After promoting a veteran ex-executive from one wirehouse rival to be its CEO, J.P. Morgan Advisors grabbed a billion-dollar team from another competitor.

Financial advisors Mark Donohue and Gordon Sommer of The Donohue Group left Morgan Stanley May 14 to join the rebranded J.P. Morgan Securities unit led by Phil Sieg since his promotion last month. Sieg came to the firm last year after decades at Merrill Lynch. Donohue’s Palm Beach Gardens, Florida-based team managed $1.1 billion in assets and generated $6.4 million in trailing 12-month production at Morgan Stanley.

J.P. Morgan’s “world-class reputation and unparalleled resources first attracted our team,” Donohue said in a statement. “After extensive due diligence, we concluded that JPM Advisors is the best place to help us offer the personalized service of a boutique organization and the global reach of one of the largest and most respected financial firms in the world.”

The team’s move came the week after a reverse play in which Morgan Stanley poached a billion-dollar team from J.P. Morgan in New York, AdvisorHub reported.

Representatives for Morgan Stanley declined to comment on the departure by Donohue’s team.

Donohue had spent a decade with Morgan Stanley and more than 25 years with RBC Wealth Management before moving to J.P. Morgan, according to FINRA BrokerCheck. Sommer, who operates from New York, had tenures with RBC, J.P. Morgan, UBS, Drexel Burnham Lambert and Smith Barney prior to his 10 years at Morgan Stanley, BrokerCheck shows. Reporting to Boston, Palm Beach and Miami Regional Director Rick Penafiel, the team includes Investment Associate Butch Massaro and Client Associate Steven Olson.

J.P. Morgan had attracted another new recruit from Merrill Lynch days before Donohue signed on when Keith “KR” Ward joined J.P. Morgan in New York. His team managed $230 million in client assets with his former firm.

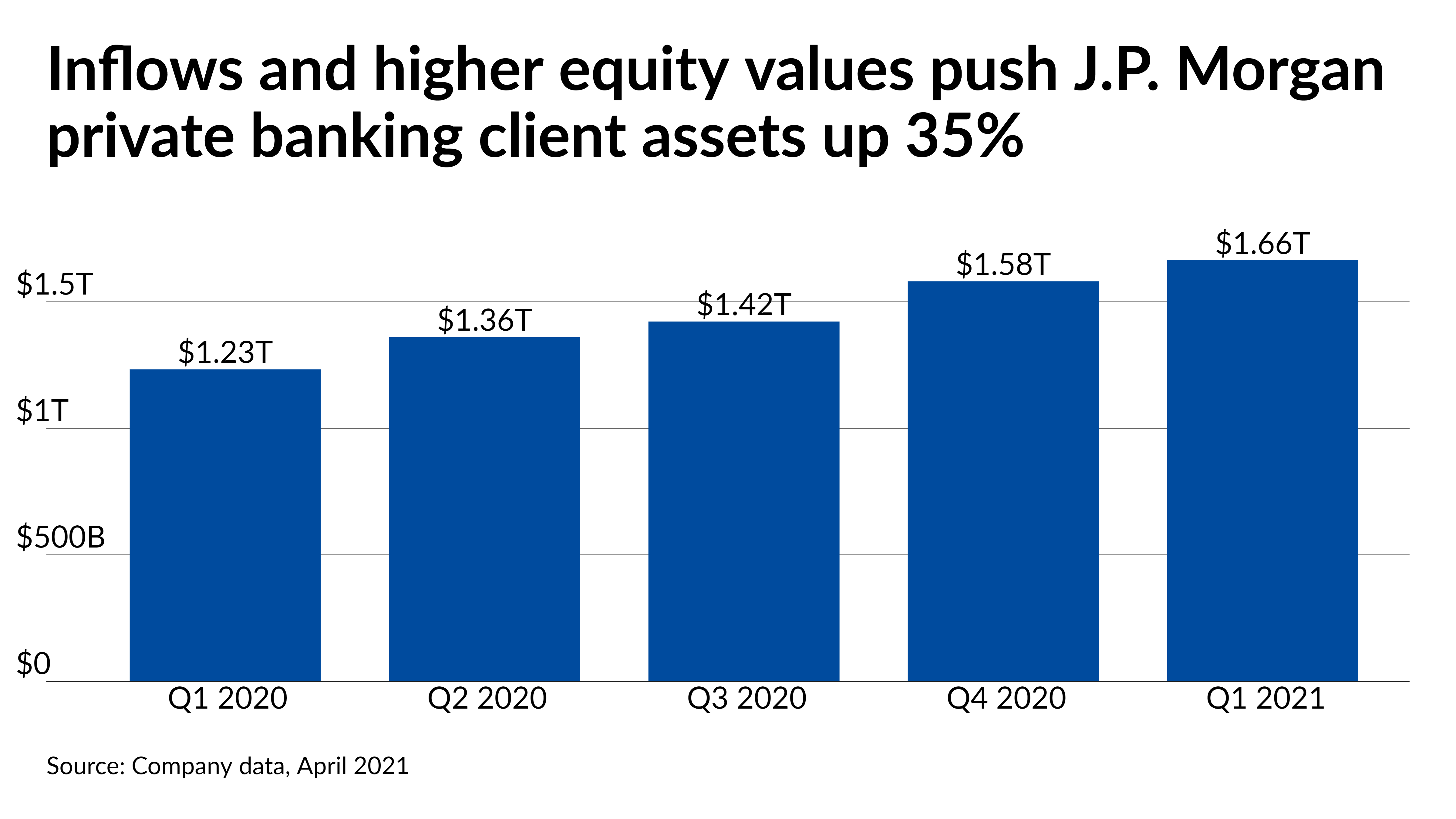

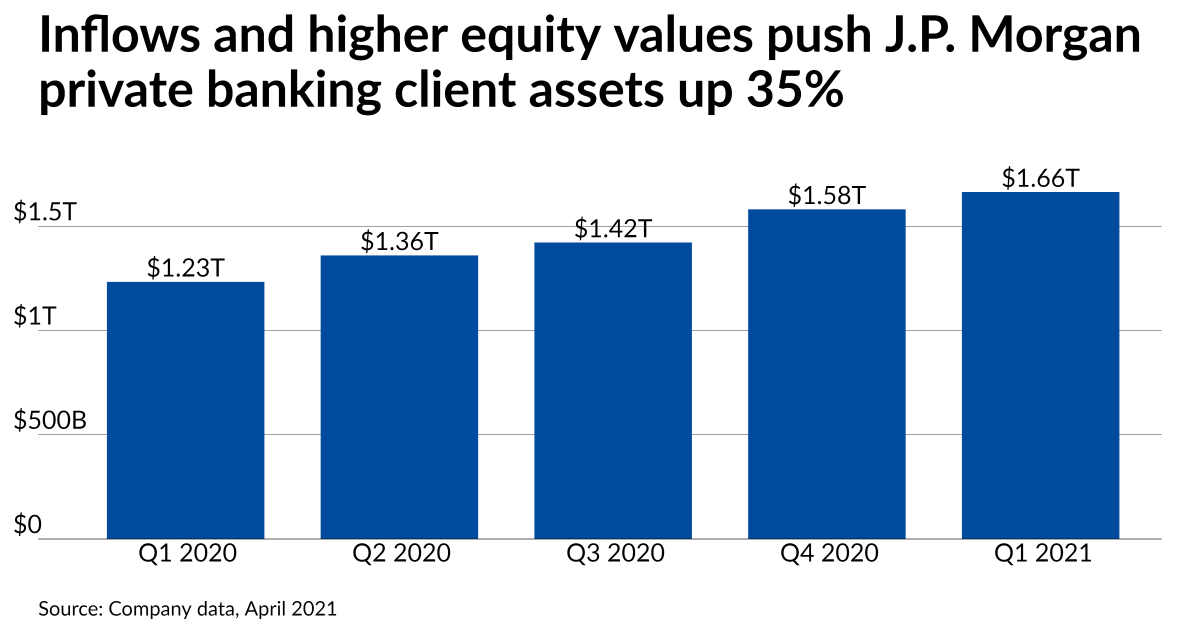

Sieg took the CEO position atop the former Bear Stearns wealth management arm a year after joining J.P. Morgan’s practice management team and following more than three decades with Merrill Lynch. The firm’s wealth and asset management businesses earned a record net income of $1.2 billion in the first quarter, according to J.P. Morgan’s latest earnings statement.

Leave a Reply