The nation’s largest independent broker-dealer is getting bigger at four times the rate it was only three years ago, with record metrics to match.

After its acquisition of Waddell & Reed and onboarding of the wealth management programs of M&T Bank and BMO Harris, LPL Financial’s net new asset growth rate has surged to 12% for the past year, compared to only 3% at the same time in 2018, CEO Dan Arnold noted on an earnings call with analysts after the firm disclosed its second quarter earnings on July 29. In correlation with the key measure of organic growth, LPL reached new highs in recruited assets, total client assets, advisory assets and financial advisor headcount.

- Expansion: The organic growth, which amounted to another quarterly record of $37 billion in net new assets, stemmed from “those traditional three oars in the water, if you talk about new store sales, same store sales and attrition,” Arnold said, according to a transcript by Seeking Alpha. LPL’s “contribution from those oars is really well balanced across all three,” and its “entry into supporting large financial institutions” like M&T and BMO is helping to drive organic growth even higher, Arnold said. The company aims to continue boosting the expansion in coming months through recruiting of its traditional independent advisors, those interested in its new affiliation options and the bank channel, he added

- Recruiting: The onboarding of Waddell & Reed, M&T and BMO have brought a combined $99.6 billion in client assets to LPL, with an additional $6.3 billion that M&T’s wealth management unit holds directly with product manufacturers left to migrate to LPL over the next several months. The mega-recruits’ transition fueled LPL’s record influx of $35 billion in recruited assets for the quarter and $80 billion over the past year, which is more than double from the same time in 2020. In terms of its advisor headcount, LPL has added a net 2,141 representatives in the past year to reach an industry-leading 19,114.

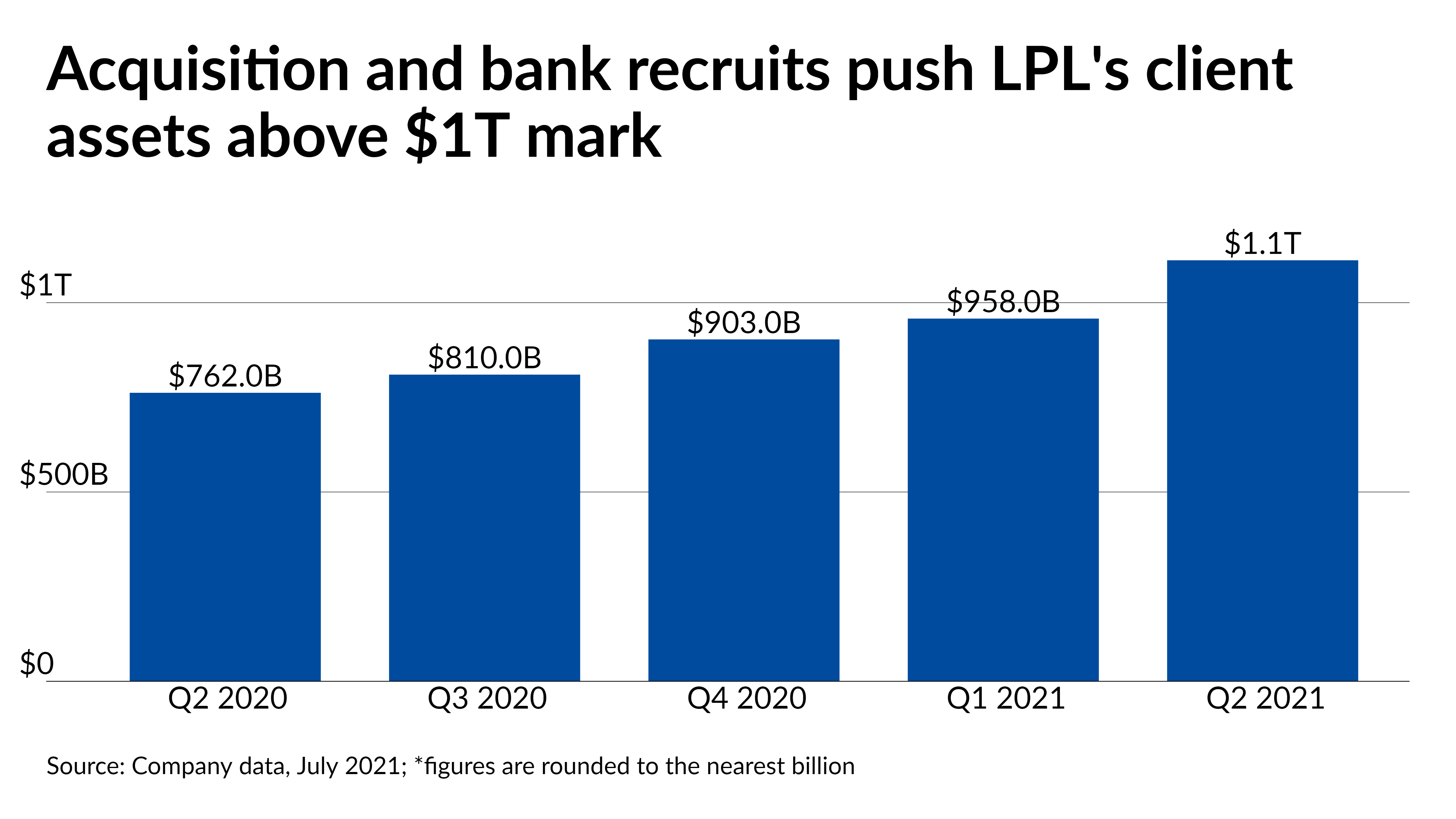

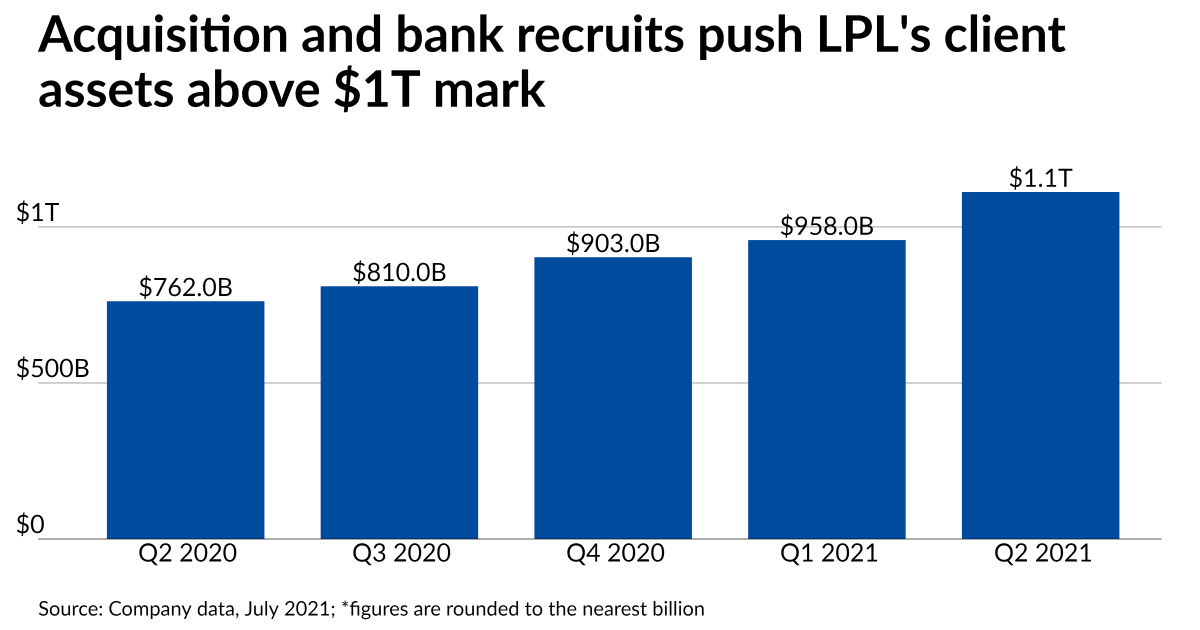

- Assets and Earnings: Due to its acquisition of Waddell & Reed and its massive recruiting, LPL’s client assets moved above the $1-trillion level for the first time ever. Client assets soared by 46% year-over-year to $1.11 trillion in the second quarter. Seen through another metric, the $300 million purchase earlier this year is going to add $85 million in estimated EBITDA each year. The company has increased its projection for the annual earnings from $80 million last quarter. LPL’s net income climbed 17% year-over to $119.1 million in the second quarter, while revenue surged by 39% to $1.90 billion.

- Outsourcing: In another way that LPL is trying to work with advisors, its burgeoning Business Solutions services are on the rise as well, to the tune of 2,100 subscribers. That’s double the amount of the same time in 2020. Roughly 80 more subscribers signed up from Waddell & Reed’s advisor base, primarily for the “admin solutions” service offering aid to practices in the operational switch over to LPL. There are seven different services now, with three more in pilot and “a handful of other offerings in the incubation phase,” Arnold said.

- Potential Bank: One analyst asked the CEO if LPL’s management team would ever reconsider the idea of opening its own bank, a step taken by some of LPL’s competitors. While Arnold said that it “strategically makes sense in the short run” to continue working with external banks, he didn’t rule out the idea. “Potentially being a bank is one of those things that we would always keep active, that assessment or that consideration,” Arnold said. “And I think we would look at it from a strategic standpoint: Are there capabilities that could potentially support advisors and their value to clients? And is it a better way to manage, ultimately, our cash balances and or ultimately deploy and execute against some of that expanded capability?”

Leave a Reply