Executive Summary

Welcome to the May 2021 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

This month’s edition kicks off with the big news that Tifin Group has raised $22M in Series B capital, shortly off the heels of its acquisition of Totum Risk and MyFinancialAnswers and its sale of 55IP to JP Morgan, in an ongoing effort to acquire smaller AdvisorTech companies, add both capital and additional developer resources, and try to incubate them to the next level of success in a world where most AdvisorTech solutions start out as undercapitalized “homegrown” solutions from advisors themselves. The real question, though, is whether Tifin envisions packaging its acquisitions together to formulate a whole that may be worth more than the sum of the parts, or instead will function as an innovation conduit for its investors who are themselves largely potential strategic acquirers (from Morningstar to Broadridge to JP Morgan). Either way, the emergence of Tifin highlights both the opportunities in AdvisorTech for small companies to receive influxes of capital and investment to grow to the next stage, as interest in AdvisorTech innovation continues to grow.

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including:

- Ethic Investing raises $29M from investors including Fidelity as ESG-driven direct indexing continues to gain traction

- Snappy Kraken raises $6M to accelerate the growth of advisor marketing technology

- Morgan Stanley spins off E*Trade Advisor Services to Axos Financial to formulate another RIA custodian competitor to Schwabitrade

- Envestnet acquires Harvest Wealth to power the ongoing convergence of banks, wealth, and trust services

Read the analysis about these announcements in this month’s column, and a discussion of more trends in advisor technology, including:

- SEI acquires the remainder of Oranj to upgrade its own digital experience to compete for independent RIAs

- Avantax acquires Guidevine’s marketing technology tools for its own advisors

- EverPresent launches a new service allowing advisors’ clients to record their own family legacy videos (with interview scripts to make the process less morbid and challenging!)

- Skience launches a new digital repapering tool as the industry turns a greater focus to using technology to reduce the friction of switching broker-dealers

- AdvicePay launches Deliverables to facilitate compliance reviews of financial plans for enterprises trying to scale fee-for-service financial advice

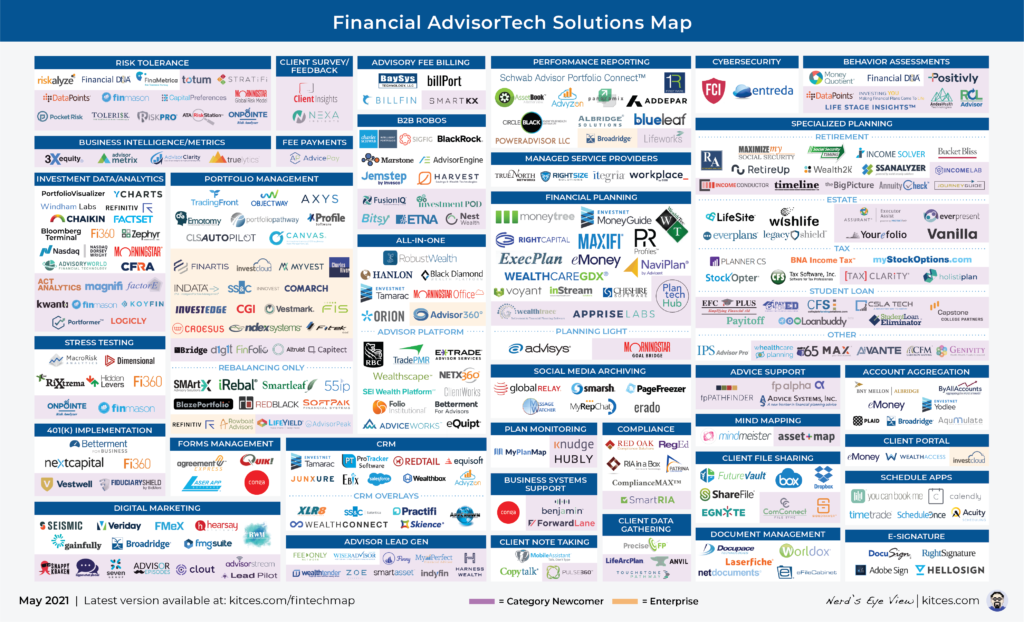

And be certain to read to the end, where we have provided an update to our popular “Financial AdvisorTech Solutions Map” as well!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to TechNews@kitces.com!

Tifin Group Raises $22.3M Series B To Incubate AdvisorTech Innovation.

As the number of players on the AdvisorTech landscape map has proliferated in recent years, it was only a matter of time before consolidation began to take hold, a trend that appears to be accelerating in the pandemic environment as a very fragmented space becomes a little bit smaller. By and large, such industry consolidation has been driven by larger platforms gobbling up smaller players to add key features (e.g., Orion acquiring Advizr), or strategic acquisitions by product companies that want to bring technology in-house to facilitate tech-based distribution (e.g., Northern Trust acquiring Emotomy, or Franklin Templeton acquiring AdvisorEngine).

In this context, the Tifin Group recently joined the fray by acquiring two companies (Totum Risk and MyFinancialAnswers), and now this month has announced their Series B of $22.3M to load their war chest for even more deals. What’s unique about Tifin Group, is that it is neither a ‘traditional’ financial buyer, nor a strategic acquirer, per se, but instead is operating as a bit of a hybrid between a private equity firm and a startup incubator with a growing portfolio of more than half a dozen AdvisorTech companies that it has variously started, incubated, and acquired.

From the advisor perspective, the good news of the Tifin Group approach is that when a significant portion of AdvisorTech solutions are “homegrowns” – built by advisors to solve problems in their own firms and then sold to other advisors in what becomes a ‘side venture’ as a tech entrepreneur – many up-and-coming solutions can spend years being underdeveloped and undernourished, launched by advisor founders who don’t have the capital to fuel growth, while still operating at too small of a size to attract traditional growth equity.

Tifin Group appears to be operating a model in between the two, taking on the heady task of trying to incubate early-stage AdvisorTech companies into more viable ongoing ventures, but also putting its own capital into play by acquiring the firms and putting its own leadership and developer resources towards growth for a future exit.

And now, Tifin Group ramping up the effort… and receiving a strong validation to its thesis with a group of Series B investors that includes heavyweights JP Morgan, Morningstar, and Broadridge.

In fact, with JP Morgan recently acquiring Tifin Group portfolio company 55IP in December, one does not have to squint too hard to see a partnership forming here where some very established brands with fantastic distribution can get a front-row seat to the innovation happening at/via Tifin Group, and then have the first chance to scoop up interesting companies that incubate there, folding them into the establish player’s existing strategies. For instance, Morningstar would likely interest in Magnifi (a company that is creating a better search engine for discovering investment products), JP Morgan may potentially be interested in Positivly (a company that helps create better investment recommendations with a more personalized approach), and Broadridge likely has an interest in Louise (which is re-thinking how donor-advised gifting is being managed and tracked).

What remains to be seen is whether or not Tifin attempts to combine its various acquisitions into one platform for advisors to use, chasing the elusive “holy grail” of the one-stop advisor workstation (especially given recent acquisitions of risk tolerance in Totum and financial planning software in MyFinancialAnswers) in the hopes that the whole can be worth more than the sum of the parts, or if Tifin will incubate the component parts separately (a la Berkshire Hathaway) and benefit from growing revenue across the portfolio (and periodic strategic exits).

Either way, it is hard not to be bullish on the AdvisorTech space, as more pathways to everything from capital to distribution to strategic partnerships (and strategic acquisition exits) continue to proliferate. If large institutional investors are putting cash to work in AdvisorTech incubators, it can only mean there is increasing confidence in the AdvisorTech market… and if Tifin Group can establish more of a track record of success, it may even become a model of AdvisorTech innovation, where founders launch companies from within Tifin (or similar providers), funded by large strategic buyers who then enter to acquire the solutions that gain traction (in contrast to the current environment where even promising AdvisorTech startups still struggle with a lack of capital and resources).

Just 4 short years ago, the ongoing rise of the RIA channel was creating a growing hunger for more businesses to get into the RIA custody business, culminating in the E*Trade acquisition of Trust Company of America, which at the time had “just” $17B of assets under custody for approximately 200 RIAs, but was bought for a whopping $275M. The premise at the time was that E*Trade could both leverage its existing retail brokerage economies of scale to improve margins on the custody business – as virtually all RIA custodian offerings ultimately gain economies of scale by pairing their retail brokerage with custody – and turn the crown jewel of its Corporate Services division (with its lucrative corporate executive planning opportunities) into both an RIA referral channel and a way to lure RIAs to the platform.

And then barely 2 years later, Schwab cut trading commissions to zero and eviscerated the RIA custody (and retail brokerage) business model. Within a year, Schwab had acquired its second-biggest competitor (TD Ameritrade), and E*Trade went from having positive growth aspirations in an RIA custody expansion to being in ‘survival’ mode, culminating in a sale to Morgan Stanley (which had a vision of converting E*Trade’s Corporate Services leads for its own advisors). And now, barely a year later, Morgan Stanley has announced that it is spinning off what is left of the E*Trade custody business (now up to $22B of assets under custody) for a fraction of what E*Trade originally spent: “just” $55M, a stunning 80% write-down on the TCA acquisition just 4 years ago.

From the Morgan Stanley perspective, the deal is not surprising, as the wirehouse never seemed interested in becoming a custodian for advisors outside of their own brand (and the fact that Morgan Stanley acquired E*Trade for $13B but sold the custody business for $55M highlights just how little the custody business was actually a factor in the deal). But the much lower valuation is eye-opening, and a sign of just what a sledgehammer Schwab’s ZeroCom pricing strategy actually was to the RIA custody business.

Nonetheless, as the TCA custody business changes hands yet again, there are clearly some who are still bullish on RIA custody. In this case, the “new” entrant is Axos Financial, a name largely unfamiliar to financial advisors, that has operated a combination of online banking, clearing business, and a ‘robo-advisor’ (having acquired WiseBanyan in 2019). In other words, Axos Financial appears to represent yet another financial services firm with a ‘retail’ banking and brokerage offering that is seeking to diversify its revenues and add another vertical with the RIA custody business and use its retail offering to gain economies of scale in the RIA marketplace (and vice versa).

From the advisor perspective, arguably more competition in the RIA custody marketplace only leads to good things for advisors and their clients. Though in what remains a hyper-competitive landscape, with Schwabitrade pushing its size and scale to compete on price, and others positioning themselves around the periphery – from Fidelity and Pershing, to Altruist and LPL (and a rumored-to-be-coming-soon Goldman Sachs offering) – the question that arises is how Axos envisions it can uniquely position and differentiate itself. Will Axos be able to leverage its existing bank offering to truly integrate banking services with RIA custody for advisors to provide to their clients, with the growing popularity of not only ‘cash management’ services, but the potential to offer lending, personalized card issuance, and other banking services all rolled into one platform?

For the time being, expect that Axos will have its hands full simply managing the E*Trade Advisor Services acquisition and integration itself, but watch for Axos/E*Trade announcements in 2022 to see how the ‘new’ RIA custodian positions itself to compete.

Over the past year, “direct indexing” has quickly become the Next Big Thing in the world of investment management. At its core, the principle of direct indexing is relatively simple: instead of buying an index mutual fund or index ETF, the investor buys all of the underlying stocks that comprise the index directly, using technology to facilitate the trading and ensure the allocations stay on target. Of course, simply replicating the allocations to an index that already exists at an ultra-low cost of just a few basis points (e.g., Vanguard and Blackrock index ETFs) isn’t necessarily valuable, but the ability to own the individual stocks of the index facilitates a greater level of tax loss harvesting by being able to harvest not just “the index” in the aggregate but each stock in the index (such that even if the index is up for the year and has no losses, any individual stocks that declined can still be tax loss harvested).

However, arguably the real appeal of direct indexing is not to just directly replicate the index, but instead to customize the index as a way to express SRI, ESG, or factor preferences (e.g., own the total market but exclude gambling stocks, overweight green energy stocks, and tilt the portfolio towards small-cap and value stock). The emerging hunger for such “custom” direct indexing (and its attendant tax loss harvesting advantages) has spurred not only a move for “traditional” asset management firms to get into the game (from Morgan Stanley buying Parametric to Blackrock acquiring Aperio and SEI launching its own direct indexing solution), but also a wave of new startups launching “next generation” direct indexing technology tools including JustInvest, OpenInvest, Canvas, and Ethic Investments.

And this month, Ethic announced a whopping new $29M Series B round (and what is rumored to be a $129M valuation), after experiencing a 10X growth spurt since its $13M Series A round in July of 2019. The growth appears to be driven both by a growing appetite for direct indexing, along with a more direct referral relationship between Ethic and Fidelity’s RIA platform, which benefits both as an investor in Ethic’s Series A, and from a revenue-sharing arrangement that Ethic provides to advisor platforms that refer it business.

Notably, though, Ethic has still grown to “only” $760M of AUM, which at its 28bps direct indexing fee amounts to “only” about $2.1M of revenue… which would mean the company raised its Series B at an eye-popping 65X revenue in the hopes that its 1,000%-every-two-years growth cycle can continue. Yet the caveat is that advisors still ultimately move client assets only “so quickly”, given both the disruptions to the advisory business to restructure its investment management process, the additional complexity of client conversations when every client may have a different “customized indexing” portfolio, and the simple fact that it’s difficult for advisory firms to pivot quickly to a new investment approach when clients have nearly 12 years of embedded capital gains given the raging bull market of the 2010s.

Which ultimately raises the question, even if direct indexing is the future of investment management, of whether venture capital firms investing in the direct indexing trend may be overhyping and overestimating just how quickly financial advisors can and will actually pivot their investment management process to a new approach in just the next few years?

One of the sadly defining characteristics of the financial services industry is its channel-based fragmentation, defined by regulatory lines that were drawn 80 – 100+ years ago, when banks and trust companies were largely chartered by (and regulated by) states, insurance agents were subject to their own (separate) state regulation, while the investment industry was overseen Federally by the Securities and Exchange Commission (SEC) and broker-dealers formed their own self-regulatory framework with the National Association of Securities Dealers (NASD, now FINRA).

For nearly a century, these separate channels were simply a logical way to compartmentalize regulation of discreet services. But over the past few decades, technology has increasingly commoditized a wide range of financial services product distribution, leading each channel to increasingly focus on more holistic advice above and beyond the products themselves. This “great convergence” of all the industry channels toward financial advice as the key value-add has struggled, though, but not only ‘legacy’ regulation that still views each channel as separate from the others, but channel-based technology that makes it especially difficult for the systems of one channel to “talk” to another (even as the offerings themselves are increasingly multi-channel).

Ironically, though, the reality is that channel-based technology has in many cases allowed firms to establish a competitive toe-hold into the marketplace by forming a solution that addresses the unique needs of that particular channel. A case-in-point example is Harvest Wealth & Savings, which was originally Trizic, a robo-advisor-for-advisors solution that struggled in its early years to gain traction in the competitive independent advisor (RIA and independent broker-dealer) channels, and ended out pivoting to work in (and quickly gaining more traction with) the relatively-less-crowded channel of bank and trust company channel with account opening tools to facilitate both “micro-savings” strategies for bank customers (e.g., bank customers saving small dollar amounts into investment accounts) and creating trust accounts for affluent clients (integrating to the unique accounting and reporting systems that exist in the world of trust companies).

And now, Envestnet has announced that it’s acquiring Harvest Wealth and its bank-channel “robo” solutions. Given Envestnet’s depth in working with independent broker-dealers and larger RIAs, when the news broke, questions abounded of why Envestnet would purchase a ‘micro-savings’ tool for firms that predominantly work with the most wealthy clientele (not younger consumers engaging in micro-savings strategies, where the competition isn’t other financial advisors but FinTech solutions like Acorns).

But the reality is that Envestnet is increasingly positioning itself as a platform-of-platforms, a series of marketplaces for everything from insurance and annuity products to lending and credit solutions, to its ‘legacy’ SMA marketplace as the largest platform TAMP… and most recently, a new “Trust Services” exchange.

In this context, the Harvest acquisition appears – like more and more of Envestnet’s marketplace strategy – to be another two-sided opportunity unto itself. On the one hand, a ‘robo’-onboarding tool that already has substantial and growing penetration into the bank and trust channel gives an entirely new pathway for Envestnet to attach its various Exchanges, as more and more banks try to round out their own more holistic offerings (to move away from “just” bank deposits and traditional trust services) but lack the technology integrations and connections to facilitate multi-channel wealth offerings (that Envestnet’s platform can help expedite with connections via Harvest). In other words, envision Harvest’s onboarding tool offering bank customers not just opportunities for micro-savings investment accounts, but also insurance and annuities via Envestnet’s exchange, managed accounts via Envestnet’s TAMP, etc.

On the other hand, having a digital onboarding tool with adoption amongst trust companies also gives Envestnet the technology it needs to better facilitate its new Trust Services exchange, where Envestnet can use the Harvest technology as a standardized front end for RIAs or broker-dealers who may want to work with more than one trust company from Envestnet’s exchange but won’t want to build their own integrations to multiple trust companies and their own trust systems. Instead, independent advisors will ostensibly be able to establish accounts with any number of Envestnet’s trust company partnerships through one onboarding system (Harvest), and Envestnet can use its size and clout to ensure that trust companies that want access do so through Envestnet’s ‘required’ portal.

All of which ultimately highlights how the fragmentation of the financial services industry across discrete channels has both aided the development of ‘niche’ solutions in smaller competitive spaces… and is now creating unique market opportunities for players like Envestnet to become the great technology platform unifier of the great convergence.

Snappy Kraken Raises $6M Series A By Marrying AdvisorTech And Services.

According to Kitces Research, the most popular financial advisor marketing strategies are almost all “in-person” endeavors, from client appreciation events to generate referrals, to networking and building relationships with COIs, to educational events and seminar marketing. So what is an advisor to do when a global pandemic takes away their ability to conduct in-person marketing events? It’s finally time to take a deeper look at the digital marketing tech they’ve been meaning to check out… which has rapidly become a boon to AdvisorTech solutions that were built to enhance advisors’ digital marketing capabilities!

One of the leading beneficiaries of this trend has been Snappy Kraken, which offers both an advisor-centric version of an email marketing platform, and the top-of-funnel marketing support services necessary to actually help advisors get leads into their marketing funnel. Accordingly, a few months ago FMG Suite acquired TwentyOverTen for its website design and marketing automation Leadpilot tool, and now this month Snappy Kraken announced a hefty $6M Series A round of capital, to both expand its technology capabilities, and its marketing support service team.

On the one hand, the acceleration of investments into advisor marketing technology isn’t entirely surprising; arguably, the financial services industry has long been in a slow and steady pivot towards more digital marketing tools (a dominant trend in marketing and advertising across a wide range of other industries for the past decade), and outside of AdvisorTech, companies like Shopify and Peleton have said that Covid has pulled the future forward by 5 years.

On the other hand, Snappy Kraken is also unique in choosing not to “just” be a niche email marketing tool – “MailChimp for Financial Advisors” – to support the middle of the marketing funnel (a path that many others have tried and largely failed, because few advisors have enough website traffic to convert into an email list in the first place), but has also built-in top-of-funnel advertising support for advisors, positioning the company as both a lead generation platform and an outsourced marketing service… all wrapped in its own “proprietary” technology solution. And ultimately, its sizable Series A round is the biggest indicator yet that the firm is actually generating real results for advisors and gaining market adoption and traction.

Consequently, expect to see a lot more of Snappy Kraken in the coming months, as the company uses its newfound capital to expand its marketing reach, makes what is typically a pivot from ‘independent’ advisors to Enterprises at this stage of growth, and launches whatever new features may be coming… since, as founder Robert Sofia notes in his own announcement of the new capital round, the goal was not simply to take capital to scale growth, but instead “even though additional funding wasn’t required from a financial perspective, we decided it was essential from an innovation perspective”.

For as long as the financial advisor business has existed, one of the biggest blocking points to success has simply been finding prospective clients to work with in the first place. In fact, nearly the entire value of a financial advisor’s practice is the “goodwill” value of their book of clients… which, in the earliest days of the business, was literally the book of client names and contact information that the advisor could call upon to potentially sell products to, a tremendous value for other advisors who would otherwise have to resort to cold-calling, cold-knocking, networking meetings, and other time-consuming endeavors to try to cultivate one prospect at a time. Over the past 20 years, the internet has spawned a new wave of prospecting strategies and opportunities, from search engine optimization to social media to online advertising, but the core challenge remains the same: it’s incredibly difficult to attract a prospect who is interested in working with a financial advisor (and stand out amongst a crowd of hundreds of other financial advisors all competing for the same prospect seeking services).

To help bridge this gap, one of the hottest categories of AdvisorTech has been the growth of advisor-specific MarTech (marketing technology), designed to help engage and nurture prospects to become clients and follow the classic “inbound marketing” funnel. The caveat, though, is that creating mid-funnel engagement tools, from email marketing automation to video engagement and lead nurture campaigns, is only helpful when advisors can generate the “top-of-funnel” traffic – the modern equivalent of “prospecting” in the digital realm – to get into their marketing funnel in the first place. And prospecting and generating that top-of-funnel traffic remains as difficult as ever… resulting in the ongoing struggle of advisor marketing tools that are focused on mid-funnel engagement, from once-high-flying Vestorly that has pivoted entirely away from email marketing tools for individual advisory firms, to the latest news that broker-dealer Avantax is acquiring Guidevine to turn it into an internal marketing solution for their advisors.

Initially, Guidevine was one of many “Find An Advisor” advisor-matching platforms that launched over the past decade… only to discover how incredibly expensive the Client Acquisition Costs are to generate digital leads for advisors and how difficult it is to generate leads without substantial capital to invest to get the marketing machine going. Which led Guidevine to pivot into creating video marketing and other marketing engagement tools that advisory firms could use with their own prospects… only to discover that most advisory firms struggle to generate digital prospects to engage with either (and if the average advisor has few digital marketing prospects to nurture, they won’t pay much for mid-funnel marketing engagement tools like Guidevine). Which is a remarkable contrast from marketing technology platforms that are focused at the top of the funnel itself, from Snappy Kraken to Zoe Financial to SmartAsset, all of whom have raised substantive venture capital to fund and accelerate their growth, and all of whom are generating substantially higher economics (from higher software fees to per-lead fees and even revenue-sharing for closed clients).

Notably, for advisory firms that do have a strong marketing funnel, mid-funnel engagement tools remain valuable… but only for the limited number of firms that have strong top-of-funnel capabilities in the first place. For the rest, “prospecting” remains the greater (and more expensive) challenge… which in turn means the advisor marketing platforms that can figure out how to solve it (in a digital top-of-funnel context) continue to reap the greatest rewards.

SEI Acquires Legacy Oranj Technology To Bolster Digital Experience For Its Independent RIA Platform.

When the robo-advisor movement first emerged nearly a decade ago, the financial services industry quickly took sides on the question of whether “robots” (or technology, more generally) would or would not replace the human financial advisor and their advisor-client relationship. Yet while the robo-advisors themselves insisted they could do what financial advisors do with technology alone, the advisor community didn’t only ‘disagree’ that there was a unique value proposition in the advisor-client relationship itself that technology couldn’t replicate… they also acknowledged that robo-advisor technology capabilities would be helpful in human advisory firms as well! In turn, the years that followed saw not only the rise of additional robo-advisors competing for consumers, but also a pivot of several robo-advisors from the competitive B2C market to the less competitive (at the time) B2B market by re-selling their technology to advisors… along with the rise of new robo-but-built-for-advisors-from-the-start platforms.

One of the early competitors in this category was Oranj, launched by a former-financial-advisor-turned-tech-entrepreneur named David Lyon, who saw the opportunity to build a better advisor-client digital experience, from client portals and dashboards leveraging account aggregation (which was rarely used at the time), to more effective digital onboarding tools (to match the first generation robo-advisors) and communication tools to engage clients via the digital platform (when an in-person meeting isn’t actually necessary). The challenge, though, is that while financial advisors expressed eagerness for better technology to augment their client relationships, there was remarkably little willingness to pay for such technology tools, which instead were increasingly expected to be provided by the advisor’s platform (e.g., broker-dealer, RIA custodian, or TAMP) directly. Which led in recent years to many of the robo-for-advisor platforms to pivot to become “model marketplaces” instead, where asset managers provide revenue-sharing payments to the technology platforms who can then offer their technology for free to advisors (in the hopes of gaining platform adoption and market share and driving more asset flows into the model marketplace to generate revenue).

Yet despite acquiring TradeWarrior rebalancing software to manage models in its marketplace and pivoting into this “freemium” business model, Oranj still ultimately struggled to gain adoption in a world where advisors remain reluctant to add a technology layer “in between” their firm and the advisor platform (broker-dealer, RIA custodian, or TAMP) itself. Accordingly, last December Oranj somewhat abruptly announced that it was shutting down, and now advisor TAMP (and ‘emerging’ RIA custodian competitor) SEI has announced that it is acquiring the Oranj “digital experience” technology to augment its own advisor platform instead as investment management itself becomes increasingly commoditized and TAMPs differentiate on the strength of their technology instead.

Which ultimately just further emphasizes that when it comes to the technology and digital experience surrounding an advisor’s investment platform, advisors still aren’t willing to pay for those tools, and instead have an expectation that advisor platforms themselves will simply build (or buy) the technology necessary to upgrade their own digital experience, either as a means to attract advisors, or at least to mitigate the risk of having advisors vote with their feet to another platform with a better digital experience!

Skience Launches “Advisor Transitions” Solution To Reduce The Pain Of Repapering.

Recent industry studies have found that every year, about 1-in-6 advisors contemplates switching advisor platforms, but fewer than half of those end up actually making a change. The reason, in a word: repapering. Because the reality is that changing broker-dealers or RIA custodians entails opening up entirely new accounts for every single client, implementing new advisory agreements for every single client, facilitating transfers for every single client, and getting clients to sign and return all the associated paperwork to make it happen. Which, simply put, doesn’t always happen. In fact, a recent Cerulli study found that, on average, advisors lose 19% of client assets when they change firms (above and beyond whatever their “planned” attrition may have been), as departing advisors can’t retain their clients in the transition unless they actually sign and return all of the paperwork (positioning the advisor to fight against both inertia and the prior firm calling on those clients to keep them from switching… both of which only get worse the more time that passes from when the advisor makes the move and is still waiting on paperwork).

Accordingly, switching advisor platforms is often a stressful and especially time-intensive endeavor, with immense pressure to make the transition (and get the paperwork done) quickly, where advisor platforms facilitating large team breakaways may even fly out administrative and operations support for a few weeks to help with the transition. Yet in a world where “paperwork” is increasingly digital and can be tracked and even automated with technology, the “repapering” process is beginning to undergo its own digital transformation, from last month’s announcement that Pershing is developing a digital repapering tool, to the news now that Skience (which provides custom overlays and other ‘apps’ for firms using Salesforce CRM) has developed its own digital repapering tool designed to queue up all the new account forms, transfers, and account agreements digitally for e-signature, send them out to clients, and track the completion for processing (and to help firms know which clients to follow up with to finish the process), in what is being dubbed an “Advisor Transitions” solution (to move away altogether from the negative connotations of the word “repapering”).

Notably, though, Skience isn’t necessarily targeting individual advisory firms for the solution, but instead broker-dealers, enterprise RIAs, and other “advisor platforms” that want to purchase and offer the tool to facilitate the process of new advisory firms joining their platforms. But in the end, the real significance of the Skience solution is not simply that it can reduce the pain of repapering, but that when the pain of repapering and the friction of switching advisor platforms is reduced, in a world where more than half of all advisors considering a switch to a better solution choose not to do so because of the pain of repapering, it may otherwise expedite the pace at which the best advisor platforms can attract new advisors (and the concomitant loss of market share for advisor platforms that can’t figure out how to step up and improve their own offerings to remain competitive).

For most of its history, a “Financial Plan” was a document created by brokers or insurance agents to analyze a customer’s situation, identify potential gaps that may limit the customer’s ability to achieve their goals, and then sell and implement financial services products to close those gaps. In this context, financial planning was effectively a form of consultative selling, and ultimately, the only part of the engagement that was actually regulated was the sale of the product at the end, not the “advice” in the plan itself (beyond ensuring that the analysis and recommendations were not “misleading” to the point that they resulted in an unsuitable product sale). With the industry’s ongoing transition from commissions (for product sales) to fees (for the advice itself), though, the regulatory structure underlying financial planning is transitioning as well, from one where the regulatory scrutiny was on the product implementation (not the financial plan), to a fiduciary advice model charging AUM or planning fees where the advice itself is the “product” being sold.

From a broader regulatory perspective, the shift of the advisor business model from product sales to advice itself is driving fiduciary regulation and reforms. At the level of the individual firm or enterprise, though, it creates a newfound pressure for advisory firms – and especially large-scale enterprises – to engage in “quality control” with respect to the financial plans and advice that are delivered, especially in situations where the firm charges for that advice and must ensure that the client received the advice (and the associated financial planning deliverables) as expected.

Except the reality is that financial services enterprises – that must engage in such oversight across dozens, hundreds, or even thousands of advisors – don’t have any way to manage the quality control and plan review process, and ensure that clients aren’t billed financial planning fees (and that those fees aren’t remitted to the advisor) until the advice (of appropriate quality) actually has been delivered, especially given how financial plans today are increasingly a “multi-system” endeavor (i.e., Kitces Research shows that half of advisors use Excel to supplement their financial planning software analyses, more than 1/3rd use Word to supplement their financial plan write-ups beyond what the planning software produces, and many enterprises are ‘multi-software’ in allowing their advisors to choose from one of several financial planning software platforms).

In this context, it is notable that this month AdvicePay launched “Deliverables”, to allow the compliance departments of financial services enterprises to centralize the process of compliance reviews of financial plans, integrated directly to AdvicePay’s Agreements and Payments systems, which allows enterprises to ensure that a financial plan (of appropriate quality) has actually been delivered by the advisor, consistent with the scope of the signed financial planning agreement, before fees are collected from the client and/or are remitted to the advisor. And with regulatory scrutiny of the potential for “fee-for-no-service” engagements – where the financial planning fee is charged but no plan or advice is actually delivered – Deliverables also automates notifications to the compliance department when the advisor has failed to deliver a financial plan to the client in a timely manner.

Because ironically, while nearly 1-in-3 financial advisors have CFP certification and financial planning is increasingly becoming the value-add on top of more ‘commoditized’ investment management, the reality is that the financial services industry is only just now beginning to build out the real capabilities for delivering real financial advice (compensated as such) at enterprise scale. On the other hand, as “scaled advice” is increasingly adopted within larger financial services enterprises, it can ultimately reduce the time-consuming costs to deliver financial planning, reducing the cost of a financial plan itself and expanding its reach to even more consumers.

Dynasty Partners With Envestnet To Launch CFO Dashboard For Financial Advisor Business Metrics.

In the commission-based model, the simple reality is that most advisory firms never become terribly “complex” business enterprises. After all, the fact that at the beginning of every year, revenue resets back to zero (or near-zero with a small portion of trails) means that it’s extremely risky to hire many (or any) full-time team members or take on much fixed overhead, which means in practice the typical commission-based practice is simply gross revenue, minus a handful of direct expenses of the advisor to do what they do, with the net simply flowing directly to the advisor-as-owner.

However, recurring-fee advisory firms – whether operating on an AUM or subscription fee basis – are fundamentally different, as they build an ongoing clientele that pays an ongoing fee large enough to be able to hire a team whose sole job is to service and provide value to those clients on an ongoing basis to retain them. And given what is often a 95%+ retention rate for advisory firm clients, the typical advisory firm operating on a recurring revenue business model will almost “inevitably” grow larger and larger over time as it simply “accumulates” a handful of new clients every year but only turns over an average client every 20 years. Which over time, has led to the rise of various “practice management benchmarking” studies to help growing and scaling advisory firms evaluate their increasingly complex business economics and compare them to others. Except the challenge is that advisory firms don’t necessarily have the time to cull together their financial data and submit it to the benchmarking studies, and, at best, doing so is often a very time-consuming process of adapting an advisory firm’s financial statements to whatever categories the benchmarking study uses.

In this context, it is notable that this month, Dynasty announced the launch of a new “Essential CFO Dashboard” for advisory firms, that will integrate directly to the advisor’s Quickbooks account, draw in current (and even several years of historical) financials, and provide the firm with benchmarking metrics (e.g., comparisons of its key financial metrics and ratios to the average of other advisory firms), along with an estimated valuation of the business based on those metrics. Notably, the Essential CFO Dashboard offering is part of Dynasty’s broader partnership with Envestnet and its Advisor Services Exchange, which includes Dynasty providing outsourced CFO support services for advisory firms as well, making the Essential CFO Dashboard more of a “lead generation” opportunity for Dynasty’s services. Nonetheless, the Dynasty CFO dashboard will be available to any advisory firms that want to use it (not just firms using Envestnet or Dynasty and its outsourced CFO service).

More generally, though, in a world where advisory firms have to manually piece together benchmarking data – which is limited by potential self-reporting biases and reduces the amount of available data given the time-consuming nature of submitting the required reporting – the real question is whether Dynasty’s new solution, and the ability to draw in a firm’s actual Quickbooks financial data, will open up new perspectives on the health of the typical advisory business?

Is Wealthfront’s New Self-Driving Money The Future Of Goals-Based Banking?

While the rise of robo-advisors was not ultimately the “financial advisor disruptor” it was anticipated to be, as a decade later Betterment is the only robo-advisor startup left standing, and financial advisor fees are actually up over the last 10 years, it’s hard to dispute that advent of the robos didn’t have a significant and lasting impact on the industry. On the one hand, investments into robo-advisors catalyzed an entire wave of venture capital firms investing into the business of investments and wealth in a way they never had before, and established “WealthTech” as a subcategory of FinTech. On the other hand, the competitive pressures that robo-advisors created also stoked a substantial cycle of technology reinvestments of financial services incumbents into their own platforms, accelerating the rise of portals, the use of account aggregation, and the rollout of digitized onboarding workflows and e-signature.

In addition, the rise of robo-advisors also brought a newfound focus on individual stock investing, the adoption and increasingly widespread use of fractional shares, and put so much pressure on trading costs that by the end of the decade the price had fallen literally to zero. Yet in the end, the biggest legacy of robo-advisors may be the confluence of these factors – including fractional share trading, zero-cost trading, and a technology overhaul of trading and portfolio management – stoking the rise of direct indexing, which had previously existed only as a niche offering for ultra-HNW clients until Wealthfront in 2014 aimed to “democratize” direct indexing with the launch of its Wealthfront 500. Ironically, though, while Wealthfront was forward-thinking enough to have started the popularization of direct indexing for non-HNW investors, the company didn’t manage to capitalize on the trend, having largely moved away from its robo-“investing” roots and pivoted in the direction of personal finance banking instead.

But now, Wealthfront has launched its latest banking-based iteration – the full launch of what it has dubbed its “Self-Driving Money”, a financial-automation-based (i.e., “robo”) approach to managing not one’s investment accounts but their cash and other banking accounts instead. At its core, Self-Driving Money is essentially a form of “Goals-Based Banking” where individuals can automate where their cash goes using a series of (self-designated) rules; for instance, a household might stipulate the goal of “build up cash in the checking account to $5,000, then save $500/month in the Emergency Fund until it reaches $20,000, then save as much as possible in the House Down Payment fund”, until that goal is accomplished and then contribute the rest to the long-term retirement account… and at that point, as the household earns its cash, the money automatically routes to the designated accounts associated with the designated goals, a form of “pay yourself first” automatic savings writ large across all of a household’s financial goals.

In turn, Wealthfront’s expansion beyond “just” brokerage investment accounts and into the world of banking means that the company can automate the process across different types of accounts – a seemingly simple feat that in practice is anything but, due to the substantively different rules and regulations that apply to investment versus bank accounts, and the fact that most such systems are siloed within banking and investment divisions that don’t “talk” to each other at all. Of course, as most financial advisors may quickly note, it’s not as though any household can’t set up separate accounts for various goals, and automate transfers to those accounts, to implement a substantively similar approach to what Wealthfront has developed.

Nonetheless, when the reality is that – with managing of a household’s cash flows in particular – the primary challenges are often a matter of habits and behaviors (not the ‘mechanics’ of setting up accounts), arguably Wealthfront’s Self-Driving Money has the opportunity to spawn a “goals-based banking” approach akin to what “goals-based investing” has done to the world of investment management, facilitating real behavior change and more positive outcomes for clients by tying financial habit change to the goals they’re meant to accomplish. Though as with its popularization of (and subsequent failure to fully capitalize on) direct indexing, even if Wealthfront is spawning the rise of goals-based banking, the question will be whether Wealthfront figures out how to turn it into real ‘business’ before the rest of the industry once again begins to copy the approach the moment it starts to gain traction?

New Product Watch: Making Estate Planning More Tangible With EverPresent’s Family Legacy Videos.

The CFP Board defines the Core Topics of Estate Planning in financial and legal terms, from the legal documents (e.g., Wills and trusts and Powers of Attorney) to the rules for how assets are distributed (titling and beneficiary designations), and the myriad of tax planning concerns (from income to estate tax planning) to the unique issues that arise when trying to transfer family businesses or navigate ‘special’ circumstances (e.g., special needs children, unmarried couples, etc.).

Yet from the perspective of beneficiaries who have lost a loved one, what matters most is usually not the mechanics and tax dynamics of asset disposition at death, but the legacy of the individual themselves… from the “tangibles” of photos and keepsakes to the intangibles of the memories, lessons, and values they leave behind. In the modern era, these legacies often extend to video, which is unique in its ability to help keep a loved one’s memory alive by preserving not just their image and likeness, but their mannerisms, communication style, voice, and even actual messages that can be left to loved ones for the future.

In practice, though, leaving such a “video legacy” is rarely done, a combination of the challenges many of us face in confronting our own mortality (nothing like leaving a video message for your family to see after you’re gone to be reminded of and potentially become depressed by the fragility of life!), and often just an outright uncertainty about what, exactly, to communicate to loved ones that will let them see and hear what they want and need to see and hear. But now, filling this void is the recently launched EverPresent. Similar to other solutions in the category, EverPresent is a “family video legacy” provider, that will record video messages for loved ones to see after the individual is gone (which EverPresent can even hold and release for significant milestones like when a child graduates from college, gets married, or has children). What’s unique about EverPresent, though, is that the platform has prepared a series of easy-to-follow questionnaires that create an interview-style format for those leaving a video legacy to figure out what to say that will leave a positive legacy for their loved ones when viewed in the future.

The solution emerged from the personal life experience of the founders, whose own father tragically passed away in his 30s from ALS and left behind four young children… for whom he left a series of messages for them to open when they graduated from school, got married, and had kids, allowing him to remain “ever present” in their lives decades after he passed.

Pricing starts at just $129 for a client to go through the EverPresent process and create their own videos (which can be downloaded and kept for the family, or hosted via EverPresent for an additional one-time fee to be made accessible to family members in the future). Which is a remarkably low cost for someone who wants to have a comfortable process to create and leave a (video) legacy that may impact their family members for years or decades after they’re gone… and for an advisor, is a remarkably affordable way for the advisory firm to remain more ‘ever present’ for the next generation heirs of their clients as well.

In the meantime, we’ve updated the latest version of our Financial AdvisorTech Solutions Map with several new companies, including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation!

So what do you think? Will Tifin be able to acquire its way to a viable all-in-one advisor platform… or incubate AdvisorTech in disparate pieces by simply nurturing each until it is ready for a strategic acquirer? Would a more digitized repapering process make you more willing to change advisor platforms? Is “goals-based banking” that automates rules-based savings across multiple goals the future of households managing their cash flow? Please share your thoughts in the comments below!

Special thanks to Kyle Van Pelt, who wrote the sections “TIFIN Raises Series B”, “E*Trade Advisor Services is sold off from Morgan Stanley to Axos as a new tech-savvy RIA custodian?”, and “Snappy Kraken raises $6M”, and to Craig Iskowitz who wrote about “Envestnet Acquires Harvest Savings And Wealth.” You can connect with Kyle via LinkedIn or follow him on Twitter at @KyleVanPelt), and with Craig on LinkedIn (or on Twitter at @craigiskowitz).

Disclosure: Michael Kitces is the co-founder of AdvicePay, which was mentioned in this article.

Leave a Reply