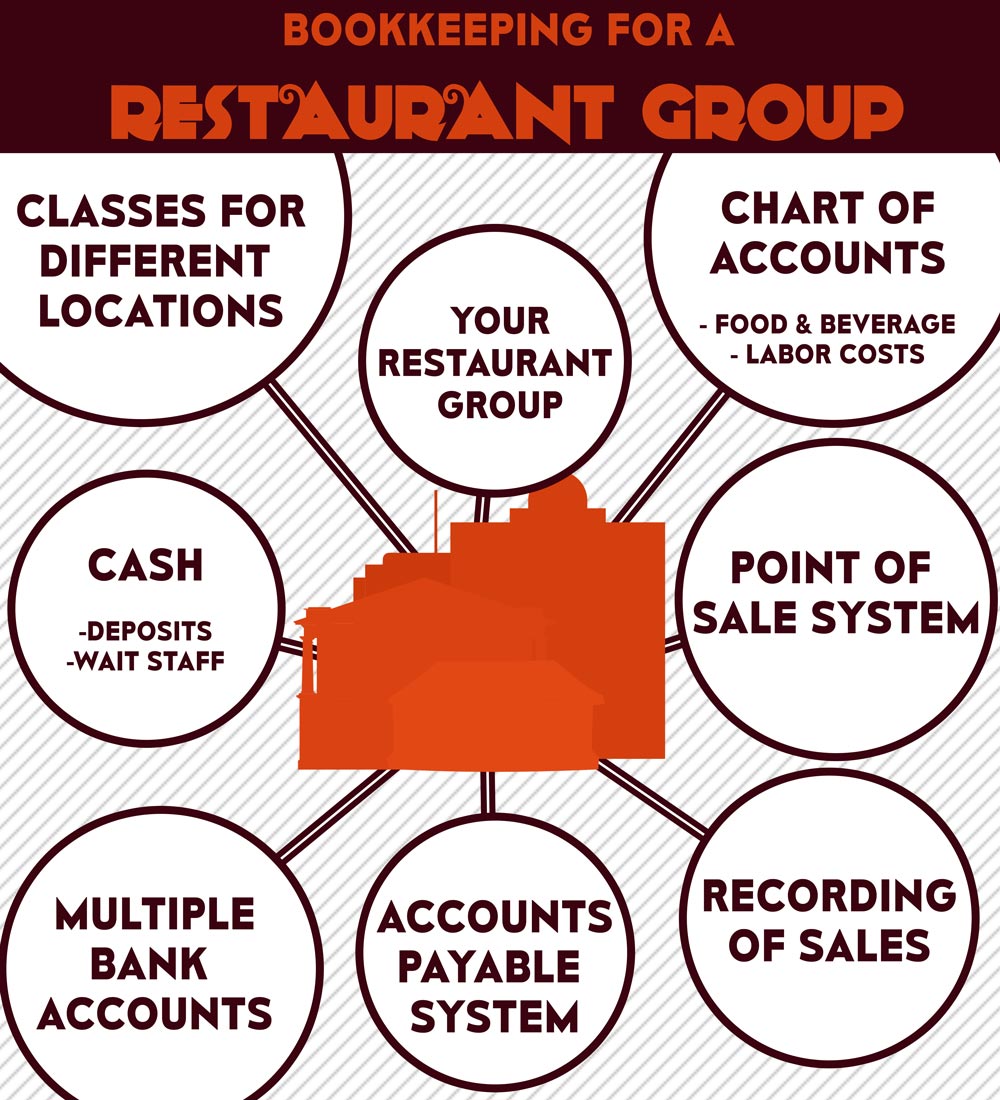

Bookkeeping for a restaurant group that has different locations and different restaurants under it can be tricky. There are tight margins to maintain.

In addition, spoilage, theft, and inventory must be controlled to maintain profitability. In order to do this, the books must work like a well-oiled machine.

There can’t be any flukes or the whole machine is compromised and margins decrease. Follow this guide to monitor profits and grow your restaurant locations.

Keep Your Chart of Accounts Simple

The chart of accounts is very important to restaurant accounting, especially when you’re working with multiple locations.

This is what’s going to generate categories for expenses and income; it will also determine how reports look.

It’s important to avoid over-complicating the chart of accounts.

If it’s complicated, generally the reports will not be understandable, and an owner may have difficulty figuring out what all the numbers mean. Here are our recommendations for a restaurant:

Food and beverage – separate income and cost of goods sold into food, alcoholic beverages, and non-alcoholic beverages. This means that food and beverage ratios can be computed a little bit easier.

Labor costs – this is one of a restaurant’s highest expenses. Keeping close track can help cut labor costs and manage how it’s affecting the bottom line.

Use Your POS System as a Tool

The restaurant POS system that you choose for your restaurant should not be taken lightly. Proper set-up of the POS system takes a long time. However, the amount of time that it takes to set up is completely worth it.

Knowing the ins-and-outs of the system means the reports produced all outline key metrics that the business has deemed important. Having the right information is worth more than having a lot of information.

Many restaurants experience theft. Having a restaurant bookkeeping system that is reporting correctly can help keep track of daily deposits from the register to the bank. If the cash reports don’t match, something is wrong.

The daily sales summary report can be a good report to check every day to make sure theft has not become a problem in a restaurant.

Our most recommended restaurant POS system is NCR Aloha Restaurant POS software.

However, depending on the size of your restaurant and your specific needs there are some good options out there. I would recommend going with one of the major players in the POS market as they come and go so quickly, you want to go with a reputable company.

I have seen restaurants go through up to three POS systems before they finally found us and asked for advice.

Aloha restaurant POS software is very easy to program, use, and train your staff on. The reporting that the system offers is very good and should have most everything you will want.

If you find you need custom financial reporting Aloha can also create custom reports to meet your needs. The software also offers controls of inventory and cash to manage theft. Lastly, and most importantly is that Aloha has always offered excellent customer service.

Monitor Your Daily Sales Summary

The daily sales summary report tells you everything that happened in your restaurant on a given day.

As a multi-location restaurant you will need to record the daily sales for each restaurant as a separate journal entry. You can create and record a daily sales journal entry for each location.

This includes not only sales, but payments and comps as well. More importantly, it’s also a reflection of how you are being paid. Payments come in as cash, check, credit cards, and comps.

You need to create a separate sales journal entry for each location and each day to mirror your bank activity. Since your merchant credit card processing occurs on a daily basis you must mimic this in your accounting system.

Each journal entry should be set up as a QuickBooks memorized transaction, which will reduce data entry. There is an external software plugin for Aloha that will allow for your daily sales journal entry to be imported into QuickBooks.

Just remember that you need to assign classes to the income and expense items in order for your financial reports to work properly.

The daily sales summary needs to be in balance every day, or reconciling the books and getting accurate information from QuickBooks will prove to be very difficult or even be unsuccessful.

Without the proper information from QuickBooks, your company may be losing money without even knowing it.

Accounts Payable System

Managing the accounts payable system can be a huge task for a restaurant, especially for owners who have restaurants with multiple locations.

You want to centralize all the invoices at one location, either an office at one of the restaurants or a separate office. All invoices then need to be entered into QuickBooks and filed.

A filing cabinet still works but we really prefer to move the filing to a digital system.

Once bills are entered they then need to be paid. I would recommend printing checks directly from QuickBooks or using QuickBooks online bill pay feature.

To make sure that bills are being entered correctly:

- Send all paperwork to one main location;

- Input all invoices into QuickBooks;

- Use a bill pay feature synced with QuickBooks to pay bills.

Pro Tip: As a precaution, you should never let a bookkeeper have the ability to sign checks and send a bill pay. This offers too much of an opportunity for theft. Instead, allow them to create the checks and print them, then have the owner sign off.

Create Multiple Bank Accounts

After seeing several restaurant groups come up with different bank account solutions I have come up with a good recommendation.

If you own a restaurant with several locations I would have the following bank accounts:

- operating checking

- payroll checking

- general savings account

Pro Tip: I would not recommend setting up separate checking accounts for each location. The only time I would separate checking accounts is if you had several different restaurant groups.

Here’s our recommendation:

- Send all cash and credit card deposits from the various locations to your operating account.

- Then, manually move money from the operating account to the payroll account as needed.

- Finally, have a savings account for additional funds, and link it to the operating and payroll accounts as overdraft protection. If the savings account can’t be used for overdraft protection, then set up a credit card that can offer overdraft protection.

Use Classes For Different Locations

It is important for restaurant bookkeeping management to figure out how to account for the income and expenses for each restaurant location.

If you are using QuickBooks as your accounting system you should use the QuickBooks class tracking feature to separate the income and expenses for the various restaurant locations.

You can turn on class tracking in QuickBooks from the menu bar by selecting:

edit/preferences/accounting/company preferences tab/use class tracking.

You will also notice a check mark; prompt to assign classes. It might not be the worst idea to check this box so that you are sure to assign a class to each transaction.

If you properly use class tracking you can now report on the profitability of each restaurant location. You can run a profit & loss by class which will show you a profit and loss for each location, as well as a summary of all locations.

This will help you track the profitability of each restaurant as well as the restaurant group as a whole.

You should use this profit and loss report to look for possible issues as well as opportunities. If you see an unclassified column it means that you did not assign a class to those particular items.

Dealing with cash in a restaurant can be a concern. I will breakdown my advice into two areas;

I recommend keeping your cash drawer at a predetermined amount that nobody knows except the owner and manager. A manager should check and sign off on each wait staff member’s checkout. All cash should be handled by the manager, both in and out of the cash drawer.

My recommendation is that the manager or owner handles the nightly cash deposit. I would then have your bookkeeper check the nightly bank deposit vs the POS daily sales report to look for discrepancies.

Cash can then be deposited into the bank for several days sales as long as that information is documented.

Bookkeeping for a multi-location restaurant can be a difficult task. You must be an experienced restaurant bookkeeper to implement a restaurant specific bookkeeping system that will work. It is integral that you keep the management of cash flow in check.

There is a lot going on and you really need an experienced restaurant bookkeeper to build and maintain the bookkeeping system.

The owners and various restaurant managers will also play a critical role in the bookkeeping system. However, setting up your restaurant bookkeeping system correctly will allow you to scale your restaurant concept.

Outsourcing your bookkeeping provides financial reporting so you can assess the profitability of your restaurant locations and determine if opening a new location is recommended.

With over a decade of restaurant bookkeeping and management experience we have developed a pretty solid bookkeeping system for multi-location restaurants.

Leave a Reply