Executive Summary

Financial advisors have used the home office deduction as a valuable tax-reducing tool for qualifying clients with home offices, allowing them to deduct certain work-related home expenses on their tax returns. However, as COVID-19 has led to a dramatic increase in the number of individuals working from home, client questions about the home office deduction have become more common than ever before. Accordingly, advisors should have conversations with clients who work from home to ensure they understand (and make proper use of!) the home office deduction rules.

In order to claim the deduction, a home office must generally pass three key tests. The first is the Exclusive Use Test, which requires that the portion of the home used as the home office is used exclusively for business purposes… 100% of the time; the second is the Regular Use Test, which requires the home office to be used on a regular, ongoing basis; and the third is the Principal Place of Business Test, which requires the home office to be the taxpayer’s principal place of business.

While employees are never allowed to claim the home office deduction, self-employed taxpayers can claim the deduction subject to certain Net Operating Loss (NOL) limitations, provided they pass the three requisite tests. Partners can also benefit from a home office deduction by claiming Unreimbursed Partner Expenses (UPEs) on Schedule E of Form 1040. However, partners seeking to do this should ensure that their partnership agreement expressly states that they are personally responsible for the payment of such expenses.

And while employees per se can’t claim the home office deduction, taxpayers who are both the owner and an employee of the same corporation can instead use Accountable Plans to shift what would otherwise be non-deductible (unreimbursed) employee expenses (e.g., expenses related to a home office) into expenses that can be deducted by the corporation at the entity level.

To calculate the home office deduction, qualifying taxpayers can use either the Regular (Actual Expense) Method or the Simplified Method. With the Regular (or Actual Expense) method, taxpayers eligible for the deduction can claim 100% of the actual cost of direct expenses (i.e., expenses entirely attributable to the home office) and a ratable amount of indirect expenses (i.e., expenses attributable to both the home office and personal, non-home office portions of the home such as taxes, rent, and utilities) associated with the home office. Alternatively, the Simplified Method allows taxpayers simply to deduct $5 for each square foot of the Home Office, up to a maximum of $1,500.

Ultimately, the key point is that financial advisors with clients who are self-employed (or who are partners of a partnership) can determine if those clients qualify for the home office deduction (by passing the three requisite home office deduction tests) and whether they have eligible expenses to claim (and if so, how much of those expenses can be claimed). And given the effect of COVID-19 on taxpayers who have adapted to a work-from-home environment, questions about the home office deduction have become increasingly prevalent. Financial advisors who understand how the home office deduction works can help eligible clients make use of a valuable tax break – potentially freeing up resources for those clients to use towards more enjoyable goals!

There are few financial goals more universally shared than (legally!) minimizing an individual’s tax liability. One of the most basic ways to help turn that goal into a reality is to make sure that an individual is claiming and maximizing every available deduction to which they are entitled.

For many small business owners, one such deduction is the deduction for expenses related to a home office (a.k.a. the “home office deduction”). At the highest level, the home office deduction is a tax break that allows individuals who use a portion of their residence exclusively for business purposes to deduct expenses incurred that are attributable to that part of their home.

Unfortunately, though, not everyone who works from home is able to claim a home office deduction. Notably, the deduction is not available for employees – even those who only work out of a home office – whether due to the ongoing coronavirus pandemic or otherwise.

On the other hand, self-employed individuals and individuals who own partnership interests are potentially eligible to claim a home office deduction. However, even self-employed individuals and partners who work exclusively from home aren’t automatically entitled to claim a home office deduction. Rather, in order to claim the deduction, such an individual’s home office use must meet a number of strict requirements, the first being the “Exclusive Use Test”.

The Exclusive Use Test Must Be Passed To Take A Home Office Deduction

In general, in order to claim a deduction for expenses related to a home office, the area being used for work must pass the “Exclusive Use Test”. The Exclusive Use Test dictates that in order to claim a home office deduction, the portion of the home that is deemed the home office must be used entirely for business purposes.

To be clear, that means that 100% of the time the space is occupied, it is being used for business purposes. Not 90% of the time. Not 95% of the time. Not even 99% of the time.

100%. Of. The. Time.

Example 1: Ned used to work primarily out of an office building, but due to the COVID-19 pandemic, he has converted a spare bedroom in his house to a home office.

For 2021, Ned intends to be the only person to use the room, and only while he is conducting business.

When Ned’s parents come to visit for Christmas, however, they will use the office as their guestroom for two nights. As a result, Ned’s home office will fail the Exclusive Use Test.

Accordingly, because the room will be used for something other than work-related purposes for two nights, Ned may not claim a home office deduction for 2021.

Exceptions To the Home Office Exclusive Use Test

Unfortunately, there aren’t many exceptions to the Exclusive Use Test. In fact, there are just two fairly narrow exceptions.

The first exception to the Exclusive Use requirement is if a portion of the home is used for the storage of inventory and/or product samples. However, to qualify for and use this exception, a slew of other requirements apply; for example, the home office must be the only fixed location of the business, and the storage spaces must be used on a regular basis.

The second exception to the Exclusive Use rule is when a portion of the home is used to provide daycare services to children, individuals who are 65 or older, or disabled individuals. In such an instance where a taxpayer is in the business of daycare and/or eldercare, they can receive a home office deduction for the portion of their home used for that business, even if they use the same part of their home for non-business use during non-business hours.

If an individual does not meet one of these exceptions, then they must meet the Exclusive Use rule requirements in order to claim the Home Office Deduction, where 100% of the time the area of the home for which the deduction is claimed is in use, the use must be for business purposes.

Nerd Note:

In some cases, a taxpayer may use the same home office for more than one business. This does not violate the Exclusive Use test. The expenses attributable to the home office would simply be prorated amongst the business interests in proportion with their (collectively exclusive) use of the home office.

Taxpayers Don’t Need An Entire Room Used For Work To Claim A Home Office Deduction

In many cases, individuals simply don’t have a true home office, or an entire room, that they can devote to the exclusive use of their business. And while this may limit their ability to claim a home office deduction, it doesn’t necessarily eliminate it altogether.

In order to claim a deduction for a home office, an individual just needs a separately identifiable space within their home that is used exclusively for business purposes. It certainly can be an entire room, but it need not be. Rather, the ‘home office’ can simply be a portion of a room where the work is carried out that can be separately identified.

Furthermore, the portion of a room that is claimed as a home office does not need to be physically separated from the rest of the room. Specifically, the Proposed Treasury Regulation Section 1.280A-2(g)(1)) states, in part:

…it is not necessary that the portion be marked off by a permanent partition.

Thus, while a single room can be used for multiple purposes, as long as a taxpayer can point to that portion of the room as a separately identifiable space (where that separately identifiable space is used exclusively for business), a home office deduction can be taken with respect to the expenses attributable to that separately identifiable space.

It is important, however, to ensure that whatever space is claimed as a home office is truly separately identifiable. Thus, an individual could use something like a 4-panel screen room divider to physically divide one space from another, or they could simply point out a section of the room where work is carried out, and that is easily distinguished from the rest of the room.

For example, an individual could say something like, “My home office is the space over there where my desk sits.” If that desk is used exclusively for business purposes, expenses that are attributable to that part of the house should qualify for a home office deduction.

Granted, the deduction claimed may not be very big, but hey, some deduction is better than no deduction, right?

Regular Use Requirement To Claim A Home Office Deduction

In order to claim a deduction for a home office, the home office must also be used on a “regular” basis. So-called “occasional” use is not sufficient, even if the space is not used for any other purpose during the tax year.

Unfortunately, there is no clearly defined bright-line test to determine whether a taxpayer has met this requirement (e.g., the office is used at least three days a week, the office is used at least 20 hours a week, etc.). Instead, the determination of whether home office use counts as “regular” can only be made when considering all the facts and circumstances of a taxpayer’s situation.

Having said that, and while the lack of any specificity can be frustrating, failure to meet the Regular Use requirement is rarely the reason a home office deduction is denied. Rather, in most situations, a home office deduction is denied by the IRS because the taxpayer failed to meet the Exclusive Use requirement.

And if that isn’t what tripped the taxpayer up, the next most likely culprit is the Principle-Place-Of-Business requirement, discussed below.

Principal Place Of Business Requirement To Claim A Home Office Deduction

In addition to the Exclusive Use Test and Regular Use Requirement, the third key requirement that must generally be met in order for a taxpayer to claim a home office deduction is that the home office must be considered the taxpayer’s principal place of business for a particular (business) activity.

In situations where a taxpayer conducts business for a particular activity only out of the home office, the home office is essentially, by default, the principal place of business.

In many situations, however, a taxpayer will regularly conduct business from more than one place. For instance, an individual may have an office in an office building where they work sometimes, and a home office, from which they work other times.

Alternatively, an individual may have a home office in two or more homes that they own. In either case, home office deduction expenses are only allowed to the extent that they are incurred with respect to the individual’s principal place of business.

Determining which of a taxpayer’s multiple business locations is the principal place of business for a particular activity can, at times, be challenging, due to the subjective nature of the decision. In arriving at the determination of a principal place of business, a taxpayer should consider both the amount of time they spend at each of their various business locations, as well as the relative importance of the tasks performed at each location.

Claiming A Home Office As A Principal Place Of Business During The COVID-19 Pandemic

While the rules for home office deductions haven’t been changed in light of the COVID-19 pandemic (much to the chagrin of many), the circumstances of many taxpayers’ have changed.

Indeed, whereas in the past, a taxpayer’s activities in a commercial office space (or similar fixed place of business) may have been significant enough to require the commercial office space to be deemed the taxpayer’s principal place of business, as a result of the COVID-19 pandemic, such a taxpayer may have shifted most, if not all, of their activities to a home office. In such situations, the taxpayer may be able to treat their home office as their principal place of business for 2020 (and, given the prevalence and trending nature of working from home, potentially for many years to come).

Advisors can help clients who would otherwise be ineligible to claim a home office deduction by identifying any changes in where most of their business activities are conducted. In the event that such activities may have shifted to the home office, they should be advised to make sure that they discuss the changes with their CPA or other tax preparer.

Exceptions To The Principal Place Of Business Rule

In general, while an individual’s home office must be their principal place of business in order to claim a deduction for expenses attributable to a home office, there are, as is often the case, some important exceptions to this rule.

In the event that one or more of these exceptions apply, a taxpayer may be able to claim a home office deduction even if another location is deemed their principal place of business.

Exception #1: Home Office Is Used Regularly For Client Meetings

The first exception, and one that is particularly relevant for advisors, themselves, as well as for some of their clients, is when a home office is used regularly to meet with clients, patients, or customers.

If a home office is used to conduct such meetings in person, and the use of the home office is “substantial and integral” to the taxpayer’s business, the taxpayer can claim a home office deduction, even if the home office is not the primary place of business.

Notably, this is true even if the taxpayer also meets with clients regularly in their primary business location!

Example 2: Jon is a financial advisor who rents office space in a large commercial office building and also has a home office which is used exclusively for business.

Jon meets with clients in his commercial office space on Mondays and Wednesdays. He also spends Tuesdays and Thursdays in his commercial office space, doing planning and other behind-the-scenes work. On Fridays, though, Jon meets with clients in his home office.

Accordingly, even though Jon’s commercial office space is his primary business location, he is eligible to take a deduction for expenses related to his home office.

There are a few key points worth emphasizing with respect to this “Client Meetings” exception for the home office deduction.

First, as noted above, in order for the meeting-with-clients-patients-or-customers exception to apply, the meetings must take place in person. This requirement is particularly applicable in the current COVID-19 environment, and there has been absolutely no change to this requirement in light of the pandemic. Accordingly, virtual meetings (e.g., through Zoom) that are conducted from the “home office” do not meet the in-person requirement that allows a taxpayer to qualify for this exception.

Second, there are a lot of subjective terms used to describe the qualifications for the Principal Place of Business Rule exception, which, in certain situations, can make determining if a taxpayer qualifies for the exception challenging. Words like “regularly” (as discussed above), “substantial,” and “integral” are not well-defined terms within the Internal Revenue Code, or otherwise. The determination of each is based on the facts and circumstances of a taxpayer’s situation.

Fortunately, though, the IRS is generally pretty liberal in applying these terms to this exception. For instance, IRS Publication 587 states:

Doctors, dentists, attorneys, and other professionals who maintain offices in their homes will generally meet this requirement.

Exception #2: Home Office Is In A Free-Standing Structure Separate From The Taxpayer’s Home

The other exception that can allow an individual to claim a deduction for expenses related to a home office, despite having a different primary business location, is if the home office is located in a free-standing structure that is separate from the taxpayer’s home. Common examples of such free-standing structures include barns and detached garages.

If such structures are used regularly and exclusively for business, a home office deduction may be claimed even if it is not the principal place of business.

Notably, this is true regardless of whether or not the structure is used for meetings with clients.

Example 3: Arya as a financial advisor in Iowa. In the summer of 2020, due to the ongoing pandemic, Arya converted an old barn on her property to a home office, even though her principal place of business was still in the financial district of Sioux City, IA.

Arya regularly works out of the barn, but she does not use it to conduct any in-person meetings with clients.

Despite the fact that no client meetings take place in the barn, Arya may still claim a home office deduction for the expenses attributable to the structure because she uses the barn for no other purpose than her work, even though her principal place of business is away from her residence.

Claiming A Home Office Deduction As A Self-Employed Person

When it comes to claiming a home office deduction, self-employed individuals generally have it the easiest.

Provided a self-employed individual meets the Exclusive Use, Regular Use, and Principal Place of Business requirements (or an applicable exception applies), they will be able to claim a home office deduction, albeit still subject to certain limitations that prevent most home office expenses from creating a Net Operating Loss (negative income from a business).

Importantly, and as discussed later, individuals who are employees are not eligible to claim the home office deduction.

Claiming A Home Office Deduction As A Partnership Or LLC

Individuals who own an interest in a partnership (or an LLC taxed as a partnership) are, like self-employed persons, also often eligible to claim a deduction for expenses related to a home office. The process by which such a deduction is claimed, however, is different and involves deducting expenses related to a home office by reporting Unreimbursed Partner Expenses (UPEs) on Schedule E (Form 1040).

There is, however, an important – yet often overlooked – requirement to be sure that a partner is able to deduct such expenses.

Specifically, in order for a partner to deduct Unreimbursed Partner Expenses, the partnership agreement should expressly state that the partner is personally responsible for such expenses.

Accordingly, partners who wish to be sure they can claim a deduction for such expenses should ensure that their partnership agreement includes a provision that reads something like:

Partners are expected to maintain a home office or similar workspace suitable for carrying out basic activities on behalf of the partnership. The expense for maintaining such a workspace shall be borne by the Partner.

Nerd Note:

In the event that a partnership agreement does not explicitly address unreimbursed partner expenses, the Tax Court will consider whether the partnership had a routine practice equal to an agreement that requires such payment. Proving such a routine practice exists can be a significant challenge, though, and, absent incredibly compelling testimony or other evidence, is likely to be rejected by the Tax Court.

Finally, it’s worth noting that partners do have one edge over self-employed individuals when it comes to deducting home office expenses. More specifically, a partner is able to deduct Unreimbursed Partner Expenses in full, even if the expenses exceed the income reported from the partnership (via the Schedule K-1). This is in contrast to SE individuals who are generally not allowed to deduct expenses if those expenses exceed gross income (although there are exceptions, discussed below).

Employees Cannot Claim A Home Office Deduction

There are plenty of rules that control who can, and cannot, claim a home office deduction. And as discussed above, there are also a significant number of exceptions to those rules. But when it comes to the home office deduction, one absolute rule is that employees cannot claim a deduction for expenses related to a home office.

Notably, prior to 2018, employees were eligible to claim a deduction for home office expenses as a miscellaneous itemized deduction. However, changes made by the Tax Cuts and Jobs Act of 2017, which were first effective for tax year 2018, eliminated miscellaneous itemized deductions, including the deduction for unreimbursed business expenses (which is the mechanism by which employees had previously claimed a deduction for home office expenses), through 2025.

Despite the ongoing COVID-19 pandemic and the fact that many employees have either been forced or opted to work from home in order to reduce their risk of contracting the virus, no changes have been made to this rule. Accordingly, employees are still unable to claim a deduction for home office expenses.

While this may be bad news for some employees who work from home, especially in the current environment, other individuals who work from home, and who are the business owner and an employee of the same business, may be able to work around this restriction by deducting expenses at the entity level.

Accountable Plans Permit S Corporation Owner-Employees To Deduct Home Office Expenses

For S corporation owners who are both the owner and employee of their business, establishing an Accountable Plan can allow the business to deduct expenses related to a home office… not as an employee, but at the business (entity) level. These plans are essentially IRS-approved employee reimbursement programs.

Accountable Plans allow a business to reimburse employees for expenses they incur on behalf of the business, which can include expenses related to a home office. The reimbursements are not taxable income to the employee, but are deductible to the business itself. Critically, the benefits under an Accountable Plan do not have to be offered to all employees (i.e., it’s a benefit that can be made available only to the business owner, so the business isn’t obligated to reimburse all employees for their home office expenses).

Even with such an Accountable Plan in place, though, the rule that employees cannot receive a home office deduction remains absolute. Instead, the Accountable Plan is used to allow a business to turn what would be non-deductible (unreimbursed) expenses of an employee (e.g., expenses related to a home office) into an expense that is deductible by the business.

For an S corporation owner, this tax ‘sleight-of-hand’ provides for a similar tax benefit for home office expenses as would be available to other business owners.

And while it’s too late for S corporation owner-employees to establish Accountable Plans for 2020 (the plan needs to be in place before the home office expenses are incurred), if such a taxpayer uses a portion of their home regularly and exclusively for business, an Accountable Plan should be established now to provide tax benefits on a go-forward basis.

Nerd Note:

While this section contemplates the use of an Accountable Plan by an S corporation to enable an owner-employee to shift home office expenses to the business where a deduction can be claimed, such plans can also be used by C corporation owner-employees.

Calculating The Home Office Deduction

There are two ways that a taxpayer can calculate the amount of their home office deduction: 1) the Regular Method and 2) the Simplified Method. Oftentimes, the Regular Method will produce a larger deduction. However, that larger deduction comes with both more complexity and a potentially nasty surprise when a taxpayer sells their home.

The Regular (Or Actual Expense) Method Of Calculating The Home Office Deduction

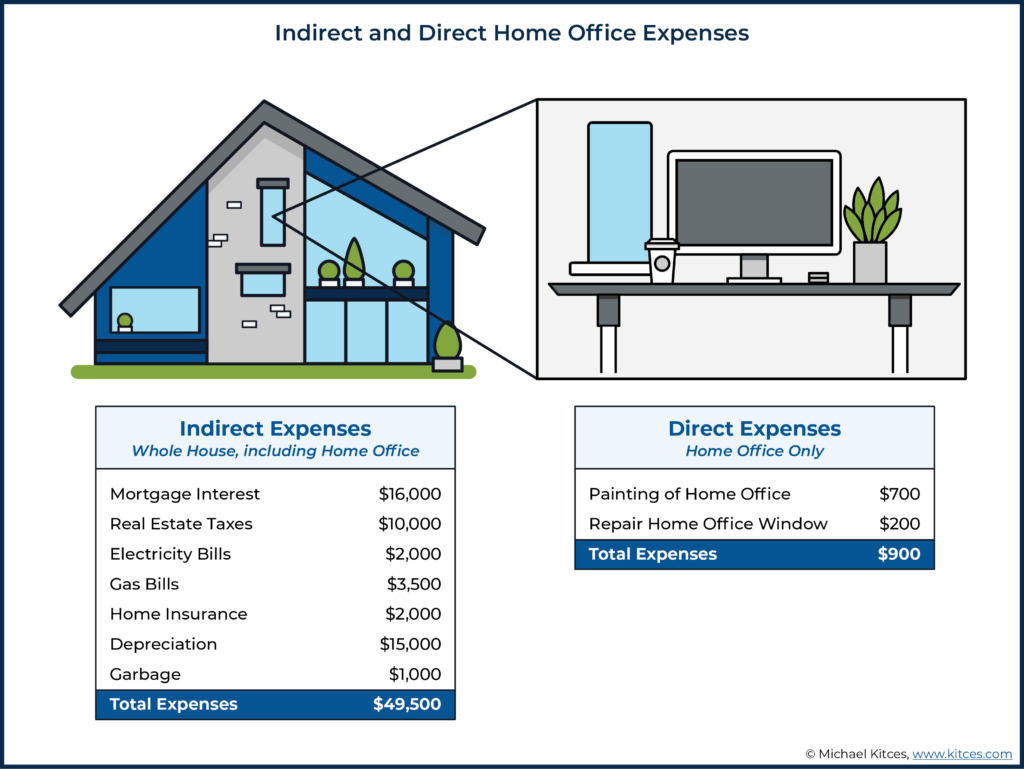

The Regular Method of calculating an individual’s home office deduction might be better thought of as the Actual Expense Method. When calculating the amount of a home office deduction using the Regular Method, broadly speaking, expenses can be divided into two categories: direct expenses and indirect expenses.

Direct expenses are those expenses that are entirely attributable to a taxpayer’s home office (i.e., the expense is used to pay for something that only benefits the home office), and as such, they are 100% deductible.

For instance, if a taxpayer decided to put wallpaper up in (only) their home office, the cost of installing the wallpaper would be considered a direct expense, since it was only installed in the office and nowhere else in the home and would thus be fully deductible.

By contrast, many – and often most – of a taxpayer’s home office expenses are indirect expenses. Such expenses are attributable to both an individual’s home office as well as the personal (non-home office) portions of their home.

Common indirect expenses include the home office’s “fair share” portion of mortgage interest, real estate taxes, rent, utilities, insurance, security systems, and depreciation.

To determine the amount of indirect expenses that can be used as a home office deduction, the gross amount of the expenses must be apportioned between a taxpayer’s home office and the personal, usable space of the rest of their home.

Technically, any “reasonable method” may be used to come up with the home-office-deduction-eligible amount, but the most common way, by far, to apportion such expenses is to divide the square footage of the home office by the total usable square footage in the taxpayer’s home. The resulting percentage is multiplied by the gross amount of the indirect expenses to arrive at the deductible portion.

Example 4: Tyrion is a self-employed individual who meets all the requirements in order to claim a home office deduction.

Tyrion’s home office is 200 square feet, while the total usable square footage of his house is 2,000 square feet.

In 2021, Tyrion incurs expenses related to his home office as illustrated in the graphic below:

- Mortgage interest – $16,000

- Real estate taxes – $10,000

- Electricity bills – $2,000

- Gas Bills – $3,500

- Home insurance – $2,000

- Depreciation – $15,000

- Garbage – $1,000

Total indirect expenses: $49,500

- Painting of home office – $700

- Repair home office window – $200

Total direct expenses: $900

As illustrated in the graphic above, Tyrion has total indirect expenses of $49,500. Accordingly, since his home office represents 200 square feet (home office area) ÷ 2,000 square feet (whole house area) = 10% of the total usable square footage of his home, 10% × $49,500 = $4,950 of his indirect expenses are deductible as a home office expense.

Meanwhile, the full $900 of direct expenses Tyrion incurs with respect to his home office is deductible.

Therefore, Tyrion’s total home office deduction for 2021 will be $4,950 (deductible portion of indirect expenses) + $900 (total direct expenses) = $5,850.

Notably, to the extent that indirect expenses may have already been deductible as an itemized deduction on Schedule A, they cannot be claimed on both.

For instance, in the above example, with $1,600 of mortgage interest and $1,000 of real estate taxes allocated to the home office deduction, the individual’s Schedule A itemized deductions could only claim a maximum of $16,000 – $1,600 = $14,400 and $10,000 – $1,000 = $9,000, respectively.

Using The Regular Method Requires Depreciation Of The Home When Claiming Home Office Deductions

One important issue to keep in mind when using the Regular Method to calculate the home office deduction is that any amount of a home office deduction claimed that is attributable to depreciation will be recaptured when/if the taxpayer’s house is sold, under the standard rules for depreciation recapture of real estate (a maximum rate of 25%, and a gain that is not eligible for the IRC Section 121 capital gains exclusion for the sale of a primary residence).

And if you’re thinking to yourself, “Why don’t such taxpayers just not take a deduction for depreciation then?”, well, you get points for creativity, but it just won’t work.

Notably, the Regular Method rules require that taxpayers depreciate their home if they want to claim all the other expenses as home office deductions. So if they take those (other) home office deductions, the IRS will recapture any depreciation deduction (that should have been taken) anyway if the home is sold!

Nerd Note:

With limited exception, a home office deduction calculated using the Regular Method cannot create or increase a self-employed taxpayer’s Net Operating Loss (NOL). However, the portion of the home office deduction that is disallowed, because it creates/increases a taxpayer’s NOL, can be carried forward for use in future years when there is positive business income.

The Simplified Method Of Calculating The Home Office Deduction

For years, the Regular Method of calculating the amount of a home office deduction was the only way to calculate the deduction. However, in 2013, the IRS released Revenue Procedure 2013-13, which introduced a new way to calculate the home office deduction, known as the Simplified Method.

The Simplified Method of calculating the home office deduction is (perhaps incredibly?) appropriately named. In fact, it may be one of the easiest tax calculations of all.

To calculate the value of a home office deduction using the Simplified Method, a taxpayer ‘simply’ multiplies the square footage of their home office, capped at a maximum of 300 square feet, by $5. The result is the taxpayer’s home office deduction. Accordingly, the maximum home office deduction using the Simplified Method is 300 square feet x $5 = $1,500.

While the Simplified Method of calculating the home office deduction may not produce the largest home office deduction (especially for houses with high indirect expenses to be allocated, such as those with a sizable mortgage), in certain cases, it may be the best option for the taxpayer. For starters, it’s a lot easier to calculate, and doesn’t require nearly the same level of organization or record-keeping. It also allows an individual’s home-related itemized deductions to still be claimed in full on Schedule A (e.g., some indirect expenses such as mortgage interest, real estate taxes, utilities, etc.), as opposed to being prorated between Schedule A and the home office deduction.

There is also no recapture of depreciation required upon the sale of the taxpayer’s home.

Finally, in what is an important factor for many, the use of the Simplified Method to claim a home office deduction is much less likely to create red flags with the IRS that could increase the likelihood of an audit. For one thing, there is less subjectivity in how the home office deduction is calculated – compared to the Regular Method that must determine indirect expenses and allocate them “reasonably.”

But the biggest reason why using the Simplified Method to claim a home office deduction is less likely to raise an audit flag is that the best the IRS can do by disallowing it is to eliminate the $1,500 maximum deduction that can be calculated using this method. By contrast, in some cases, taxpayers using the Regular Method may claim home office deductions of $10,000 or more!

Nerd Note:

A home office deduction calculated using the Simplified Method cannot create or increase a self-employed taxpayer’s Net Operating Loss (NOL). Furthermore, no portion of the deduction that is disallowed (because it created/increased the taxpayer’s NOL) can be carried forward.

The COVID-19 pandemic has led to a dramatic increase in the number of individuals working from home. For some self-employed individuals and partners who have started working from a home-based office because of the pandemic, a home office deduction may now be claimed where one was not previously available. Unfortunately, however, for the millions of employees who have been forced, or have chosen, to work primarily from home, no similar benefit is available (other than via the use of an Accountable Plan by an owner-employee of a corporation).

Just being self-employed, or a partner, however, is not enough to be able to claim a home office deduction. Such individuals must still pass a number of tests to be able to take any amount of a home office deduction. More specifically, the portion of the home that is used for business must be used exclusively for business (the Exclusive Use Test), other than when the inventory or daycare exceptions apply. This space must be used regularly (Regular Use Requirement), and it must generally be the principal place of the individual’s business (Principal Place of Business Requirement) unless they use it to regularly meet with clients or it is a separate, free-standing structure.

Assuming an eligible individual meets all the requirements necessary to claim a home office deduction, they can choose to calculate the amount of their deduction using either the Regular (or Actual Expense) Method or the Simplified Method.

Oftentimes, the Regular Method will produce a higher deduction today, but at the expense of additional complexity, and the need to recapture any portion of the home office deduction that was (or could have been) attributable to depreciation. On the other hand, the Simplified Method may not yield as much of a deduction as the Regular Method, but the use of a simple formula (home office area x $5) can make the ease of determining the deduction appealing to some taxpayers.

Ultimately, the key point is that, as a result of the coronavirus pandemic, more individuals are working from home than ever before. Which means more individuals than ever before may likely be able to claim a home office deduction or erroneously think they can claim such a deduction. Accordingly, advisors should be sure to have conversations with all clients working from home to make sure they understand and make proper use of the home office deduction rules.

Leave a Reply