Equity Mutual Funds are one of the best investments to generate wealth in the long run while Debt mutual funds are more suited to park money for the short term (as an alternative to fixed deposits). But as in case of any investment, the final returns are determined on the way these Mutual Funds are taxed. This post discusses tax on mutual funds for FY 2021-22 [AY 2022-23].

Types of Mutual Funds

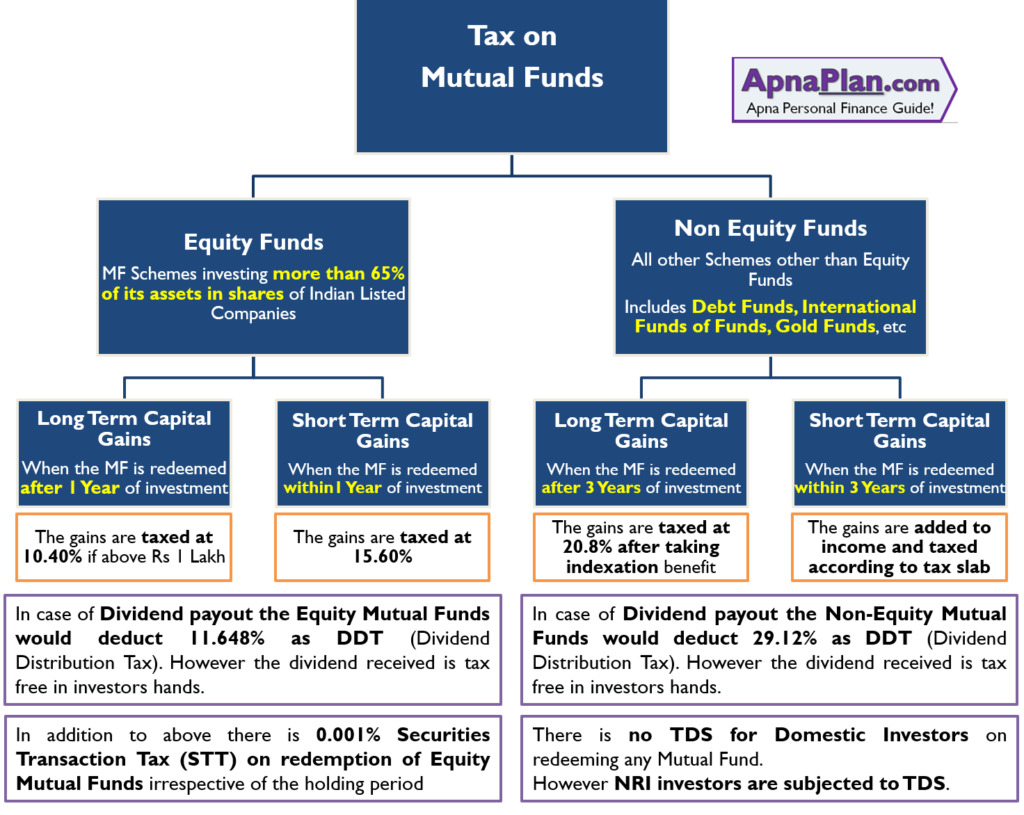

For Taxation purpose the Mutual Funds can be divided into Two categories:

- Equity Mutual Funds – Schemes investing more than 65% of its assets in shares of Indian Listed companies

- Non Equity Mutual Funds – All other Schemes which do not qualify as Equity Funds by above definition. This includes Debt Funds, International Funds of Funds, Gold Funds, Monthly Income Plans (MIP) etc

Capital Gains Tax on Mutual Funds

From tax perspective the tax on mutual funds fall under “Income from Capital Gains”. This would be useful information when you have to decide which ITR Form to use to file income tax returns.

The gains that are generated on redeeming the Mutual Fund units can be classified as Short Term or Long Term Capital Gains depending on period of holding which is different in case of equity Vs non-equity mutual Fund. We cover both types of funds one by one.

Tax on Equity Mutual Fund

Long Term Capital Gains/Losses: If the redemption of mutual fund happens after 1 year of investment, the gains or losses are classified as long term capital gains/losses in case of equity mutual fund.

Short Term Capital Gains/Losses: If the redemption of mutual fund happens with-in 1 year of investment, the gains or losses are classified as short term capital gains/losses in case of equity mutual fund.

The tax treatment on both types of capital gains are different.

Starting April 1, 2018 Long Term Capital Gains of more than Rs 1 Lakh would be taxed at the rate of 10.4% (including cess). This was introduced in Budget 2018. Until last financial year (FY 2016-17) the long term capital gains from equity funds were tax free.

There is NO complication in calculation if you purchased the fund after February 1, 2018 i.e. after Budget 2018. However if your purchase was on or before January 31, 2018 you would be eligible for grandfathering of capital gains till January 31, 2018 for calculation of long term capital gains.

Purchase price is to be considered higher of (a) and (b). (the idea is that only gains made after Jan 31 are taxable)

- Actual purchase price

- Closing NAV as on January 31, 2018

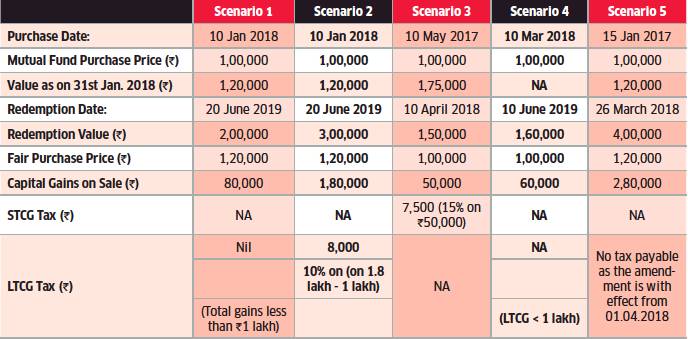

Below are different scenarios and how LTCG would be calculated:

The Short Term Capital Gains are taxed at 15.6% (including cess).

How to Pay 0 Income Tax on Salary of Rs 20+ Lakh (FY 2020-21)?

As you can see with the above income tax calculation, salary components and salary structure plays a very important role in how much income tax you pay. We have come up with some optimised salary structure using which you pay NO income tax even with CTC of more than Rs 20 Lakhs.

Tax on Non-Equity Mutual Funds (includes Debt, Liquid, International Funds, etc):

Long Term Capital Gains/Losses: If the redemption of mutual fund happens after 3 year of investment [Changed in Budget 2014], the gains or losses are classified as long term capital gains/losses in case of equity mutual fund.

Short Term Capital Gains/Losses: If the redemption of mutual fund happens with-in 3 year of investment, the gains or losses are classified as short term capital gains/losses in case of equity mutual fund.

The tax treatment on both types of capital gains are different.

Long Term Capital Gains are taxed at the rate of 20.8% (including cess) after taking indexation benefit.

The Short Term Capital Gains are added to the total income and taxed at the marginal income tax slabs.

How to generate Regular Monthly Income?

There can be several situations when we look for regular income. This is especially true for people after retirement without any pension. Also there would be new entrepreneurs who need regular income until their start-up stabilises. We tell you 13 investments which can generate regular income for you along with their pros and cons.

The info-graphic below summarizes the capital gains tax on Mutual Funds:

Tax on Dividend Income from Mutual Funds

Budget 2020 has made dividend in excess of Rs 10 Lakh taxable in the hand of investor at the rate of 10%. Anything less than Rs 10 Lakh is tax free.

STT on Mutual Funds

In addition to above there is 0.001% Securities Transaction Tax (STT) (changed from 0.25% from June 2013) is levied on redemption of Equity Mutual Funds irrespective of the holding period

There is no STT for non-Equity mutual Funds

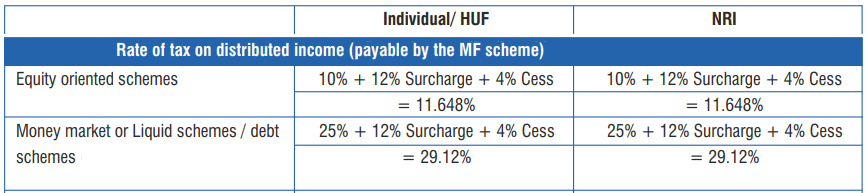

Dividend Distribution Tax on Mutual Funds

In addition to the above capital gains tax and STT there is Dividend Distribution Tax (DDT) which is paid directly by Mutual Funds. The dividend paid to investor is after the deduction of DDT and so the dividend received is Tax Free in the hands of investors. The rates of DDT are as follows:

How much Taxes you Need to Pay this Year? Download Our Income Tax Calculator to Know your Numbers

Do you know how much tax you need to pay for the year? Have you taken benefit of all tax saving rules and investments? Should you use the “NEW” tax regime or continue with the old one? In case you have all these questions just Download the Free Excel Income Tax Calculator for FY 2021-22 (AY 2022-23) and get your answers.

Wealth Tax on Mutual Funds

There is no Wealth Tax on Mutual Fund Investments

TDS on Mutual Funds

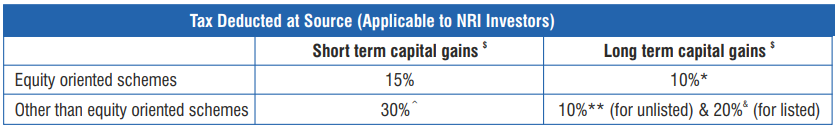

There is no TDS (tax Deduction at Source) for Domestic Investors on redeeming any Mutual Fund.

However NRI investors are subjected to TDS as follows:

We hope the post would have cleared your doubts on various taxes (like Long Term or Short Term Capital Gains Tax, Dividend Distribution Tax, STT) associated with the Equity and Debt Mutual Funds.

Tax on Mutual Funds FAQs

✅ Is there tax on mutual funds dividend?

Budget 2020 introduced tax on dividends of mutual funds. Dividend received in excess of Rs 10 Lakh in a financial year is taxed at 10%.

✅ How to Calculate Tax on Mutual Funds?

You should follow following steps to calculate tax on mutual funds:

1. Classify the fund in – equity or non-equity funds.

2. Check Investment Duration to check if the gains are short term or long term capital gains

3. Long Term capital gains are taxed as follows:

i> Equity Fund – 10.4%

ii> Non Equity Fund – 20.8%

3. Short Term capital gains are taxed as follows:

i> Equity Fund – 15.6%

ii> Non Equity Fund – as per income tax slab

✅ Is there tax on mutual funds withdrawal?

The good thing about mutual funds is – its taxed only after you withdraw it (unlike Fixed deposits). So all tax calculation explained in above section comes in effect only after you withdraw mutual fund investment.

✅ How much tax is on mutual funds?

Tax on Mutual Fund depends on type of mutual fund and duration of investment. Its as follows:

Long Term capital gains are taxed as follows:

i> Equity Fund (invested for more than a year) – 10.4%

ii> Non Equity Fund (invested for more than 3 years) – 20.8%

Short Term capital gains are taxed as follows:

i> Equity Fund (invested for less than a year) – 15.6%

ii> Non Equity Fund (invested for less than 3 years) – as per income tax slab

✅ How to pay tax on mutual funds?

There is no TDS on Mutual Fund redemption. Hence you have to calculate the tax yourself and pay it as advance tax.

Leave a Reply