Registering for GST is a ‘must do’ for a variety of Australia businesses. This is mostly due to passing the GST turnover threshold, but there are also several scenarios where you will have to register regardless of your turnover. Let’s have a look at three common business cases where you might register for GST.

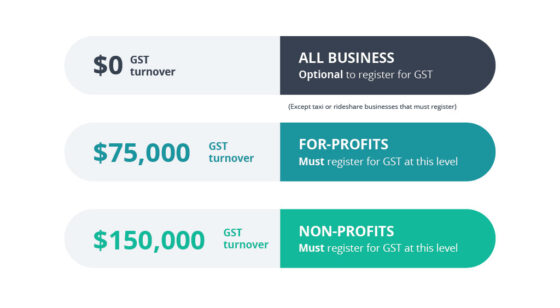

First, let’s take a look at the GST thresholds for Aussie businesses.

But not so fast! There are also other caveats and considerations outside of these strict rules that would also see you registering for GST, depending on your circumstances.

Before we look at three common scenarios where small business owners would register for GST, let’s see the rules laid out by the ATO:

You need to register for GST when:

- Your business has a GST turnover of more than $75 000 per year (or you project that you will).

- Your non-profit has a GST turnover of more than $150,000 per year (or you project that you will).

- You are a ride share driver.

- You choose to register for GST voluntarily.

So, how do some of the less straightforward scenarios play out in the real world?

Sandy registered for GST before her turnover reached the mandatory GST threshold.

1) Sandy the hairdresser

Approaching the GST threshold.

Sandy had been hairdressing as a freelancer for a few years before she registered for GST. When the GST first came in (in 1999), she was still driving to a client’s houses, or they could come to her flat to get their hair done.

Back in the 90s and 00s, Sandy still wasn’t earning nearly enough for GST to be mandatory, but she started thinking about registering in 2015, just after she opened ‘Fringe Benefits‘, a brick-and-mortar salon and began turning over much higher levels of cash.

Just before the 2016 reporting period, Sandy realised that (with a GST turnover of $72,000) registering her business for GST with the ATO, would be mandatory should she turnover just $3,000 more in GST.)

Since she was approaching the GST threshold, and anticipating surpassing it before EOFY, Sandy pre-emptively registered for GST. She was well-prepared when her business boomed in the pandemic aftermath, and she doubled her normal GST turnover.

Using Reckon’s handy calculator, Arnie the Uber driver can easily work out the GST for each ride.

2) Arnie the Uber Driver

The ride-share GST exception.

Arnie has had a few side businesses over the years and often juggled work and study. However, even in his other freelance gigs, Arnie never quite earned enough to register for GST.

Once Arnie decided to make a move to driving Ubers, he found himself earning around $35,000 per annum.

Arnie may be earning less than the GST threshold of $75,000, however he still needs to immediately register for GST, and thus charge GST to his passengers, as he’s classified as a ride share driver. This is an exception to the GST threshold rule.

3) Fern the freelance copywriter

Choosing to voluntarily register for GST.

After copywriting for a local business for a year or two, Fern decided she wanted to back herself and start her own freelance writing business.

Originally, she would pitch her services to businesses using her own name, with the understanding that she was a small sole trader with no employees. However, Fern found that businesses preferred larger service providers who were more established, and thus reliable.

To give off the impression that she was a larger organisation, Fern changed her business name to ‘Business Writers inc.’ and voluntarily registered for GST.

Now that her brand is more professional, and she includes GST on her invoices, she appears to be a larger entity than she is and benefits from repeat business and word of mouth clients.

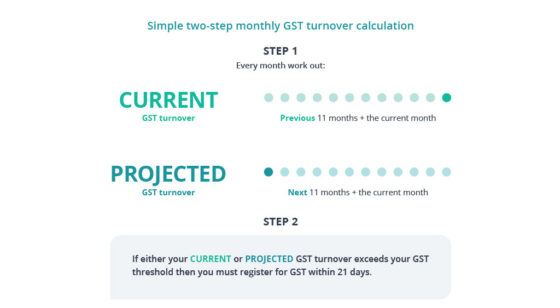

What’s my GST turnover?

To work out your GST turnover, simply follow the below chart.

How do I know if I’m projected to reach the GST threshold?

If you’re like Sandy the hairdresser and are not sure if you’re projected to reach the GST threshold, consult the below chart.

Notes:

- If you’re a member of a GST group: turnover includes members.

- Exclude amounts from sale of a business from PROJECTED.

- Exclude any sale made (or likely to be made) as a consequence of substantially or permanently reducing your business size.

- If your current GST turnover reaches or exceeds the GST turnover threshold, but the tax office is satisfied that your PROJECTED turnover will be below threshold, you do not have to register for GST.

How do you register for GST?

Now that we can see the various business scenarios that can lead you to registering for GST, how do you go about it? Thankfully, the process is rather simple.

All you need to do is visit the ATO Business Portal, which is the hub of most your interactions with the ATO. From there you can easily register for GST online.

You can also choose to have your bookkeeper or accountant register on your behalf. Find an advisor near you by using our free advisor search tool.

This advice is general in nature, Reckon does not give specific business advice and you should always consult with an accredited advisor.

Leave a Reply