Knocking out a big QuickBooks Online cleanup project requires the right preparation, tools, and strategy. Imagine if a boxer were to walk into the ring unprepared, without a strategy or the tools to take on their opponent – they would most likely lose the fight. Are you facing the challenge of a messy QuickBooks Online cleanup project, and want to triumph? Keep reading or click on the video linked below to learn about the paid diagnostic review: every bookkeeper’s weapon for taking on a big QuickBooks Online cleanup project.

After doing hundreds of cleanups, the number one tool that I have used consistently and that has led to profitable cleanups and also providing additional services to my clients is the paid diagnostic review. What is the paid diagnostic review and how can you use it effectively for your bookkeeping business? Well, to answer that question, let’s first start by defining what is a cleanup.

What is a QuickBooks Online cleanup?

A cleanup is needed when we’re taking a client who’s using QuickBooks Online and they have messy and incomplete books. Our goal is to review the books, catch them up, fix the books, and reconcile them. The end result should be that we are now providing the client with complete, accurate and tax ready books. Sounds pretty straight forward, right? Actually, the journey from messy books to cleaned up books can be tricky.

There are a lot of challenges when taking on cleanup clients, including:

- You’re not getting paid to diagnose the books ahead of time.

- You have no idea what’s wrong with the books.

- You have no idea how to price the clean up because you don’t even know what you’re getting into.

- You’re pricing by the hour but the client gets sticker shock when they get your invoice.

- There’s no agreement with the client on a desired outcome.

- The client tries to control the process.

What is the QuickBooks Online paid diagnostic review?

The strategy that I developed to overcome all of the challenges of taking on cleanup clients is doing a paid diagnostic review. Let’s take a look at what a paid diagnostic review is, and what’s involved.

Goal #1: Get a full scope of work

The first goal when doing the paid diagnostic review is to get a full scope of work before you cleanup or catch up the books. Just like a doctor would diagnose you before prescribing a treatment, doing the diagnostic review allows you to first get a full scope of work before you ever take on a large project, such as a cleanup.

Goal #2: Get paid to assess the books

The second goal of a paid diagnostic review is to get paid to assess the books. The QuickBooks diagnostic review is a paid project. It enables you to:

- Assess the health of your clients QuickBooks Online data.

- Diagnose problems and assess the level of cleanup needed.

- Identify transactions that need to be brought up to date.

- Get a clear scope of work before you ever take on the cleanup.

- Offer additional services to your client.

Selling the QuickBooks Online paid diagnostic review

So, how do we offer a paid diagnostic review to our prospective clients? First, you need to train yourself to listen. When talking to a prospective client, they will generally tell you all of their pain points. They might tell you that their books are messed up, and maybe that their previous bookkeeper disappeared on them. Or, that they’ve tried to do their own books and it didn’t go well, and that they connected QuickBooks to an app, and that didn’t go well either. Once they finish telling you all their pain points, you’re then going to recommend the paid diagnostic review. Notice how I use the word “recommend” because we’re not going to sell. We’re going to recommend the service.

Here’s an example of what you can say in your sales conversation:

“I recommend doing paid diagnostic review of your books so that I can get a clear picture of what’s wrong with your books. At the end of my review, I will go over my findings with you. I will also give you upfront pricing for my services.”

Workflow basics for a QuickBooks Online paid diagnostic review

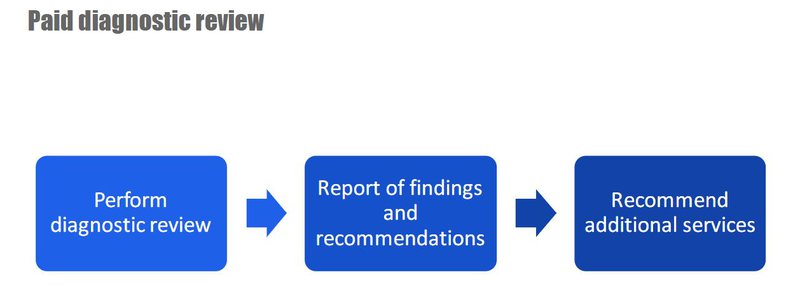

Let’s go over some workflow basics for a paid diagnostic review. Take a look at the 3 steps in flow chart below.

Once a client has signed a service agreement for a paid QuickBooks diagnostic review, our first step is to perform the diagnostic review. Next, we’re going to prepare a report of findings and recommendations for our client. Last, we’re going to recommend additional services. Let’s take a deeper look at what’s involved with each of these steps.

Step #1 – Performing the paid diagnostic review

So what goes into performing the diagnostic review? It’s really important to use a checklist so that you can cover all of the areas that you need to review.

The things that you need to look at during a diagnostic review include:

- Whether the balance sheet on the books reconciles to a balance sheet on the tax return (if there is one).

- Banking and Credit Card Accounts.

- Undeposited Funds.

- Profit and Loss Accounts.

- Balance Sheet Accounts.

- Accounts Receivable and Accounts Payable agings.

- Chart of accounts.

- Products and services list.

- Other areas such as payroll, inventory and sales taxes (if they’re tracking that in QuickBooks Online).

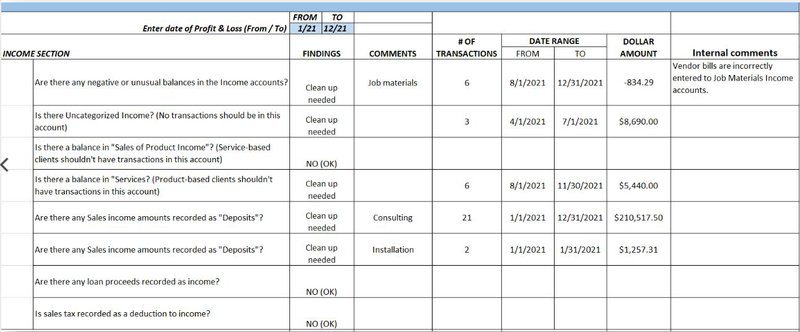

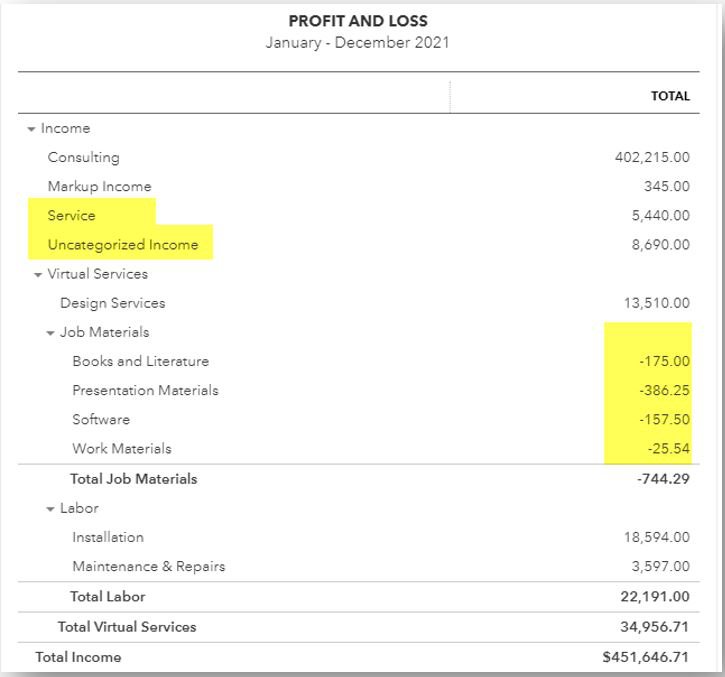

Let’s look at an example from my diagnostic review checklist, focusing on the income section on a Profit and Loss report. As you can see from the following excerpt from my diagnostic review checklist, we are looking for unusual balances in the income accounts, uncategorized income, balances in sales of product income or services, any loan proceeds recorded as income, and any sales taxes recorded as a deduction to income.

For this example, I used the following income section of a sample Profit and Loss report.

Overall, I’m looking for any errors that have been made, which I will note on my checklist. I will include any additional details on the checklist such as number of transactions found, the date range, and the dollar amount of the transactions that need to be corrected.

Step #2 – Preparing a report of findings and recommendations

After you’ve performed the QuickBooks diagnostic review, your next step is to prepare a report of findings and recommendations, which is a professional report that we are providing to our client. Here’s a sample cover sheet for the report of findings and recommendations.

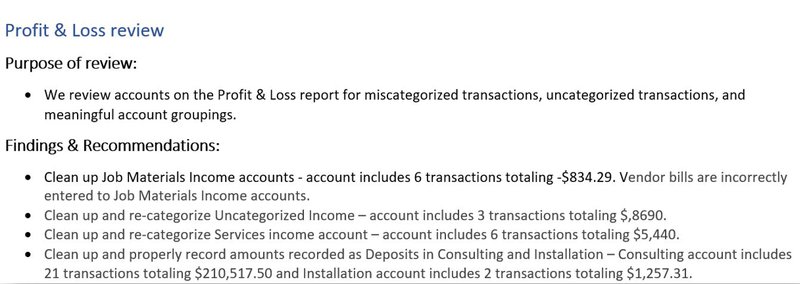

Now here’s an excerpt from my sample report of findings and recommendations for the Profit and Loss review example above.

As you can see from the report excerpt above, we’re listing all of the findings that we noted on the checklist, and include the recommendations for getting all of that cleaned up.

Step #3 – Recommend additional services to client

After you present the report of findings and recommendations to your clients, your next step is to then present additional services to them. These additional services may include cleaning up their books, catching them up, monthly bookkeeping, or coaching and training.

Closing

Are you facing a messy QuickBooks Online cleanup? You can knock it out with confidence using a paid diagnostic review: every bookkeeper’s weapon for taking on a big QuickBooks Online cleanup project. If you’d like to learn more about my paid diagnostic review and my approach to QuickBooks Online cleanups, I recommend my YouTube playlist: QuickBooks Online cleanup & diagnosis.

Looking for more resources? Here is a link to get my free Smart Review Checklist so you can learn how to review your prospective clients books in 15 minutes or less. You can also visit my 5MB Academy to see a full list of my QuickBooks Online cleanup related courses and resources linked here. As always, I’d like to invite you to join my 5 Minute Bookkeeping Community on Facebook to connect with fellow bookkeepers. It’s a safe place to ask questions and share your journey. I hope to see you there!

The post Paid diagnostic review: Every bookkeeper’s weapon for taking on a big QuickBooks Online cleanup appeared first on 5 Minute Bookkeeping.

Leave a Reply