The first Labor budget in a decade will be dropped on Tuesday 25 October by the new Treasurer, Jim Chalmers. Amidst an existing economic climate that’s replete with consecutive interest rate rises, mortgage pressure, soaring inflation and a higher cost of living – this will be an important budget for both individuals and small businesses.

We recently polled over 350 Australian small businesses to test the temperature ahead of the budget.

So, what did we discover? What do Australian businesses want to see? Let’s unpack the findings and have a chat to Reckon CEO Sam Allert for his two cents.

Rising inflation and cost of living is a sore spot

When we asked over 350 Australian businesses how confident they were that the government would assist small businesses with inflation and the rising cost of living, the response was decisive.

“Three in four small businesses (75%) think the federal government’s response to inflation/cost of living pressures have not been appropriate in balancing the needs of small business.”

That’s a stark lack of confidence coming from a small business community that’s feeling the pinch. This is clearly reflective of the tumultuous past few years, which were peppered with a host of challenges, from COVID-19, to supply chain issues and soaring inflation.

This lack of confidence was also echoed when we asked Australian small businesses about their concerns about a recession:

“4 in 5 businesses are concerned that Australia will be heading into a recession.”

It’s clear from these stats that we’ll be looking to the budget for signs that these issues will be more adequately addressed.

But as Sam Allert notes,

“Australia’s robust economy, which has weathered the storms of the last few years, will be tested once more. I find myself quietly confident that we’ll emerge with strength, like the resilient nation we are.”

Tax stimulus wish list

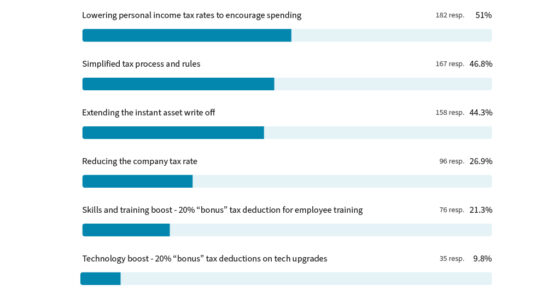

In terms of taxation, we also asked the small business community what kinds of stimulus measures they would most like to see announced and actioned in the 2022/23 budget.

The most popular measure the business community voted for (at 51%) was ‘lowering of personal income tax rates to encourage spending’. This was closely followed (at 47%) with ‘simplified tax processes and rules’.

Interestingly, although we’re entering a golden age of digital transformation, a ‘technology boost’ was the least important measure to the businesses we polled.

Let’s examine the complete hierarchy of the tax stimulus wish list:

Q: What are the top tax-related stimulus measures you would like to see for businesses like yours in the 2022-2023 budget? (Select 2 measures)

With businesses crying out for more support – what are the most called-for measures?

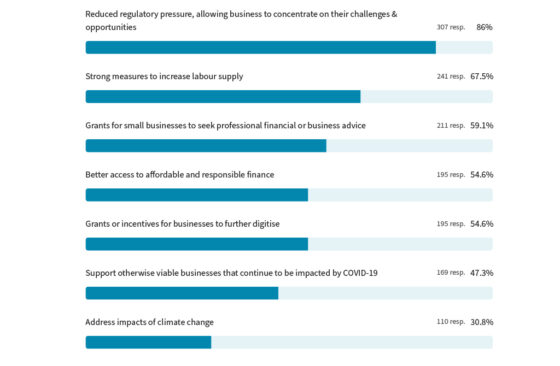

Outside of tax breaks and tax stimulus, we were also interested in what other budget measures were important for businesses in 2022.

Far and away, the top response was for the government to “reduce regulatory pressure” at a whopping 86%. At 67.5%, we also saw strong support for the government doing more to increase labour supply.

Interestingly, the global challenge of climate change was lowest on the list of priorities, perhaps highlighting how immediate challenges are so stark that seemingly abstract ideas like climate change are not highly valued, despite the far-reaching and long-term economic implications of inaction. This short-term thinking was echoed when we inquired whether climate change was high on agendas, with 61% of our customers saying climate change strategies should not be a focus of the budget.

Let’s look at the stimulus priorities:

Q: What other stimulus measures would you like to see for businesses like yours in the 2021/2022 budget? (select 4 measures)

Rising consciousness of mental health

In recent years, the issue of mental health gained more recognition. As Reckon CEO Sam Allert noted,

“As a nation, we’re becoming much better at recognising the importance of delivering mental health support to the community. Let’s hope this recognition and action continues through 2023 and beyond.”

When we asked our customers, “Do you think the Federal budget should address provisions for small business mental health support?” 60% said yes, with the remaining 40% saying no.

Helping small businesses digitise and combat cyber threats

With the recognition that Australia is lagging behind the rest of the developed world when it comes to the digitisation of our business community, we wanted to know how local businesses felt about this phenomenon.

We were also interested in the rising wake of sophisticated cyber threats, which have dominated headlines of late, and whether they would like to see more government support.

The result was a resounding ‘yes’ – with 84% of respondents agreeing that more support was required. Only 16% didn’t think this was a priority necessitating concern.

Sam Allert commented on the resounding call for digitisation assistance,

“The vast majority of small business owners want to see government support to help them digitise, given how critical digital capacity is in modern business operations.

“COVID-19 restrictions over 2020/2021 meant we saw huge portions of Australia’s workforce and economy move into the digital space within the span of weeks. Since then, we’ve seen many small businesses undergo a challenging period of digital adjustment, transitioning operations and administration online.

“We’ve also witnessed large scale and sophisticated cybercrime rise sharply in prominence, threatening Australian businesses of all sizes. In light of this, it’s not surprising SMBs want to see more support in this area.”

Testing the general confidence of the small business community

We were also keen to understand how confident (or pessimistic) Australian SMBs were of the upcoming budget’s ability to mitigate their business concerns and provide adequate support.

We found that 90% of Australian small businesses were not confident that the Federal budget would deliver positive change.

Let’s wait and see what happens on Tuesday 25 October 2022 to understand what actually comes to pass and how well the SMB community has been catered for. Watch this space for a follow-up report on what the Federal Budget delivers, and what it doesn’t.

Leave a Reply