Income Tax department has formally launched compliance portal and started e-Campaign for certain tax payers. An e-mail is sent to tax payers who have not filed income tax return or not reported high value transactions in their income tax returns. Income tax department has gathered data from various sources and based on the data e-Campaign e-mail is sent. The main idea here is to increase the tax compliance and help tax payer to validate their financial transactions. This compliance facility is launched for assesse of FY 2019-2020 (AY 2020-21).

How information is gathered for e-Campaign?

Income tax department make use of various sources for collecting financial transactions. The prime source of collecting information is the bank account of the tax payer. As bank account of tax payer is linked with Aadhaar, it is easy to collect information centrally.

Income tax department also collect information from statement of financial transactions (SFT), Tax deducted at source (TDS), Tax collected at source (TCS), Foreign Remittance etc.

Other methods to extract information is GST, export, import, stock market transactions and mutual fund transactions. Additionally, income tax department has also started collecting information for real estate transactions.

Tax payer must note that all high and even low value transactions are monitored by income tax department.

What type of e-Campaign email is sent?

Your last date to file income-tax returns (ITR) for income earned in the current financial year (2020-21) is July 31. But if you haven’t yet filed tour income-tax returns for income earned in the previous financial year (2019-20), then chances are that the income-tax department may have already sent you and email or message. The last date to file returns (with penalty) for income-earned in the financial year (FY) 2019-20 is March 31.

Not mentioning Interest income from FDR/Saving Bank Account

We appreciate that you have filed your Income Tax Return and contributed towards the progress of Nation. However, the Income Tax Department has received information on high value transactions relating to XXXXX1 for Financial Year 2019-20. On the basis of data analysis, the Income Tax Department has identified following high value information which does not appear to be in line with the Income Tax Return filed for Assessment Year 2020-21 (relating to FY 2019-20):

- Total Interest payable by banking company

The objective of this campaign is to validate above information and promote voluntary compliance.

You need to login to compliance portal to file your response.

What is Income Tax Compliance Portal?

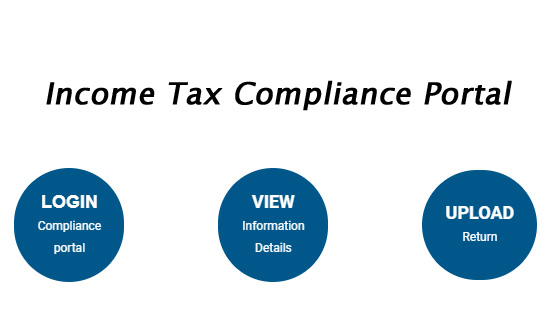

Income Tax Compliance portal is website where tax payer can maintain response to the compliance. This is to avoid notice, scrutiny and other actions from the income tax department. The another objective is to impart confidence to the citizen for paying taxes.

This step will surely enhance tax compliance and people will be filing income tax return with honesty.

How to submit response on Income Tax Compliance Portal?

#1 Login to the e-filing portal (https://incometaxindiaefiling.gov.in) and click on the ‘Compliance Portal’ link available in ‘My Account’ to navigate to Compliance portal (https://compliance.insight.gov.in)

#2 Click on the ‘e-Campaign – High Value Transactions’ tab to view information details. Please submit online response by selecting among the following options on Compliance Portal.

Following response can be selected.

- Information is correct – If information belongs to you and correct in all aspects you can select option that information is correct.

- Information is not fully correct – If information is partially correct or not up to mark you can select this option. You need to provide additional information such as value, information, account etc when you select this option.

- Information relates to other person or year – The information given is belongs to other person or year you can select this option. This generally happens if joint account, joint property holding is selected. Tax payer needs to provide correct information about person to whom the information belongs. You required to mention PAN card number, relationship detail, FY etc.

- Information is duplicate and included in other displayed information – If information is duplicate and already mentioned in any other tab tax payer can select this option.

- Information is denied – If as a tax payer you are not aware of the given information you can select this option.

What are the next steps after submitting response to Income tax compliance portal?

Once you submit the response on the portal you need to take action with respect to revising income tax return. Along with revising income tax return you need to pay self-assessment tax (if any).

Incase date of revising income tax return is passed you need to wait till income tax department generates demand on the portal. You need to pay tax on the generated demand to close your income tax liability.

Leave a Reply