I’m on vacation so I got to watch three or four hours of CNBC over the last two days from my hotel room. I don’t get to watch any CNBC during the week when I’m in New York working. Andrew, Joe and Becky are great at what they do, and I enjoyed a lot of the interviews I caught on Squawk.

But that’s not what I want to talk about.

I want to talk about something of greater import.

It’s a realization I was able to come to only as a result of stepping away and watching from a distance as the commentator class remarked upon the latest dozen or so SPACs to raise money or consummate a deal with an unprofitable, experimental business.

Or the moment by moment push of Bitcoin through the latest Big Round Number (it’s pulsing its way through $51,000 per coin as I type this). Add in all the alt-coins (which put the lie to the investment premise of scarcity, but that’s a different story for a different day) as well as the Non Fungible Tokens (NFTs), which is like a delusion of a delusion – we’re now inventing new “assets” solely for the purpose of digitally securitizing them and reselling them to an even more credulous buyer who will in turn find someone even thirstier to come in behind him.

Or the latest electric vehicle startup to be worth billions of dollars before selling even a few thousand cars or trucks on the open market.

Or the IPO explosion, where just for showing up the investor class awards your deal with an almost automatic, quasi-obligatory 50 percent premium above the offering price. “Thanks for getting out of bed this morning, here’s three billion dollars.”

Or the latest fintech contender entering the arena with yet another take on the free services in exchange for rapid user growth conceit. When your business model is selling stock, user growth is much more critical than profitability, and, in fact, profitability may even be a hindrance to attaining the sky-high valuations your stock buyers are hoping for. If you earn a profit, there’s a numerical multiple that can be placed on it. No profit? No problem. The valuation can be a multiple on our collective hopes and dreams. Can you quantify the majestic grace of a pegasus in flight? Can you tabulate the dollar value of a double rainbow? I didn’t think so.

Or the newest example of Generation Z know-nothings risking their in utero investment portfolios under the sway of a peer-pressurized message board casino atmosphere that, in another time and place, would result in a leap into the Bellagio fountain or entering a wet t-shirt contest on Spring Break in Mexico. They don’t have these outlets anymore in the physical world, so the online brokerages and trading apps have created a virtual Rumschpringe to help them scratch the itch.

But beneath the surface of all of these antics and activities is a single underlying fact: The risk-free rate is zero and, as a result, no one has any care or concern for current cash flow.

The risk-free rate is what you can earn from buying an asset that theoretically cannot lose its value (think 3-month Treasury bills or 3-7 year Treasury bonds) and subtracting the rate of inflation from the current yield of those bills or bonds. If we believe inflation is 2 percent annually (sure, so long as you don’t try to actually buy something), then the risk-free rate is effectively and actually zero (or worse).

In theory, this means money is almost free. Which means that if you’re borrowing it to earn a better return elsewhere, your hurdle rate to clear in terms of generating income is also almost zero. The investments you are making do not have to generate cash flow right now to support the cost of your borrowing, because you’re borrowing for nothing.

We’re in year twelve of this phenomenon for all practical purposes – zero percent interest rates and no cost of capital whatsoever, save for that short-lived game of chicken between the Fed and the S&P 500 that resolved itself on Christmas Eve 2018 (spoiler: the Fed swerved, the stock market got to kiss the hot girl who waved the flag). And of course, the monetary policy that was necessary to counteract the pandemic was like dropping a gasoline truck onto a forest fire.

So now you have trillions of dollars, owed with almost no interest, all chasing investments with the potential for massive capital appreciation – the cost of this money being so low as to render the need for current cash flows completely irrelevant to the global players of this game: Sovereign wealth funds, hedge funds, asset managers, index ETFs, mutual and closed-end funds, retirement savers, family offices, day traders, corporate treasuries and teenagers on TikTok.

GM cut its dividend and the stock price doubled. Disney too. Dividends used to be sacred. Cutting them was a sign that something was severely wrong. Not anymore. Nobody wants your stupid f***ing two percent dividend yield. “What is this a tip?” We want annually recurring revenue business models and 300 percent capital appreciation of the share price. We don’t even care if you actually earn profits. Just don’t tell us there’s a ceiling on revenue growth. That’s the kiss of death. No limit. No ceiling. Other than that, do whatever you want. Smoke weed on Joe Rogan’s podcast. Launch rockets. Manipulate crypto currencies. Tweet on acid. Pierce your nose. Spit in the eyes of your regulators. Incite a riot. Just don’t anchor yourself to a profit margin or take your foot off the accelerator.

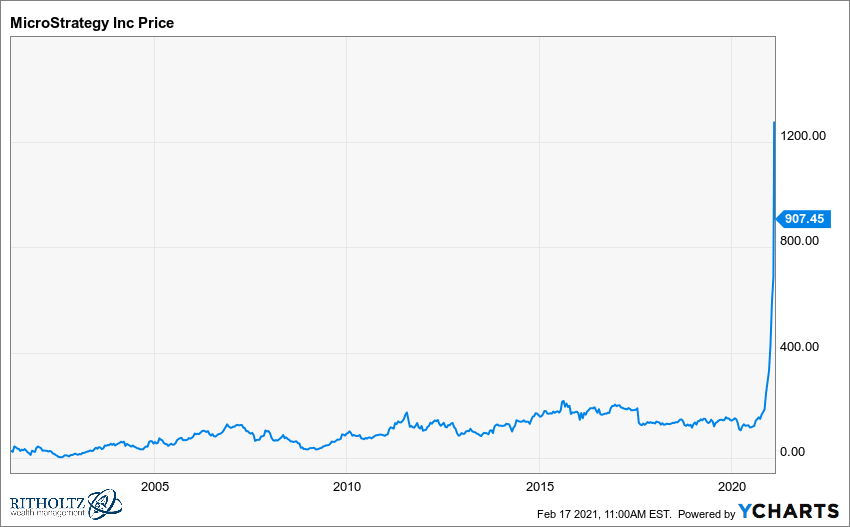

One year ago, MicroStrategy was a mundane, third-tier publicly traded software concern with a moribund stock price that hadn’t moved in nearly two decades. Then the CEO decided to dump most of his treasury into Bitcoin. The the stock went from 100 to 1000. Now he’s doing a convertible bond offering (more free money) with the express purpose of buying more Bitcoin. He’s not even pretending to invest in his company’s software products. He’s not working on productivity nor innovation. He’s simply creating value out of thin air through a massive bet on asset price inflation. Equity money is free. No interest rate to repay. The only cost is dilution of the existing shareholder base. But the existing shareholder base is probably 100% Bitcoin Zealot, so give the people what they want. They want more f***ing Bitcoin. “Drown us in it, if you please, sir.” Dilute them for the right reason and they will reward you with an even higher share price ex-post.

Not giving a damn about current income is the secret formula that sets you free from all terrestrial bounds of physics and logic. The way you pull it off is by executing on growth at any cost (GAAC?). Profits can come later once the market share battle is already won. Shareholders are willing to wait. And why wouldn’t they be patient. None of the money is costing anyone anything.

This is the feeling underlying all the stuff that’s exponentially rising in price right now. It’s all one, big trade. It’s the same capital, chasing the same assets and strategies, with the same mindset. And the longer it goes on for, the more crowded the room, the higher the risks and the more relatively narrow the exits become. But no one is looking at the exits. No one is even thinking about making their egress. Because to do so would be to leave the potential for thousands of percentage points of return on the table. Almost no one can do that – especially if they pitched potential market-beating returns to their investors from the outset.

A risk-free rate of 1 percent doesn’t necessarily crash the prices and values of these trades as much as it holds them back from proliferating any further. We’re six weeks into 2021 and 145 SPACs have already raised over $50 billion. That doesn’t happen at a risk-free rate of over 1 percent. A risk-free rate of 1.5 percent probably unwinds the trend and sets it in reverse. A 2 percent risk-free rate starts blowing up deals. It knocks down a lot of the desire to invest in greater fool-driven digital asset schemes and shrinks the valuations now being assigned to growth-at-any-cost business models. Because the cash has a price attached to it. A vig it has to earn today, this month, this year.

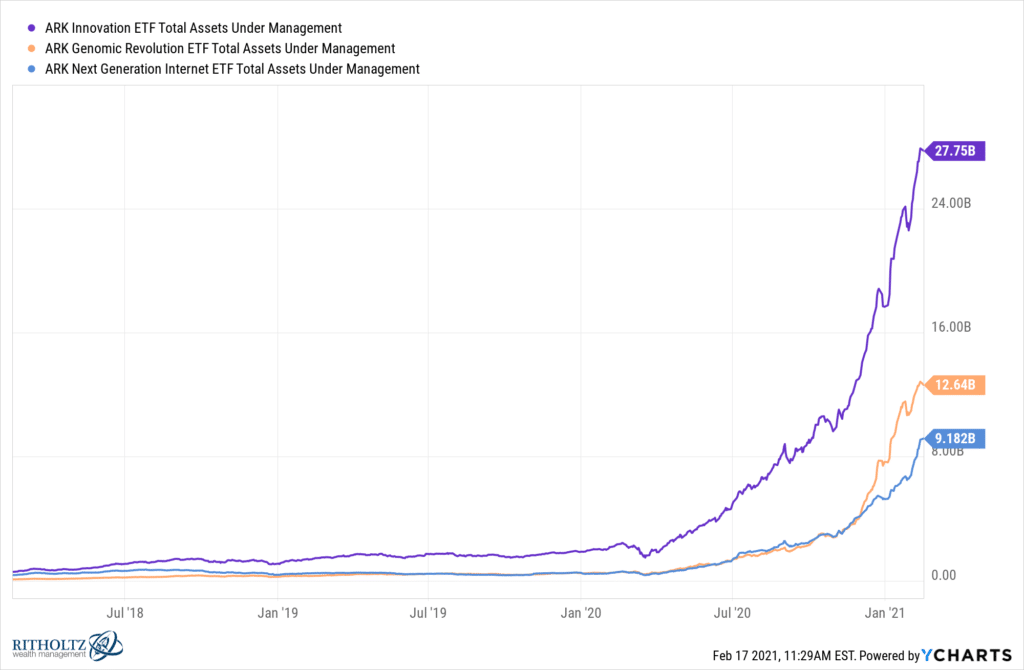

But 2 percent risk free rates practically require a higher overnight rate from the Fed and the Fed has gone out of its way to make explicit promises that this is not in the cards for 2021. They’re guaranteeing a continuation of the way things are for a long time. In the meanwhile, President Biden is promising a concurrent flood in the form of almost $2 trillion worth of liquidity flooding the bank accounts and municipal cisterns of every man, woman, child, city and state within reach. It’s no wonder investors have reacted to this flood of liquidity by building an ARK:

So I’ve retreated Zarathrustra-style to the cave (okay, Sunny Isles, FL) and have had this realization come over me, removed as I’ve been from the market’s daily commotion. Now what? What does one do with this information?

My answer never changes. A diversified strategic asset allocation has enabled you to benefit from much of this commotion, but, of course, not all of it. You can’t have all the upside unless you’re willing to risk all of the downside. If you’ve been diversified, you’ve owned assets all along that have not kept pace with the gains of Tesla, Bitcoin, pre-announcement SPACs, gene-editing biotechs and all of the other one-way trades that have increasingly become a gigantic, homogenous bet on endless zero percent risk-free rates. And you might have felt left out from time to time.

But when this all reverses (and it always does), those regrets will transform into sighs of relief. And if you’ve got any form of tactical asset allocation reacting to this reversal on your behalf, even better – despite what this mechanism might have “cost” you while everything was on the upswing.

Since there’s no telling whether or not we might have another year or three of the current environment, and I don’t have the ability to predict turning points in advance, I employee both strategic asset allocation as well as tactical asset allocation. If I could confidently predict how much longer we’ll be in the current paradigm, I would throw both of those things out and just play the game. But I can’t. So we have rules and guardrails and responses planned in advance instead. You might have a better answer than mine (MARKET TIMING! INVERSE ETFS! OPTIONS! WITCHCRAFT!), but I know that mine works for me.

If the Big Long goes on for the remainder of the twenty-teens decade, I will thrive. If it ends today, I will survive. I’ll never be in first place. I’ll never be in last. But I will be happy.

I want to end by quoting Kurt Vonnegut’s remarks to one of the lucky graduating classes who had gotten to see him deliver a commencement speech over the years:

“My Uncle Alex, who is up in Heaven now, one of the things he found objectionable about human beings was that they so rarely noticed it when times were sweet. We could be drinking lemonade in the shade of an apple tree in the summertime, and Uncle Alex would interrupt the conversation to say, “If this isn’t nice, what is?”

So I hope that you will do the same for the rest of your lives. When things are going sweetly and peacefully, please pause a moment, and then say out loud, “If this isn’t nice, what is?”

Everything is working. Everyone is making money. Enjoy the moment while it lasts. If this isn’t nice, what is?

Amen, Kurt. Amen.

Leave a Reply