Right! There we have it folks – the Federal Budget for 2024 has dropped with a host of measures that look good for business owners and individuals, as well as some omissions that people were looking for in our pre-budget poll.

When we took a poll last week to gauge the temperature of small business owners ahead of the budget, we were able to home in on the most and least important budget inclusions.

To properly frame this budget, let’s first take a quick look at the government’s stated intentions and our pre-budget study. From there, we can review the most important budget announcements that may affect you.

How did the government frame the 2024 Budget?

In the interest of a brief snapshot of the Budget in the government’s own words, let’s look at the primary pillars.

In his Budget speech, Treasurer Jim Chalmers stated that the government’s main priorities are:

- Helping with the cost of living

- Building more homes for Australians

- Investing in a Future Made in Australia – and the skills and universities we’ll need to make it a reality

- Strengthening Medicare and the care economy

- Responsible economic management, which is set to produce another surplus and help fight inflation

What were small business owners looking for ahead of the Budget?

It’s worth taking a moment to see what small business owners placed importance upon before the budget was released, and which topics were of little interest. Have a quick flick through our pre-budget article to get a good grip on business priorities.

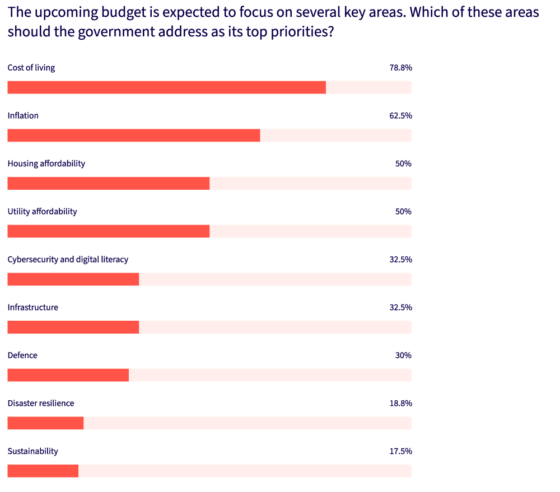

Here were the top priorities for SMEs, with the highest priority placed upon cost of living (79%), inflation (63%), housing affordability (50%), and utility affordability (50%):

What else did we find out in our pre-budget business poll?

- 73% were looking for personal income tax cuts

- 86% were hoping the budget would address inflation

- 53% were asking for an extension to the instant asset write-off

- 86% were wanting to see measures to bolster cybersecurity

- 51% were unconcerned with climate change while 15% were very concerned

- 92% do not believe enough is being done to support the prosperity, growth, and resilience of small businesses

What were the most important budget measures announced for small businesses?

Now, I don’t think anyone could say this was a highly small business focused budget. There were certainly several omissions here for many SMEs, and I’m sure many were hoping for more direct support.

However, there was also a decent level of crossover when you compare the pre-budget wish list to the actual announcement.

Let’s do a quick recap of what was in this year’s budget for business owners.

1) The instant asset write-off has been extended

In a move that will delight those who are looking to purchase new equipment for their businesses, the instant asset write-off has been extended for another year.

With 53% of our survey respondents looking for this, many business owners will be pleased by the extension.

If your business has a turnover of less than $10 million, your ability to immediately deduct the full cost of eligible expenses, costing up to $20 000, will continue. This means that SMEs can write off multiple pieces of new business equipment immediately.

As Chalmers commented,

“We want Australian small businesses to share in the big opportunities ahead as well, that’s why we are extending the $20,000 instant asset write-off until 30 June 2025, providing $290 million in cash flow support for up to 4 million small businesses.”

2) Energy rebates for households and eligible small businesses

One of the bigger announcements in the budget was the rebates for electricity costs. With 50% of small businesses looking for better utility affordability, this should be a welcomed move.

Further than financial relief, the rebate is estimated by the government to “directly reduce headline inflation by around 1/2 of a percentage point in 2024–25 and is not expected to add to broader inflationary pressures.”

This should go some way to appeasing the 86% of small businesses that wanted to see measures to address inflation.

The new power bill relief will mean:

- Every household (around 10 million) will receive a $300 power bill rebate

- Eligible small businesses (around 1 million) will also receive a $325 rebate on their power bills throughout the year

3) Tax cuts for all Australians

The previously announced, and revised, stage three tax cuts are now in play. This should please the 73% of small business owners (particularly sole traders) who were looking for personal income tax cuts.

From 1 July, all 13.6 million Australian taxpayers will receive a tax cut, with new rules to cover more earners across the spectrum.

The government will also now:

- Reduce the 19% tax rate to 16%

- Reduce the 32.5% tax rate to 30%

- Increase the 37% tax rate income threshold from $120,000 to $135,000

- Increase the 45% tax rate income threshold from 180,000 to $190,000

3) Measures to address the cost of living and inflation

With the cost of living at the forefront of business owner’s minds – coming in as the single most important budget measure (79%) Australians were certainly looking for meaningful relief to rampant living cost pressures.

According to the stated aim of the budget, as framed by Jim Chalmers,

“The number one priority of this government and this Budget is helping Australians with the cost of living,” Chalmers told Parliament.

“Responsible relief that eases pressure on people and directly reduces inflation.”

With a number of initiatives aimed to ease inflation as well as living costs, on top of a $9.3 Billion budget surplus, the intent is clear. However, with this aim in mind, not everyone agrees that the Budget delivers on its promise.

For example, shadow treasurer, Angus Taylor, has accused Labor of offering up a “windfall surplus” that was built through “higher tax receipts from low unemployment and strong commodity prices, rather than through fiscal astuteness”.

There are also a host of dissenting voices in the economic world who have varying opinions on how well the budget actually addresses inflation.

The major measures intended to reduce inflation and help alleviate the cost of living include:

- Power bill relief

- Income tax cuts

- Housing and rent support

- Cheaper medicine

- Student debt relief

- Examining supermarket pricing and competition

- Energy transition assistance

5) Addressing housing pressures

With 49% of surveyed businesses listing housing affordability as a top priority, these business owners may be pleased to see a number of inclusions here.

Although, it must be said there’s no silver bullet here, and much of the allocated funds will be aimed at those experiencing severe, not moderate, housing stress.

To address housing affordability the government has announced:

- $6.2 billion invested in existing housing initiatives. Such initiatives include further expansion to the National Housing Accord, Housing Australia Future Fund and Social Housing Accelerator.

- Support for more homes. A further $1 billion will be provided to states and territories to help deliver more housing and associated utilities and roads.

- More rent assistance. Almost $2 billion will be injected into adding a further 10% to the Commonwealth Rent Assistance program, building on the previous 15% rise made in 2023.

- More support for vulnerable Australians. $9.3 billion will be invested in a new five year National Agreement on Social Housing and Homelessness by working with states and territories.

6) The push for a ‘Future Made in Australia’

In news that will mainly affect the larger businesses in Australia – and those more specifically in manufacturing, rare mineral mining, and renewable energy – there’s a lot up for grabs.

The government has pledged almost $23 billion for a range of measures that look to boost Aussie manufacturing, reach net zero more quickly, support green energy such as hydrogen, and capitalise on critical minerals for products like batteries.

According to Chalmers, “Australian energy can power it, Australian resources can build it, Australia’s regions can drive it, Australian researchers can shape it and Australian workers can thrive in it. Our $22.7bn Future Made in Australia package will help make us an indispensable part of the global economy.”

Of course, this will be a politically contentious proposition, with the opposition labelling much of it a ‘handout to billionaires’.

Leave a Reply