There are two types of people come tax time. You’ve got the ones who are excited and file their taxes on the first day they can. And, you’ve got the ones who moan and groan and file at the last minute. Which one are you?

Maybe you’re the second one—the person whose least favorite thing in the world is filing your small business tax return. If that’s the case, you need a small business tax preparation checklist.

Or maybe you’re the first one—the one who can’t wait to file your company tax return. In that case, maybe you made your own small business tax return checklist already and want to compare.

Whatever the case, read on to check out our small business tax prep checklist … and say goodbye to procrastination.

Small business tax preparation checklist

Some might argue that checking things off their to-do list is fun. Fun or not, using a checklist can help you stay organized and accurate. And who wants to miss out on tax deductions or pay penalties due to a sloppy return?

Use this small business tax preparation checklist this tax season to help you stay on top of your responsibilities:

1. Pick your poison (tax form, that is)

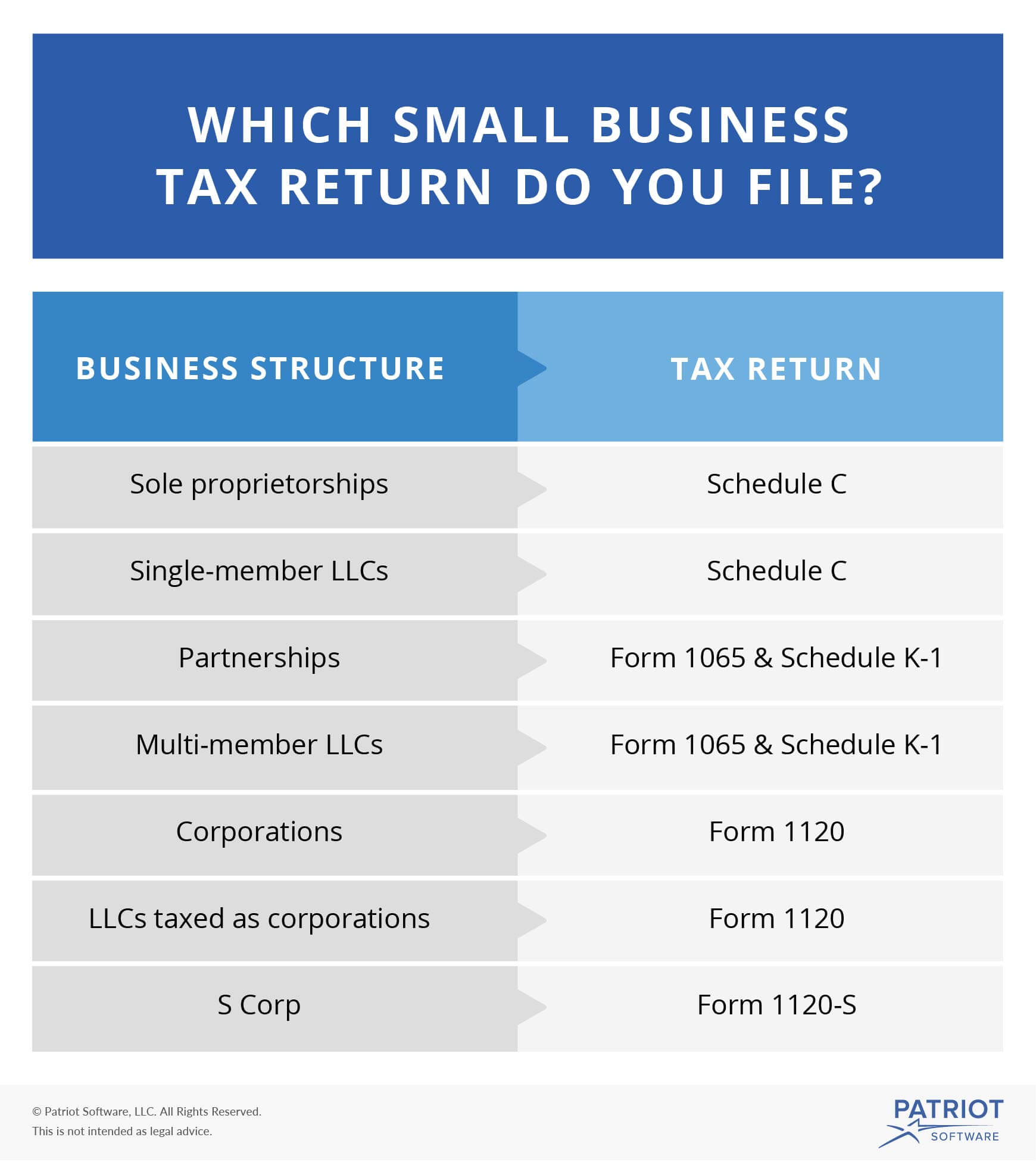

Your first task on the small business tax prep checklist is finding out which form you need to file. There isn’t a standard form that all small business owners use—your form depends on your business entity.

Are you a sole proprietor or single-member LLC owner? Use Schedule C, Profit or Loss from Business, and attach it to your personal income tax return (Form 1040).

Or, are you a partner in a partnership or part owner in a multi-member LLC? If so, file Form 1065, U.S. Return of Partnership Income, and attach Schedule K-1 (Form 1065).

And for those of you needing a corporate tax preparation checklist, your tax form is Form 1120, U.S. Corporation Income Tax Return. Multi-member LLCs taxed as corporations also use Form 1120.

Last but not least, the tax form you must use if you structure as an S Corp is Form 1120-S, U.S. Income Tax Return for an S Corporation.

2. Understand your tax filing deadline

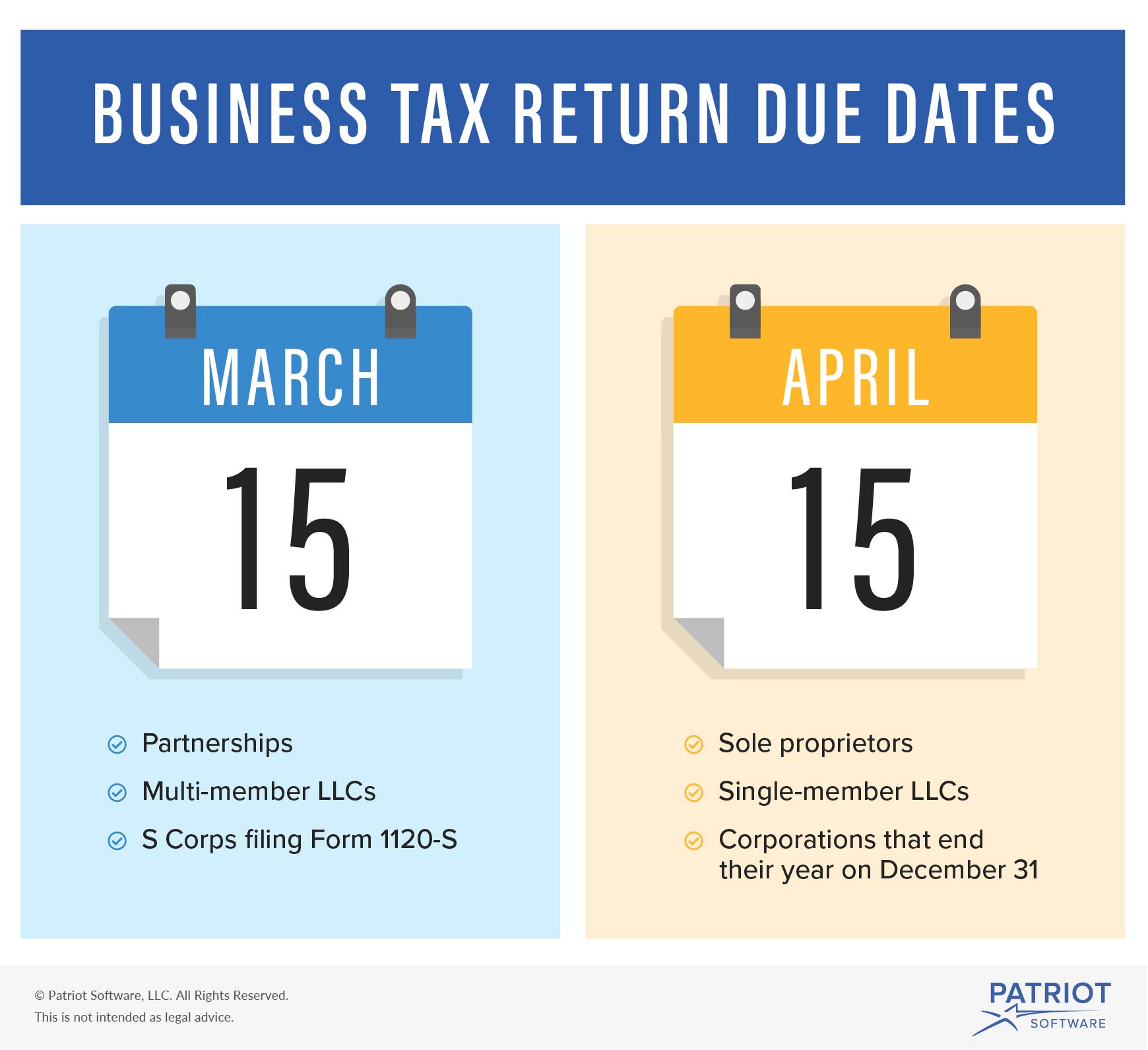

The next step in your small business tax preparation checklist is to know when are business taxes due. Your filing deadline depends on your business structure.

Sole proprietorships, single-member LLCs, multi-member LLCs taxed as corporations, and corporations that end their tax year on December 31 must file by April 15. This is the same due date as personal tax returns.

Partnerships, multi-member LLCs, and S Corps have a tax filing deadline of March 15.

If March 15 or April 15 falls on a weekend or holiday, you have until the next business day to file.

3. Gather and analyze your records

All steps in the small business tax prep checklist are important. But this one is arguably one of the lengthiest, most intricate, and important parts in preparing an accurate tax form.

Filling out tax information isn’t a guessing game. You can’t arbitrarily input income and expenses based on a hazy memory. You need to have hard facts in front of you if you want to complete an accurate return.

Locate your taxpayer identification number. This is essential. How else will the IRS be able to identify your business? Depending on your business structure and whether you have any employees, you may be able to use your Social Security number. Otherwise, you need to use your Federal Employer Identification Number (FEIN).

Next, gather and analyze your balance sheet and income statement. If you use accounting software, generating these reports should be easy to do. Your income statement lists your business’s income, expenses, and bottom line throughout the year. And, your balance sheet shows your assets, liabilities, and equity.

In addition to your financial statements, you need some supporting documents. Gather your receipts, bank statements, credit card statements, and payroll records to back up your work.

Also, be prepared to locate copies of your estimated tax payments. And, find your previous year’s business tax return.

4. Look for tax deductions and credits

Next stop on the tax preparation train is finding out if you qualify for a tax break. Business tax credits and deductions are a great way to lower your tax liability. And depending on your business, you may qualify for a few.

Businesses can claim tax deductions and credits for qualifying expenses. Generally, tax credits encourage businesses to take some sort of action that benefits others (e.g., offering reasonable accommodation).

Take a look at these tax credits you might qualify for:

- Small employer health insurance

- Disabled access

- Work opportunity

And, here are some examples of expenses you might be able to claim a tax deduction for:

- Home office

- Business use of car

- Travel

- Charitable contributions

- Bad debt

Before claiming a credit or deduction, make sure you have the records to back it up. And, you must understand the IRS’s rules. For example, you can’t claim a home office tax deduction unless you meet certain IRS requirements.

5. Deduct estimated tax payments

If you are self-employed, you have to make estimated tax payments to cover your liabilities. Nobody withholds taxes from your wages when you’re self-employed.

Business owners pay estimated taxes quarterly. If you’ve made estimated tax payments throughout the year, you can deduct these from your total tax liability.

That way, you don’t overpay your taxes.

6. Determine if you need a filing extension

Things happen. Maybe you get caught up in other responsibilities and are rushing to file your return.

Instead of putting together something questionable, you may decide to file a business tax extension. A filing extension gives you more time to complete and file your small business tax returns.

If you need an extension on your tax return, you have to submit the IRS extension form before your tax return due date.

Use the chart below to determine what form you need to file and your due date:

Include information about your business and the taxes you owe on the extension application form.

7. Research alternatives if you can’t pay your tax liability

You may need to prepare for a situation where you can’t afford to pay your tax liability in one lump sum.

Although estimated tax payments help, you may have miscalculated your liability and left too much of an expense come tax time. If that’s the case, you must know your options and pursue one that meets your business’s needs.

If you can’t afford to pay taxes in business, the IRS gives you a few options, including:

- IRS installment agreement (monthly payment plan)

- Offer in compromise (tax debt settlement)

- Temporary delay (postpone your payment until your financial condition improves)

Regardless of which tax payment option you pursue with the IRS, you still must file your tax return on time (unless you received a filing extension).

8. Talk to your accountant

Once you’ve assembled all of your records and made some preliminary decisions about which deductions and credits you can claim, it’s time to turn to your accountant.

Your accountant can help verify that your return is accurate. They may also be able to find other deductions or credits you can claim. And, an accountant can help you through the filing process to make sure your return is solid.

9. File away!

At last, you’ve arrived at the very last box to tick off of your small business tax return checklist. After you and your accountant give the green light, it’s time to file.

You can either e-File or paper file your business tax return. E-Filing is a faster process than paper filing, and you receive a quick confirmation that your filing went through.

If you decide to e-File through the IRS’s system, you can make tax payments through the Electronic Federal Tax Payment System (EFTPS).

Want to make tax time easier? Track your expenses and income year-round with Patriot’s online accounting software. Get your free trial now!

This is not intended as legal advice; for more information, please click here.

Leave a Reply