As a business owner, you have likely heard of the term sales tax before. Heck, you might have even heard about sales tax nexus before. But, have you heard of economic nexus?

If you have in-person or online sales, it’s time to listen up and learn about economic nexus. Read on to learn what is economic nexus, if your sales fall into economic nexus territory, and what states have economic nexus rules.

What is economic nexus?

Economic nexus is when a seller must collect sales tax in a state because they earn above a sales or revenue threshold in that specific state. Economic nexus is most common for out-of-state sellers.

Economic nexus is basically sales tax nexus (which you’ll read more about later) for online sales. With online sales becoming more popular and common, more states are creating economic nexus laws.

Each state with economic nexus laws sets its own threshold that businesses must meet to have economic nexus. States’ thresholds for economic nexus vary. However, the most common economic nexus threshold is when a seller reaches $100,000 in sales or 200 transactions in a state annually.

Due to new Supreme Court rulings in the South Dakota v. Wayfair case, both physical and economic presence in a state (e.g., location, employees, inventory) creates sales tax nexus. With the ruling, even if you don’t have a physical presence in a state, you still need to collect and remit sales tax to the applicable state.

Economic nexus can include:

- Physical presence (e.g., brick-and-mortar location)

- Digital presence (e.g., online sales)

Other nexus terminology

Before you can dive into more details about economic nexus, you need to know a little more about other sales tax terms. Here’s your crash course on sales tax terminology.

Nexus

Nexus refers to the amount of presence your business has in a location, like a state or city. For example, you might have nexus in a state if you sell goods to customers in that state.

Sales tax

Sales tax is a pass-through tax that businesses collect from customers at the point of sale. Customers purchasing products or services from a business are responsible for paying sales tax.

Businesses are responsible for collecting, depositing, and reporting the sales tax.

Sales tax nexus

Sales tax nexus determines whether your business has presence in a location (e.g., city or state) to collect sales tax from customers. Certain factors determine if you have sales tax nexus in an area. Factors and sales tax laws by state can vary.

Some things that create sales tax nexus include:

- Your office, warehouse, store, or business location

- Employees, contractors, salespeople, or other personnel

- Amount of sales

- Trade show sales

For example, if you sell goods or services in Cleveland, you must file and pay Ohio sales taxes.

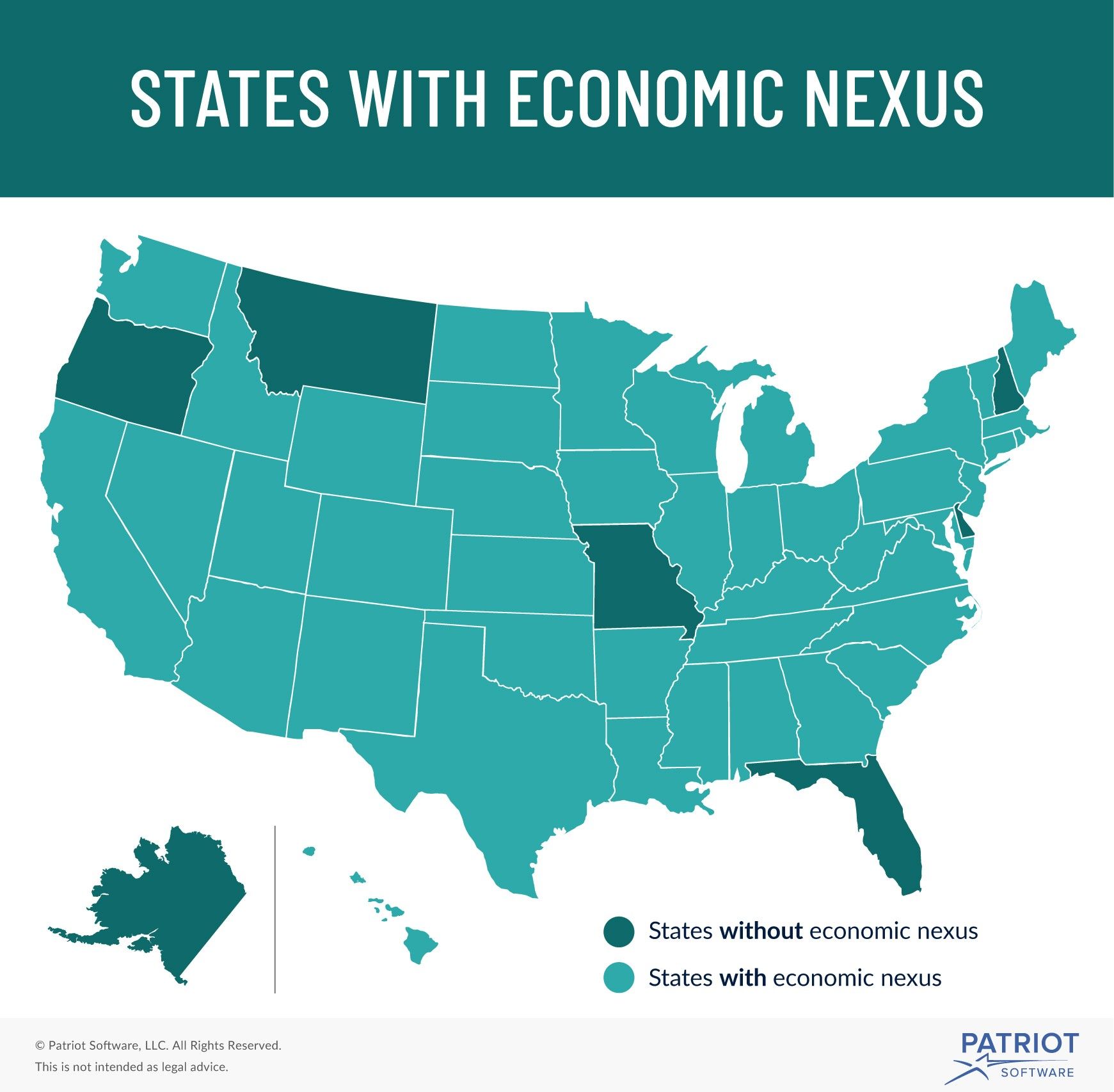

States with economic nexus

With nexus laws expanding, more states have jumped on board the economic nexus sales tax train. As of late 2019, there are 43 states (plus Washington D.C.) with economic nexus rules.

Only two states, Florida and Missouri, have not enacted an economic nexus law yet. Five out of the seven remaining states without economic nexus laws do not have sales tax to begin with.

The states below do not have any economic nexus laws in place:

- Alaska

- Delaware

- Florida

- Missouri

- Montana

- New Hampshire

- Oregon

Keep in mind that five of the above states do not have sales tax. These states are Alaska, Delaware, Montana, New Hampshire, and Oregon.

Again, 43 states plus D.C. do follow an economic nexus law. The following states have some form of economic nexus:

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Nebraska

- Nevada

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Seller’s responsibilities with economic nexus

If you’re a business owner and sell products or services in other states, you need to know your obligations. Otherwise, you could be subject to fines and cause your business bigger issues down the road.

As a seller, you must do the following:

- Determine the states you have economic nexus for

- Evaluate economic nexus thresholds

- Determine states where you meet the threshold

- Register as a seller in each state where you have economic nexus (e.g., apply for a sales tax permit)

- Collect applicable sales taxes from customers

- File and remit sales tax

Economic nexus: Chart

Don’t have time to skim through a bunch of information about your state’s economic nexus rules? No worries. Take a look at our handy chart below for must-have economic nexus details by state.

| State | Economic Nexus Law? | Threshold Amount |

|---|---|---|

| Alabama | Yes | $250,000 in sales |

| Alaska | No (no sales tax) | N/A |

| Arizona | Yes | $200,000 (2019), $150,000 (2020), $100,000 (2021) in sales |

| Arkansas | Yes | $100,000 in sales or 200 transactions |

| California | Yes | $500,000 in sales |

| Colorado | Yes | $100,000 in sales |

| Connecticut | Yes | $100,000 in sales and 200 transactions as of July 1, 2019 |

| Delaware | No (no sales tax) | N/A |

| Florida | No | N/A |

| Georgia | Yes | $250,000 in sales or 200 transactions. As of January 1, 2020, the threshold will change to $100,000 in sales or 200 transactions |

| Hawaii | Yes | $100,000 in sales or 200 transactions |

| Idaho | Yes | $100,000 in sales |

| Illinois | Yes | $100,000 in sales or 200 transactions |

| Indiana | Yes | $100,000 in sales or 200 transactions |

| Iowa | Yes | $100,000 in sales |

| Kansas | Yes | N/A; all businesses that sell in the state have economic nexus |

| Kentucky | Yes | $100,000 in sales or 200 transactions |

| Louisiana | Yes | $100,000 in sales or 200 transactions |

| Maine | Yes | $100,000 in sales or 200 transactions |

| Maryland | Yes | $100,000 in sales or 200 transactions |

| Massachusetts | Yes | $100,000 in sales |

| Michigan | Yes | $100,000 in sales or 200 transactions |

| Minnesota | Yes | $100,000 in sales or 200 or more retail sales |

| Mississippi | Yes | $250,000 in sales |

| Missouri | No | N/A |

| Montana | No (no sales tax) | N/A |

| Nebraska | Yes | $100,000 in sales or 200 transactions |

| Nevada | Yes | $100,000 in sales or 200 transactions |

| New Hampshire | No (no sales tax) | N/A |

| New Jersey | Yes | $100,000 in sales or 200 transactions |

| New Mexico | Yes | $100,000 in sales |

| New York | Yes | $500,000 in sales and 100 transactions |

| North Carolina | Yes | $100,000 in sales or 200 transactions |

| North Dakota | Yes | $100,000 in sales as of January 1, 2019 |

| Ohio | Yes | $100,000 in sales or 200 transactions |

| Oklahoma | Yes | $100,000 in sales |

| Oregon | No (no sales tax) | N/A |

| Pennsylvania | Yes | $100,000 in sales |

| Rhode Island | Yes | $100,000 in sales or 200 transactions |

| South Carolina | Yes | $100,000 in sales |

| South Dakota | Yes | $100,000 in sales or 200 transactions |

| Tennessee | Yes | $500,000 in sales |

| Texas | Yes | $500,000 in sales |

| Utah | Yes | $100,000 in sales or 200 transactions |

| Vermont | Yes | $100,000 in sales or 200 transactions |

| Virginia | Yes | $100,000 in sales or 200 transactions |

| Washington | Yes | $100,000 in sales |

| Washington D.C. | Yes | $100,000 in sales or 200 transactions |

| West Virginia | Yes | $100,000 in sales or 200 transactions |

| Wisconsin | Yes | $100,000 in sales or 200 transactions |

| Wyoming | Yes | $100,000 in sales or 200 transactions |

Searching for a simple way to track your state’s sales tax and business transactions? Patriot’s accounting software has you covered. Streamline the way you record your business’s income and expenses and get back to your small business. Start your no-obligation free trial today!

This is not intended as legal advice; for more information, please click here.

Leave a Reply