Gold has always fascinated us Indians but you may not realise that it is a very volatile asset. We look at Gold Price History in India since 1964 or for more than 55 years. These numbers are sourced from RBI reports.

If you look at the numbers in the table below, you would realise there has been a lot of fluctuations in the price. The green shaded years are the ones where the prices have gone up by more than 20% as compared to previous year. The red shaded years are where the prices have come down from last year.

| Year | Gold Price (Rs.) | Year | Gold Price (Rs.) | Year | Gold Price (Rs.) |

|---|---|---|---|---|---|

| 1964 | 63 | 1984 | 1,970 | 2004 | 5,850 |

| 1965 | 72 | 1985 | 2,130 | 2005 | 7,000 |

| 1966 | 84 | 1986 | 2,140 | 2006 | 8,400 |

| 1967 | 103 | 1987 | 2,570 | 2007 | 10,800 |

| 1968 | 162 | 1988 | 3,130 | 2008 | 12,500 |

| 1969 | 176 | 1989 | 3,140 | 2009 | 14,500 |

| 1970 | 184 | 1990 | 3,200 | 2010 | 18,500 |

| 1971 | 193 | 1991 | 3,466 | 2011 | 26,400 |

| 1972 | 202 | 1992 | 4,334 | 2012 | 31,050 |

| 1973 | 279 | 1993 | 4,140 | 2013 | 29,600 |

| 1974 | 506 | 1994 | 4,598 | 2014 | 28,007 |

| 1975 | 540 | 1995 | 4,680 | 2015 | 26,344 |

| 1976 | 432 | 1996 | 5,160 | 2016 | 28,624 |

| 1977 | 486 | 1997 | 4,725 | 2017 | 29,668 |

| 1978 | 685 | 1998 | 4,045 | 2018 | 31,438 |

| 1979 | 937 | 1999 | 4,234 | 2019 | 35,220 |

| 1980 | 1,330 | 2000 | 4,400 | 2020 | 48,651 |

| 1981 | 1,800 | 2001 | 4,300 | 2021 | 47,470 |

| 1982 | 1,645 | 2002 | 4,990 | 2022 | x |

| 1983 | 1,800 | 2003 | 5,600 | 2023 | x |

The prices above are approximate average of gold prices for the year.

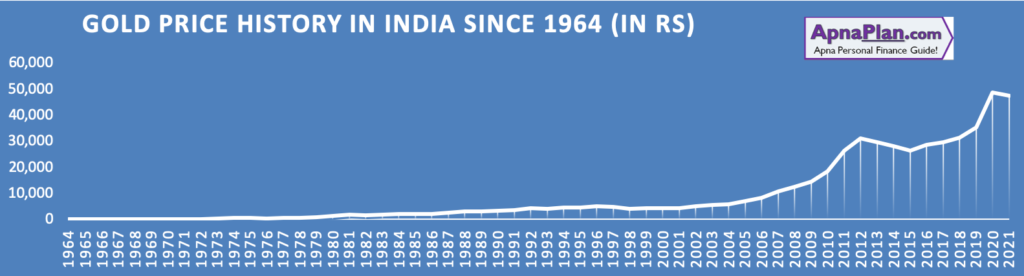

Gold Price History in India Trend

If you look at the trends in Gold Price below, the gold prices rallied in 1978 to 1981 and rose 4 times in 4 years. The second rally came after 2004 and in next 8 years it went up from Rs 6,000 to 31,000 – more than 5 times in 8 years.

There was stagnancy with slight dip in the gold prices from 2012 to 2015. It again saw a sharp rise of ~40% in 2020 due to global pandemic.

Gold Price History in India – Return on Gold

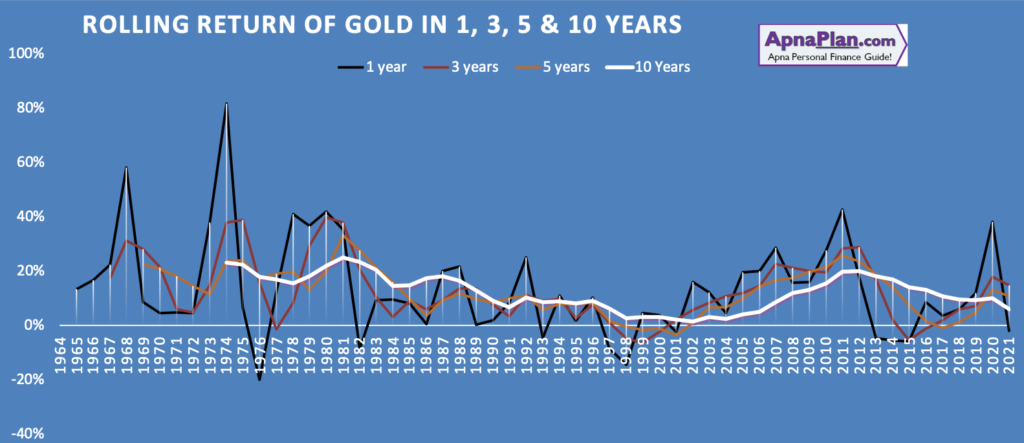

Below is the chart showing the rolling return on Gold for 1, 3 , 5 and 10 Years period. For e.g. for 5 years rolling return its assumed that you buy Gold every year and sell it after five years.

The significant point to note here is except for 10 Years rolling return gold at some point of time has given negative returns. The worst period for Gold has been 1997 – 2002 and 2012 – 2015 where the Gold prices remained virtually stagnant. This graph also proves that returns in Gold is not always positive which most of us assume. Its depended on market factors, currency equations and economy.

How much Taxes you Need to Pay this Year? Download Our Income Tax Calculator to Know your Numbers

Do you know how much tax you need to pay for the year? Have you taken benefit of all tax saving rules and investments? Should you use the “NEW” tax regime or continue with the old one? In case you have all these questions just Download the Free Excel Income Tax Calculator for FY 2021-22 (AY 2022-23) and get your answers.

Should you Invest in Gold?

Gold has been considered a valuable asset in India from time immemorial. There has always been a conception that Gold prices never fall. However if you look at 56 years Gold Price History in India in tables & charts above – you can find years with spectacular rallies and years with fall in prices. So gold is also a volatile asset. However if your investment is for long term, the chances of loosing money goes down substantially.

The table below shows what happens if you invest in gold for 1 Year, 3 years, 5 years and 10 Years. Based on the Gold Price History in India since 1964, we can say the volatility of gold decreases as your investment tenure goes up. Also the chance of loosing i.e. getting negative return is 0 if the investment was for 10 years or more.

This is how we have calculated % chance of loosing money. For 1 Year rolling returns we have total of 57 instances since 1964, in this 10 years gave negative returns compared to previous year. So the ration for 1 year rolling goes to 10/57 = 18%

| Rolling Years | Average Return | Minimum Return | Maximum Return | % Chance of Loosing Money |

|---|---|---|---|---|

| 1 Year | 13.6% | -20.0% | 81.7% | 18% |

| 3 Years | 12.9% | -6.4% | 39.9% | 11% |

| 5 Years | 12.4% | -3.6% | 33.0% | 8% |

| 10 Years | 12.3% | 1.4% | 25.0% | 0% |

Should you invest in Gold? Based on the Gold Price History in India it seems its a good idea to invest some part of your assets in gold for long term.

How to Pay 0 Income Tax on Salary of Rs 20+ Lakh (FY 2020-21)?

As you can see with the above income tax calculation, salary components and salary structure plays a very important role in how much income tax you pay. We have come up with some optimised salary structure using which you pay NO income tax even with CTC of more than Rs 20 Lakhs.

How to Invest in Gold?

Below are the most popular ways to invest in Gold:

- Sovereign Gold Bonds

- Gold ETFs

- Gold Fund of Funds

- eGold

- 24 carat Coins & Bars

- Jewellery

The first 4 is like investing in “Gold on Paper” as you do not have any physical gold with you. Out of the above I personally recommend investing through Sovereign Gold Bonds due to following reasons:

- You get interest of 2.5% every year on your gold

- You need not worry about the purity of gold

- You have no worry about storage

- The buying and selling is easy – you can do it all online from comforts of your home

- In case you need to exit in emergency, you can resell it through stock market

- There is no capital gains tax on gains you make (if you redeem the bonds on maturity)

Know about the latest issues of Sovereign Gold Bonds

Sovereign Gold Bonds are one of the better ways to invest in gold. It’s safe, backed by government of India and you need not be worried about purity of gold or storage. The icing on the cake is you get interest paid on your investment. You can buy these Sovereign Gold Bonds from NSE/BSE but the liquidity is a problem. So it’s a good idea to subscribe to latest issue of Sovereign Gold Bonds which comes almost every month.

We hope the Gold Price History in India for more than 55 years would have helped you take informed decision for investing in gold. Just a word of caution “in investment the history may not always repeat itself”

Leave a Reply