Mistakes happen, especially when it comes to recording transactions in your books. One type of accounting mistake that’s easy to make is a transposition error. Read on to learn what is transposition error and how it can affect your accounting books.

What is a transposition error?

A transposition error in accounting is when someone reverses the order of two numbers when recording a transaction (e.g., 81 vs. 18). This type of accounting error is easy to make, especially when copying down transactions by hand. You might make a transposition error when writing a two-digit number or a string of numbers (e.g., 1835 vs. 1853).

Now that you know what is transposition in accounting, you might wonder where these errors can occur. Transposition accounting might creep into your journal entries, business ledger, financial statements, or invoices. You can also inadvertently flip-flop the numbers of an employee’s wages while writing their paycheck.

Basically, transposition mistakes can occur anywhere you record numbers.

Keep in mind that transposition errors aren’t just limited to accounting books. Businesses can also make these types of errors when writing down a customer’s phone number, address, or sequence of numbers in an email address. Likewise, individuals can make transposition errors.

Accounting mistakes are time-consuming and costly. There are a number of problems that a simple transposition error can lead to, including:

- Inaccurate books

- Overspending

- Paying too much or too little for taxes

- Tax penalties

- IRS audits

Transposition error example

There are many types of accounting errors transposition you can make. Take a look at the examples below to learn how a simple transposition error can affect your small business.

Journal entry error

Let’s say you make a sale on credit to a customer for $1,810. While creating the journal entry, you credit your Sales account $1,810. But, you transpose the numbers and debit your Accounts Receivable account $1,180.

Here’s what your journal entry would look like:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| X/XX/XXXX | Accounts Receivable Sales | Sale made on credit | 1180 | 1810 |

As you can see, the debit and credit are unequal.

Invoicing error

Now let’s pretend you go to invoice the customer for the Accounts Receivable above. You skim over your journal entries and see the $1,180 you accidentally wrote down.

Rather than invoicing the customer for $1,810, you invoice them for $1,180. Can you afford to cover the $630 difference between what you’re owed and what you bill for?

Payroll error

Employers can also make a transposition error when running payroll. Let’s say you reverse the numbers of an employee’s hourly rate while entering information into your payroll software.

The employee’s hourly rate is $21 per hour, but you accidentally enter $12. Not only does this mistake result in lower wages for your employee, but it also leads to costly tax miscalculations.

This is one transposition error that’s going to require retro pay.

Tax form error

There are a number of tax forms where you could make transposition mistakes, including your small business tax returns and payroll tax forms.

Let’s say you are filling out Form 941, Employer’s QUARTERLY Federal Tax Return. You go to write down the wages, tips, and other compensation you paid your staff during the quarter. But instead of writing down $41,935.12, you transpose the numbers and enter $49,135.12.

That simple, easy-to-make transposition error alerts the IRS that your tax deposits don’t match wages paid.

How to find a transposition error

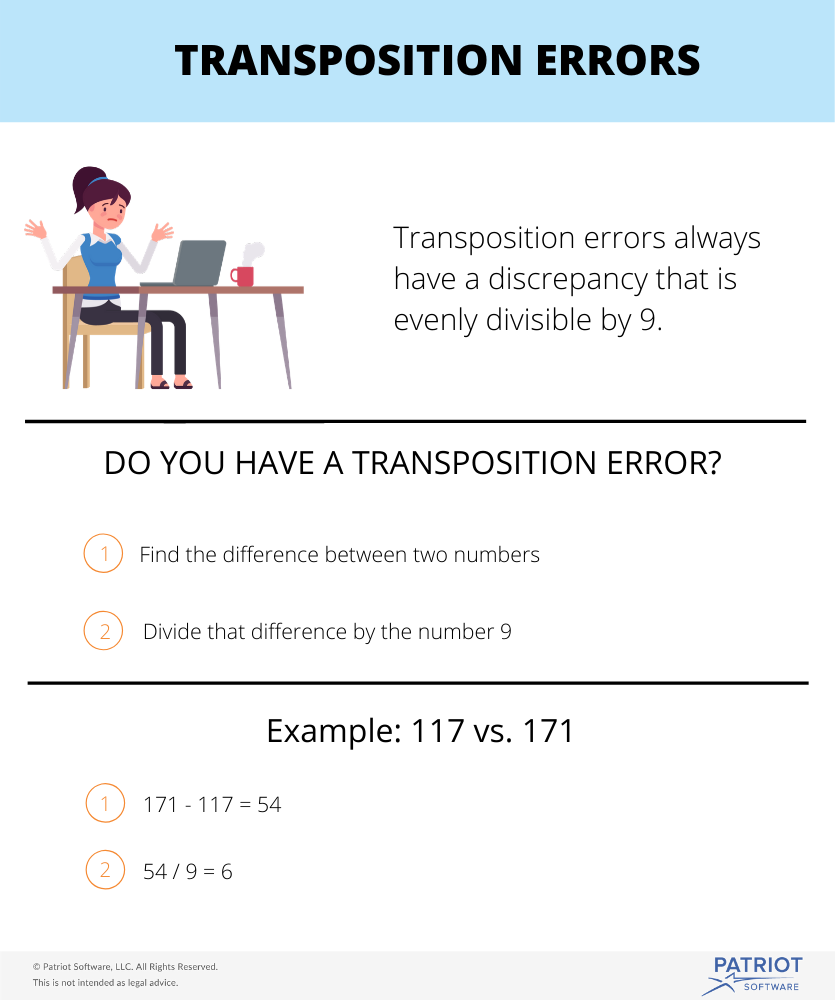

Unlike other accounting mistakes, there’s a simple trick you can use to spot a transposition error. And it all comes down to the number “9.”

But first, let’s take a quick step back and talk about where you can find number discrepancies. You might spot a transposition error in trial balance, when your accounts don’t equal.

A trial balance is a report businesses use to catch accounting errors. Trial balances show whether debits and credits equal one another. If they are unequal, you can go back to your journal entries to find where the error originates from.

Generally, businesses prepare trial balances at the end of each reporting period. But, you don’t need to wait that long to spot a transposition error. If you notice two accounts are unequal, you should take action immediately.

OK, so now let’s get back into the transposition mistake magic “9” identifier. All transposition error discrepancies are divisible by the number 9. If your discrepancy is evenly divisible by the number 9, you may have a transposition error on your hands.

Example

Using the numbers from the above example, you write down $1,180 when you should have written $1,810.

To determine if it’s a transposition error, find the difference ($1,810 – $1,180). You’re left with a discrepancy of $630.

Is it divisible by 9?

$630 / 9 = 70

Yes! The divisible by 9 trick shows that you have a transposition mistake on your hands.

Need a better way to track your business’s money? Patriot’s online accounting software can help. Seamlessly enter balances, record payments, send estimates, and so much more! Why wait until tomorrow? Start your free trial today.

This is not intended as legal advice; for more information, please click here.

Leave a Reply