New FCA data has revealed that misleading financial promotions by authorised firms more than doubled from 207 in 2020 to 564 in 2021.

The doubling in misleading promotions – which required FCA intervention – came from a similar number of authorised firms over each year, about 130.

The data has suggested a hardcore of regular offenders and also the emergence of new problems with social influencers pushing investments.

The latest data also revealed a sharp rise in suspected scam activity in 2021 compared to 2020 with the FCA receiving 34,244 reports about potential unauthorised business during the past 12 months.

The FCA released the data this week to highlight its work tackling suspicious financial promotions. The regulator has been criticised in the past for being too slow to act on toxic financial promotions before consumers were harmed, for example in the case of the LCF £236m mini-bond scam.

The data, released by the FCA as part of its new Consumer Investments Strategy and transparency policy, revealed:

• The number of alerts issued about unauthorised firms and individuals in 2021 totalled 1,410, an increase of 18% from 2020

• Just under 30% of alerts related to clone scams where legitimate firms had their details ‘cloned’ or copied by scammers to cheat consumers

• In 2021, 34,244 reports were received about potential unauthorised business

The FCA cracked down harder on suspicious activity in 2021 and a total of 1,686 financial promotions from multiple sources were reviewed.

{loadposition hidden2}

There were 8 Voluntary Applications for Imposition of Requirements (VREQs) approved in 2021, restricting the targeted firm’s ability to communicate or approve financial promotions – a doubling of the number seen in 2020.

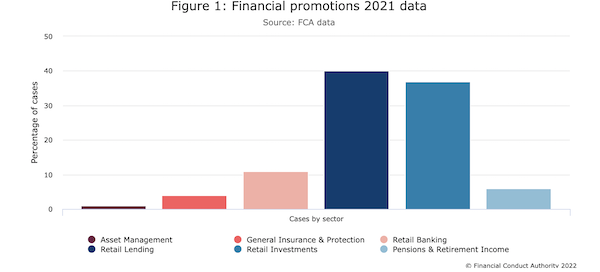

Cases in 2021 which resulted in firms withdrawing or amending a promotion across different sectors

Source: FCA

In terms of authorised firms, the FCA recorded in 2021 approximately 300 amendments or withdrawals of promotions, similar to 2020.

Retail investments and retail lending were the sectors with the highest amend/withdraw outcomes, amounting to 77% of interventions with authorised firms.

Some of the most common breaches, according to the regulator, were in the Retail Lending sector, in particular Claims Management Companies, and Retail Finance promotions.

Retail investments’ use of social media influencers on various platforms to market investments is becoming a “concern”, the watchdog said.

It said firms should ensure they have taken appropriate legal advice to understand their responsibilities prior to using influencers. In terms of illegal financial promotions by unauthorised persons, last year saw an increase of 10% compared to 2020.

On the positive side the FCA said it had seen a significant reduction in non-compliant, paid-for advertisements by unauthorised entities on Google since its work with the search engine and Google’s new financial services advertising policy.

The FCA said publishing the data related to its Consumer Investments Strategy underlined its aim to be transparent about the outcomes it was seeking to achieve with its financial promotions interventions.

Under the new strategy the FCA aims to be “more innovative, assertive and adaptive in tackling harm,” it said.

The FCA data relates to financial promotions across all sectors and not just consumer investments.

• FCA Financial Promotions Data 2021

{loadmoduleid 444}

Leave a Reply