You probably depend on equipment to run your business. Computers, cars, and copy machines are just some of the must-have company assets you use. When it’s time to buy new equipment, know how to account for it in your books with a purchase of equipment journal entry.

Accounting for assets, like equipment, is relatively easy when you first buy the item. But, you also need to account for depreciation—and the eventual disposal of property.

Let’s get started, shall we?

Equipment in business overview

Your business likely has a good amount of equipment that you use in your day-to-day operations. Examples of equipment you may use in business include:

- Computers

- Cars

- Software

- Phones

- Copy machines

- Printers

- Shredders

- Forklift

- Trucks

Equipment, along with your company’s property (e.g., building), make up your business’s physical assets. Generally, equipment and property fall under the “fixed asset” category. Fixed assets are long-term (i.e., more than one year) assets you use in your operations to generate income. These types of assets are subject to depreciation. Depreciation reflects the loss in value of the equipment as you use it.

Keep in mind that equipment and property aren’t the only types of physical (i.e., tangible) assets that you have. You may also have inventory. Unlike equipment, inventory is a current asset you expect to convert to cash or use within a year.

Because equipment is typically a long-term asset, you must record and account for its journey in your business. This includes recording the equipment in your books:

- When you purchase it

- As it depreciates

- When you sell or dispose of it

Purchase of equipment on balance sheet and cash flow statement

When you first buy new, long-term equipment (i.e., fixed assets), it doesn’t go on your income statement right away. Instead, record an asset purchase entry on your business balance sheet and cash flow statement.

Record new equipment costs on your business’s balance sheet, typically as Property, plant, and equipment (PP&E).

And, record new equipment on your company’s cash flow statement in the investments section.

Equipment depreciation on income statement

When it comes to recording equipment, loop the income statement in once you start using the asset. Record the asset’s annual depreciation on your business income statement until the asset fully depreciates.

Purchase of equipment journal entry

When you purchase equipment with the intention of keeping it for more than one year, you’re not just making one journal entry recording the purchase…

You also need to make journal entries to reflect depreciation. And, make an equipment journal entry when you get rid of the asset.

In some cases, you may also need to record any asset impairment that comes along (i.e., when an asset’s market value is less than its balance sheet value).

Before we dive into how to create each kind of fixed asset journal entry, brush up on debits and credits.

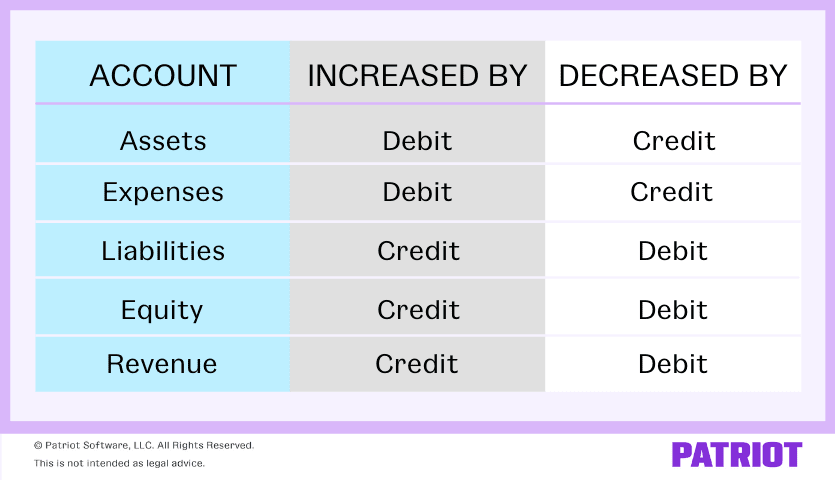

Again, equipment is an asset. Do debits and credits impact assets (and other types of accounts in accounting)? Use our chart below to find out:

Using the chart, asset accounts increase with a debit and decrease with a credit. Keep this key piece of information in mind as we cover journal entries for the asset’s:

- Purchase

- Depreciation

- Disposal

1. Asset purchase

When you first purchase new equipment, you need to debit the specific equipment (i.e., asset) account. And, credit the account you pay for the asset from.

Let’s say you buy $10,000 worth of computers and pay in cash. Debit your Computers account $10,000 and credit your Cash account $10,000. Take a look at how your journal entry for purchase of asset might look:

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Computers | 10,000 | |

| Cash | 10,000 |

Remember to make changes to your balance sheet to reflect the additional asset you have and your reduction in cash.

2. Asset depreciation

Equipment is a long-term asset, which means its value depreciates as you use it. Depreciating the asset lets you offset its decreasing value (and decrease your taxable income).

In short, depreciation lets you spread out the asset’s cost over its useful life (how long you expect it’ll last).

There are a few ways you can calculate your depreciation expense, including straight-line depreciation. Straight-line depreciation is the easiest method, as you evenly spread out the asset’s cost over its useful life.

Let’s say you need to create journal entries showing your computers’ depreciation over time. You predict the equipment has a useful life of five years and use the straight-line method of depreciation.

To determine the amount of each equipment depreciation journal entry, divide the value of the computers by the predicted useful life:

$10,000 / 5 = $2,000

Now, debit your Depreciation Expense account $2,000 and credit your Accumulated Depreciation account $2,000.

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Depreciation Expense | 2,000 | |

| Accumulated Depreciation | 2,000 |

3. Asset disposal

After the asset’s useful life is over, you might decide to dispose of it by:

- Throwing / Giving it away

- Selling it

The journal entry you make depends on whether the asset is fully depreciated and whether you sell it for a profit or loss.

If the asset is fully depreciated, you can sell it to make a profit or throw / give it away. If the asset is not fully depreciated, you can sell it and still make a profit, sell it and take a loss, or throw / give it away and write off the loss.

Fully depreciated and giving it away

Let’s say your asset is fully depreciated and you want to give it away, free of charge. Debit your Accumulated Depreciation account $10,000 and credit your Computers account $10,000. Your journal entry would look like this:

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Accumulated Depreciation | 10,000 | |

| Computers | 10,000 |

Not fully depreciated and giving it away

Now, let’s say your asset’s accumulated depreciation is only at $8,000, but you want to give it away, free of charge. This makes your loss $2,000 ($10,000 – $8,000).

Debit your Loss on Asset Disposal account $2,000, debit your Accumulated Depreciation account $8,000, and credit your Computers account $10,000. Take a look at the following journal entry example:

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Loss on Asset Disposal | 2,000 | |

| Accumulated Depreciation | 8,000 | ||

| Computers | 10,000 |

Not fully depreciated and selling for a profit

Let’s say you sell your asset and end up making money. To show this journal entry, use four accounts:

- Cash

- Accumulated Depreciation

- Gain on Asset Disposal

- Computers

Say you sell the computers for $4,000. The computers’ accumulated depreciation is $8,000. Debit your Cash account $4,000, and debit your Accumulated Depreciation account $8,000.

You also must credit your Computers account $10,000 (the amount you paid for the equipment). But now, your debits equal $12,000 ($4,000 + $8,000) and your credits $10,000. To balance your debits and credits, record your gain of $2,000 by crediting your Gain on Asset Disposal account.

Here’s how your journal entry would look:

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Cash | 4,000 | |

| Accumulated Depreciation | 8,000 | ||

| Gain on Asset Disposal | 2,000 | ||

| Computers | 10,000 |

It’s time to kiss spreadsheets for accounting goodbye. Streamline the way you account for your business’s income and expenses with Patriot’s accounting software. And with a free trial, what do you have to lose? Learn more about our accounting options here.

This is not intended as legal advice; for more information, please click here.

Leave a Reply