Do you have a small business as defined by the Affordable Care Act (ACA)? Do you offer health insurance to your employees? If so, you might be eligible for health insurance tax credits for the coverage you provide your employees. And, you may qualify for write-offs if you’re self-employed. Keep reading to find out if you can take the health coverage tax credit.

SHOP healthcare coverage

Typically, you must purchase health insurance through the ACA Small Business Health Options Program (SHOP) to receive tax credits. The Affordable Care Act does not require small businesses to provide health insurance coverage to employees.

To use the SHOP marketplace to purchase healthcare coverage for your employees, you must:

- Meet the ACA definition of a small business: 50 or fewer full-time equivalent employees (FTE), not including owners, spouses, partners, or family members of owners

- Enroll the minimum amount of employees in the health program (percent varies by state but is typically 70%)

- Have a physical work location or office in the state whose SHOP marketplace you use

- Offer the healthcare plan to all full-time employees

The SHOP Marketplace is an affordable option for small businesses with up to 50 full-time equivalent employees. Self-employed individuals may also use the SHOP Marketplace to purchase individual coverage.

Health insurance tax credits for small business

What is a tax credit for health insurance? The IRS designed the small business tax credit for healthcare to encourage small business owners to offer group health insurance. With the healthcare tax credit, small employers can provide their employees with group health insurance and cut down expenses.

To receive the tax credit, claim the credits on your small business tax return at the end of the year. ACA tax credits are not automatically included in your returns. So, be sure to notify your accountant or tax preparer (if applicable) if you want to take the tax credit.

Small business healthcare tax credit requirements

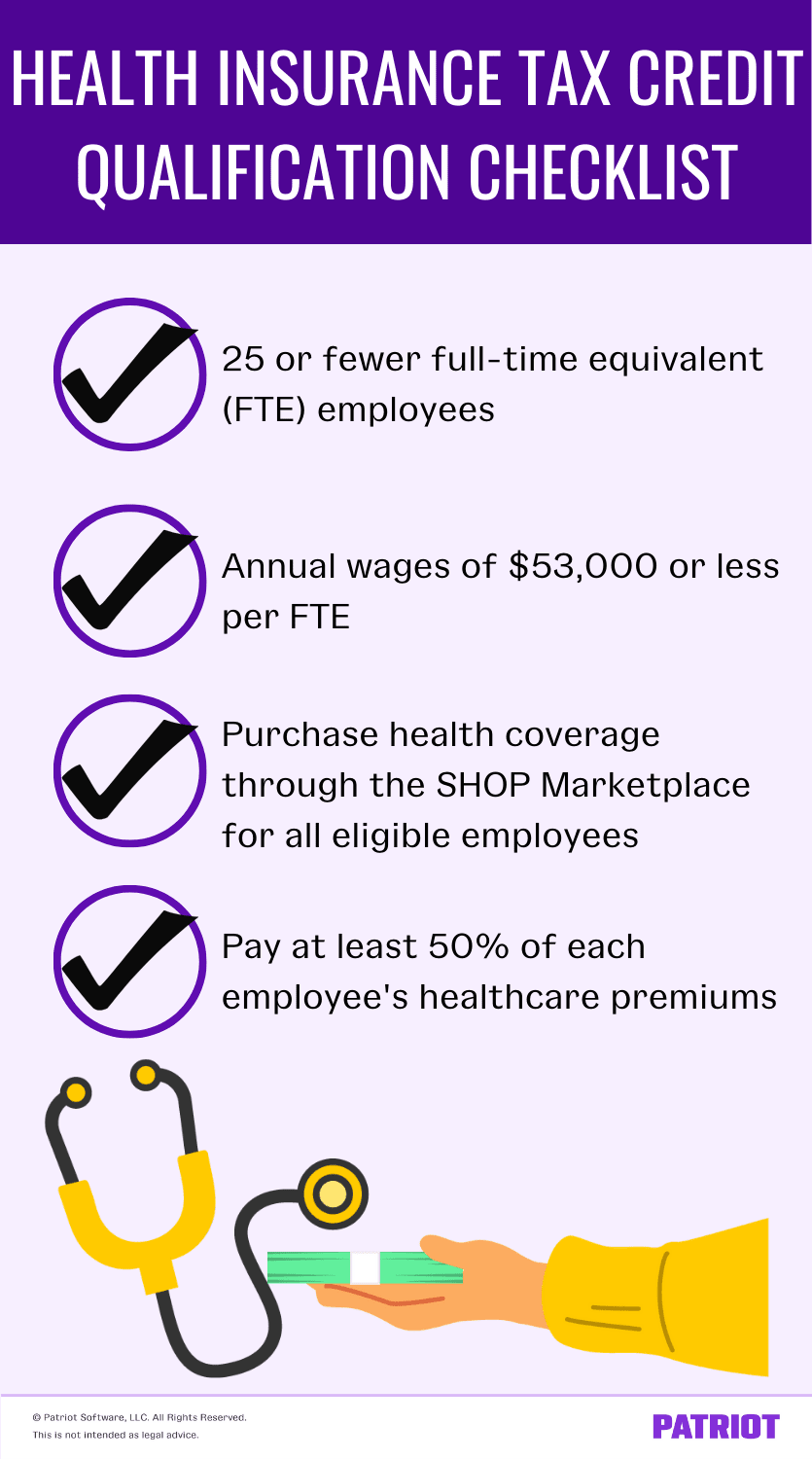

You might be thinking, Do I qualify for a tax credit for health insurance? According to the IRS, not all employers who purchase group health insurance through the SHOP Marketplace are eligible for the small business healthcare tax credit. Your small business must meet the following requirements to qualify:

- Have 25 or fewer FTE employees

- Pay annual wages below $53,000 per FTE

- Purchase and offer group health coverage through the SHOP Marketplace to all eligible employees

- Contribute at least 50% of each employee’s premiums (you don’t have to pay for family or dependent premiums)

What are full-time equivalent (FTE) employees?

Again, you need to have 50 or fewer FTE employees to purchase health insurance through the SHOP Marketplace and 25 or fewer FTEs to qualify for the tax credit. But, what’s an FTE?

Under the Affordable Care Act, a standard full-time employee is someone who works at least 30 hours per week and 120 days per year. So, an FTE is a combination of your part-time employees that add up to make one or more full-time employees.

To determine your number of full-time equivalent employees:

- Add up the hours for all your part-time employees

- Divide the total part-time hours worked by 30 (the hours needed to be considered full-time)

- If your result is a decimal, round down to the nearest whole number

- Add that number to the number of full-time workers you employ

Let’s take a look at an example. You have two full-time employees and 20 part-time employees whose annual hours equal 450 hours. Divide the 450 part-time hours by 30:

450 / 30 = 15

Add your full-time employees to your result:

2 + 15 = 17 FTEs

Your final figure is your number of full-time equivalent employees. In this example, you have fewer than 25 FTEs, so you meet the employee requirements for the health care tax credit.

How does health insurance tax credit work?

To qualify for the health insurance tax credit, pay at least 50% of the employees’ premiums. So if the total plan is $200 per employee, you must pay at least $100 toward the premiums for each employee. But, that is not the amount of tax credit you can receive.

The tax credit is up to 50% of the premiums you pay for the whole year. For example, you pay $15,000 for your employees’ health insurance in 2021. If you are eligible for the entire 50% credit, you would receive $7,500.

The IRS uses a sliding scale to determine your health insurance premium tax credit. The smaller the employer, the higher the credit. Only employers with 10 or fewer FTE employees and average annual wages of less than $25,000 qualify for the full 50% tax credit.

Can tax-exempt organizations receive the credit?

A tax-exempt organization with employees can also claim the health premium tax credit. If your business is tax-exempt, you have the same requirements as businesses that are not tax-exempt:

- Have 25 or fewer FTE employees

- Pay average annual wages of $25,000 or less

- Contribute 50% or more toward the employees’ insurance premiums

- Purchase group health coverage through the SHOP Marketplace

Unlike nontax-exempt businesses, nonprofit and tax-exempt organizations only qualify for up to 35% of the employee premiums. The tax credit is on a sliding scale, so companies with fewer employees can receive bigger credits.

How to claim the tax credit

To claim the ACA tax credit, attach Form 8941, Credit for Small Employer Health Insurance Premiums, to your annual business tax return (e.g., Form 1120). Form 8941 helps you calculate the amount of the tax credit you can receive.

The premium tax credit is only available for two consecutive years. If your tax credit is more than the amount of taxes you owe, you can carry the unused amount back to previous tax years (if you still owe past taxes) or forward to the next year.

Nonprofit organizations can receive a refundable tax credit. This means that nonprofit, tax-exempt organizations can receive cash for unused credit.

Can self-employed individuals use the SHOP Marketplace and take the tax credit?

If you’re self-employed, you can purchase health coverage through the SHOP Marketplace. But, can you receive the ACA tax credit? Yes. And, you could be eligible for tax write-offs.

The IRS defines self-employed individuals as someone who is one of the following:

There are several healthcare tax write-offs for self-employed individuals, including:

- The Self-employed Health Insurance Tax Deduction

- Itemized medical and dental expenses deductions

- Premium tax credits

When you file your tax returns, you can only claim one of the deductions. Take a closer look at each write-off for self-employed individuals.

The Self-Employed Health Insurance Tax Deduction

If you are self-employed and bought health coverage through the SHOP Marketplace, the health insurance premiums for you and your dependents are fully deductible.

How does the deduction work? The Self-employed Health Insurance Tax Deduction lowers your adjusted gross income (AGI) by the amount you pay in health insurance, dental insurance, and qualified long-term care premiums. Include the full amount of the premiums for yourself, your spouse, and any dependents.

For example, your annual premiums are $15,000 for you, your spouse, and your dependents. Your adjusted gross income is $40,000. Because the premiums are fully deductible, you can lower your $40,000 AGI to $25,000, which can lower your tax bill.

Use Line 29 on your individual tax return, Form 1040, to record the deduction. There are some conditions to taking the deduction based on your source of income and how you file your taxes. IRS Publication 535 includes the full list of restrictions.

You cannot deduct your premiums if you are eligible for group health insurance through your or your spouse’s employer. For example, you own your business, but you also work full-time for another employer. If your other employer offers a group insurance plan, you cannot claim the deduction.

Itemized medical and dental expenses deduction

Self-employed persons can list unreimbursed medical expenses as itemized deductions on individual take returns. Use Schedule A to record all expenses, and attach it to Form 1040. When you itemize medical and dental expenses, you can only deduct up to 10% of your adjusted gross income.

Let’s say you choose to deduct medical and dental expenses, and your AGI is $25,000. You can deduct up to $2,500 for qualifying expenses.

Premium tax credits

Household income determines premium tax credits. You only qualify for premium tax credits if you earn 100% to 400% of the Federal Poverty Level. For 2021, the poverty level range is:

- Individuals: Between $12,760 and $51,040

- Family of four: Between $26,200 and $104,800

If your family includes more than four individuals, consult with an accountant to determine if you are eligible for premium tax credits.

You can use the premium tax credit to lower your adjusted gross income on your annual income tax return. The credit uses a sliding scale to determine the amount. The lower your income, the higher the credit.

Advanced premium tax credit

Are your monthly health insurance premiums high? Well, you can use the premium tax credit to pay your insurer in advance, lowering your monthly premium. This is called an advanced premium tax credit.

Here’s how advanced premium credits work:

During your enrollment in the SHOP Marketplace plan, select to have the Marketplace calculate an estimated credit. Keep in mind that you need to estimate your expected income for the year. If you qualify for a premium tax credit based on your estimated income, you are eligible to use any amount of the credit to lower your monthly premium.

When you elect to use the advanced premium tax credit, the Marketplace directly pays your insurance company the credit. In turn, the insurer lowers your monthly payments. At the end of the year, reconcile the advance paid with the actual amount of the credit calculated when you file your taxes.

What happens if your advanced credit payment is more than the actual allowable amount you calculate on your return? The IRS subtracts the difference from your return or adds the balance to taxes due.

For example, you estimated that your total credit would be $5,000, and the credit lowered your monthly payments. At the end of the year, you earned more than you originally estimated, and your allowable credit was $4,500. The IRS will subtract $500 ($5,000 – $4,500) from a refund or add $500 to a tax bill.

Use Form 8962, Premium Tax Credit, to calculate the amount of your actual allowable premium tax credit. You need either Form 1095-A or Form 1095-B to complete Form 8962. Both forms provide information about your premium payments.

Are you offering SHOP health insurance to your employees? Need a solution that makes deducting and contributing premium costs a breeze? Patriot’s online payroll software makes it easy to add deductions and contributions to employees, so you have accurate calculations every time, guaranteed. Start your free 30-day trial today!

This article has been updated from its original publication date of January 19, 2017.

This is not intended as legal advice; for more information, please click here.

Leave a Reply