After achieving positive flows last year in its asset management business, Ameriprise Financial has inked a deal that would introduce even more clients to the company’s funds.

Ameriprise is buying BMO Financial Group’s EMEA asset management business for approximately $845 million, it said April 12. The deal, expected to close in the fourth quarter, will add $124 billion of European AUM and give Ameriprise access to the Canadian bank’s ESG strategies. It will also initiate a distribution relationship with BMO’s North American wealth management business.

“This strategic acquisition represents an important next step as we expand our solutions capabilities, broaden our client offering and deepen our talented team,” Jim Cracchiolo, CEO of Ameriprise, said in a statement.

Spokespeople at Ameriprise and BMO declined to make executives available for an interview.

Through the deal, Ameriprise will gain a “substantial presence” in Europe’s institutional market and grow its asset management AUM to $671 billion —but Ameriprise is also anticipating a benefit within the retail market.

The acquisition “establishes a strategic relationship with BMO Wealth Management” that will give Bank of Montreal clients access to Ameriprise’s funds, offered through its asset management subsidiary, Columbia Threadneedle Investments, according to the company

Ameriprise purchased Threadneedle, and later Columbia Management, more than a decade ago, merging the brands together in 2015.

Ameriprise will begin working with BMO “to determine which of our products will be made available to BMO Wealth Management clients and how in the U.S. certain of their clients can transfer their business to Columbia Threadneedle if they choose,” Ameriprise spokesman Carlos Melville said in a statement. He noted that there will not be any immediate changes, as there are “several months of work ahead” before closing the deal.

Approximately 59% of Ameriprise’s asset management business was with retail clients at the end of 2020, but the latest deal with BMO appears to be heavily focused on accumulating institutional clients, according to John Barnidge, an analyst with Piper Sandler who has been covering Ameriprise since 2015. Still, Barnidge added that the company’s focus on the retail market will be “something to watch for” in impending earnings calls.

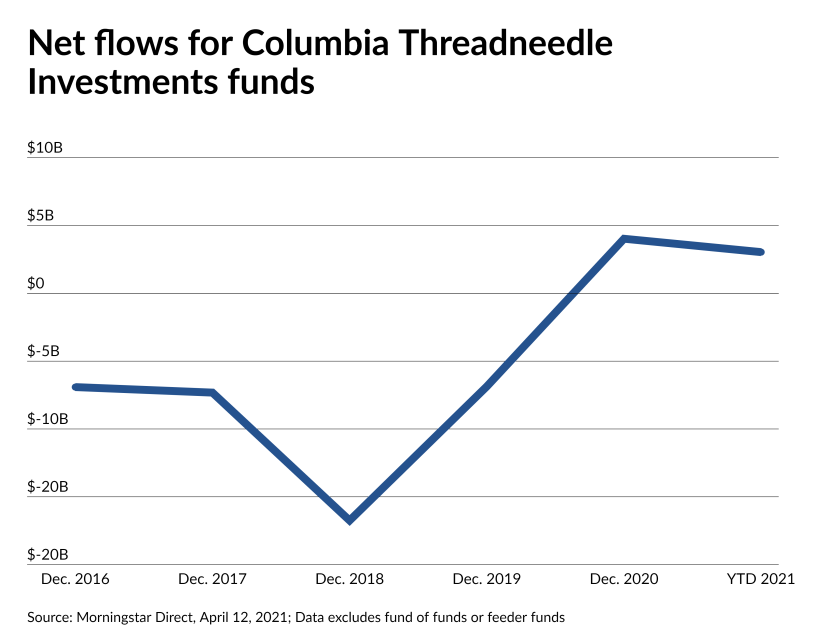

In years past, Ameriprise’s asset management business experienced year-over-year outflows, although that started to turn around in 2019. By the end of 2020, Ameriprises reported $546.6 billion in asset management assets, a $52.4 billion increase from the year-ago period.

“They’ve radically turned around their flows in the asset management business that had been a headwind for a long time,” Barnidge says, noting the acquisition appears to be in line with Ameriprise’s overall strategy to grow that business.

Year to date, Columbia Threadneedle ETFs and open-end funds have attracted more than $3 billion in U.S. assets, according to Morningstar Direct.

Ameriprise spokesman Melville attributed the flows to strong performance “complemented by strong sales that reflect our focus on working with advisors to help their clients reach their goals.”

Barnidge suggested that the company’s decision to merge the Columbia and Threadneedle brands may have contributed as well.

Ameriprise said it expects to enhance its current product lineup with some of the capabilities of BMO’s international asset management division, namely their ESG and European real estate offerings, among others.

Following necessary regulatory approval and subsequent integration, Ameriprise will have more than $1.2 trillion of assets under management and administration, according to the company.

Barnidge noted that this deal only represents a small percentage of Ameriprise’s market cap, and wouldn’t have a significant impact on the overall company.

“That’s a good thing, because a lot of things are working really well,” he says.

In March, BMO’s retail brokerage and advisory business, BMO Harris Financial Advisors, affiliated with LPL as its broker-dealer and custodian after leaving Pershing. The bank had been looking for a potential buyer for its asset management business as early as October, according to Bloomberg News.

Leave a Reply