With wealth management M&A breaking records on multiple metrics, two of the fastest growing RIA aggregators unveiled deals for billion-dollar firms within five hours of each other.

CI Financial struck first on June 28, with the announcement that the Canadian asset manager and giant entrant to the U.S. wealth management scene is making its 19th RIA acquisition since January 2020 in a deal for Radnor Financial Advisors, a Philadelphia-area firm managing $2.60 billion in client assets. Later, Focus Financial Partners followed up on its seven transactions in the first quarter with the news that it’s buying Seattle-based Badgley Phelps Wealth Managers, which lists $3.82 billion in assets under management in its latest SEC Form ADV.

The firms didn’t disclose the purchase prices in either deal. Both are expected to close in the third quarter. The start of the second half of the year brought many big deals: Three days later, Focus added one billion-dollar acquisition agreement in the morning and one in the early evening.

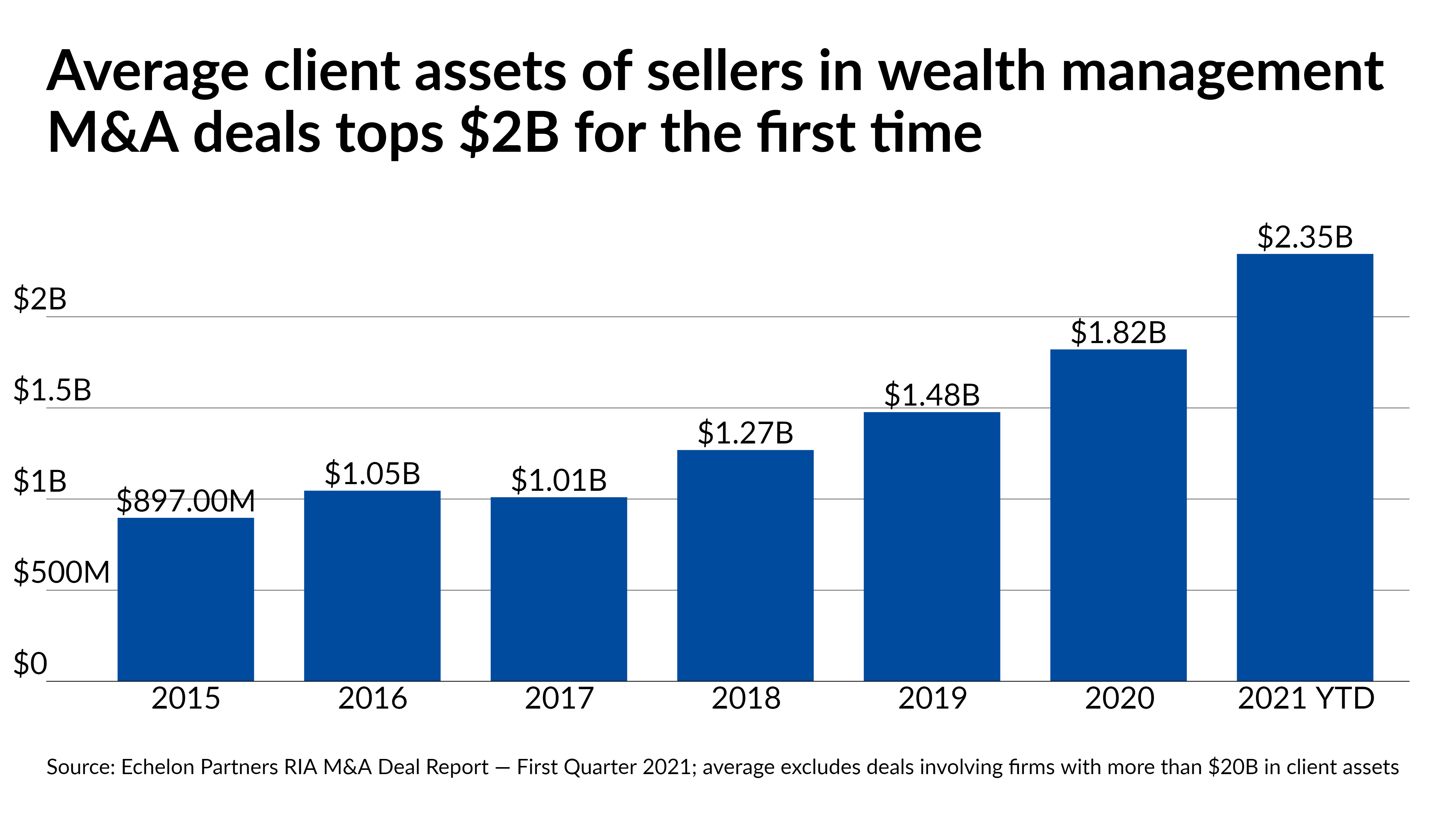

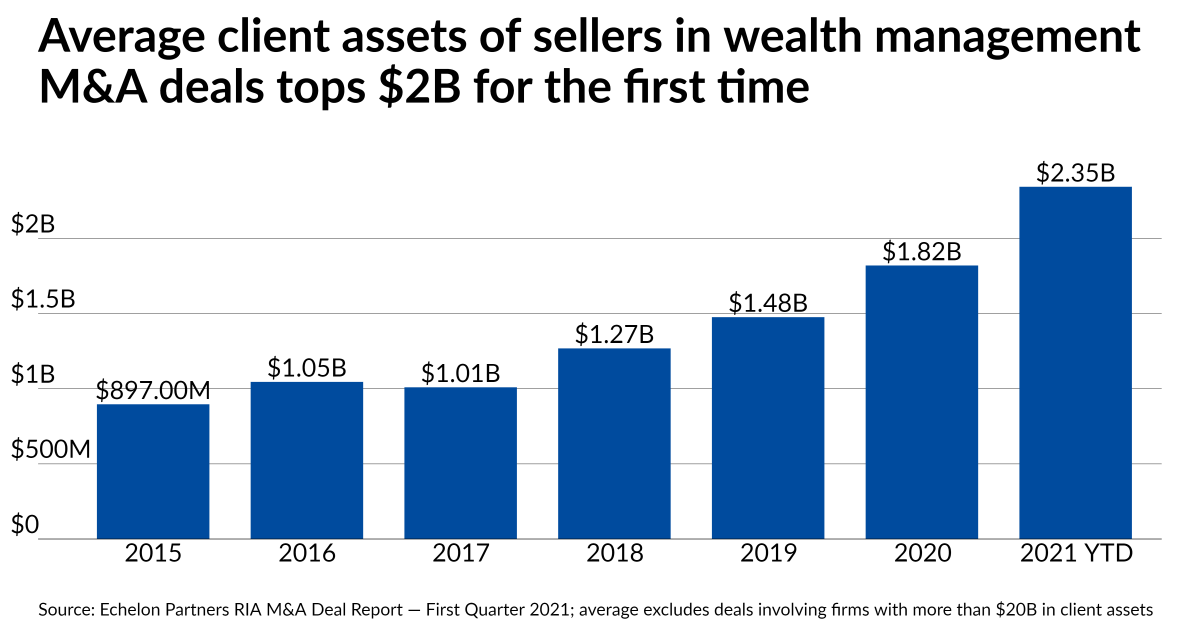

While massive, the deals are only a little bit above the industry mean. Wealth management M&A reached record deal volume, at 76 transactions, and a new high in sellers’ average client assets, at $2.35 billion, in the first quarter, according to investment bank and consulting firm Echelon Partners. The avalanche of deals for firms with at least $1 billion in client assets stems in part from the “record advisor-employee turnover post-pandemic” seen in wealth management and other industries, according to consultant Angie Herbers of Herbers & Co.

“The $1B+ firms who do not have formalized partnership programs are at the highest risk of losing talent, due to rapidly increasing valuations that most employee-advisors can now ill afford,” Herbers said in an email. “Folding into larger firms is how they are preserving client relationships from walking out the door, and smart acquirers know this. Targeting the $1B+ firms with no formalized partnership, right as they are losing talent, is strategic.”

In the case of Wayne, Pennsylvania-based Radnor, the decision to fold into CI came out of a need for more scale over the next three decades at the 32-year-old firm, according to President Michael Mattise. The fee-only RIA has 26 employees, including six shareholders and seven financial consultants. It’s no stranger to M&A itself, having earlier sold a minority interest in the firm to investment firm Emigrant Partners. The stake is changing hands to CI in the deal as well.

“One of the attractive features of this is that, largely, Radnor will continue to operate as it always has operated,” Mattise said in an interview. “Giving us autonomy and keeping the entrepreneurial spirit alive is something that they believe in.”

Alston & Bird represented Radnor in the deal, while Hogan Lovells advised CI. In the Focus deal, Cambridge International Partners served as the advisor to 55-year-old Badgley Phelps.

Like Radnor, the other fee-only firm cited plans for the future in explaining why they made the deal to roll up into Focus. Badgley Phelps counts 22 employees, with 18 registered with state securities authorities as investment advisors, according to its April 30 Form ADV filing.

“Taking this step will preserve the Badgley Phelps legacy for generations to come, while enabling us to continue operating autonomously, managing our business and clients the way we have always done,” CEO Steve Phelps said in a statement. “We believe that becoming part of the large and diverse group of firms in the Focus partnership will yield many benefits to our business in the years to come.”

The group is likely to keep expanding, if subsequent Focus deals three days later are any indication. In addition to announcing a tuck-in acquisition for an existing Focus partner of a practice with $2.83 billion in AUM and a new partnership with a third RIA that has $1.35 billion, the firm also closed a transaction adding a 7-year, $800 million tranche to its first lien term loan.

“Our M&A pipeline is at record levels and we believe that this pace of activity will increase further in the second half of 2021,” Focus CFO Jim Shanahan said in a statement. “We expect to deploy capital this year significantly in excess of our historical levels as we accelerate the expansion of our partnership globally.”

At least 33 wealth management firms with $1 billion or more in client assets sold in the first quarter, according to Echelon. Average AUM per deal is up 29% on its level in 2020, which saw the previous record at $1.82 billion. Strong performance, the “heightened buyer attention placed on the upper AUM spectrum” of the industry and the ability among RIAs to carry out growth strategies are driving the number of massive deals, the firm’s first-quarter deals report says.

“We expect another record year for dealmaking, particularly as sellers try to outpace potential tax changes and buyer demand remains high,” the report states. “We also see new buyers entering the market and the competition for high quality targets has intensified M&A.”

Leave a Reply