Young women are risking their retirement ‘security’ by opting out of their workplace pensions in higher numbers than men, according to a new study.

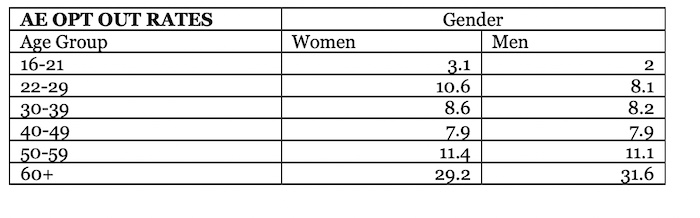

Analysis by Royal London of its auto-enrolment book revealed a spike in opt outs with 10.5% of women aged 22-29 opting out of their workplace pension, compared to 8.1% of men in the same age group.

The mutual insurer warns that if this trend continues it could mean significant challenges for women in their twenties and thirties when they get to retirement.

This will be exacerbated by many leaving the workforce to look after children and only returning to work on a part time basis.

The high cost of childcare means some women do not feel able to save for retirement, it says.

While the difference between male and female opt outs is stark in the 20-29 age group it gradually declines from the age of 30. After the age of 60 the picture changes with significantly more men than women opting out.

Source: Royal London

Helen Morrissey, pension specialist at Royal London, said: “The data highlights a spike in women opting out of pension saving in their 20s and 30s, most likely as they face other commitments like childcare or saving for a house.

“While this may seem like a good idea for them in the short term to fund other priorities, opting out of a pension will only lead to greater financial problems in the future.”

Leave a Reply