Xero Payroll is already a valuable tool, helping you manage your payroll and accounting, all in one place. Not to mention features like automatic reporting directly to IR, and automated tax and KiwiSaver calculations, that can help you save a stack of time.

But recently, we’ve been listening to your feedback about Xero Payroll and have made some additional investments to help you and your clients become more efficient, and give you more control and flexibility. Let’s take a look at what improvements we’ve made lately, as well as all the good stuff that’s on the way.

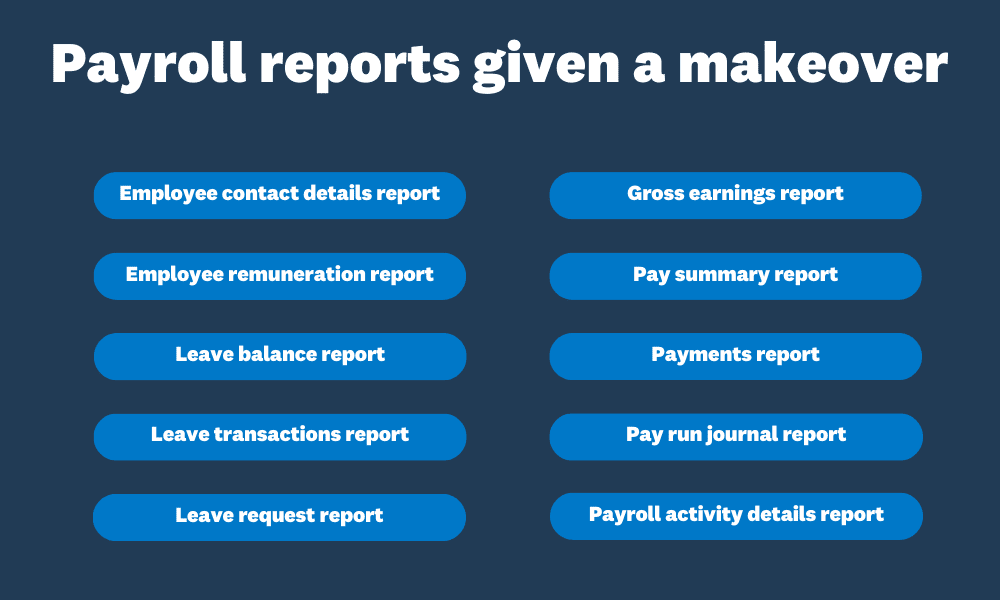

Payroll reports have been given a makeover

If you’re using Xero Payroll, you may have already seen some of the refreshed experiences when loading common payroll reports. These updates ensure their look and feel is consistent with our recently modernised accounting reports.

We’ve also introduced some new features to these reports, including a new group and summarise filter, the ability to reorder columns, and an option to export a report to Google Sheets. Here are a list of the reports that have been given a makeover, and now have the same look as other reports in Xero.

Xero Payroll setup, including employee details, made easy

We know that getting started with Xero Payroll is a daunting task for small businesses, as well as accountants and bookkeepers looking to onboard new clients. So we want to make it easier than ever for them to get started.

That’s why we’ve made changes to the guided onboarding process. This not only makes it a seamless experience, but gives small businesses and their advisors the confidence that they’re entering the right information the first time, so they can pay employees correctly and start processing pay runs as soon as possible.

We’ve also made changes across the following areas of the Xero Payroll setup experience:

- Bank and chart of accounts: you can now create and nominate accounts without navigating to other areas of the product

- Pay frequency: you can now create pay frequencies from the setup screen. We’ve also changed the name ‘pay calendar’ to ‘pay frequency’ for additional clarity

Our teams are also working on making it easier to add payroll filing details, and review default KiwiSaver and superannuation settings, from the payroll overview screen. Stay tuned for when these improvements will go live.

This is only the beginning: even more changes are on the way

We’re excited to give you a sneak peek into some other significant updates we’ve made, based on your feedback.

Soon, Xero Payroll admins will be able to tailor the working patterns of employees working non-traditional hours.

The idea of traditional working hours has evolved over the last few years with the rise of flexible working arrangements, so we’re creating new working pattern templates in Xero Payroll, to help you record the hours your employees or clients are actually working.

Small businesses and advisors will also be able to enter more information about employee’s contracted work patterns, digitising the process to make it easier to manage their payroll.

Here are some other features you can expect:

- You’ll be able to specify an employee’s employment type and set up payroll to match their salary and work patterns

- You’ll have the ability to track and report FBAPS leave in days, and annual leave in weeks, which better aligns to the Holidays Act (FBAPS includes family violence leave, bereavement leave, alternative holidays, public holidays, and sick leave)

We can’t wait to share more as these updates roll out. If you’re an accountant or bookkeeper that would like to learn more, we hope you’ll join us for the New Zealand Roadshow coming up in July 2024. See you then!

The post How we’re bolstering Xero Payroll in NZ with new value appeared first on Xero Blog.

Leave a Reply