We just kicked off day one of Xerocon — the vibe and the atmosphere in Sydney is fantastic!

Our leadership team — including new Chief Product Officer, Diya Jolly — shared the latest enhancements to our platform that will help accountants and bookkeepers grow their practice, help their clients succeed, and get the most out of Xero. These include several AI-powered product features and experiments that will help you work smarter and more efficiently.

We also demonstrated how we’re tackling common pain points like managing cash flow and payroll, to give you valuable time back to focus on other business priorities. If you weren’t able to attend Xerocon Sydney, here’s a recap of the enhancements we announced today.

Saving time for small businesses with predictive AI

We’re supercharging Xero with several new AI-powered features. Short-term cash flow in Xero Analytics Plus now includes predictions for recurring invoice and bill payments, giving small businesses a clearer picture of their potential future cash flow. Businesses can choose to include future invoice and bill payments, collectively or individually, within their cash flow forecast.

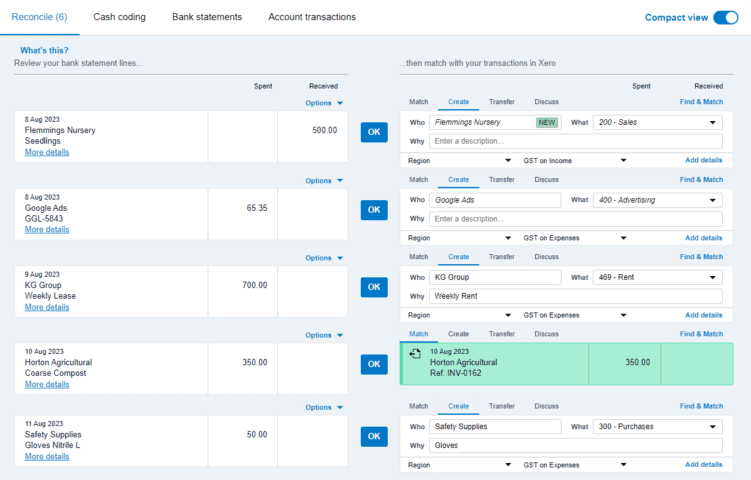

In the coming months, we’ll also be enhancing the way we use AI in bank reconciliation, to populate new contacts that aren’t already in your clients’ contact lists. This will reduce manual data entry and means that for clients new to Xero, bank reconciliation is made easier on day one.

Experimenting with generative AI to improve customer support

AI already powers a range of products across Xero. Beyond Analytics Plus and bank reconciliation, it’s also embedded in Hubdoc (with document capture and data entry), Xero Expenses and Xero Go. Collectively, our products are already saving customers a huge amount of time each year.

We’ve been following the recent explosion of interest and development in generative AI, which has revolutionised the ability of AI systems to create content. At Xerocon, we announced that we’re conducting two experiments in Xero using generative AI.

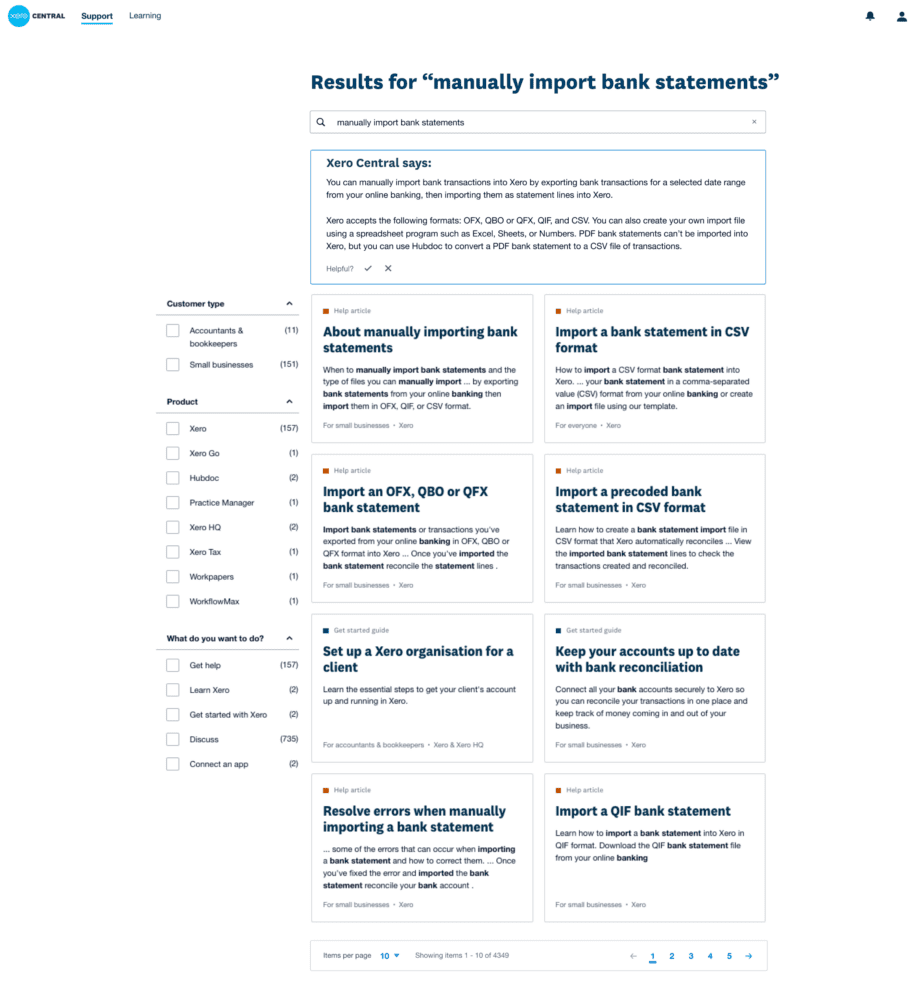

Xero Central is already powered by an AI tool that serves up the most relevant content to your search query. But we’re about to pilot a large language model — similar to the one ChatGPT uses — to surface the best answer from across all of our content in Xero Central. This will help us give you the answers you need for your clients faster.

We’re also experimenting with an AI assistant to help small businesses set up their Xero organisation during the onboarding process. This AI assistant will draw on Xero Central articles, providing relevant answers and information to key questions, and guiding them on how to complete tasks.

We’re excited to see how these experiments with generative AI can continue to help us improve the lives of our small business customers and their advisors.

Planday’s award interpretation tool now available to hospitality sector

Planday’s award interpretation tool can already be used by businesses paying staff within the retail and clerks awards, improving their confidence when it comes to managing payroll and rostering requirements.

We announced today that Planday has expanded its award interpretation tool, helping Australian small businesses who are paying staff under the three hospitality modern awards — hospitality, restaurant and fast food.

When Planday is connected to Xero Payroll, it gives businesses a real-time view of most labour costs compared to projected revenue, with daily forecasts and analytics. It also makes it easier for small businesses to manage staff shifts and communicate with teams.

A more seamless practice workflow for advisors

At Xerocon, we explained how we’re working to integrate all of our practice tools into one connected experience within Xero. Our vision is that in the future, Xero Practice Manager (XPM), Xero HQ and Xero Tax will be seamlessly connected, with no duplicates or double handling.

Connecting your practice tools will provide you with the foundation to be more efficient — you’ll have one client list, one staff list and one set of user permissions — all in one place. This will really streamline your workflows — and give you confidence that your data is accurate and your teams are all working from the same information, no matter what practice tool they’re using.

The first stage of this journey is to provide you with a single source of truth for your client records. New practices and those who only use Xero HQ can now access a single client record across their practice tools. As soon as your practice activates XPM or Xero Tax, you’ll have all your client records in there straight away.

For existing practices using XPM, Xero HQ and Xero Tax, we’ll start transitioning you to a single client record soon. The way you do this will depend on the complexity of your practice records, but we’ll provide you with the support of a reconciliation tool if needed as well as detailed instructions on how to make the transition.

A new invoice payments experience in Xero

We’re partnering with Stripe to create an embedded invoice payments experience in Xero. Stripe customers using Xero will be able to access this embedded experience later this year. The new experience will help small businesses manage more of their payments directly in Xero, as well as view payment transaction details and issue refunds to customers within Xero.

Our partnership with Stripe goes back a decade, and we’re building on this to add more flexible payment options for customers — both in-person and online. It’s also an opportunity for us to continue to speed up payments — we know that Xero customers who accept Stripe payments on Xero online invoices get paid up to twice as fast than those who don’t.

Day one is done and dusted, but there’s more to see

It’s been a huge day at Xerocon Sydney 2023, and we’re truly excited about the way we’re continuing to enhance our products — focusing on the areas we know are most important to you.

It’s been great to see so many accountants and bookkeepers from across the APAC region, and listen to your feedback on our products. But there’s plenty more in store for day two — enjoy the rest of Xerocon!

The post Product wrap from Xerocon Sydney 2023 appeared first on Xero Blog.

Leave a Reply