If you use a double-entry bookkeeping system, you know that every account you debit requires you to credit the corresponding account, and vice versa. But what happens when the transaction affects more than two accounts? It’s time to create a compound journal entry.

A compound journal entry may sound fancy, but it’s actually a pretty easy concept to master. Read on to learn about compound journal entries and see actionable examples.

What is a compound journal entry?

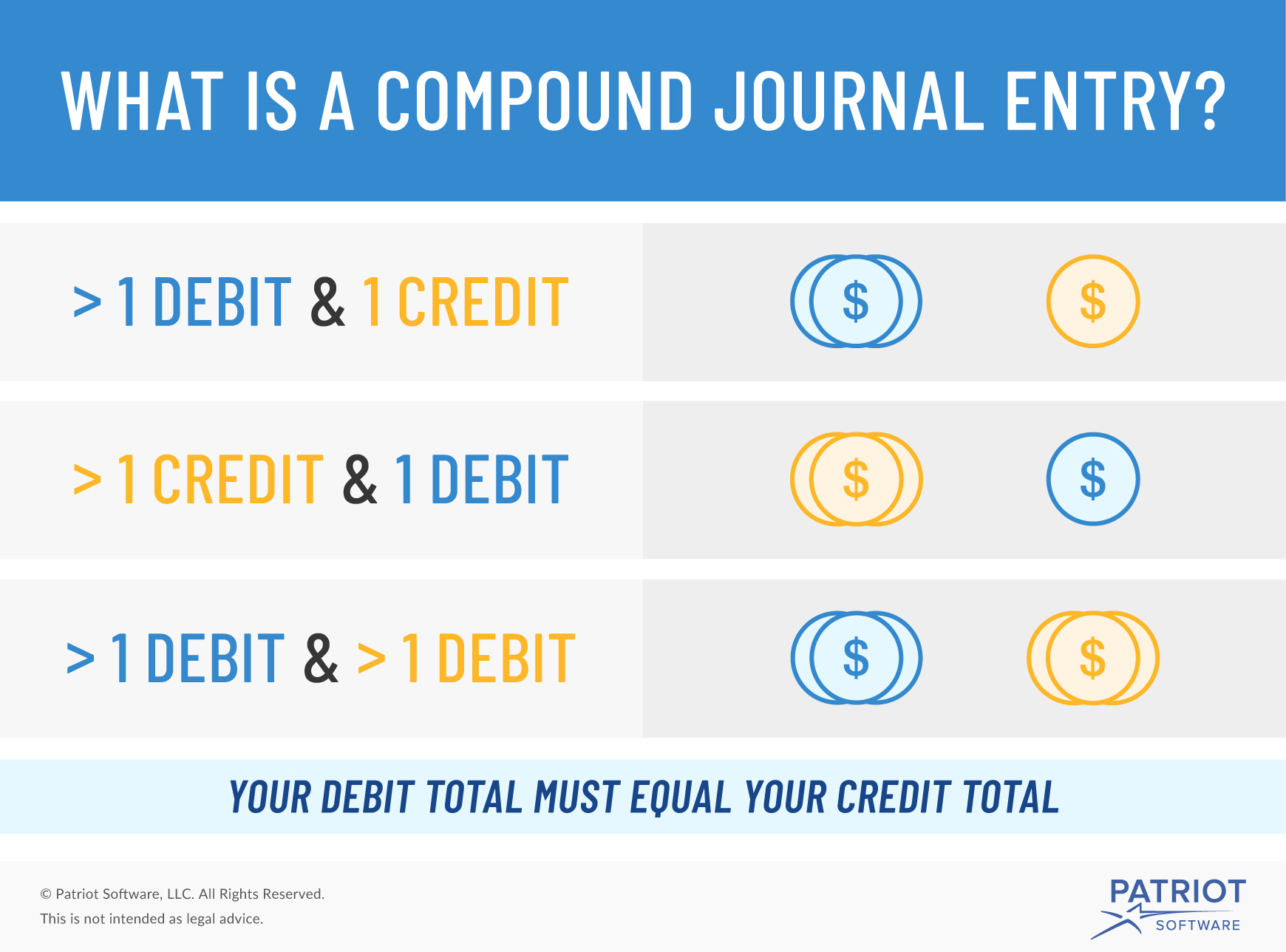

A compound journal entry is an entry involving more than two accounts. In a compound journal entry, there are two or more debits, credits, or both. Rather than making separate journal entries for the same transaction, you can combine the debits and credits under one entry.

Keep in mind that your debits and credits must be equal in a compound journal entry.

If you have more than one debit and only one credit, the sum of your debits must equal the credit. Likewise, if you have more than one credit and only one debit, the sum of your credits must equal the debit.

Simple vs. compound journal entry accounting

If you use double-entry bookkeeping, you will more than likely need to create both simple and compound journal entries.

So, what’s the difference?

Whereas a compound journal entry involves more than two accounts, a simple journal entry only involves two accounts. To make a simple journal entry, simply debit one account and credit the corresponding account.

Here’s how a simple journal entry looks:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| X/XX/XXXX | ABC XYZ | X | X |

And, here’s a compound entry example:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| X/XX/XXXX | ABC CBA XYZ | X X | X |

When do you need to use compound journal entries?

You might be wondering when and if you would need to use a compound entry in your small business.

Create a compound journal entry anytime a transaction involves more than two accounts. Here are some examples:

Learn more about each of these transactions by taking a look at our compound journal entry examples below.

Compound journal entry examples

There are a number of times you may need to make a compound journal entry. Here are a few common scenarios you may come across in your business.

Credit card transactions

If you accept credit card payments from customers, you know that you also have to foot the bill for credit card fees. And, that means you must record those fees in your books.

At the minimum, a credit card transaction deals with Cash, Credit Card Expense, and Sales accounts. If the credit card company doesn’t pay you immediately, you also have to deal with additional accounts, but we’re not going to get into all of that.

Here’s a compound journal example for recording credit card transactions:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| X/XX/XXXX | Cash Credit Card Expense Sales | Credit card sales | X X | X |

Multiple petty cash purchases

Do you have a petty cash fund in your business? If so, you may make multiple transactions when withdrawing money from the account.

Instead of wasting time recording separate entries, combine them into one compound journal entry.

For example, you withdraw money from your petty cash account to pay for office supplies and furniture. You would debit both your Office Supplies and Furniture accounts and credit your Petty Cash account.

Take a look at how a compound journal entry for petty cash accounting would look:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| X/XX/XXXX | Office Supplies Furniture Petty Cash | Petty cash used for business expenses during period | X X | X |

Business loan payments

Did you take out a business loan? If so, you know that a portion of your loan payments goes toward interest. Not all of your payment goes toward your loan balance.

You can create a compound journal entry for business loan payments that looks like the following:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| X/XX/XXXX | Loans Payable Interest Expense Cash | Business loan ABC payment | X X | X |

Payroll

Regardless of the number of employees you have, payroll accounting involves a number of different accounts. Why? Because when you run payroll, you need to withhold money for taxes and other deductions (e.g., health insurance premiums).

Employers don’t pay employees their gross wages. Instead, they use gross wages to calculate and withhold FICA tax, federal income tax, and (if applicable) state and local income tax.

Here’s a compound entry example for payroll accounting:

| Account | Debit | Credit |

|---|---|---|

| Gross Wages | X | |

| FICA Tax Payable (Employee) | X | |

| Federal Income Tax Payable | X | |

| State Income Tax Payable | X | |

| Payroll Payable (Net Wages) | X |

As you can see, all of the tax accounts are payable accounts. This is because you must remit these taxes to the appropriate agencies. And, the employees’ net wages are also a payable account because you have not yet paid the employees. You will need to create new journal entries when you pay the agencies and your employees.

Sales tax

Most business owners are responsible for collecting sales tax from their customers and remitting it to their state. You must use a compound entry for sales tax accounting.

Because you do not keep collected sales tax, you must record received funds in a Sales Tax Payable account. You also need to record the sale and the cash you receive.

Here’s how a compound journal entry would look when you make a sale and collect sales tax:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| X/XX/XXXX | Cash Sales Sales Tax Payable | Collected sales tax | X X | X |

Looking for a simpler solution for managing your books? Patriot’s online accounting software has you covered. Track your expenses and income, accept credit card payments, record payments, and more. Why not start your free trial today?

This is not intended as legal advice; for more information, please click here.

Leave a Reply