Executive Summary

In 1999, the Social Security Administration began mailing paper copies of Social Security statements to most American workers that summarized their personalized retirement and disability benefits. While these statements were a valuable source of information for workers to understand their future benefits, budget cuts in 2011 ultimately precluded the Administration from continuing to mail paper statements to all workers. However, the Social Security Administration did make online statements available for workers who went through a simple process to establish an account. Whatever the means of access, though, the annual Social Security statement remains the most straightforward way to both know what Social Security benefits are anticipated to be in the future (at least on the worker’s current earnings trajectory), and to spot discrepancies that could be corrected to increase future benefits as well!

Given the likelihood that the Social Security Administration will continue its current practice of not mailing statements to most workers for the foreseeable future, the primary way financial advisors can help clients access their annual Social Security statements is online via a “my Social Security” account.

Once clients establish their my Social Security account and access their Social Security statements, advisors can review these statements with their clients and use them to verify the client’s reported work history, review current estimates of anticipated Social Security benefits, and explore how the benefits align to the client’s retirement income needs. (Though it is important to note that while advisors can help guide clients through the process of creating a my Social Security account (if their clients don’t have one already), they cannot create such an account for their clients, even with the client’s consent!).

Page 1 of the Social Security statement indicates that Social Security benefits are meant to be a supplementary source of income in retirement. This can be an opportune time to discuss a client’s overall sources of income, reviewing anticipated income to be provided by Social Security benefits, current retirement savings, other retirement income sources like a pension, and the potential need for guaranteed income products such as annuities.

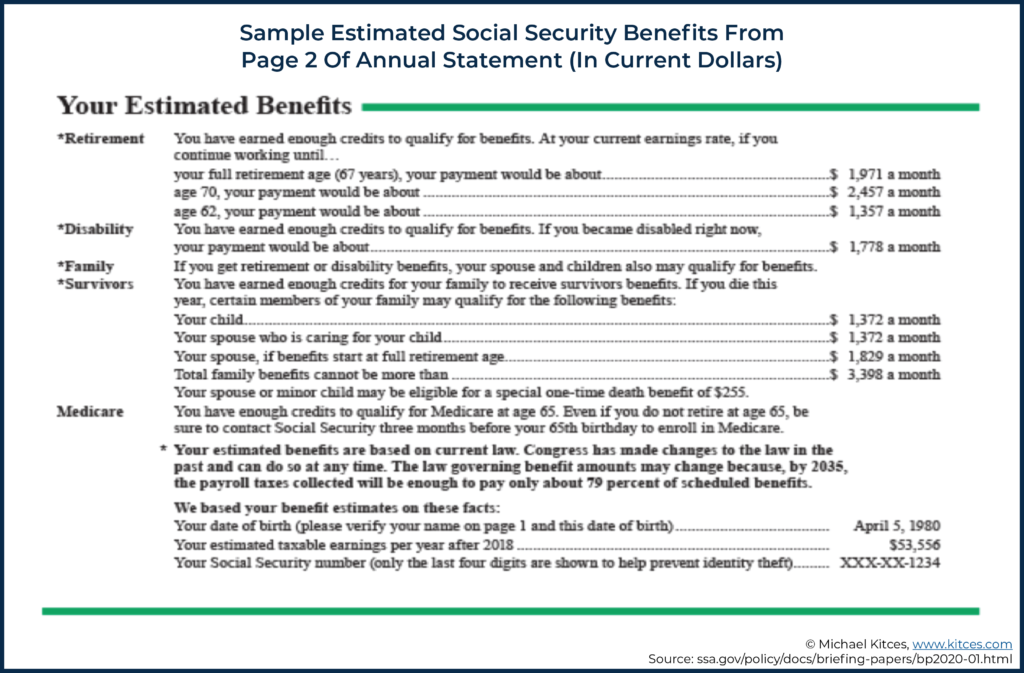

Page 2 of the Social Security statement includes a summary of the worker’s estimated retirement, disability, family survivors, and Medicare benefits. Notably, these benefits do not adjust for inflation (i.e., they are reported in current dollars, not future dollars with projected cost-of-living adjustments). Retirement benefit projections also generally assume that the income a worker earned last year will be how much they will continue to earn, in inflation-adjusting dollars, each year until they reach their Full Retirement Age. If there are no reported earnings from the prior year, but there are earnings from the prior-prior year, the earnings from the prior-prior year will be assumed through Full Retirement Age. Though if a worker has no earnings from either the prior year or the prior-prior year, the Social Security Administration will assume that there will be no future earnings when projecting future benefits.

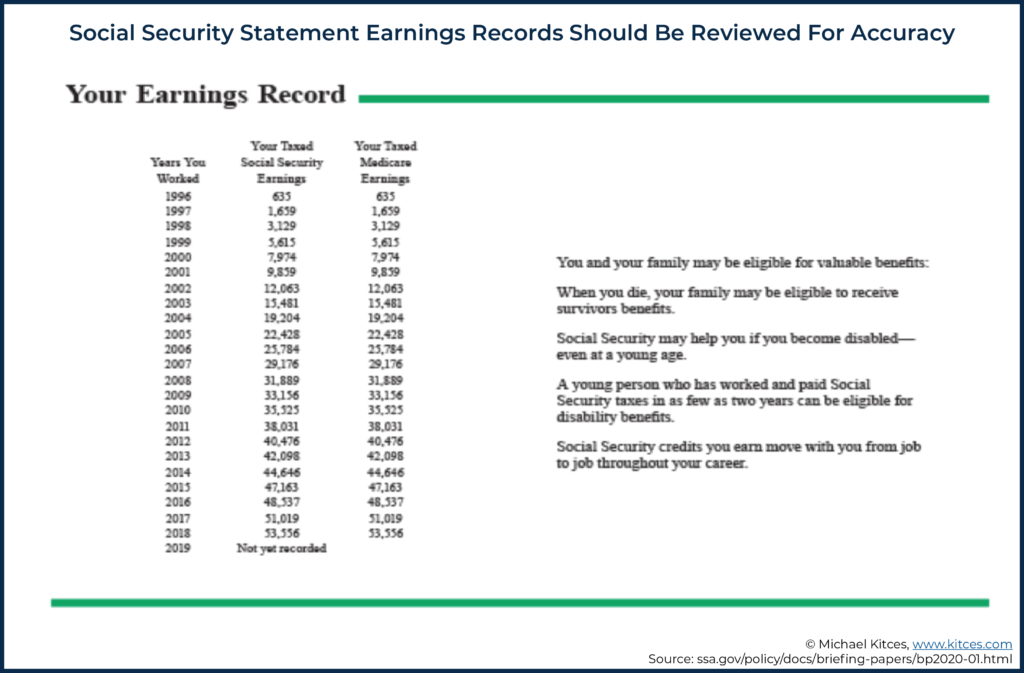

Page 3 of an individual’s Social Security statement details the earnings that the Administration has on file for each year since an individual began working. Advisors should encourage clients, especially those who are long-term self-employed individuals, to carefully review the earnings history on their statements. If an error or omission is identified, the mistake should be corrected as soon as possible by providing evidence (e.g., old Form W-2s or pay stubs, and/or tax) of the under-reported income to the Social Security Administration.

Ultimately, the key point is that a client’s Social Security statement can provide an advisor with valuable information, help clients to better understand their future potential Social Security Retirement Benefits (or fix their projected benefits if historical earnings are missing!), and serve as a launching point for deeper conversations with the client to explore how they can meet their financial planning goals!

In October of 1999, the Social Security Administration began mailing annual statements to (what was then about 125 million) workers. At the time, the endeavor marked the largest customized mailing ever for a Federal agency. And for more than a decade, workers could continue to count on receiving an annual statement from Social Security once per year by mail.

But by 2011, budget issues at the Social Security Administration led the agency to make the cost-cutting decision to stop mailing annual statements. A few years later, in 2014, the Social Security Administration partially reintroduced the mailing of statements for those age 60 and under at five-year intervals (beginning at age 25 and ending at age 60). Meanwhile, those 60 and over began to receive annual statements again, but only if they had not yet started to receive Social Security benefits and had not yet registered for an online account with SSA.gov.

In early 2017, though, budget woes once again forced the Social Security Administration to cut back on its mailing of statements, resulting in workers under age 60 no longer receiving mailed statements at all. Accordingly, the only workers to receive Social Security statements by mail thereafter were those who were both 60 or older and who had not yet registered for an online SSA account.

To date – and despite some bipartisan efforts to ‘force’ the Social Security Administration to resume mailing annual statements to most workers – this continues to be the policy of the Social Security Administration.

How To Help Clients Access Their Social Security Statements Online

While Social Security statements are no longer mailed to most workers, the statement remains an important source of information for clients planning for retirement (and/or disability or death).

Additionally, receiving a Social Security statement has been linked to other benefits, such as reduced pessimism surrounding the potential for Congressionally imposed benefit cuts in the immediate future.

Thankfully, though, even though the Social Security Administration no longer mails statements to most workers, it does continue to make them available online, via its ssa.gov website.

And given both the continued importance of the Social Security statement in the planning process and the likelihood that the Social Security Administration will continue its current practice of not mailing statements to most workers for the foreseeable future, one valuable service that financial advisors can provide is to help clients without an online Social Security account – known officially as a “my Social Security” account – to create one.

Only Workers Themselves Can Establish A my Social Security Account

While advisors can, and should, help guide clients through the process of creating a my Social Security account (if they don’t have one already), advisors cannot create a my Social Security account for clients… even if they have the client’s consent!

This applies even when an advisor has all the information on file to do so. It doesn’t matter if they have received permission from a client – verbally or in writing. They are simply not permitted to create an account on behalf of a client.

From the Social Security Administration’s website:

You may only create an account using your own personal information. Do not create an account using another person’s information or identity, even if you have that person’s written permission or are that person’s representative payee or appointed representative.

Accordingly, and as cumbersome as this may seem, if an advisor is helping a client establish their my Social Security account in the advisor’s office, the advisor should turn over control of the keyboard and mouse to the client while completing the application.

In addition, advisors should ensure that only the client has access to their password. Advisors should not only proactively instruct clients to avoid sharing their password verbally, but they should also ensure that the client’s password is not saved by the advisor’s web browser or any of the advisor’s password-capturing tools (e.g., LastPass, DashLane, Okta, etc.).

Furthermore, advisors should make sure that they only help an individual to establish that individual’s own my Social Security account. For example, while one spouse may be the primary ‘finance person’ and the only one who meets with the advisor on a regular basis, a financial advisor should not help that individual establish in my Social Security account for the non-present other spouse. Doing so would be aiding the present spouse in violating the Social Security Administration’s Terms of Service.

Guiding Clients Through The Creation Of Their my Social Security Account

If you’re a financial advisor, the chances are high that you’ve already established your own my Social Security account (and if you haven’t, you should!). But it may have been several years or longer since you’ve created your account or helped walk a family member, friend, or client through the process.

In order to create a my Social Security account, individuals should visit www.ssa.gov/myaccount, and click the “Create an Account” button, after which individuals will be brought to another page, where they will need to click another “Create New Account” button (“Department of Redundancy Department, how may we help you?”).

From there, users will be prompted to agree to the Terms of Service, which include acknowledging that false or misleading statements can lead to civil and/or criminal penalties, as well as important restrictions on the extent to which others may aid in the process to establish the account (more on this in a bit).

After agreeing to the Terms of Service, clients will be required to provide some basic information, including the following:

- First and last name, as shown on their Social Security card;

- Social Security number;

- Date of birth;

- Home address; and

- Email address.

Note that in an effort to help increase the security of workers’ my Social Security accounts, beginning June 10, 2017, two-factor authentication is required each time an individual logs into their account. Workers have the opportunity to provide a valid cell phone number to use for this purpose.

If, however, individuals prefer not to provide the Social Security Administration with their phone number, they can continue the application process and use their email address (which, as noted above, is required) for future two-factor authentication purposes.

After providing the information above, individuals will be required to complete an identity verification process. Notably, the verification process has recently changed and is significantly different than the verification process that was used in the past.

Advisors and workers who previously used the Social Security’s website to set up a my Social Security account may recall that the verification process previously required users to answer a series of questions, pulled from information on file with credit bureaus.

Common questions would include things like, “Which of the following streets have you lived on?” and, “Which of the following is a company through which you have previously held a line of credit?” While individuals generally were able to recall answers to questions like the former, the answers to questions like the latter were often much more troublesome, in part because of the opaqueness of the actual name of lenders when a DBA was used, and in part, simply because, over time, people would forget such things.

And to make matters worse, the pressure some workers felt to answer the questions correctly would lead to anxiety, which only further increased the likelihood that they would answer one of the questions wrong!

No more. Gone is the old system of requiring an exam-like series of questions about one’s past (though this still remains a secondary option for certain individuals). In its place, workers are now given a choice to verify their identity in one of two ways. The first way, and likely the simplest for most individuals establishing a new my Social Security account, is the ability to verify their identity using their smartphone and a state-issued ID card.

Workers who choose this method will be prompted to request a text message from the Social Security Administration containing a link that will take them to a photo capturing tool that will allow them to ‘snap’ a picture of their state-issued photo ID, such as a driver’s license. The process is similar to using one’s phone to capture an image of a check to make a virtual deposit to one’s bank account.

After uploading the image of the state-issued photo ID, workers will return to the my Social Security application to fill in some basic information about the ID, such as the type of ID (e.g., driver’s license, learners permit, or other state-issued photo ID), the state in which the ID was issued, and the number associated with the ID.

Workers who want to establish a my Social Security account and either can’t or don’t want to provide the Social Security Administration with a picture of their state-issued photo ID can opt for a second method of verification.

The second method of verification uses financial information to verify the worker’s identity. Workers can choose to use credit card information, Social Security benefit amount information, a Form W-2 Wage and Tax Statement, or a Schedule SE (Self-Employment Tax) from the most recent Form 1040 on file with the Social Security Administration.

Once workers select the applicable document, they will be prompted to enter the specific information needed to verify their identity.

Once a worker has completed their verification, they will receive an activation code at the email address or cell phone number that they provided for two-step authentication purposes earlier in the application process.

They can then establish a username and password and will also be able to select security questions to help them access their account in the event they forget their password or are otherwise locked out.

Understanding Benefits Shown On A Social Security Statement

Once a worker has established their my Social Security account, they can easily access and download a current Social Security statement.

The information that most workers and advisors are concerned with can be found on pages 2 and 3 (which include a summary of a worker’s estimated benefits and earnings record to date) of the statement, but advisors may wish to pause to review information on page 1 with clients, too, as it can help prompt important planning conversations.

Using Page One Of The Social Security Statement As A Conversation Starter

Page 1 of the Social Security statement indicates that Social Security benefits are meant to be a supplementary source of income in retirement and should not be one’s only source of income in retirement. The statement says (in part):

Social Security benefits are not intended to be your only source of income when you retire. On average, Social Security will replace about 40 percent of your annual pre-retirement earnings. You will need other savings, investments, pensions, or retirement accounts to make sure you have enough money to live comfortably when you retire.

To the extent advisors have not already had such a discussion with the client, this can be an opportune time to discuss how much of a client’s retirement income needs are anticipated to be covered by Social Security benefits.

Notably, while the Social Security statement states that, on average, 40% of pre-retirement earnings are replaced by Social Security benefits, this number is often dramatically lower for the high-income and/or high-net-worth individuals with whom many advisors work.

In some cases, clients may wish to see more of their future income needs covered by guaranteed sources. This can, in turn, lead to discussions about pension options, Qualifying Longevity Annuity Contracts (QLACs) and other Deferred Income Annuities (DIAs), Single Premium Immediate Annuities (SPIAs), and other ways clients may wish to generate guaranteed income to cover a higher percentage of their desired/necessary retirement income.

Interpreting Projected Social Security Retirement Benefits (Shown In Current Dollars)

While using page 1 of the Social Security statement as a conversation starter has the potential to help drive meaningful dialogue between an advisor and their client, the real ‘meat and potatoes’ of the Social Security statement can be found on pages 2 and 3.

Page 2 of the Social Security statement includes a summary of the worker’s estimated retirement, disability, family survivors, and Medicare benefits, based on the average earnings over the person’s entire work history (included on Page 3, discussed below). In most instances, individuals are most interested in reviewing these estimated benefits, and in particular, their estimated retirement benefit.

Oftentimes, when workers look at their Social Security statement, their first reaction is something along the lines of, “What!? By the time I retire, that monthly benefit amount will be worth almost nothing!” This is especially true when a worker has a significant amount of time before they expect to retire.

In all likelihood, when a client makes such a statement, it’s because they are unaware that the estimated benefits shown on a Social Security statement do not take inflation into account and are presented in current dollars, and not as future value dollars.

In other words, there are no cost-of-living adjustments (COLAs) being applied to the benefit amounts, even though they may not be claimed for many years yet, after which many years (or even decades) of cost-of-living adjustments will almost certainly have been made.

Accordingly, when discussing the estimated benefits presented on a Social Security statement with clients (and how much, or how little, those benefits can be expected to satisfy future income needs), advisors can try to frame the projected benefit in a way that accounts for a client’s current spending needs.

For instance, an advisor might say something like, “Assuming you were receiving that benefit today, how much additional income do you think you would still need in order to meet your goals?”

Of course, even when presented that way, clients will often still want to know what their future benefit will look like in nominal dollars (i.e., future dollars after adjusting for inflation).

As a starting point, advisors can use their baseline inflation assumption (otherwise used for the rest of the client’s financial plan) to inflation-adjust the current benefit to a future one. Of course, inflation itself is still uncertain, and absent a proverbial crystal ball, there’s no way to know for sure. However, it’s worth noting that the latest 2020 annual reports from the Social Security and Medicare Boards of Trustees use 2.4% as the expected future annual inflation (as measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers, or CPI-W), which was reduced from the 2.6% figure that had been used in the last 2019 annual report.

It’s also important to note that these inflation rates represent the Social Security Board of Trustees’ estimation for inflation over the next 75 years. And given today’s hyper-low interest rates, as well as other economic factors, it’s therefore reasonable to assume that the average annual COLA may be somewhat less than 2.4%, at least for some initial period of years (or even decades?). Accordingly, advisors may wish to assume more conservative COLAs for clients’ projected Social Security benefits.

Nerd Note:

While the projected COLA is an important consideration as part of a client’s plan, the most significant concern, from a planning perspective, is how the COLA applied to the client’s Social Security benefit compares to the inflation adjustment otherwise applied to the client’s projected expenses.

For instance, if an advisor uses 2% as an inflation assumption for a client’s overall retirement plan, but uses the Social Security Board of Trustees’ long-term inflation assumption of 2.4%, the real growth of the client’s Social Security benefit, with the plan, is going to exceed the real growth of their expenses. This could happen, but it is unlikely.

At the very least, conservatism would generally suggest that the COLA applied to the Social Security benefits within a client’s plan be no higher than the percentage used for the inflation of expenses within the plan.

Alternatively, some advisors will deliberately use a Social Security COLA assumption that is 0.5% to 1% less than their general assumption, as a way of gently haircutting Social Security benefits, either out of fear that they will outright fail to keep pace with inflation or to account for the risk of future benefit reductions if Social Security is changed in the future to account for projected shortfalls.

Example #1: Sally is a 55-year-old worker who plans to begin collecting her Social Security Retirement Benefit at her Full Retirement Age of 67.

Her current Social Security statement, which she is reviewing with her financial advisor, estimates a Retirement Benefit at Full Retirement Age of $3,000 per month.

Sally and her advisor are using estimated COLAs for future Social Security benefits of 1.5% as a part of her plan.

Therefore, all else being equal (more on this in a moment), Sally should expect to receive a monthly check of $3,000 [current value of retirement benefit] × (1+ 0.015)12 [factor to compute future value based on 1.5% COLA assumption and 12-year retirement timeline] = $3,587 when she reaches age 67.

Future Earnings Assumptions Embedded In Projected Retirement Benefits On The Social Security Statement

The actual Social Security Retirement Benefit to which an individual will ultimately be entitled can be ‘off’ from the projected Retirement Benefit shown on a Social Security statement today because of more than just incorrect (or rather, lack of any) inflation assumptions. This is because a worker’s projected Social Security Retirement Benefit, as shown on their Social Security statement, is also based on certain assumptions about future earnings.

More specifically, the Social Security Administration generally assumes that whatever a worker earned last year will be what they continue to earn, in inflation-adjusted dollars, each year in the future until they reach their Full Retirement Age.

Example #2: Arthur is a 50-year-old sales rep who typically earns about $65,000 a year.

But in 2020, the most recent year for which earnings are on file with the Social Security Administration, Arthur landed a once-in-a-lifetime mega-deal, earning more than the Social Security maximum wage base of $137,700 for 2020.

Accordingly, and despite the fact that Arthur fully anticipates future earnings of roughly $65,000 (not adjusted for inflation) per year, his 2021 Social Security statement will calculate his benefit using future earnings of $137,700 per year for the next 17 years (until Arthur reaches his Full Retirement Age).

On the other hand, in the event that an individual has no reported earnings from the prior year, but does have earnings from two years prior, the Social Security Administration will assume that the earnings for last year simply have not been reported yet, and that the earnings from the prior-prior year will continue to be earned, in inflation-adjusted dollars, until the worker reaches their Full Retirement Age.

Example #3: Mia is 60 years old and retired in December of 2019. Prior to her retirement, Mia earned $100,000 for 2019. In 2021, Mia meets with a financial advisor to create a retirement plan and brings with her a current Social Security statement.

Despite the fact that Mia had no earnings for 2020 and that she is, in fact, retired, the Social Security Administration will continue to assume that Mia’s prior-prior 2019 earnings of $100,000 will be earned through her Full Retirement Age of 67.

And if a worker has no earnings from either last year or the year before last, the Social Security Administration will assume that there will be no earnings between now and the worker’s Full Retirement Age.

Example #4: Up until 2018, Ed, age 42, was a high-earning worker. In 2018, though, after the birth of his daughter, Ed decided to take a few years off work to spend time at home raising his daughter while his wife continued to work.

If Ed reviews his 2021 Social Security statement, his projected future Retirement Benefit will assume that Ed has stopped working permanently and will have no additional years of earnings to lift up his benefits for the next 2+ decades!

Accordingly, his projected benefit on the Social Security statement will likely be substantially smaller than it will actually be if he returns to work, as planned, and continues to accrue more benefits.

In each of the examples discussed above, the worker’s projected Social Security benefits, as shown on their Social Security statement, could be dramatically different from what they should actually expect to receive upon reaching their Full Retirement Age.

Accordingly, these are prime examples of where a financial advisor, along with an appropriate calculator or software program, can help an individual to get a more accurate estimate of what their future Social Security Retirement Benefit will actually be.

Popular advisor tools that can be used to help estimate future projected Social Security Retirement Benefits include Social Security Analyzer, Maximize my Social Security, Social Security Timing, and the calculators included as part of Horsesmouth LLC’s Savvy Social Security program. There is also a calculator available on the Social Security Administration’s website that can be used to help project a more accurate future benefit amount.

Review The Client’s Earnings Record (And Make Corrections?)

When it comes to software or calculations, there’s an old expression, “Garbage in, garbage out.”

The Social Security Administration calculates an individual’s projected and, ultimately, actual Retirement Benefit using their highest 35 years of wage-inflation-adjusted earnings. Accordingly, helping a client to verify that the earnings on file with the Social Security Administration are accurate – and that they really are getting full credit for all of their (highest) earnings years – is another important service that financial advisors can provide.

Page 3 of an individual’s Social Security statement details the earnings that the Administration has on file for each year since an individual began working.

In most instances, the information is accurate, but it is not terribly uncommon for earnings information to be missing or incorrect.

Among other reasons, errors can occur because an employer misreported earnings (i.e., provided the wrong amount), reported earnings using an incorrect Social Security number (which means the client’s earnings will show as $0 that year because it was reported to someone else’s name!), or because the worker changed their name (often due to marriage or divorce) and didn’t report the change to the Social Security Administration (which again causes their actual earnings not to be reported under their current name).

In particular, advisors should encourage self-employed individuals to carefully review the earnings history on their statements. The reason is that self-employed workers’ earnings have to be pulled from their tax returns, and, up until about 15 years ago, the majority of taxpayers still filed their income tax returns using paper returns. As such, transferring a self-employed worker’s earnings information from their tax return to the Social Security Administration’s database was more likely to result in an error or omission of earnings, especially before around 2005.

Nerd Note:

In the event that an error or omission in a worker’s earnings history is spotted, the mistake should be corrected as soon as possible. To do so, workers should first gather evidence to support the fact that earnings are missing and/or improperly reported.

Common documents that can be used to support prior earnings include old Form W-2s or pay stubs to substantiate what the employer paid, and tax returns to show what was already reported as income. Once supporting evidence has been gathered, the worker can contact the Social Security Administration by calling 1-800-722-1213, by going to their local Social Security office, or by completing Form SSA-7008 and mailing it to the Social Security Administration’s office in Baltimore, MD.

It’s worth noting that even when there are no errors in an individual’s earnings history, a quick review is often still valuable. There are, for instance, a variety of observations an advisor may be able to make from a quick review of a client’s earnings history that may help answer common client questions.

For example, if an advisor observes that the client already has 35 years or more of solid earnings history, they can safely conclude that continuing to work will not substantially increase the client’s projected Social Security Retirement Benefits.

The earnings history report can also be a simple way of noticing trends in a worker’s earnings over time, helping an advisor to determine whether earnings viewed on a recent tax return are reasonable to use as a gauge for future earnings in a client plan, or whether they are more of an aberration (because they are either much lower or much higher than typical earnings), in which case further discussions should be had to identify the cause of the anomalous earnings.

Social Security benefits are an important part of most retirement plans. And even in situations where individuals are fortunate enough not to have to rely on Social Security benefits to provide some (or all) of their required income in retirement, workers still want to make sure they ‘get what they paid for.’ In either case, having an accurate Social Security statement is an important step.

Accordingly, in the event that a client does not yet have a my Social Security account, advisors should encourage them to establish one as soon as possible. Advisors can help such individuals by letting them know, in advance, what information and documents they should have available.

They can even be present, either virtually or physically, to help walk the person through the my Social Security account application process. Advisors cannot, however, complete the application for clients, even if clients provide such permission in writing (or otherwise).

Once clients have access to a current Social Security statement, advisors can walk the client through the statement to help them better understand and verify the relevant information. Specifically, advisors should make sure that clients understand that benefits are presented in current dollars (and that future earnings are projected based on only the most recent earnings history on file) and should encourage clients to verify that their earnings history is reported correctly on the Social Security statement. If there are any errors identified, they should advise (and help) clients to fix these promptly.

Ultimately, the key point is that reviewing an individual’s Social Security statement can provide an advisor with valuable information, help clients to better understand their future potential Social Security Retirement Benefits, and serve as a launching point for deeper conversations with the client, such as how much guaranteed retirement income an individual needs to feel comfortable.

Leave a Reply