Edelweiss Finance and Investments Ltd has come out with public issue of non-convertible debentures (NCD) offering up to 10.25% interest rate and opens for subscription from January 23, 2020.

Edelweiss Finance is a non-banking finance company, focused on offering a broad suite of secured corporate loan products, retail loan products which are customized to suit the needs of the corporate, SMEs and individuals.

Edelweiss Finance NCD – Significant Points:

- Offer Period: January 23 to 31, 2020

- Annual Interest Rates for Retail Investors: 9.75% to 10.25% depending on tenure

- Price of each bond: Rs 1,000

- Minimum Investment: 10 Bonds (Rs 10,000)

- Max Investment Limit for Retail Investor: Rs 10 Lakhs

- Credit Rating: “CARE AA-; Stable” and “CRISIL AA-/Stable”

- NCD Size: Rs. 125 Crores with an option to Retain Over-subscription Up to Rs 250 crore

- Allotment: First Come First Serve

- Listing: Bonds would be listed on BSE and will entail capital gains tax on exit through secondary market

Also Read – Know NCD – Investment Tips, TDS and Taxation

Edelweiss Finance NCD – Investment Options:

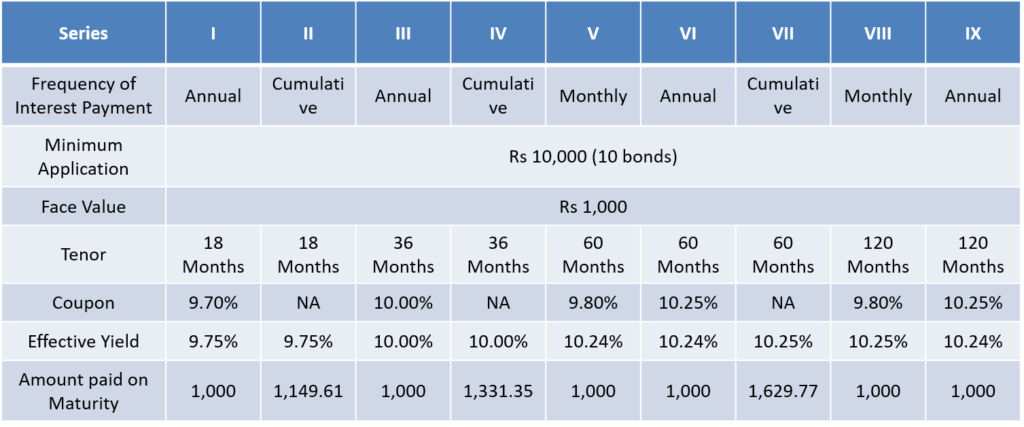

There are 9 options of investment in Edelweiss Finance NCD.

Edelweiss Finance and Investments Ltd NCD – Jan 2020 – Investment options

Company would allot the Series III NCDs, wherein the Applicants have not indicated their choice of the relevant Series of NCDs in the application form.

Edelweiss Finance NCD – Who can Apply?

This issue is open to all Indian residents, HUFs and Institutions.

- Category I – Institutional Investors – 20% of the issue is reserved

- Category II – Non-Institutional Investors, Corporates – 20% of the issue is reserved

- Category III – HNIs – 30% of the issue is reserved

- Category IV – Retail Individual Investors – 30% of the issue is reserved

However NRIs cannot apply for this NCD.

Also Read: 25 Tax Free Incomes & Investments in India

Why you should invest in Edelweiss Finance NCD?

- AA- Credit rating means less likely hood of credit default

- The NCD is secured, which means the above debt is backed by assets of the company

- The interest rate has started to go down, so a good time to lock in high interest rate.

- The interest rates are 2% higher than your regular Bank FDs

- No TDS if invested in Demat Form

Why you should not invest in Edelweiss Finance NCD?

- There have been issues with some well rated companies like DHFL, IL&FS where rating agencies suddenly downgrade the rating. This risk always existed but it has come to forefront in last few months

- There are NCDs available in secondary market which have higher yields with similar rating. The problem is low liquidity and hence is difficult to buy in large numbers.

- The present Tax Free Bonds are offering yields up to 6.5% in secondary market, which is better investment for People in highest tax bracket.

How to Apply for Edelweiss Finance NCD?

You can apply online by ASBA facility provided by banks. It’s the easiest way to apply and also avoids a lot of hassle in terms of KYC and paper work.

In case you don’t want to do it online, you can download the application form from company site or Financial Institutions and submit to collection centers.

Edelweiss Finance and Investments Ltd NCD – Jan 2020

Recommendation:

- My recommendation is to invest some part of your Fixed Income investment in this NCD Issue

- You should always have diversified portfolio be it fixed deposit, NCD or equity investment

- Its good idea to remain invested till maturity because liquidity on exchanges are low and hence you would get lower than market value

Leave a Reply