stuck with me for more than ten years,” even if factually correct, would be considered misleading if the adviser actually has a very high client turnover rate.

- Takeaway: Don’t obscure or misdirect from reality. Getting too “cute” with what may technically be true won’t be tolerated.

- “We do not believe that the general prohibition requires an adviser to present an equal number of negative testimonials alongside positive testimonials in an advertisement, or balance endorsements with negative statements in order to avoid giving rise to a misleading inference. […] One approach that we believe would generally be consistent with the general prohibitions would be for an adviser to include a disclaimer that the testimonial provided was not representative, and then provide a link to, or other means of accessing (such as oral directions to go to the relevant parts of an adviser’s website), all or a representative sample of the testimonials about the adviser.”

- Takeaway: To the extent an advertisement includes excerpted testimonials or endorsements, disclosure and cross-references to the entirety of testimonials or endorsements would be appropriate.

- “We continue to believe that advertisements should provide an accurate portrayal of both the risks and benefits of the adviser’s services. […] For example, an advertisement could comply with this requirement by identifying one benefit of an adviser’s services, accompany the discussion of the benefit with fair and balanced treatment of material risks associated with that benefit within the four corners of that advertisement, and then include a hyperlink to additional content that discusses additional benefits and additional risks of the adviser’s services in a fair and balanced manner.”

- Takeaway: Advertisements must be fair and balanced, and the SEC supports layered disclosure (i.e., where initial but limited information is provided upfront, with subsequent links/references to deeper, more detailed disclosures thereafter). Still, though, certain disclosures must be “clear and prominent” (i.e., within the four corners of the advertisement itself), while others may be provided via cross-reference or hyperlink. (More on the “clear and prominent” expectation discussed below.)

RIA Marketing Compliance “Specific Conditions” Applicable To Using Testimonials And Endorsements

Assuming the communication in question is actually an “advertisement” and does not violate any of the seven general prohibitions described above, an adviser must still satisfy three specific “conditions” to utilize a testimonial or endorsement (whether compensated or uncompensated).

The three testimonial/endorsement conditions for RIA advertising are thematically categorized by (1) required disclosures, (2) adviser oversight and compliance obligations, and (3) promoter disqualifications. Potential exemptions apply to all conditions.

RIA Required Disclosures For Testimonials And Endorsements

Disclosure is a fundamental concept in the Investment Advisers Act of 1940 as a whole, and the marketing rule is no exception. And specifically with respect to testimonials and endorsements, there are five required disclosures under the new marketing rule.

Advisers must either make all five disclosures themselves, or must “reasonably believe” that the person giving the testimonial or endorsement makes all five disclosures (if the RIA is using a promoter). If the promoter is to make the disclosures, the adviser can achieve such reasonable belief by providing the disclosures to the promoter, and subsequently seeking to confirm that they have indeed been provided to investors. Regardless of who ultimately makes the disclosures, they must be made at the time the testimonial or endorsement is disseminated.

Three of the five required disclosures must be made “clearly and prominently,” which means that such disclosures “must be at least as prominent as the testimonial or endorsement” (i.e., included within the four corners of the testimonial or endorsement itself). In the case of an oral testimonial or endorsement, such clear and prominent disclosures (whether delivered verbally or in writing) must be provided at the same time as the actual oral communication of the testimonial or endorsement itself. Cross-references/hyperlinks to such disclosures, as well as disclosures that are “spatially distant” from the testimonial/endorsement itself, would not satisfy the “clearly and prominently” expectation.

So what is the investment adviser or promoter actually required to disclose?

The three clear/prominent disclosures are as follows:

- The testimonial was given by a current client (or private fund investor), or that the endorsement was given by a person other than a current client (or private fund investor);

- Note: The name of the promoter need not be disclosed for privacy reasons; just the status as a client or non-client is required.

- Cash or non-cash compensation was provided for the testimonial or endorsement; and

- Note: A compensated testimonial or endorsement disseminated through a social media platform must clearly and prominently label it as a paid testimonial or endorsement. (Bear this in mind for character-limiting platforms like Twitter!)

- A brief statement of any material conflicts of interest on the part of the promoter resulting from the adviser’s relationship with such promoter.

The other two required disclosures are to include:

- The material terms of any compensation arrangement, including a description of the compensation provided or to be provided, directly or indirectly, to the promoter for the testimonial or endorsement; and

- Note: This compensation disclosure requirement is sourced from the rescinded cash solicitation rule, and requires specificity: “If a specific amount of cash compensation is paid, […] disclose that amount. If the compensation takes the form of a percentage of the total advisory fee over a period of time, […] disclose such percentage and time period. With respect to non-cash compensation, if the value of the non-cash compensation is readily ascertainable, […] include that amount. Moreover, if all or part of the compensation, cash or non-cash, is payable upon dissemination of the testimonial or endorsement or is deferred or contingent on a certain future event, such as an investor’s continuation or renewal of its advisory relationship, agreement, or investment, then […] disclose those terms.” If the investor will pay a reasonably ascertainable increased advisory fee as a result of the promoter’s testimonial or endorsement, then include that amount.

- A description of any material conflicts of interest on the part of the promoter resulting from the adviser’s relationship with such promoter and/or any compensation arrangement.

- To quote the Adopting Release, “there should be explicit disclosure that the promoter, due to such compensation, has an incentive to recommend the adviser, resulting in a material conflict of interest.”

While the above disclosures must be provided, it is important to note that testimonials and endorsements may be accompanied by contemporaneous oral disclosures (i.e., such disclosures need not be written). Though caution is recommended for advisers relying on oral disclosure delivery – especially if relying on the promoter to deliver such oral disclosures – as the adviser must still maintain an appropriate record proving that the appropriate disclosures were provided appropriately and in a timely manner.

If the required disclosures are delivered orally, the adviser essentially has two compliance options: (a) record the video or audio delivery of the oral disclosure delivery, and keep the recording in its records, or (b) create a file (not necessarily a recording) noting the fact that oral disclosures were provided, the substance of what was provided, and when. For oral testimonials and endorsements where the required disclosures are delivered in writing, the adviser or promoter may provide the written disclosures at the same time as the oral testimonial or endorsement, and alert the recipient to the importance of the written disclosures. Failure to alert the recipient as to the importance of written disclosures accompanying oral testimonials or endorsements would violate the general prohibition against false or misleading statements.

In addition, it’s also important to recognize that a testimonial or endorsement made by an adviser’s affiliated persons (specifically, “partners, officers, directors, or employees, or a person that controls, is controlled by, or is under common control with the investment adviser, or is a partner, officer, director or employee of such a person”) is not subject to the above disclosure requirements. However, such affiliation must be “readily apparent to or disclosed to the client or investor at the time the testimonial or endorsement is disseminated, and the investment adviser must document such person’s status at the time the testimonial or endorsement is disseminated.”

What may or may not be considered “readily apparent” to a client or investor is a facts and circumstances analysis, but the Adopting Release does offer some helpful commentary with respect to the carve-out’s applicability to independent contractors versus employees: “The supervision and control an adviser exercises over an endorsing independent contractor may vary among different advisers and independent contractors. If the adviser exercises substantially the same level of supervision and control over an independent contractor as the adviser exercises over its own employees with respect to its marketing activities, the partial exemption would be available.”

The kicker to the disclosure requirement carve-out for an adviser’s affiliated persons is that the adviser must document the affiliated person’s status contemporaneously with disseminating the testimonial or endorsement. Consider memorializing the affiliation on an internal form, or otherwise ensure other pre-existing records (such as corporate records, employee payroll records, IARD/CRD, or any other similar records and licensing for investment adviser representatives) are kept current.

Investment Adviser Oversight And Compliance Obligations For Testimonials And Endorsements

The second condition to using a testimonial or endorsement is comprised of two elements, one of which applies to all testimonials and endorsements, and one of which applies only to testimonials and endorsements that involve more than de minimis compensation to a non-affiliated promoter.

“De minimis compensation” in the context of RIA promoters is $1,000 or less (or the equivalent value in non-cash compensation) during the preceding 12 months. The definition of “affiliated” is the same as described above in the Required Disclosures section discussed above (pertaining to various types of roles that are ‘affiliated’ with the RIA itself).

Regardless of whether the testimonial or endorsement is compensated or uncompensated, the requirement for all testimonials and endorsements is that the adviser must have a “reasonable basis for believing that any testimonial or endorsement complies with the requirements of the rule.” If the (non-affiliated) promoter is to be paid more than de minimis compensation for the testimonial or endorsement, the adviser must additionally sign a written agreement with such promoter that “describes the scope of the agreed-upon activities and the terms of the compensation for those activities.”

There are several examples of how an adviser may ultimately become satisfied that the testimonial or endorsement is compliant: (i) periodically asking solicited/referred clients what statements the promoter made to them, (ii) adopting reasonably designed policies and procedures that could, among other requirements, subject testimonials and endorsements to pre-review and pre-approval and impose restrictions on the content of such testimonials and endorsements (e.g., by specifically referencing the seven general prohibitions and five required disclosures), and (iii) requiring certain representations or attestations in the agreement signed with the promoter (e.g., that the promoter is and will remain duly qualified, licensed, and registered, if necessary, is not and will not later become an “ineligible person” [as discussed below], and that the promoter shall comply with the content and disclosure requirements of the marketing rule as well as any pre-approval requirements of the adviser). Again, the SEC is not prescriptive in spelling out exactly how an adviser must ultimately form its “reasonable basis,” but a combination of these efforts should go a long way.

Those that are familiar with the now-rescinded cash solicitation rule’s requirements will likely note that the promoter is not required to deliver the adviser’s brochure, will not require a separate solicitor’s/promoter’s disclosure document, and will not require a signed and dated acknowledgment of receipt from the solicited/referred client. All three requirements of the former rule are gone and partially replaced by disclosure requirements in the testimonial or endorsement itself (which, as noted earlier, may ‘just’ be oral and do not even need to be written anymore, though again the RIA is still expected to enact some process or procedure to determine that the potentially oral disclosures are being provided (and kept in the adviser’s books and records).

The $1,000 annual de minimis threshold is significant, as compensation arrangements up to that amount do not even require a written agreement with the promoter. As an example, an adviser may waive up to $1,000 per year in advisory fees for an existing client if such existing client provides a testimonial for the adviser or otherwise refers friends and family to the adviser – all without requiring the client/promoter to enter into an agreement with the adviser. This was the SEC’s olive branch to “refer-a-friend” programs, but bear in mind that the adviser will still need to comply with the other applicable prohibitions, conditions, and requirements of the marketing rule, including the (oral) disclosure requirements of such an arrangement.

One other helpful tidbit from the adopting release specifically relates to promoters that are registered investment advisers themselves: “We do not believe that an adviser that is acting as a promoter would be required to deliver its Form ADV Part 2 to a person the adviser was soliciting to become a client of another investment adviser.” Though seemingly innocuous, the implications of this statement are actually quite intriguing. An adviser’s Form ADV Part 2 is required to be delivered to clients of such advisers. Since the SEC concludes that an RIA promoter need not deliver its own ADV Part 2 to potential clients it is soliciting for or referring to another RIA, it stands to reason that the SEC does not consider such solicited or referred clients to be clients of the RIA promoter. Therefore, such RIA promoters would ostensibly not need to count clients solicited for or referred to another RIA for purposes of ADV reporting, which in turn may also make it easier for a successful promoter to avoid needing to notice file in multiple states (as most states, but not all, do not require notice filing if an RIA has no place of business in the state and fewer than 6 clients in the state, though notice filing obligations and the interpretation of whether a solicited or referred client is deemed a client of the RIA promoter as such may still differ from state to state).

Again, though, it’s crucial to bear in mind the reality that many or even most RIA promoters are registered at the state level and not with the SEC. And if they aren’t otherwise eligible for SEC registration, the SEC’s new marketing rule and any dicta in the Adopting Release are facially inapplicable, unless otherwise explicitly incorporated by a state’s rules and regulations, and instead will remain a matter of the state’s own (existing) rules and regulations. And, not to beat a dead horse, but RIAs both at the state and federal level will also need to account for state-by-state qualification, licensing, and registration requirements applicable to their investment adviser representatives. Federalism!

Disqualifications For Being An RIA Promoter Providing Testimonials Or Endorsements

The last condition to using testimonials and endorsements is that there are certain persons that will be prohibited from acting as compensated promoters (much like under the rescinded cash solicitation rule). Such persons are considered “ineligible persons”, either because they are subject to a “disqualifying Commission action” (an SEC opinion or order barring, suspending, or prohibiting the person from acting in any capacity under the Federal securities laws), or have experienced a “disqualifying event” (certain felony or misdemeanor convictions, certain SEC, CFTC, or SRO final orders, certain court-issued orders, judgments or decrees, and certain SEC cease-and-desist orders). These terms are all defined in the marketing rule itself, and ineligibility is further subject to a ten-year lookback period and carve-outs for certain affiliates and broker-dealers.

Notably, though, these restrictions apply only to compensated promoters. Thus, the entire disqualification analysis is not applicable to uncompensated testimonials and endorsements.

The takeaway here for advisers is not to put your head in the sand with respect to compensated promoters that you know – or reasonably should know – are ineligible persons. Consider some level of initial due diligence on a would-be promoter and require certain representations, covenants, and ongoing attestation requirements in the agreement to be signed with the promoter.

With respect to ongoing monitoring of promoters for potential future disqualification, the SEC strikes a balance: “Advisers could likely take a similar approach to monitoring promoters as they take in monitoring their own supervised persons, though advisers may assess the eligibility of their supervised persons more frequently in light of their obligations to report promptly certain disciplinary events on Form ADV. […] We would expect an adviser to update its inquiry into the compensated promoter’s eligibility at least annually while the endorsement or testimonial is available to clients and investors.”

New RIA Marketing Rules To Advertise Third-Party Ratings

In comparison to the page-count dedicated to testimonials and endorsements, the SEC dedicated relatively few pages to its thoughts on the rise of various third-party ratings platforms (e.g., Yelp). Thankfully, though, the concept and implementation requirements applicable to third-party ratings are a lot more straightforward.

A third-party rating in SEC-speak is a “rating or ranking of an investment adviser provided by a person who is not a related person […], and such person provides such ratings or rankings in the ordinary course of its business.” Thus, to qualify as the third-party rating and its conditional permissibility, the rating or ranking must be made by a person that actually issues such ratings or rankings in the ordinary course of its business (e.g., platforms like Yelp, Google Reviews, or new Advisor Rating/Review platforms that may arise in the future); otherwise, the rating or ranking would likely be deemed a testimonial or endorsement and subject to the framework described above.

Even assuming the third-party rating is issued by an unrelated and legitimate rater/ranker, an RIA’s advertising still may not include a third-party rating unless the adviser satisfies the “due diligence requirement” and the “disclosure requirement.”

To satisfy the due diligence requirement, an adviser “must have a reasonable basis for believing that any questionnaire or survey used in the preparation of the third-party rating is structured to make it equally easy for a participant to provide favorable and unfavorable responses, and is not designed or prepared to produce any predetermined result”.

In other words, the rating/ranking can’t be based on a skewed questionnaire or survey that drives respondents to respond in any particular way. But how much due diligence must an adviser do in order to get comfortable that the original questionnaire or survey passes the smell test? To quote the Adopting Release: “some due diligence”. The adviser could, for instance, obtain a copy of the original questionnaire or survey, seek representations from the rater/ranker about the underlying design, structure, and administration of the questionnaire or survey, or obtain publicly available information about the questionnaire or survey methodology. But the key is that the adviser can’t solely rely on the (favorable) results themselves.

To satisfy the disclosure requirement, the third-party rating must clearly and prominently disclose the following: “(i) The date on which the rating was given and the period of time upon which the rating was based; (ii) The identity of the third party that created and tabulated the rating; and (iii) If applicable, that compensation has been provided directly or indirectly by the adviser in connection with obtaining or using the third-party rating.”

Note that such disclosures must be made “clearly and prominently,” which, as discussed above, means that such disclosures must appear within the four corners of the advertisement itself and not be incorporated by cross-reference or hyperlink. Though the fact that compensation was paid must be disclosed (if applicable), though the advertisement need not include the actual amount of compensation paid.

As a reminder, a third-party rating must still satisfy the marketing rule’s general prohibitions or other general anti-fraud provisions of the Federal securities laws as well. The SEC’s Adopting Release on the marketing rule provides two examples of third-party rankings that would be considered misleading: (i) an advertisement references a recent rating and discloses the date, but the rating is based upon on an aspect of the adviser’s business that has since materially changed, or (ii) an advertisement indicates that the adviser is rated highly without disclosing that the rating is based solely on a criterion, such as assets under management, that may not relate to the quality of the investment advice.” In other words, an adviser shouldn’t disseminate an advertisement that touts it as the “Highest Ranked Advisor in the Tri-City Area”, cite to a third-party rating, and not disclose that the ranking is solely based on AUM and no other quantitative or qualitative factors. Bear this in mind when participating in and citing to various “Top Advisor” or “5-Star Advisor” ratings/rankings!

Conclusions & Practical Tips For RIAs Looking To Use Testimonials And Endorsements

Notwithstanding all the details of the SEC’s new marketing rule discussed here, the reality is that it will take some time for everyone in the legal and compliance realm to fully digest and regurgitate the complexities of the new marketing rule in a palatable format for advisors. And frankly, it will likely take some time for the SEC and its examinations staff (that audit RIAs and their compliance processes and procedures) to get their arms around how the requirements will be reviewed in practice. There will likely be a marketing rule FAQ page on the SEC’s website in the future (let’s hope it doesn’t get as bloated and convoluted as the custody rule’s FAQ page!).

In addition, it’s important to recognize that this article doesn’t even address the other equally important arm of the new marketing rule: performance advertising. (That deep-dive will be left for another day, when my fingers recover and my keyboard cools off!)

But for now, some practical tips and considerations for RIAs eager to leverage the marketing opportunities in the new rule when it comes to testimonials, endorsements, and third-party ratings:

- While it’s fair to say that the new marketing rule is more permissive in many respects than the former advertising rule, its permissive nature is subject to meeting the intricate clarifications, conditions, caveats, and carve-outs that weave their way between the lines. For those SEC-registered investment advisers champing at the bit to go on a testimonial spree, look before you leap (especially state-registered RIAs that technically aren’t even eligible to follow these new rules until/unless they are specifically incorporated into their state’s own investment adviser regulations!).

- There are no categorical prohibitions against asking current clients to provide testimonials, posting Yelp or Google Reviews, or paying a COI (Center Of Influence, like an attorney or accountant) to refer prospective clients. At the same time, advisers can’t do any of these things before analyzing how to do so correctly and compliantly. Accordingly, consider whether:

- The RIA is asking all of its clients to provide testimonials, or only the ones it knows will have nice things to say?

- The RIA is only excerpting positive reviews from Google Reviews, or including appropriate disclosure about and cross-referencing to the entirety of available reviews?

- The COI is an ineligible person, and/or do they need to be appropriately qualified, licensed, and registered to refer clients (and be compensated for it)?

- Sometime before the compliance date (in/around the fall of 2022), all existing solicitor agreements an adviser may have with a third-party will likely need to be re-drafted and re-signed to comport with the new endorsement framework. To the extent an adviser has any written (or unwritten) referral agreements with third-parties, such arrangements should also be scrutinized for potential SEC and state investment adviser and/or investment adviser representative qualification, licensing, and registration requirements with respect to what will now be known as the “promoter” (no longer a solicitor).

- To the extent an adviser matchmaking or referral network has relied on one or more no-action letters related to the cash solicitation rule, such reliance will not be justified after such no-action letters are withdrawn. RIAs that leverage such sites should stay tuned for which “Find An Advisor” programs either conform their programs so as to not be deemed promoters, determine that they will be deemed a promoter but exempt from qualification, licensing, and registration as an RIA, or register as an RIA themselves (which may then, in turn, require the adviser to include a disclosure in their own Form ADV regarding the promoter relationship, among other requirements).

- If an adviser wants to avail itself of testimonials, endorsements, and third-party ratings as soon as it can (i.e., upon the effective date but before the compliance date), remember that the entirety of the new marketing rule and corresponding recordkeeping obligations will immediately be imposed upon the adviser – including all of the performance advertising requirements that were part of the new marketing rule but not discussed in this article.

- Spend some time in the marketing rule’s definitions section, especially with respect to the term “advertisement.” From there, start to create an inventory of what advertisements are currently in existence, and what advertisements are on the horizon. If the RIA’s advertising inventory and future pipeline aren’t or won’t be compliant with the new marketing rule, start to reform such advertisements sooner rather than later.

- When it comes to the compliance professional’s heartthrob – compliance policies and procedures – RIAs should be certain, at a minimum, they prepare to revise and update the sections related to marketing/advertising, solicitor relationships, and recordkeeping. Since compliance policies and procedures aren’t worth anything if they’re not actually followed and tested, operational workflows and day-to-day practices will need to be revised in parallel. Plan to test for compliance after the compliance date (or earlier if the firm elects to be an early adopter) and assess the effect on the firm as part of the firm’s immediately subsequent annual compliance program review.

When the Investment Advisers Act was first created, and the existing rules for marketing were first implemented, the registered investment adviser was just a small pocket of the investing world, focused solely on portfolio management for institutions or (very affluent) individuals, and operated in a performance-based world where it was crucial to limit firms from inappropriately touting their investment performance (or testimonials regarding such performance) in a way that could over-promise and under-deliver to consumers.

Yet the reality is that in today’s world, the business of RIAs has increasingly shifted towards financial planning, wealth management, and more holistic financial advice, a domain where consumers pay for an intangible expertise that is difficult to vet and evaluate… especially when RIAs were prohibited from sharing the actual experiences of anyone they had ever served with that expertise!

With its newly revised marketing rule, the SEC has brought its advertising regulations into the modern era, with not only updates to better accommodate the rise of everything from social media to (advisor) review platforms, but a recognition that consumers are often the best to highlight who is (and isn’t) an effective financial advisor. But with new rules come new responsibilities for RIAs to comply with those rules to ensure the new framework is not abused. And financial advisors themselves will need to navigate what will still be overlapping (and sometimes incongruous) regulations applicable to SEC- and state-based registered investment advisers, as well as FINRA advertising and communication rules for those who are dually registered with a FINRA-registered broker-dealer as well.

Leave a Reply