As a business owner, there are two important things you want to keep—time and money. That’s why you need to create a budget and stick to it. But, budget challenges are common and can pop up throughout the year. Familiarize yourself with budget challenges so you can tackle them before they get too far out of hand. So, what are the budget challenges you should keep an eye out for?

Budget challenges to look out for

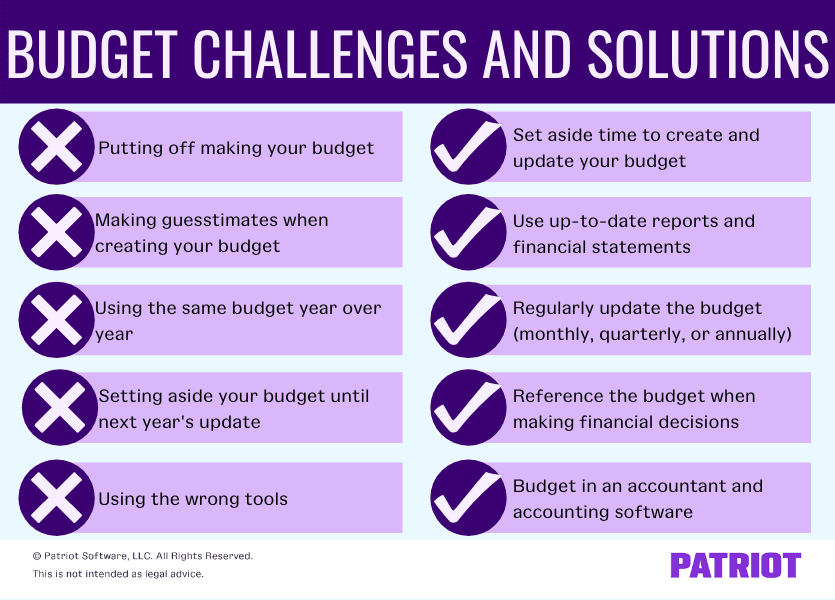

Whether you’re a new business owner or entrepreneurship is old to you, budget challenges for business can pop up. Keep an eye on your business budget and changing business goals to stay on top of and avoid issues. Here are some common budget challenges and their solutions.

1. Not making time for budgeting

Of all the budget challenges, time might just be the most important one to approach first. If you don’t take time to lay out your annual budget, you could rush the process—and make mistakes.

The solution

Creating your budget takes time. Keep in mind that budgeting also takes time to manage throughout the year. Work reviewing the budget into your schedule at regular intervals (e.g., monthly or quarterly review). Make time to look over your company’s short- and long-term goals.

If you are considering a monthly review of the budget, a rolling budget may be your best bet. A rolling budget:

- Changes throughout the year based on current data

- Adds another month’s budget to the end after one month passes

- Updates every time you create financial statements

- Is organized the same way as traditional budgets

- May save you time at the end of the year because you update it more frequently

Another option you can consider is zero-based budgeting, especially if you have a small business. Zero-based budgeting means the budget starts at zero every year. This option is especially beneficial for start-ups in their first year. Some small businesses opt to use zero-based budgeting every few years and traditional budgets in-between.

Additionally, zero-based budgeting can:

- Help you reduce business expenses

- Determine where to prioritize funds

Budgeting for business owners varies based on your business’s needs. However you budget, find ways to make time for budget planning and upkeep.

2. Failing to use up-to-date reports

Accurate reporting is crucial to your success. And, it’s one of the biggest budget challenges you may face. You need to know how much money is going out of and coming into your business.

Some of the documents you need for accurate reporting include:

Why are reports so important? Because they show you accurate data to help you make sure you are reaching your financial goals. Reports tell you where you may be overspending or under-spending so you can make changes that accommodate your business. They also allow you to better forecast future budgets.

The solution

Budget challenges for businesses often start with not having enough information. Without all the necessary information, your budget could be inaccurate and pose potential problems down the road. Remove any guesstimates from your data so that you set your budget based on real information.

Reports are not just valuable for creating one budget, but they can also set the groundwork for future budgets and company goals. You need to see where you were to create a plan for where you want to go.

To combat reporting challenges, make sure you have clear and organized documentation.

3. Not updating your budget

You know you must update your budget every year. But, what about when unforeseen events happen (e.g., COVID-19 or natural disasters)? When big changes impact how you can proceed throughout the rest of the year, you need to update your budget. Unforeseen events could result in:

- Supply chain issues

- Different supply needs (e.g., hiring a sanitation expert due to COVID-19)

- Payroll changes, such as hazard pay

The solution

Regularly update your budget, especially if a natural disaster or other emergency disrupts business operations. Evaluate your reports to look for any issues that arise throughout the month or year to create a baseline for future budgets. Consider consulting with your accountant if any big changes happen that impact your business financially.

4. Forgetting to use your budget

Using your budget seems like a no-brainer, but it’s easy to make a budget and set it aside until next year.

The solution

Consult your budget when you make financial decisions to resolve this accounting budget challenge.

Here are a few ways to make sure you use the budget you spent time creating:

- Schedule time throughout the year to review the budget

- Plan budgetary meetings with your accountant and/or employees

- Reference the budget when proposed expenses pop up

5. Using the wrong tools

Good old-fashioned pen and paper are great, but they may not be the best tools for planning your budget. As mentioned, reporting needs to be accurate and up-to-date. And, doing the reports by hand means you might be missing an opportunity to save yourself some time.

OK, so maybe you decide to sub out the pen and paper in favor of spreadsheets. But, spreadsheets might not give you all the data you want, either…

The solution

Tools like accounting software allow you to see real-time reports whenever you enter expenses. And, make sure to add budgetary line items for expenses such as accounting software, an accountant, or both. The combination of these may help you to stay on track with your financial goals (and see more profits).

Feeling some budget fatigue? Make pulling reports for budgeting easier with Patriot’s online accounting software. Try it free for 30 days now!

This is not intended as legal advice; for more information, please click here.

Leave a Reply