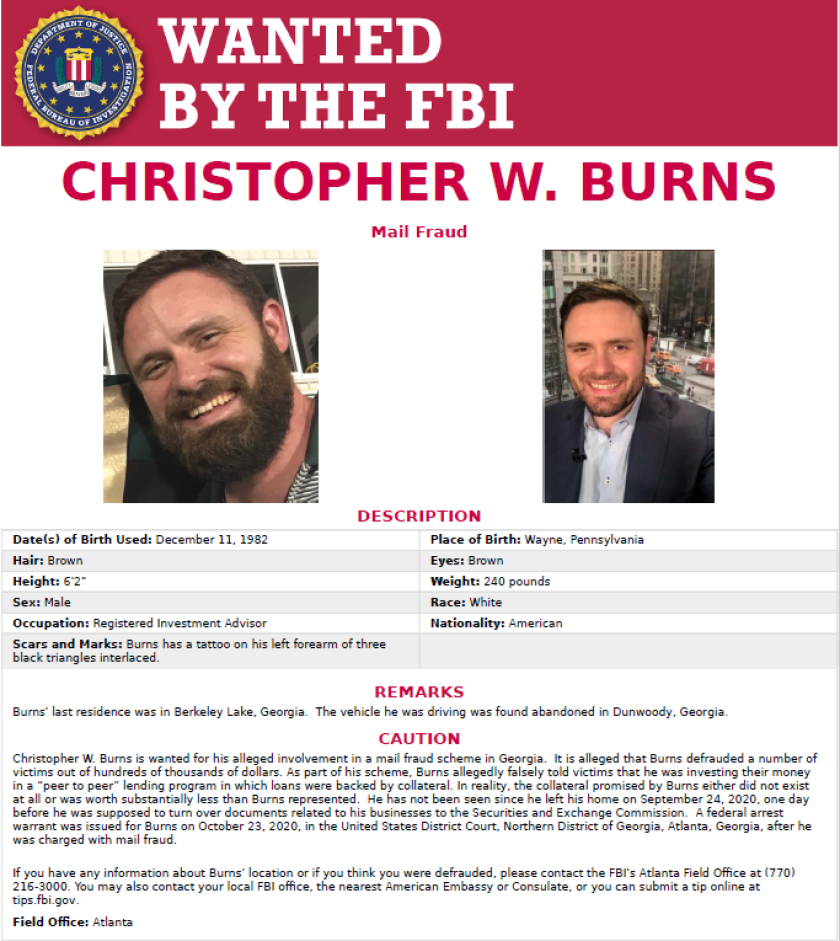

Ex-financial advisor Chris Wayne Burns’ truck was found about six months ago in a parking lot with copies of three cashier’s checks. He wasn’t in it.

Meredith Brown, his wife at the time, filed a missing person report with the police on Sept. 25, after using OnStar to track down his vehicle. The SEC had requested paperwork from his business only one month prior. It had been due that day.

The Gwinnett County, Georgia police department, the FBI, the SEC and the IRS, among other agencies, have been trying to find Burns in recent months to no avail.

But it’s not just the ex-advisor who’s vanished.

Approximately $10 million has gone missing — money and retirement savings Burns’ clients had entrusted with their advisor — in what the SEC has alleged was a fraudulent scheme. Burns collected nearly $320,000 of those funds within the eight days prior to his disappearance, all but $75 of which he withdrew to personal bank accounts or cash, according to the SEC.

FBI

Whether or not Burns, 38, re-emerges, there are at least 40 individuals who may never see those savings again.

“The FBI’s job is to try to get justice,” says Jason Doss, who is one of three attorneys representing victims in a federal lawsuit in Georgia. “Our job is to try to get [their] money back.”

On the air

Burns developed a brand for himself as a financial expert in the Atlanta area, according to the SEC. His radio show, “The Chris Burns Show,” aired on Sundays at 2 p.m. on WSB. He appeared on Fox & Friends and other television shows.

His radio show, in particular, was a selling point to some of Burns’ clients, according to the lawsuit Doss’ clients filed against Burns and his business entities, as well as the TAMP the ex-advisor used, Matson Money.

One client, Norman Zimmerman, Jr., tuned into Burns’ radio show on his way to go hunting one Sunday morning in 2017, according to the lawsuit. He and his wife, Susan, had been looking for someone to help them save for retirement.

Susan Zimmerman, a plaintiff in the case, ultimately invested $350,000 of her savings, all of which has allegedly been lost, according to the lawsuit and her attorneys.

Doss Law Firm

As early as February 2017, Burns allegedly began recommending promissory notes, issued by two companies he owned and controlled, Investus Financial and Peer Connect, according to the SEC. Approximately 40 individuals in Georgia, North Carolina and Florida invested in those notes, most of whom were RIA clients. Investus Advisers, Burns’ RIA, had more than 90 client relationships, according to the latest Form ADV he filed with the SEC.

His pitch to these individuals was that their investments would be loaned to small businesses in need of capital and deliver 5-20% returns each year for their duration, according to the SEC complaint.

The promissory notes were safe and had “little or no risk,” he allegedly told them, asserting to many clients that the loans were backed by collateral held in Charles Schwab accounts. He also signed a personal guarantee that he would pay back 100% of any principal loss of the notes, giving clients the belief that their investments had “yet another layer of security,” the SEC says.

The “peer-to-peer lending program was a sham,” the SEC claims. So, allegedly, were the assurances: The Schwab accounts didn’t exist, according to the regulator, and Burns didn’t have the personal funds to repay those clients.

The ex-advisor allegedly used the $10 million he raised “to fund his lifestyle” and purchase a million-dollar lake house, a boat, cars and “tens of thousands of dollars of airtime for his local radio show,” among other expenses, according to the SEC complaint.

Post-disappearance

After Burns vanished Sept. 25, leaving behind his 2020 Black GMC Yukon in a parking lot in Dunwoody, Georgia, everyone else from law enforcement to investors was left to pick up the pieces.

The Georgia Securities Division filed an emergency order against the ex-advisor Oct. 20, citing “unethical practices by abandoning firm and clients” and failure to disclose promissory note information, according to FINRA BrokerCheck. Three days later, the FBI issued a warrant for his arrest for mail fraud. The SEC charged Burns and three of his business entities with fraud in mid-November.

Burns’ RIA, Investus Advisers, had another advisor on staff, Cliff Hitt, who is no longer a registered rep and has gone on to become the vice president of advisor planning at a financial marketing company, The Impact Partnership.

“I am not at a position where I can entertain any questions,” Hitt said in an emailed statement.

FBI

Seven former clients have filed a lawsuit against Burns, his four business entities, and Matson Money. The clients, who are seeking class action status, allege that Matson Money was an “integral part of the scheme” and that it breached its fiduciary duty and did not conduct adequate due diligence of Burns, among other claims.

“They have to know where the money is coming from,” Doss says. “What’s the source of the funds? What are [the clients’] goals?”

Matson Money denies the allegations against it and says it is not responsible for undisclosed and unaffiliated activities of independent financial advisors, according to Ray Hennessey, spokesman for the TAMP.

“Mr. Burns invested a portion of his client capital in Matson Money funds. Matson Money and Dynamic Money are separate and have no affiliation with one another. At no time was Matson Money aware of or party to any of Mr. Burns’ alleged fraudulent activities. We did not know, nor would we have a way to know, that separately and outside of our agreement, Mr. Burns was offering peer-to-peer lending opportunities to his clients, which, by their very nature, fall outside of the scope of the investments we manage,” Hennessey said.

An FBI spokesman in Atlanta, Kevin Rowson, confirmed that its investigation of Burns is ongoing, and that the SEC and IRS are involved. He said there was no update on the case and declined to comment on any specific questions.

Meredith Brown, Burns’ ex-wife, has been providing information as needed to the FBI and U.S. Attorney’s office to help find Burns and is anxious he will emerge, according to her attorney, Kristen Novay.

Burns left his family in disarray, according to Novay, who has known Brown since she was two years old.

“There are books on how to handle something when a spouse is unfaithful or they’re dishonest or you have to deal with the death of somebody close to you,” Novay says. “There’s no Hallmark card for what to do if your spouse has stolen money from friends and family and lied to you about who they were for who knows how long.”

Brown and Burns are now legally divorced, according to Gwinnett County records. Burns filed for divorce in February 2020, according to the documents. Both parties had signed the agreement the day he went missing, and Meredith legally changed her last name to Brown, her maiden name, at the end of October, according to the records.

Shortly after Burns’ disappearance, the SEC froze assets, including bank and brokerage accounts, belonging to Burns, his business entities and Brown, who was named as a relief defendant in the SEC’s charges.

Brown subsequently sold the family’s lake house, which is a little more than 30 minutes outside of Atlanta, for $1.1 million on Nov. 20, according to property records. She had been awarded the home as part of the divorce, according to documents.

The SEC permitted the sale, but ordered the proceeds be frozen. The SEC released $50,000 to Brown to “cover her reasonable living expenses,” according to the SEC order.

The boat — a 2020 Catalina Funship pontoon, according to documents — is currently up for sale, too, Novay says.

Brown pressed identity theft charges against her husband in mid-January, alleging that Burns had purchased his GMC, and applied for a loan, in her name, forging her signature in the process, according to a Gwinnett County police report. The dealership has taken the truck back, according to Novay. The other two vehicles, which belong to Brown and her son, remain with the family, she says.

Emotional aftermath

Following Burns’ disappearance, regulators have been attempting to piece together where he is — and what happened. His family and his clients were left to do the same, according to their attorneys.

“This was their retirement savings — all of it,” Doss says of the clients. “They thought they were doing the right thing. … They were checking off all the boxes on what a diligent investor who was trying to plan for the future is going to do.”

It’s a monetary loss, but it’s also personal and emotionally devastating, according to Robert Port, one of the other two attorneys representing the clients.

“Stripping aside all the legal stuff, it’s a breach of trust,” he says.

As for Burns’ ex-wife and children, they are trying to process what’s taken place, and figure out what comes next, according to Novay.

“We’re just hoping that [the FBI is] making some headway, that they find him, that he’s alive and he can start the road to redemption,” Novay says, for both his family and his clients.

What could redemption look like at this point? His family “may not even be ready to answer that yet,” Novay says.

The FBI requests those with further information on Burns and his whereabouts to call the Atlanta field office at 770-216-3000 or go to tips.fbi.gov.

Leave a Reply