Whether you’re opening the doors to your business or 20 years into the swing of things, you may be considering a loan. One option is a loan through the Small Business Administration (SBA) if you have a small business. But, what is an SBA loan? And, how do you complete an SBA loan application? Let’s take a look at what it is and how to apply for an SBA loan.

What is an SBA loan?

Before we get into the nitty-gritty about applying for an SBA loan, let’s briefly recap what an SBA loan is. An SBA loan is a type of loan businesses can receive that is partially guaranteed and backed by the SBA.

The SBA does not pay out small business loans. Instead, the SBA partners with lending agents to provide the loans and sets strict guidelines for the loans through the partners. Lending partners include traditional lenders, community lenders, and micro-lending institutions.

In general, you can use SBA loans for most business purposes, and you can apply for up to $5 million. Some lenders set limits on what you can use funds for, so check with the specific lender before applying.

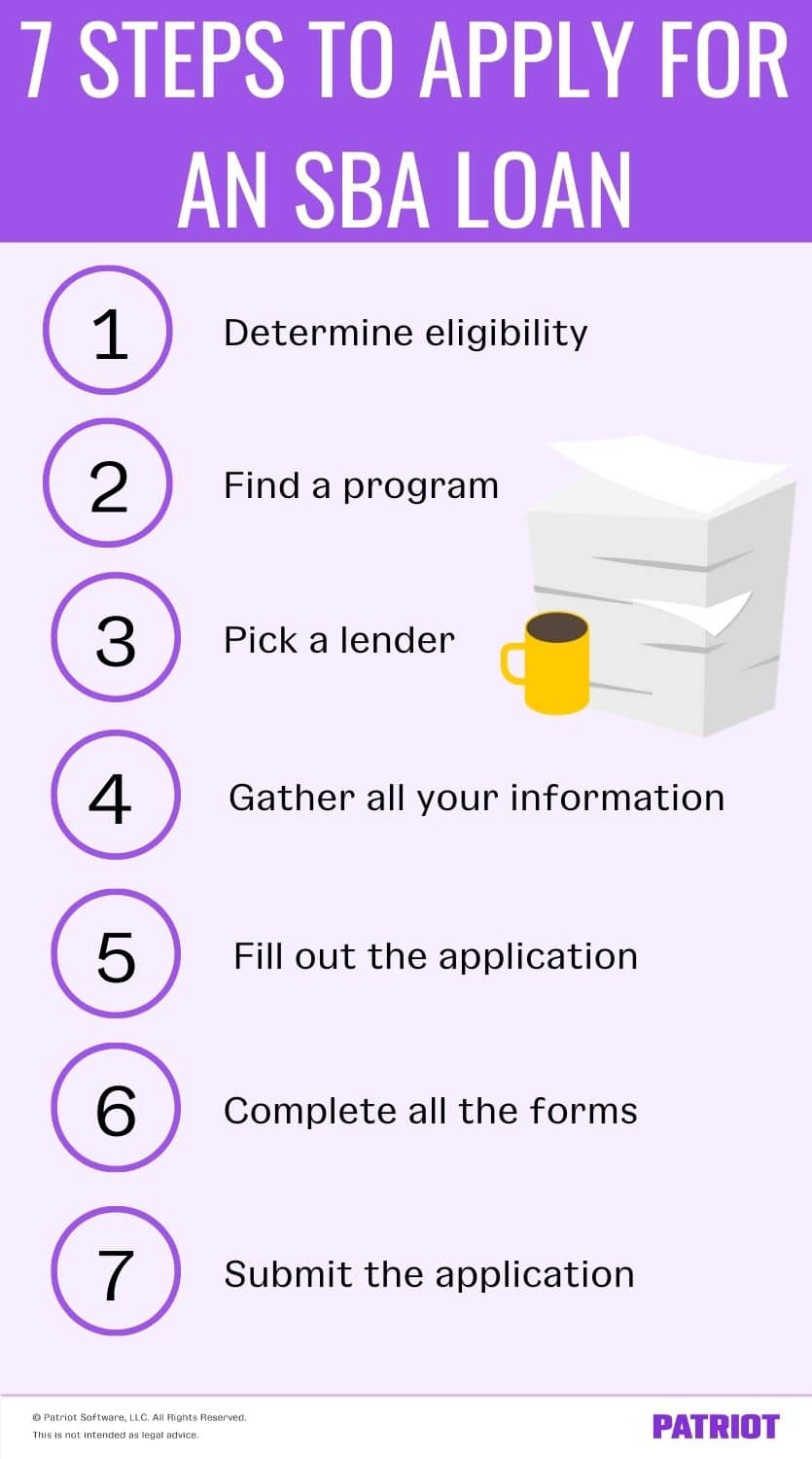

How to apply for an SBA loan

So, you decide to move forward with applying for a business loan. If you’re a small business by SBA standards, you can apply for a loan through the SBA.

Applying for an SBA loan can be a lengthy process. Some loans take several months from start to finish. So, what are the steps for applying for an SBA loan?

Step 1: Determine your eligibility

Before you can apply for a loan through the SBA, make sure you are eligible. You may still qualify for an SBA loan even if you do not qualify for loans through other lenders. The general requirements for SBA loan eligibility include:

- Having good personal credit (all majority owners)

- Being a U.S.-based business that is for-profit

- Belonging to an eligible industry

- Being in business for at least two years

- Not having defaults or delinquencies on government loans

- Being a small business through SBA standards

Owners must also have a reasonable amount of equity in the business. And, owners must provide proof that they have tried and failed to get funding from other lenders. How do you know if your business is a small business by SBA standards? Well, it can vary by industry. However, the SBA generally classifies a small business as one that is:

- Between or below 50 and 1,500 employees

- Between or below $1 million and $41.5 million in annual receipts

To be considered a small business by the SBA, your business must also:

- Be a for-profit of any business structure (e.g., S Corp or LLC)

- Have independent ownership and operations (no parent company)

- Be physically located and operate in the USA or its territories

- Not be nationally dominant in the industry (i.e., owning the majority of the market share)

Some SBA programs have additional requirements for eligibility or waive certain requirements. For example, the SBA startup loan program does not require two years in business or credit scores.

Step 2: Find a program

Once you know that you are eligible for an SBA loan, consider why you need the loan. Is it to purchase real estate? Does your business operate in an area impacted by a natural disaster (e.g., hurricane)? Do you need a loan due to COVID-19? All of these reasons have different SBA loan options.

Some of the most common SBA loans include:

- SBA 7(a): Covers a variety of loans. In general, these are term loans up to $5 million that any qualified business owner can use for almost any legitimate purpose.

- SBA CAPLines: Falls under the SBA 7(a) program but is the standard use line of credit. CAPLine loans have a cap of $5 million.

- SBA 504: Can help a business expand and buy fixed assets, such as equipment or real estate. The SBA requires a down payment of 10% – 20%. Applicants apply through a Certified Development Company instead of a lender.

- Export programs: Loans for small export businesses that have trouble getting business loans. There are three programs: SBA Export Express, Export Working Capital, and International trade.

- Veterans Advantage Guaranteed Loans: Helps veterans get the funding they need to start, grow, or succeed in business. The business must be veteran-owned to qualify. A veteran-owned business can apply for up to $5 million in loan assistance.

- Economic Injury Disaster Loans (EIDL): Specific to disasters (e.g., hurricane, coronavirus, etc.). An EIDL loan helps businesses that were damaged or face financial difficulties due to disaster. An SBA disaster loan is available in amounts up to $2 million and has a low interest rate. Use the SBA website to find the SBA disaster loan application.

- Paycheck Protection Program (PPP): The PPP loan helps small businesses, independent contractors, sole proprietors, nonprofit organizations, etc. impacted by COVID-19 by providing forgivable loans for payroll and qualifying non-payroll costs.

Carefully consider why you need the business loan when picking a loan program.

Step 3: Pick a lender

Because the SBA does not offer loans directly, you need to find a lender. The SBA provides guidelines, but lenders can determine credit score requirements and loan eligibility.

When looking for where to apply for an SBA loan, you can contact a financial institution or use the SBA 100 most active lenders list. When choosing your lender, consider the following:

- The SBA programs the lender offers (e.g., PPP)

- How much you need to borrow

- Qualifications for the program

- Interest rates for the loan you’re applying for

- Any down payments required for the loan

- If you need collateral and what kind, if applicable

- How long the application process takes

Check to see if the lender is an SBA preferred lender. Why? SBA preferred lenders have a history of providing loans to small businesses and understand the application process.

Step 4: Gather information

Applying for an SBA loan means you need to gather some information for your lender. In general, you will need:

- Personal and business financial statements

- Ownership and/or affiliate documentation

- Business licenses and permits

- Loan application history

- Personal and business federal income tax returns

- Business overview and history

- Business lease information (e.g., a copy of your current lease agreement)

Lenders may require more information depending on the type of loan you apply for. If you are purchasing an existing business, you generally need to provide additional documentation for an SBA loan.

Step 5: Fill out the application

SBA loan applications vary based on the program and lender. However, the SBA has general information it requires for applications. Most of the information may already be in your business plan, including:

- Executive summary

- Contact information

- Number of employees

- Basic business details

- Ownership breakdown

- Any other debt issued by the government, including other SBA loans

- Financial information

You also need to provide:

- Details of how you plan on using the loan

- How you plan on repaying the loan

Different applications may require additional information. Speak with your loan officer about what details they need from you before submitting your application.

Step 6: Complete the forms

Did you gather all of your documents and fill out your application? Great! There’s one last step before you are done and ready to submit everything to your lender. In many cases, there are a few extra forms the SBA needs from you.

Borrower information form

The SBA Form 1919 is the borrower information form for SBA 7(a) applications. The borrower information form gives both the SBA and lender basic information on the business and the owners, business affiliates, or investors. SBA Form 1919 determines eligibility for loans and lets a lender know if the business needs to provide additional forms.

Fee disclosure form

SBA Form 159 is the fee disclosure form borrowers complete if they receive help from an agent. If you apply for a 7(a) loan, 504 loan, or SBA disaster loan assistance, the SBA requires you to submit this form. The form protects applicants from paying unnecessary fees or overpaying for services.

Personal financial statement

Every applicant applying for a 7(a) or 504 loan must complete a personal financial statement, SBA Form 413. The SBA includes all business owners and co-signers as applicants. The personal financial statement includes the following:

- Inherited property

- Debts

- Life insurance policies

- Real estate

The SBA and lender require you to list all assets and liabilities for each owner or co-signer on SBA Form 413.

Step 7: Submit the application to your lender

After you complete the application and any necessary forms, submit them with all of the other required documentation to your lender. Your lender may take several weeks or months to review and authorize a loan for your business.

Check in with your lender throughout the process to be aware of any changes to your SBA loan application status. And, send any additional information your lender requests as soon as possible to keep the process moving smoothly.

Applying for an SBA loan and need financial reports? Patriot’s online accounting software lets you easily access all of your financial information in one place. And, you can access your information from anywhere, anytime. Try it free for 30 days!

This is not intended as legal advice; for more information, please click here.

Leave a Reply