As a business owner, you’ve probably made purchases for your company on credit before. And if you make a lot of purchases on credit, tracking how much you owe each vendor can be overwhelming. The solution? An accounts payable aging report.

What is an accounts payable aging report?

So, what is an AP aging report? Well, before we can answer that question, you need to fully understand what accounts payable is.

Accounts payable, or AP, is money you owe to vendors. Your accounts payable consists of debts from purchasing things like inventory, supplies, and services to operate your business. When you make a purchase and don’t immediately pay (aka buy something on credit), your accounts payable increases. The supplier or vendor invoices you, and you pay them back at a later date.

An accounts payable aging summary report shows the balances you owe to others. The report helps you organize and visualize the amounts you owe. Typically, an aging of accounts payable includes:

- Vendor names

- How much you owe each vendor

- Amount of time you have owed debts

- Whether any payments are past due

Using an accounts payable aging detail report can give you a simple way to track and manage your debts. That way, you can pay vendors in a timely manner and avoid fees for past due payments.

Aged payables report vs. accounts receivable aging

So, what’s the difference between an AP aging report and an accounts receivable aging report? An accounts receivable (AR) aging report is the opposite of an aging accounts payable report.

Instead of showing what you owe others, an accounts receivable aging report shows the balances of how much others owe your business. Your AR aging report includes details about credit you extend to customers when they purchase something from you.

Perks of using an AP aging summary for your business

An aging accounts payable report is a helpful tool for organizing and managing your business’s debts. Your AP aging summary can also help you:

- Handle cash flow

- Make decisions about which debt to pay first

- Plan future expenses and your business budget

- Catch accounts payable issues quickly

- Avoid missing payments

- Find opportunities to negotiate invoice payment terms

Components of the AP aging report

Again, the accounts payable aging report has a few different components. Some parts of the AP aging schedule include columns that organize your vendors and age of the invoice, vendor names, and debt amounts. Each vendor or supplier has their own row that includes the total you owe and how much the debt is past due, if applicable.

On accounts payable aging schedule, there are typically various columns that categorize debt based on the age of the invoice. Each column represents a time frame after you receive a bill. Usually, the columns go by 30-day increments:

- Current (0 – 30 days old)

- 1 – 30 days past due

- 31 – 60 days past due

- 61 – 90 days past due

- Over 90 days past due

The current column shows current balances that are 0 – 30 days old (aka not past due). These are new balances of orders placed within the last 30 days.

The other columns are invoices that are over 30 days old and are typically past due. They range in days depending on how past due the invoice is. For example, if a balance is under the 1 – 30 days column, it is 1 – 30 days past due.

Your report keeps a running balance of the amount you owe vendors. When you purchase goods or services on credit, you may wind up owing a vendor for several transactions. On your report, you can typically see the total you owe each supplier under a “Total Balance” column.

Your report can help you see which payments are past due and determine which balances to pay off first.

Accounts payable aging report example

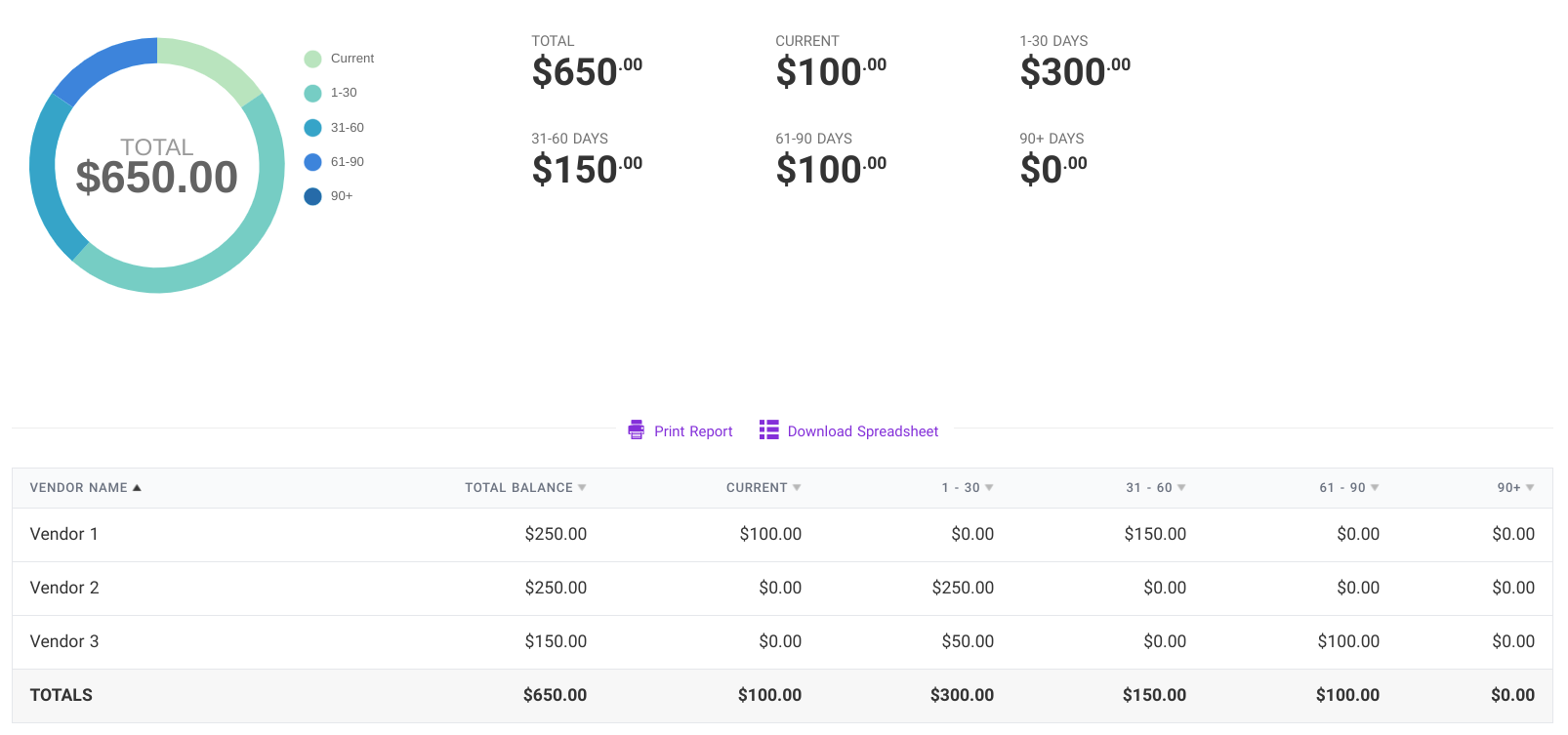

Although every business’s AP aging summary can vary, your report typically looks something like this:

In the accounts payable aging report sample above, there’s a total balance listed for each vendor. And, the report includes how much is past due for each vendor and how long it’s past due.

When you pay off an invoice, remove the current or past due amount from your report. For example, say you paid off the $100 invoice that’s 61 – 90 days past due for Vendor 3. After you pay Vendor 3 the $100, make sure you change the 61 – 90 days column to say $0.

If you use accounting software, the software automatically removes the balance from the accounts payable aging report when you record the payment in your books.

Other things to keep in mind about an AP aging report

When using an accounts payable aging report, keep a couple of other things in mind to ensure your report is accurate and helpful.

Most AP aging reports do not include the vendor’s terms because they assume payments are due within 30 days. But, this is not always the case with a vendor. To avoid any late payments, understand your vendor’s credit terms. And if a vendor has varying terms, make note of it.

Also, make sure to regularly update your AP aging report. If you pay an invoice, remove the amount from the report. If an invoice goes unpaid, move it to the correct column (e.g., 1 – 30 days past due). Again, if you use software, this should automatically be done for you when you record a payment made to your vendor.

Need an easy way to track your accounts payable and other transactions? Patriot’s online accounting software is designed with businesses and accountants in mind. Easy-to-use, affordable, and free, USA-based support—what’s not to love? Try it for free today!

This article has been updated from its original publication date of June 13, 2017.

This is not intended as legal advice; for more information, please click here.

Leave a Reply