What are GTD, GTT and VTC order in the stock market? When it comes to stock market investment you should buy stock when market declines. However, it is extremely difficult to track stock market and place order at preferred price. In order to achieve this stock brokers are providing facility of creating special orders. These special orders are GTT – Good till trigger, GTD – Good till Date, GTC – Good till cancel and VTC – Valid till cancellation order. The facility of such orders are created by means of using advanced technologies. Zerodha, ICICI direct and HDFC securities provide facility of such orders. Let’s try to deep dive and understand how to create such order and invest in the stock market.

What are GTT, GTD, GTC and VTC order in Stock Market?

GTD Order

GTD stands for Good till date order. GTD orders are valid order till specified date. This means this order remains active till mentioned date in the order. This order is also known as GTC order. (Good Till Cancel) If order is not executed up to specific date as desired price is not achieved the order stands cancelled. This means GTD orders are long term orders. GTD order can be used for long term investor who want to buy or sell stock at specific price.

GTT Order

GTT stands for Good Till Trigger order. GTT order remains active till trigger condition is achieved. GTT order is long term order and remain valid till 1 year. This order can be buy order or sell order. This order will be executed when trigger price is achieved. The order remains pending till that time.

VTC Order

VTC stands for valid till cancellation. VTC order validity is less compared to GTT order. VTC order remains active till 45 days. This means order gets executed when stock reach desired set price or get cancelled automatically after 45 days.

How to create GTD order at HDFC Securities?

GTD order facility is provided by HDFC securities. This order is known as GTDt order by HDFC securities. This facility is provided to specific clients by HDFC securities.

GTDt order can be placed via various channels such as internet, mPowered trading platform and Call Trade facility. This order can be placed in equity.

In order to place this order, select GTDt option from drop down menu in the order panel. You need to provide desired price with buy and sell action and stock code.

This facility is available for equity and cash products. GTDt is available in all securities in BSE & NSE, except NCD, bonds and illiquid scrips.

How to create GTT order at Zerodha?

GTT order facility is provided by Zerodha discount stock broker. Good Till Trigger remains active across multiple trading sessions. GTT orders are of buy type or sell type.

Buy GTT order is used for buying stock for the delivery. In GTT buy order stock will be purchased once trigger price is reached. Second type of order is Sell GTT order. Sell GTT order is used for selling stock. Sell order is of two type stoploss and target. In this order any of the one condition is met other gets cancel it is also known as OCO.

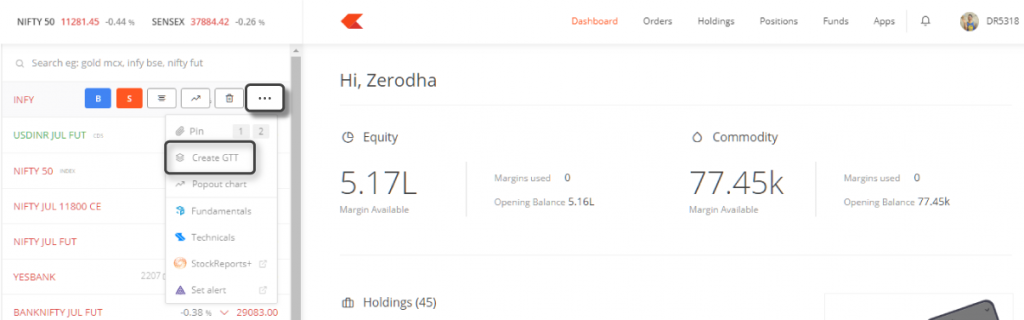

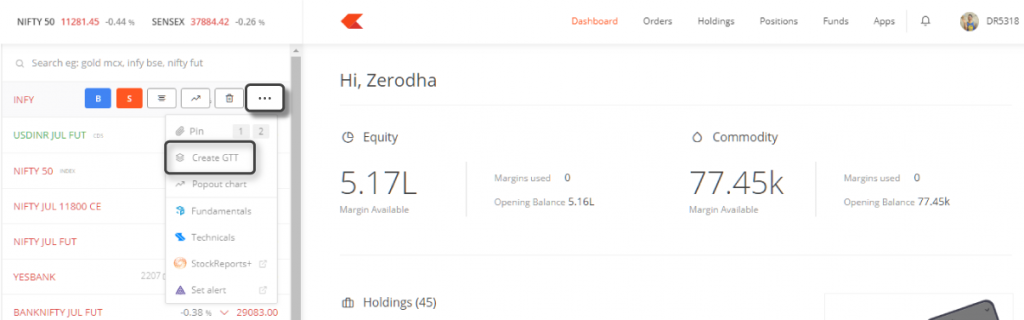

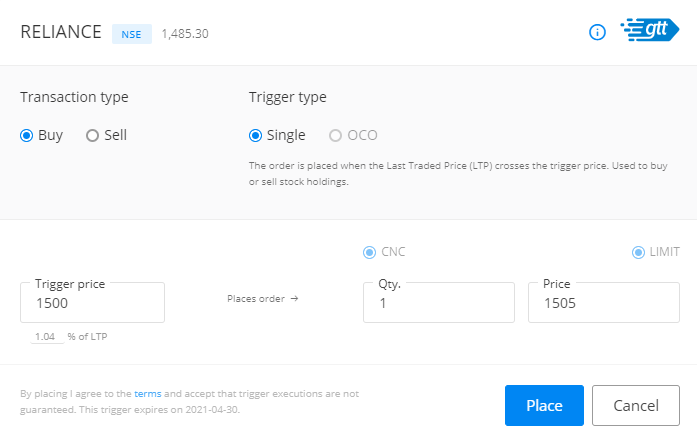

To create GTT order at Zerodha, Login to the Kite using Zerodha login and password. Now find out the stock for which you want to generate order. Add stock to market watch and click on the three dot icon and select create GTT.

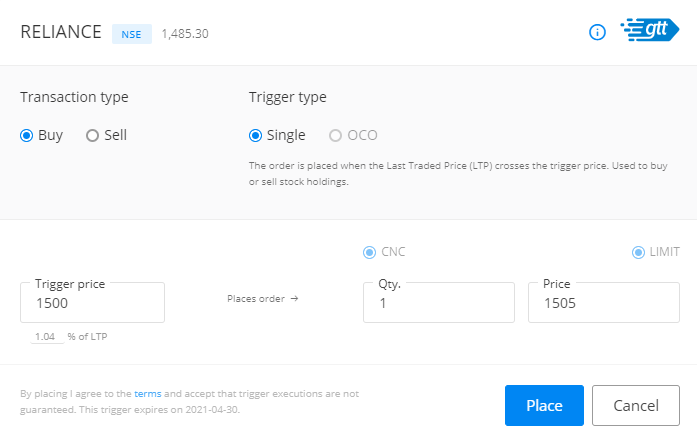

Now you will be able to see screen where you can select transaction type, enter the trigger price and quantity. Once you are done you need to click place button.

Refer to image given below where example of buy GTT is given for the Reliance stock. Where trigger price is set at Rs.1500. On this price order will be sent to exchange. The second price is limit price Rs.1505. On limit price share will be purchased.

How to create VTC order at ICICI Direct?

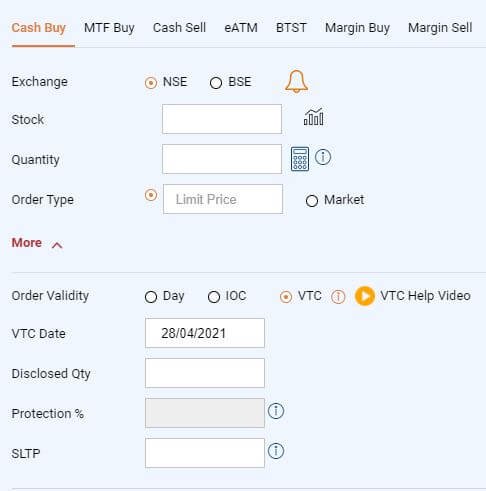

VTC order facility is provided by ICICI direct. VTC order allows customer to define number of days for the cancellation. The maximum days allowed for cancellation is 45 days.

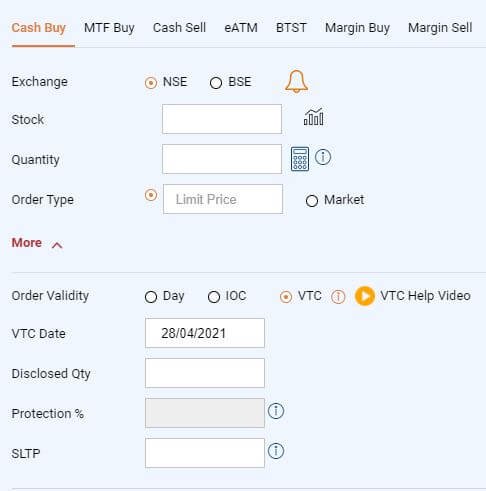

To create VTC order at ICICI direct login at ICICI direct using your customer ID and password. Once you login click on the place order button. Select the exchange and enter the stock code for which you want to place the order.

Enter the quantity and select VTC. Now you need to select the date order validity date. You can enter any date within 45 days range. Now enter the limit price and click on buy now button.

Only limit price orders are placed via VTC route. Market order cannot be placed. Customer can modify or cancel this order anytime.

Over to you

Do you use any of the mentioned order facility given above? Do you think facility of ordering at desired price mentioned above will be useful? Share your experience and views via comment in the section given below.

What are GTD, GTT and VTC order in the stock market? When it comes to stock market investment you should buy stock when market declines. However, it is extremely difficult to track stock market and place order at preferred price. In order to achieve this stock brokers are providing facility of creating special orders. These special orders are GTT – Good till trigger, GTD – Good till Date, GTC – Good till cancel and VTC – Valid till cancellation order. The facility of such orders are created by means of using advanced technologies. Zerodha, ICICI direct and HDFC securities provide facility of such orders. Let’s try to deep dive and understand how to create such order and invest in the stock market.

What are GTT, GTD, GTC and VTC order in Stock Market?

GTD Order

GTD stands for Good till date order. GTD orders are valid order till specified date. This means this order remains active till mentioned date in the order. This order is also known as GTC order. (Good Till Cancel) If order is not executed up to specific date as desired price is not achieved the order stands cancelled. This means GTD orders are long term orders. GTD order can be used for long term investor who want to buy or sell stock at specific price.

GTT Order

GTT stands for Good Till Trigger order. GTT order remains active till trigger condition is achieved. GTT order is long term order and remain valid till 1 year. This order can be buy order or sell order. This order will be executed when trigger price is achieved. The order remains pending till that time.

VTC Order

VTC stands for valid till cancellation. VTC order validity is less compared to GTT order. VTC order remains active till 45 days. This means order gets executed when stock reach desired set price or get cancelled automatically after 45 days.

How to create GTD order at HDFC Securities?

GTD order facility is provided by HDFC securities. This order is known as GTDt order by HDFC securities. This facility is provided to specific clients by HDFC securities.

GTDt order can be placed via various channels such as internet, mPowered trading platform and Call Trade facility. This order can be placed in equity.

In order to place this order, select GTDt option from drop down menu in the order panel. You need to provide desired price with buy and sell action and stock code.

This facility is available for equity and cash products. GTDt is available in all securities in BSE & NSE, except NCD, bonds and illiquid scrips.

How to create GTT order at Zerodha?

GTT order facility is provided by Zerodha discount stock broker. Good Till Trigger remains active across multiple trading sessions. GTT orders are of buy type or sell type.

Buy GTT order is used for buying stock for the delivery. In GTT buy order stock will be purchased once trigger price is reached. Second type of order is Sell GTT order. Sell GTT order is used for selling stock. Sell order is of two type stoploss and target. In this order any of the one condition is met other gets cancel it is also known as OCO.

To create GTT order at Zerodha, Login to the Kite using Zerodha login and password. Now find out the stock for which you want to generate order. Add stock to market watch and click on the three dot icon and select create GTT.

Now you will be able to see screen where you can select transaction type, enter the trigger price and quantity. Once you are done you need to click place button.

Refer to image given below where example of buy GTT is given for the Reliance stock. Where trigger price is set at Rs.1500. On this price order will be sent to exchange. The second price is limit price Rs.1505. On limit price share will be purchased.

How to create VTC order at ICICI Direct?

VTC order facility is provided by ICICI direct. VTC order allows customer to define number of days for the cancellation. The maximum days allowed for cancellation is 45 days.

To create VTC order at ICICI direct login at ICICI direct using your customer ID and password. Once you login click on the place order button. Select the exchange and enter the stock code for which you want to place the order.

Enter the quantity and select VTC. Now you need to select the date order validity date. You can enter any date within 45 days range. Now enter the limit price and click on buy now button.

Only limit price orders are placed via VTC route. Market order cannot be placed. Customer can modify or cancel this order anytime.

Over to you

Do you use any of the mentioned order facility given above? Do you think facility of ordering at desired price mentioned above will be useful? Share your experience and views via comment in the section given below.

Leave a Reply