Do you have freelancers or contractors working for you? Is your labor force full of short-term contracts? You might be working in a gig economy with gig workers. If so, you need to know the laws for hiring gig workers. Keep reading to learn more about the gig economy.

What is a gig economy, and who are gig workers?

Let’s define gig economy first. The gig economy meaning is a labor market where freelance, temporary, or independent contract work is common. Full-time, permanent positions are not part of the gig economy. The term “gig” comes from musicians and describes a job that lasts for only a specified period of time.

Now, let’s define gig worker (sometimes incorrectly called a gig employee). A gig worker is someone you hire to perform temporary or freelance work for your business.

So if you have any freelancers, temporary workers, or 1099 contractors, you have gig workers. There are many types of gig workers, and common gig workers examples include:

- Ride-sharing drivers (e.g., Uber)

- Consultants

- Handymen

- Fitness / personal trainers or coaches

- Tutors

- Performers

- Photographers

The gig economy consists of individuals who are not on payroll. Because they are not on payroll, you send payments to these freelancers without deducting any taxes or paying employer taxes.

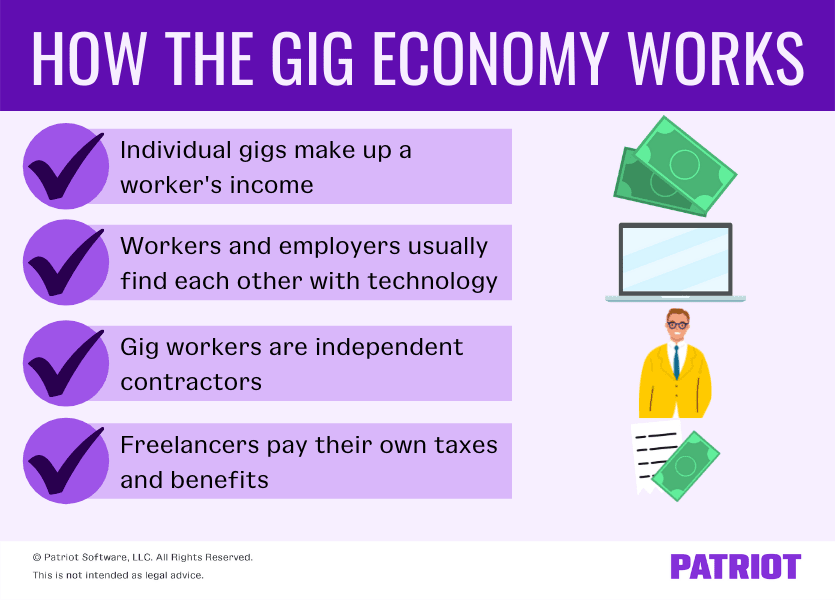

How does the gig economy work?

The gig economy is a free market system that allows individuals to earn wages for short-term work. Employers contract out specific jobs and hire workers as 1099 contractors. Here is how the gig economy works:

- Individual gigs make up gig workers’ income

- Employers and contractors typically find each other via technology (e.g., job boards)

- Workers are independent contractors

- Freelancers pay their own benefits and taxes

Individual gigs make up gig workers’ income

The nature of gig work is that it is temporary work. So, gig economy workers may work multiple gigs in a year to create a total yearly income.

Each gig economy job is a small portion of the total income. When added together over the course of a year, the gig worker’s pay is similar to a full-time employee’s.

Employers and contractors typically find each other via technology

Not all employers find gig workers using technology or the internet. But, the world is heavily reliant on digital means, so finding gig workers online might be easiest for your business.

The days of posting on physical job boards have gone by the wayside. Consider posting your opportunities on social media (e.g., LinkedIn) or digital job boards (e.g., Indeed).

Workers are independent contractors

As a 1099 contractor, a gig worker performs work independently of employment contracts.

Freelancers pay all their own benefits and taxes

Because gig workers are not employees, employers do not withhold taxes or provide benefits (we’ll get to that later). Instead, gig workers are self-employed individuals who must pay taxes and benefits on their own.

What is the difference between an employee and a gig worker?

When hiring gig workers for your business, you may be asking yourself what the difference is between a contractor and an employee. The IRS and the Fair Labor Standards Act (FLSA) have specific criteria for classifying contractors and employees.

IRS rules on gig workers

The IRS has three main criteria for distinguishing between employees and gig workers, including:

- Behavioral

- Financial

- Type of relationship

As the employer, consider how much control you have over the worker to determine if the worker should be a contractor.

Behavioral

The basis of the behavioral criteria is whether or not your company has the ability and right to control how the contractor works. Do you get to determine what the worker does and how they complete the assignment?

If you have control over the project and the employee’s work (and how they do it!), you likely have an employee. If you do not have control over the worker and how they complete the project, the worker is likely a contractor.

Financial

Financial control depends on whether or not you can control other business aspects of the worker’s job. For example, a gig employee tells you their fees for performing the work upfront and typically brings their own equipment.

If you determine the payment amount for the worker and/or supply all of the materials for the work, you may have an employee. Payments can be negotiable with employees, but generally, you set the terms (e.g., a set hourly wage).

Type of relationship

One of the easiest ways to differentiate between employees and gig workers is the type of working relationship. Ask questions like:

- Do I provide any benefits to the worker (e.g., a retirement plan)?

- Will our working relationship continue after the project is completed?

- Are there any written contracts regarding the type of employment?

Generally, you do not provide employee benefits to contractors, and the working relationship ends once the project is done because the work is temporary.

You can have written contracts with employees and contractors, but the type of contract determines the relationship. Generally, if you provide the agreement outlining the terms of employment and the pay, you probably have an employee. But if the worker gives you a contract outlining the work and the payment amount, you may have a contractor.

FLSA rules on gig workers

In addition to the IRS’s regulations, the Fair Labor Standards Act (FLSA) provides six factors to help you determine your worker’s employment status, including:

- If the work performed is an integral part of your business

- If the worker’s managerial skills affect their opportunity for profit and loss

- The worker’s investments in the business’s facilities and equipment

- If the work requires specialized skills and initiative

- The permanency of the work

- The nature and degree of control you have over the worker

Employers must look at all six points to determine worker classification, not just one. Contact the Department of Labor for more information.

State laws regarding contractors

Some states have their own laws regarding who can and cannot be classified as a contractor. For example, California has the California AB 5 law that requires most industries to use the ABC test to determine if a worker is a contractor.

Other states, like Massachusetts and New Jersey, have similar laws. Maine also has an ABC test law for unemployment compensation determinations. But, what is the ABC test?

The ABC test says that a worker is only an independent contractor if they meet all three parts of the test (aka A, B, and C). Those three parts are:

- A worker is free from the control and direction of the hirer concerning the performance of the work, both under the contract and in fact (i.e., the employer does not have behavioral control)

- The worker performs work that is outside the usual course of the hirer’s business

- The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed for the hirer

Let’s look at two examples, one of an employee and one of a gig worker.

You own a retail business selling clothing and offer tailoring services for the clothing you sell. As part of your operations, you need to hire a professional photographer and a seamstress. Which is the employee, and which is the contractor?

Using the ABC test, you determine that the seamstress must be an employee. Why? Because they perform work in line with the services you offer.

In contrast, the photographer is an independent contractor. Why? Because the photographer performs a project outside of the services you provide, is not under your behavioral control, and is engaged in an independent trade of the same kind they offer to you.

How do you pay gig workers?

Now that you’ve determined you have a gig worker, you might be wondering just how you pay them. Gig workers do not carry the same responsibilities as employees when it comes to paying them. Do not withhold taxes, pay employer taxes, or deduct any benefits from a gig worker.

When you hire the independent contractor, have them complete a Form W-9 and issue a Form 1099 at the end of the year. The type of Form 1099 you issue depends on the nature of the work. Typically, you distribute a Form 1099-NEC or Form 1099-MISC.

Form 1099-NEC is for nonemployee compensation. If the contractor is a nonemployee you compensate for work performed, they may receive Form 1099-NEC at the end of the year.

But, you may use Form 1099-MISC for individuals who perform “one-off” work for your business, such as photographers at an event. Speak with an accountant to determine if your gig workers should receive a Form 1099-MISC.

Paying gig workers and issuing their tax documents at the end of the year can be confusing. Make it simple with Patriot’s online accounting software. Add your vendors, enter payments, and print checks in a few easy steps. Get your free 30-day trial!

This is not intended as legal advice; for more information, please click here.

Leave a Reply