.png)

In a deal that will push its tens of billions of dollars in client assets to more than triple the size of two years ago, a private equity-backed hybrid RIA is purchasing another massive practice.

Hoover Financial Advisors agreed to fold into Wealth Enhancement Group under a transaction with an undisclosed price tag that’s expected to close July 1. The Philadelphia-area practice has nine financial advisors, four seasonal tax consultants and 13 other employees managing $1.46 billion in client assets. Upon completion of the deal, the team will switch their broker-dealer affiliation to LPL Financial from Purshe Kaplan Sterling Investments.

In the past six months, TA Associates-backed Wealth Enhancement has unveiled three other deals to buy RIAs with at least $1 billion in assets under management. Upon the close of the Hoover deal, the Minneapolis-based hybrid RIA will top $34.6 billion in client assets as a firm. In July 2019, when funds affiliated with the PE firm purchased a majority of the firm, Wealth Enhancement had $11.3 billion. Its latest acquisition comes as earnings multiples in RIA M&A deals continue their upward slope and assets changing hands reach new highs as well.

Wealth Enhancement buys some practices with less than $500 million in AUM, but its main targets have between $1 billion and $3 billion and have been located almost exclusively in the Northeast and Upper Midwest, CEO Jeff Dekko says.

“To get that number and to sustain that number they’ve had to bring more talent to their organization,” he says. “They’re having to make decisions on whether they want to invest forward in their businesses…It’s scale and capital coming together at the same time.”

Representatives for PKS, which serves a small portion of Hoover’s assets on the brokerage side of the business, didn’t respond to a request for comment on the team’s impending exit.

The Malvern, Pennsylvania-based firm has $1.38 billion in AUM, according to its latest SEC Form ADV from February. Hoover launched the RIA in 2005, and he leads it now alongside the firm’s president, William Mullin. Prior to spending eight years with PKS as his BD, Hoover had an eight-year affiliation with Cambridge Investment Research and a six-year tenure with Advisor Group’s Royal Alliance Associates during his 39-year career, according to FINRA BrokerCheck.

Hoover praises Dekko’s team as contrasting with other potential buyers by pitching them with resources designed to keep operating their business in the same way, just with greater services and tools from the corporate office for its future growth.

“There have been many companies and suitors that have been calling on us and talking to us over the years,” says Hoover. “The other firms that I spoke to wanted me to become them.”

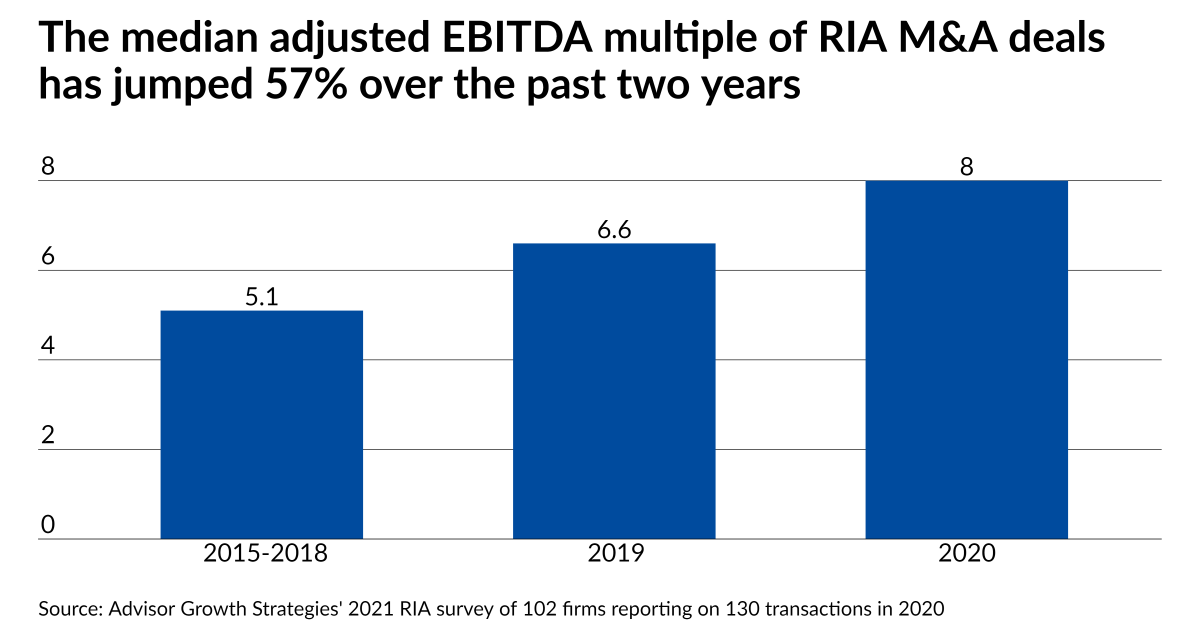

Record M&A in wealth management isn’t showing any signs of slowing down, and it’s still a seller’s market: The median adjusted EBITDA multiple of deals discussed by more than 100 RIAs participating in consulting firm Advisor Growth Strategies’ annual survey has soared by nearly 60% since 2018 to 8x. Valuations are running especially high for firms with at least $1 billion in AUM, according to the firm.

The low cost of capital and increasing numbers of PE and other investors marching into the space are driving the higher multiples, according to Advisor Growth Principal Brandon Kawal. From the other side, sellers searching out growth opportunities, succession plans and more scale have found more reasons to agree to deals amid the coronavirus and the prospect of higher capital gains taxes under President Biden’s plans, he says.

“The pandemic just put a lot of pressure on owners and operators,” Kawal says. “What we’re seeing in the M&A market is firms coming into the market because they’re fed up.”

In this environment, Wealth Enhancement has found a bumper crop of deals, including one in April to create its first office in California. As of that month, the firm had nearly 600 employees and roughly 200 advisors, according to Dekko.

Leave a Reply