Executive Summary

Since 1991, the CFP Board has offered the CFP certification exam to establish a high standard of excellence for financial advisors to act as fiduciaries for their clients. The exam is a rigorous, 6-hour test, and is offered only three times a year. Because of the rigorous nature of the exam and the scope of material covered (not to mention the relatively low pass rate generally ranging from 60–65%), candidates aspiring for CFP certification invest an inordinate amount of time to ensure that they pass the exam. And to make sure that they structure the time devoted to test preparation most accurately, candidates need to consider several factors, including the requirements to take the exam, their own learning styles and study habits, the resources available to them, and how to structure a schedule to follow to stay on track to best prepare for the exam.

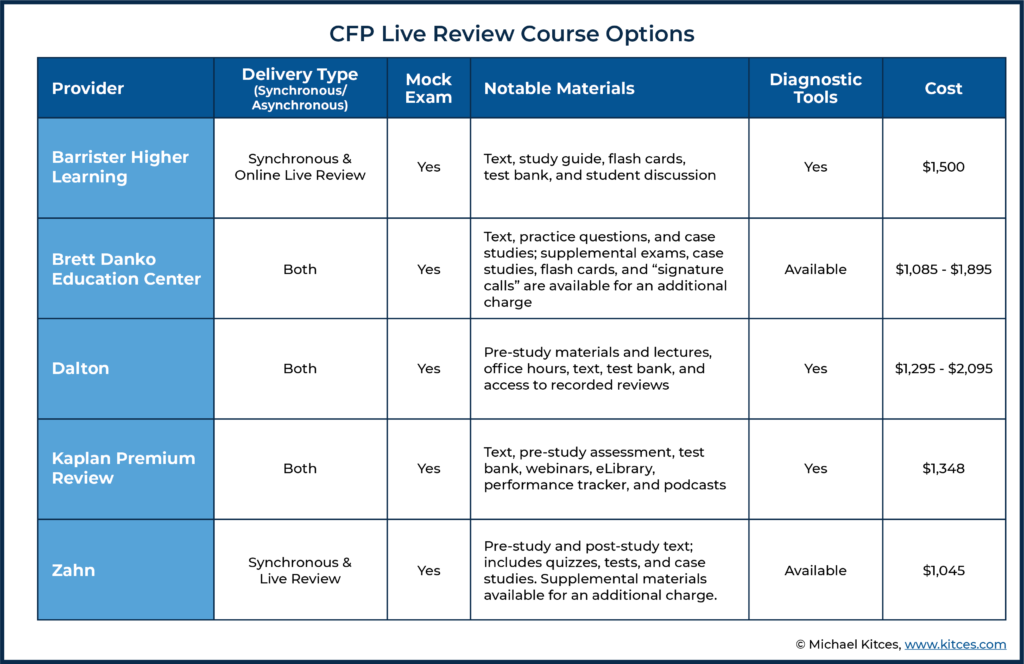

The first important key for any CFP candidate to create a workable study plan for the CFP exam is to understand whether they are visual, auditory, or kinesthetic learners. By knowing their own learning style, candidates can implement the most useful CFP exam prep tools to help them retain and apply the information they will need to pass the exam. Understanding their learning style can also help candidates choose the right CFP exam review course to prepare for the test. While review programs can be expensive (generally ranging from $800 to $1,500), they have helped many candidates successfully prepare for (and pass!) the exam by conditioning them to the style and pacing of questions, helping them review material and create a framework to recall important facts, and providing general support and practice materials.

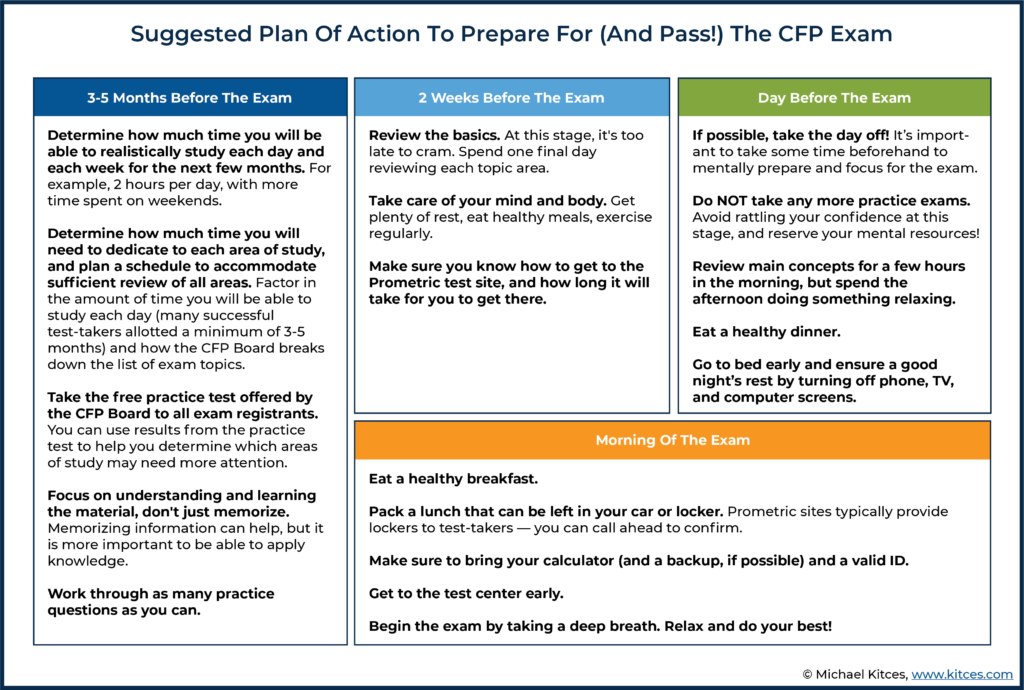

Candidates will find that creating a structured study schedule is critical for successfully preparing to take the exam. The general recommendation is to devote at least 10 hours per week, with a total of 150-250 hours (which means approximately 4-6 months of preparation), to study for the CFP exam. While most review courses guide candidates through creating a structured study plan, candidates should ensure that they actually stick to their plan of action and devote ample time to any areas they may be struggling with, being mindful to learn and understand the material – not just to memorize it – knowing how the breakdown of topics covered by the exam are weighted. Taking practice exams and working through as many practice questions as possible will help candidates get accustomed to the nature and scope of questions that will be on the exam.

During the final stage of exam preparation, candidates should focus on developing confidence in passing the exam, spending time reviewing the basics in each topic area, and getting plenty of rest to mentally prepare for exam day. On the day of the test, candidates should ensure they have their calculator (and a backup, if possible), a valid photo ID, and a packed lunch that can be kept in their car or on-site locker.

Ultimately, attaining CFP certification is no small task; the exam requires a great deal of commitment and requires candidates to build up enough confidence to actually decide – with conviction! – to pass the exam. While preparing for the exam requires hard work, focus, tenacity, and a lot of effort, the payoff is well worth the sacrifice. CFP professionals can confidently set themselves apart as competent and knowledgeable financial planners who can use their financial planning knowledge to positively impact their clients’ lives by helping them achieve their goals!

As financial planning continues its march towards becoming a globally recognized profession, the Certified Financial Planner (CFP) designation has become the baseline standard for aspiring financial planners.

Accordingly, CFP certification has become a substitute for the Series 65 in many states, as attaining the CFP mark demonstrates not just core financial planning competency but also carries the responsibility of fiduciary advice. Further, it elevates a professional’s standing with the American public and within the profession.

It’s important to note, though, that CFP certification isn’t legally required for financial planners to ‘hang a shingle’ and practice financial planning – it is a completely voluntary certification. Requirements to practice financial planning are actually dependent on the particular services and/or products provided, the size of the firm, and the state in which the business operates.

To attain the CFP mark, you must have earned a bachelor’s degree (in any discipline) from an accredited college or university, complete specific courses within a CFP Board registered program, pass a comprehensive exam, meet one of two minimum experience requirements, and meet an ethics requirement. These requirements are known as the “Four E’s” of Education, Exam, Experience, and Ethics.

Notably, though, sitting for the CFP exam requires only the completion of the CFP education coursework as a prerequisite, and in practice is often done before CFP candidates complete their Experience requirement. But because the CFP exam is a substantial (6-hour!) exam, and only offered 3 times per year in specified 1-week exam windows, it is important to have sufficiently studied for and be prepared to pass the Exam when the time comes!

The CFP Exam: What To Expect

The first CFP exam was offered in 1991 and initially consisted of a two-day 10-hour paper-and-pencil exam consisting of 285 multiple-choice questions and written responses.

Since then, it has evolved with the financial planning profession and was adjusted over the years (most recently in 2014) to what is now administered as a computer-based 170-question multiple-choice exam delivered over two, 3-hour sessions that are completed in one day. Each multiple-choice question has four answer choices, sometimes with a case study that precedes a series of multiple-choice questions. There are no essays or written response questions.

The content spans the full range of the CFP Board’s 72 Principal Knowledge Topics and includes professional conduct and regulation; general principles of financial planning; and issues involving estate, tax, investment, retirement, risk management, and insurance planning.

The exam is designed to confirm technical competency and to test one’s ability to apply that knowledge in practical scenarios. Exam questions are written by volunteer subject-matter experts in the field of financial planning.

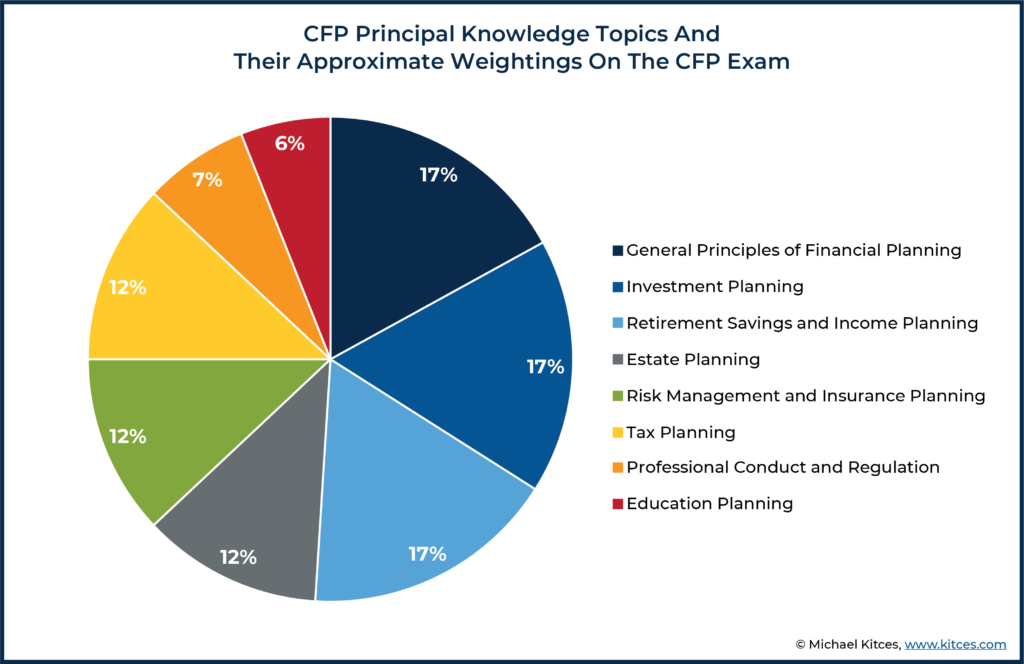

CFP Principal Topics And Their Appropriate Weightings On The CFP Exam

The overall pass rate of the CFP Exam typically hovers between 60%-65%, with first-time test takers faring slightly better. The exam is typically offered at Prometric testing centers in March, July, and November. With the COVID-19 pandemic promoting innovation across the globe, it was recently announced that the exam will be temporarily offered remotely as well (i.e., where test takers can take the CFP exam remotely from their own home, though they must comply with stringent remote proctoring requirements to ensure there is no cheating).

How To Prepare For The CFP Exam

Like most things in life, creating a plan and sticking to it is vital, and the same is definitely true when it comes to preparing for the CFP exam.

Knowing Your Learning Style Will Help You Study For The CFP Exam More Effectively

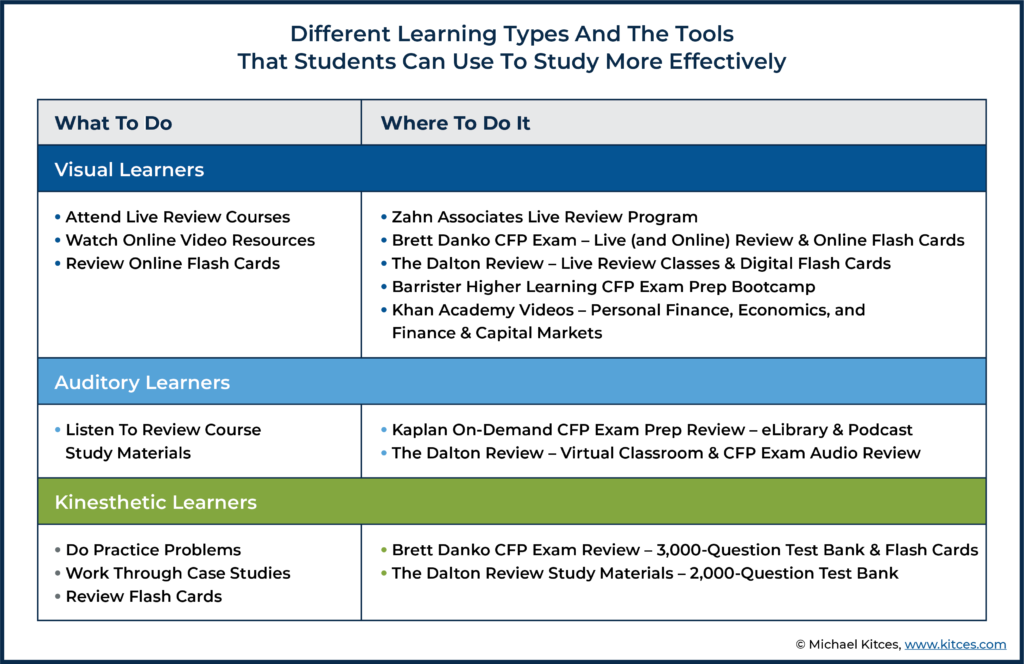

Everyone learns differently, and each person must determine what type of learner they are. There are three types of learners: Visual, Auditory, and Kinesthetic. Visual learners, of course, learn best by watching or observing others. Auditory learners best learn by listening to information/instruction. And those who learn best by doing are typically described as kinesthetic learners.

Determining your learning style will be especially important when preparing for an exam as rigorous and study-intensive as the CFP exam. Doing so will help you determine which materials will be most helpful in facilitating retention of both the material and helpful test-taking tips.

For instance, a kinesthetic learner may find it most helpful to spend large quantities of time practicing problems and working through relevant casework. They will likely find Danko’s review course with its 3,000-question test bank, or Dalton’s 2,000 question bank, to be the most comfortable way to prepare for the exam.

Visual learners may find that attending a live review is imperative to their preparation. The review course offered by Zahn has long been celebrated for its live review and Danko, Dalton, and Barrister offer live review options as well. If you’re a visual learner who needs a refresher on foundational concepts, check out the Khan Academy videos (yes, the same Khan Academy that helped you survive college calculus) or other “doodle” style videos that illustrate solutions to financial problems. You can find countless visual resources like this on YouTube.

Auditory learners will benefit from the ability to listen to, and re-listen to, the study material provided by the review course. Kaplan’s on-demand webinars, eLibrary, and CFP Exam podcasts may prove especially beneficial to auditory learners. Leveraging Dalton’s self-paced online program, which allows test takers to listen to instructor-led classes live or on-demand, may be a solid option as well.

We often encourage candidates to find an online assessment quiz (like the one offered by the University of Connecticut) or take the time to consider how they most effectively learn the material. This will go a long way in creating a cohesive study plan.

How CFP Exam Review Courses Can Help Students Prepare For Their Test

A review course can be one of the most important ingredients of your study plan. We’re asked daily whether a review course is worth the investment and our answer is almost always, “Yes!” Review courses can be as simple as Kaplan’s self-paced “essentials” review ($449) that consists of textbooks and a study bank, or as immersive as Brett Danko’s Signature Live Review ($1,895) that features not only study texts and a live review, but a full slate of group review sessions, one-on-one “Signature Calls”, and additional practice materials. Most review courses fall into the $800-$1,500 range and will consist of some combination of review material, practice questions, and lecture-style instruction.

Remember, technical expertise in financial planning and the mastery of a test-taking approach needed to pass the CFP exam are not necessarily the same thing. The purpose of a review course isn’t to teach you the material, but to provide you with the tools, structure, and perhaps some forced discipline to pass the exam. In other words, the true value of the review course isn’t necessarily in gaining the financial planning expertise (which ideally comes from completing the education component required for CFP certification), but in helping you focus on which topics are most likely to be tested and in preparing you for how those topics will be presented on the exam.

Further, considering that test takers are encouraged to spend between 150-250 hours studying for the exam, finding the right review course can help you properly allocate and focus your time on the most important material. Attaining the CFP designation can prove financially and professionally beneficial, so investing in a review course comes with a positive ROI.

The CFP Board provides a list of CFP review courses, each offering a unique approach to preparing for the exam. It’s worth noting that some of the university review courses are taught in conjunction with, or as an extension of, other review course offerings by established vendors like Kaplan or Dalton.

Most review courses offer some combination of review material, practice questions, and feedback specific to your strengths and weaknesses. Some offer asynchronous review sessions or lectures, others offer periodic live review sessions, and others a condensed “live review”.

The table above details the offerings of some of the most widely recognized providers. For test takers who are looking for the most immersive preparation, Dalton, Danko, or Kaplan’s premium options are quite comprehensive. Dalton is celebrated for the sheer volume of information they provide to candidates. For those who already possess a strong technical foundation and need coaching on how best to approach the exam, Zahn is a solid choice. If cost is the driving factor, Kaplan’s “Essentials” review ($449) provides self-motivated individuals with pre-study texts, a test bank, and baseline assessments. Though perhaps not as well-known, Wiley offers a solid slate of exam review products that range in price from $395-$695, and contain virtual lectures, practice questions, flashcards, and full-length mock exams. We regularly encounter test takers who choose to pair one of the live review offerings, such as Zahn, or Danko’s less expensive offering, with a material set from another provider.

To decide which program will work best for you, spend some time researching each program and ask successful test takers in your network about their experience with the review course of their choosing. It may also be helpful to join the CFP Board Candidate Forum as there is a vast amount of information exchanged there.

Almost all of the review courses we’ve encountered offer some sort of “guarantee”, free re-take feature, or additional coaching should your first attempt prove unsuccessful. Regardless of which review course you choose, it’s important to exhaust the provided materials and trust the study plan.

Getting Started: Creating A Study Plan Of Action To Pass The CFP Exam

Once a test date and review course have been chosen, it’s time to get started. You must now determine how much time you’ll need to allocate to preparing for the exam. After speaking with successful test takers across the nation, we encourage at least three to five months of focused study.

This will likely include studying at least 10 hours per week and should total between 150-250 hours. The CFP Board recommends studying for 250 hours, as referenced by Kaplan, while Dalton recommends a target of 200 hours. A recent study found that 76% of those who passed the exam studied at least 10 hours per week while only 62% of those who failed studied more than 10 hours per week. Some test takers will need to study more than that, of course, and honest self-assessment is requisite to effective preparation. Should you choose to purchase a review course, you will be provided with a study plan specific to their materials.

The CFP Board offers a free practice test to everyone who registers for the exam. It may be best to start with this exam to set a baseline for areas in which you need to improve. The practice exam provides you with instant feedback, including explanations for incorrectly answered questions. Perhaps you struggle with estate planning; taking a pretest will uncover specific deficiencies in your knowledge. Be sure to spend additional time reviewing these concepts and working through difficult practice problems. Remember, it’s better to study for a couple of hours every day rather than cramming at the last minute.

It’s also important to be mindful of how much each topic is tested on the exam. This is vital to assign the appropriate amount of time to each core area of the exam, as illustrated in the graphic above.

For instance, candidates might consider allotting more time to study topics under General Principles of Financial Planning, Investment Planning, and Retirement Savings and Income Planning, since these areas are weighted the highest on the exam, with an approximate allocation of 17% each. On the other hand, Education Planning and Professional Conduct and Regulation, while both critically important areas, are weighted 6% and 7%, respectively, so the time spent studying for questions on these topics should be adjusted accordingly.

Many candidates overlook the general principles and professional conduct sections of the material. These sections cover the basic regulatory framework, the financial planning process, and the maintenance of the CFP mark. It is imperative that you get these questions right.

Further, don’t skim over the areas where you feel most comfortable. Nothing invokes panic during an exam as much as floundering on a question you ‘should’ know the answer to.

As you work through the study material, make sure you focus on learning – not just memorizing – the material. The exam tests your ability to apply knowledge more so than just having the knowledge itself. Make sure you understand the why in the correct answer. Further, work through as many practice questions as you can.

If your exam review course offers a test bank; exhaust it. If, after exhausting the review materials, you are still struggling to attain adequate scores on the practice exams, consider Kaplan’s “Essentials” offering, Pocket Prep’s CFP offering, Wiley’s CFP Test Bank, and last but not least, the CFP Board’s practice exam offerings.

Remember, you are offered one free practice exam when you register for the exam and can buy a second for $250 ($125 if you registered for early bird pricing). You’ll feel most confident if you can apply your knowledge to tackle questions in any way the CFP Board throws them at you. There are a lot of questions where the correct answer is the ‘exception to the exception’ of the rule, so it is imperative you can apply what you have learned.

Final Stage Of CFP Exam Preparation

As you get closer to exam time, you should have a solid grasp on the material, have taken multiple practice exams, and should be refining your knowledge in those remaining trouble areas. During the final two weeks, the heavy studying you did early on should be paying off, and developing confidence should be your focus.

At this juncture, it’s too late to cram. Take time to review the basics one last time and spend one final day on each topic area. Get plenty of sleep and don’t make the mistake of taking a practice exam the day before the real thing. Not only will you be mentally exhausted, but you also don’t want your confidence rattled this close to exam time.

If you have the option to take the day before the exam off, it may be a good idea to do so. Spend a couple of hours that morning reviewing concepts and do something relaxing that afternoon. Eating a healthy meal for dinner, going to bed early, and turning off screens will ensure you’re mentally prepared for the big day!

On the morning of the exam, be sure to allow plenty of time to get to the testing center. Eat a healthy breakfast and remember to pack a lunch. You will not be able to bring food or beverages into the exam so pack items you can leave in a vehicle or locker. Most Prometric sites offer locker storage for valuables that aren’t allowed in the test center. It would be wise to call ahead and ensure your center will have a locker for you. Remember, you’re entitled to a 40-minute break between the three-hour exam sessions. If you have a favorite candy bar or treat, put one in your lunch as a reward for completing the first half of the exam.

You must also remember your calculator and a valid, government-issued ID. It’s probably prudent to have a “back-up” calculator on hand as well. The CFP Board clearly states that you are allowed “one or more battery-powered, non-programmable, dedicated financial function calculator.” If you have two calculators, bring them both, and if you only have one, be sure it has fresh batteries. We’ve heard many stories of candidates showing up to the testing site and forgetting a basic item, like an ID or calculator.

Once you sit down to begin the exam, take a deep breath, and relax. At this point, it’s all about focus and execution.

Indicators That Can Predict CFP Exam Success Or Failure

We speak with hundreds of candidates every year who are successful in passing the CFP exam and many others who are not. We have found that candidates who are successful in passing the exam share the following characteristics:

- They commit to a structured study routine and maintain consistent discipline throughout the process;

- They prioritize their exam for at least three months and have ‘buy-in’ from their personal and professional support systems (e.g., their friends and family allow for and support their CFP Exam study time); and

- They focus on what they don’t know, rather than on what they do. It’s tempting to over-study for the topics you enjoy or are most comfortable with. We all love financial planning and never miss an opportunity to ‘nerd out’ on our favorite topic, but students must remember that the ultimate goal is to pass the exam. It’s important to go into the exam with a balanced understanding of the material. You will have the rest of your career to develop more nuanced expertise!

On the other hand, students who do not pass the exam typically demonstrate the following characteristics:

- They underestimate the difficulty and rigor of the exam;

- They do not take it seriously or feel forced to take it;

- They rely too much on professional experience and not enough on the review material;

- They spend too much time studying material they already understand; and

- They have too many personal and professional distractions to spend an adequate amount of time preparing for the exam.

It’s important to note that there is no single approach that guarantees you’ll pass the exam on your first try, but the aforementioned items are good indicators. There are certainly underprepared individuals who pass and well-prepared individuals who do not. Many intelligent, diligent, test takers fail the exam each testing cycle. Passage or failure of the CFP exam is not a permanent indication of your ability to thrive in the profession.

When To Take The CFP Exam

Deciding when to take the CFP exam is among the most important considerations of the process. It’s a question we get often: “Should I take the exam as soon as I complete the CFP exam coursework, or gain experience first?”

Like most answers to questions of this magnitude, it depends on the individual. Countless candidates have successfully completed the exam with both approaches. In general, for strong students graduating from a top-tier financial planning program such as the University of Georgia, Texas Tech, Kansas State, Virginia Tech, or Golden Gate University to name a few, their best bet is to complete a review course and sit for the exam within twelve months of graduation. The technical knowledge is still fresh, the tax laws memorized in school remain current, and the process of studying is still a natural part of the routine.

On the other hand, for recent graduates who struggled with the coursework, those overwhelmed by responsibilities inside or outside of the office, or professionals who are still identifying the “why” in financial planning concepts, waiting to sit for the exam may be their best option.

It’s important, however, that the exam isn’t delayed for too long. Setting a goal to take the exam by a certain time (18-24 months out, perhaps) and then identifying tangible, short-term goals for the attainment of financial planning competency will be necessary.

For example, spending time in a financial planning firm (whether that’s a job, internship, or externship), developing a better grasp of the language of planning, attending conferences, and simply participating in the profession may assist in connecting concepts. Sitting for the Securities Industry Essentials (SIE) or Series 65 exam may build confidence as well. Finally, carefully reviewing the coursework from a CFP program may be a great way to “jump-start” the path to passing the exam.

Once the aforementioned goals have been accomplished, it will be time to schedule an exam, complete a review course, and pass the exam. All of this, of course, is dependent on the individual and is a decision that should be made with the help of sincere counsel.

Speaking of counsel, surrounding oneself with a support system of friends, family, mentors, and colleagues can be an important ingredient for success. Programs like the CFP Board’s Find a Mentor Program and FPA NexGen are excellent places to go for support. Creating a study group with colleagues, members of the test taker’s CFP Board Program graduation cohort, or relationships fostered during a “live review” event may be especially helpful in navigating the exam preparation process.

Another question that candidates often ask is “Should I take the CFP exam just to see what’s on it?”. Generally speaking, this probably isn’t the best approach. Not only does the CFP exam cost $925 (the current standard registration for the March 2021 exam), but a solid review course will provide better and easier-to-retain information about what is on the exam.

Furthermore, while the core of the CFP exam is consistent, each testing cycle is unique, and the questions can and do vary from one test to the next (e.g., there are 170 questions on the CFP exam, but the CFP Board has more than 170 questions to choose from and rotates the questions in any particular exam that’s offered). There is no guarantee that taking the exam in March will sufficiently prepare you for the exam in July. If you want a proxy on your “readiness”, consider taking the CFP Board’s sample quiz to get a sense of your readiness.

Passing the CFP exam requires a great deal of commitment and requires the requisite work needed to build up the confidence and actually decide, with conviction, to pass the exam. It is also better if you can tell potential employers that you passed the exam on the first attempt.

What To Expect After The CFP Exam

After completing your exam, you’ll receive an email from Prometric providing one of two results: a preliminary pass, or a diagnostic report of your performance.

Regardless of the outcome, plan something to help you decompress after the exam. This could be any activity of your choosing, dinner with friends and family, reading a book, or binge-watching your favorite show to give your mind some much-needed rest. Or perhaps consider taking the exam on a Friday so that you can plan a weekend getaway as a reward for the sacrifices you made while preparing for the exam!

Preliminary Pass On The CFP Exam!

Congratulations! After months of study and sacrifice, you’ve taken a major step in your career. It’s time to share this moment with family, friends, mentors, and colleagues, as this is a huge milestone in your career.

Passing results are “preliminary” as they have to be reviewed and certified by the CFP Board before they become official. Sometimes a question may, after review, be removed and ultimately alter a person’s final score. According to the CFP Board, however, no one has received a “preliminary pass” only to receive an official result of “fail”; in other words, a preliminary pass won’t become a “fail”, but a “fail” could become a “pass” if a question you answered incorrectly is removed from the scoring.

You will receive official results approximately four weeks from your test date. Those who pass the exam do not receive a diagnostic report, only confirmation of passage. You do not immediately become a CFP certificant upon passage of the exam. You must still meet the experience requirement, pay the applicable fee, and meet the ethics requirement to use the marks.

Diagnostic Performance Report – Minimum Score Not Met

If you did not meet the minimum score to receive a preliminary pass, you will receive an official notification from the CFP Board and a Prometric diagnostic report of your performance in each topic area. This does not mean you don’t have what it takes to be a great planner, so don’t give up!

Set aside the diagnostic report and take a couple of days to process the results before charting a path forward. Many review material providers offer one-on-one counseling to help you tackle your next attempt at the exam and may allow you to take the review course again at a reduced rate or no charge.

Once you receive the official results, which will also take approximately four weeks from the test date, you can decide whether the time is right to take the exam again. The CFP Board’s retake policy is rather straightforward. You must wait until the next testing window opens (i.e., you cannot take the March exam twice, even if you start early in the March window and find out immediately that you didn’t pass) and may only attempt the exam three times in a twenty-four-month window. The CFP Board only allows test takers five total attempts at passing the exam. Be mindful (but not fearful!) of this policy.

Successfully attaining the CFP mark is no small task. The coursework entails quantitative challenges and emotional nuance. Passing the exam requires shrewd discipline in both scheduling and focus.

The payoff, however, is well worth the sacrifice. Not only will you set yourself apart in the job market, but you’ll also find yourself one step closer to fulfilling the ultimate aspiration: using your financial planning knowledge to impact clients and help them achieve their goals!

Leave a Reply