Sachin Bansal, who acquired microfinance firm Chaitanya India last September after his momentous Flipkart exit, travelled to Jagalur, a small town in Karnataka, recently for a branch visit and decided to check out the competition, a government-owned regional bank.

Jagalur, about 250km from Bengaluru, has a population of 25,000. The regional bank’s offices here were packed that day; Kannada-speaking customers, upset about a problem, were shouting at the 25-year-old branch manager, a Maharashtra native who didn’t understand the local language.

“There were about 100 depositors in that branch, and the manager did not speak Kannada,” said Bansal, using the episode to illustrate the state of banking in rural India.

The central government’s mandate is that 33% of branches of public sector banks should be in rural pockets. But Bansal believes the sector needs fresh ideas to serve these regions more efficiently and at lower costs.

“Regulators understand that existing players may not be able to solve problems and they need new players coming in,” Bansal said.

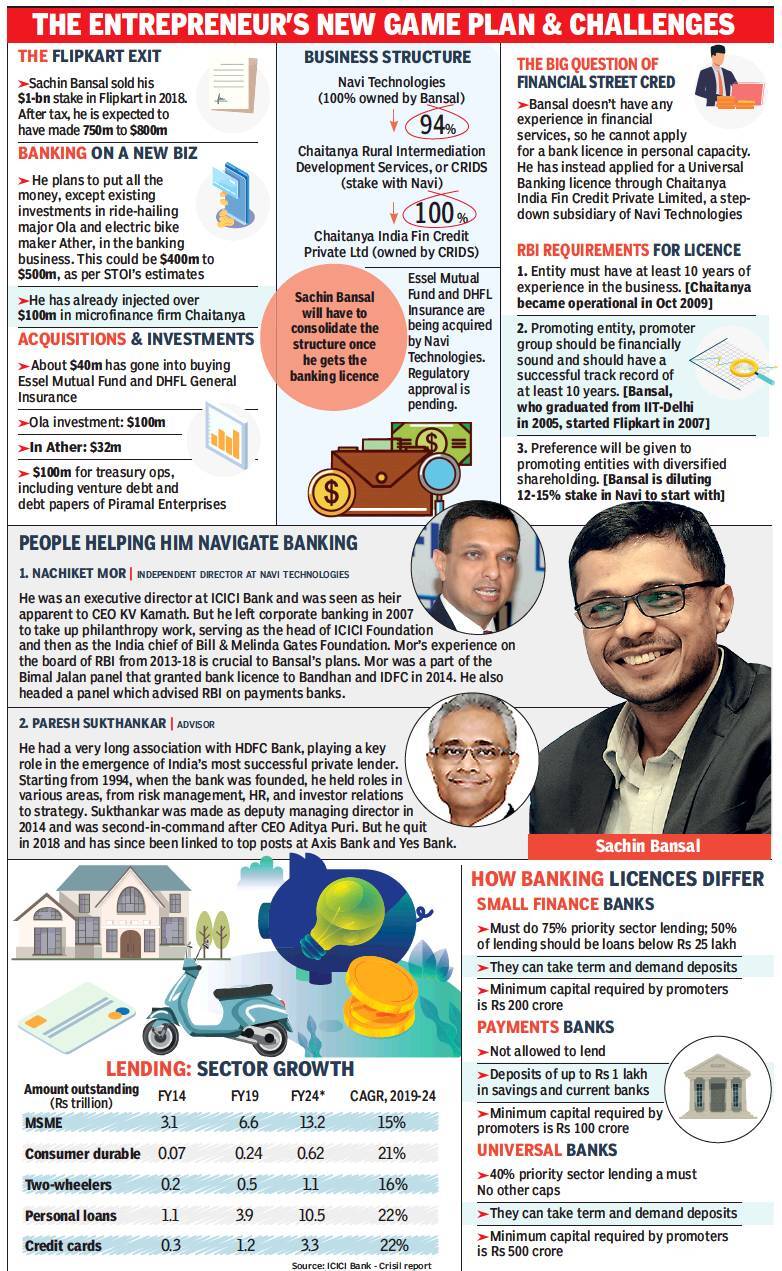

This is not just a broad, detached observation. Bansal, through Chaitanya India, has applied for a banking licence. And this is just the start. The 38-year-old entrepreneur, who built India’s largest online retailer Flipkart and sold his stake to US retail giant Walmart for $1 billion in 2018, is putting nearly all his money into building a digital financial services empire. Can he repeat the success of Flipkart, which had a valuation of $22 billion when sold and is among the top 20 most-valued private companies in India, in a highly regulated sector?

Unfinished business

While the Flipkart exit made Bansal the first billionaire (in terms of cash in hand) in India’s digital economy, it came on a bitter note.

He wanted to continue running the company and make it the first $100-billion valuation digital company; he was also looking to increase his stake, according to reports from 2018. But most investors at Flipkart preferred an exit. Incoming promoter Walmart also wanted to work with Flipkart co-founder Binny Bansal and CEO Kalyan Krishnamurthy, who were running day-to-day operations after Sachin Bansal became the executive chairman in 2016. This had left him “very disappointed” and he felt there was “unfinished business” of creating a mega-billion-dollar, truly Indian company, the Economic Times reported in May 2018, citing sources.

The ambition is clear: to build a modern-day HDFC Bank, India’s largest private sector lender whose market capitalisation hovers close to $100 billion. The approach, however, will be different. Bansal wants smartphones, not branches, to be at the front and centre.

“If you look at building HDFC Bank from scratch with today’s technology and capabilities, it will look very different,” Bansal told STOI at the head office of Navi Technologies, an entity he owns, in Koramangala, Bengaluru. Navi is short for navigator through financial services and also means “new” in Hindi.

“Ultimately we want to become a financial services ecosystem providing all kinds of services,” he said.

Navi is buying Essel Mutual Fund for a foray into asset management and DHFL General Insurance for insurance. Both firms were sold off by Mumbai-based business groups in distress sales as liquidity crunch hits the financial services space. The two deals are awaiting regulatory approval. Bankers tracking the space say neither DHFL nor Essel have significant operations and should be seen as “speedy” licence acquisitions.

Given the trouble in the banking sector, Bansal could have also opted for an acquisition, which may have accelerated the foray. “I think there are corporate governance issues in banks that are available. What you pay for the bank may not be the end of it,” he said, when asked if the merger & acquisition option was considered. “The culture of any organisation takes years to develop and it is hard to change. We would prefer the greenfield route if the RBI allows it.”

First on the agenda is to speed up the lending business. Chaitanya India is working on plans to bring down cash payments in favour of digital transactions and reduce paperwork and travel for both credit officers and customers through technology, which will make the business more efficient. Bansal’s cash infusion in the company has already made an impact. Earlier this month, rating agency ICRA revised Chaitanya India’s outlook to positive and lifted its rating from BBB- to BBB.

Bansal intends to devise a new product under the Navi brand that will focus on the middle class. Chaitanya India, on the other hand, will continue to offer microfinance options to the low-income segment. This way, different brands will serve different segments.

“We saw this in ecommerce: even if the exact same collection was available on Flipkart, people still preferred to shop on Myntra for fashion because the brand appealed to them,” Bansal said.

He didn’t disclose the focus area for Navi, but an ICRA filing reveals that he plans to expand loan portfolio to Rs 3,600 crore by March 2023 from Rs 738 crore as of September 2019. While microfinance portfolio is expected to reach Rs 2,600 crore in this four year period, he will, through Chaitanya Rural, lend another Rs 1,000 crore in consumer, personal, two-wheeler and business loan segments. These are expected to be among the fastest-growing segments in India’s retail loan market (see graphic).

The issue with traditional banks is that they have been built on old technology, as the outage of HDFC Bank’s net banking services for 2-3 days in December showed. “It is not a new app like a PhonePe or Paytm, which were created for the smartphone and which were much faster than bank applications. Banks don’t want to spend as they feel returns might not be that high,” said a banker tracking the space.

Tech entrepreneurs have already shown a lot of interest in the overall banking space. Over half a dozen startups, including Jupiter, Open and Niyo, have raised capital from top investors like China’s Tencent, New York-based Tiger Global and venture firms Sequoia Capital and Matrix Partners. They are, however, building neo-banks by partnering with existing lenders. Paytm Payments Bank, a part of the group which owns the most-valued internet company ($16 billion) in India, will be a major competitor, and it hopes to turn into a small finance bank, as STOI had reported in December.

“There is an opportunity to own new-generation customers, something that many neo-banks and fintech companies are trying to do by carving out a niche,” said TCM Sundaram, managing director at Chiratae Ventures. “Bansal, however, can’t grow this business like ecommerce, as one can end up with high non-performing assets. Since he has said he wants to invest all his capital, he seems to be here for the long haul.”

Navigating regulators

Bansal is aware of the market expectations and is building a business with a 20-year vision. He says that unlike in e-commerce or ride-hailing, bad service in finance can lead to unrepairable and collateral damage, as there is a multi-decade relationship and consumers are more risk-averse. Regulations require banks to go for a public offering within six years of operation, and Indian public markets are not kind to loss-making companies.

“Financial services is not a winner-takes-all business, and regulators are very strong. We need to grow fast but start achieving balanced growth and profitability early, as the confidence of regulators will not be high if you are not profitable,” Bansal said.

His chances of securing a licence are strong, according to about half a dozen fintech founders and executives with regulatory experience. But they said the process would take at least a year and he would have to go through grilling. RBI’s fit-and-proper criteria are quite demanding, and Bansal will have to present a clean record, which will be also scrutinised by the ministry of home affairs. Those aware of the central bank’s thinking said it was keenly watching how digital challenger banks in the UK, where over half a dozen players like N26 and Monzo have been granted licence, are shaping up.

“RBI wants professionals coming forward who have a technological bent and it is not inclined to give licences to business houses,” said a fintech founder, who didn’t want to be named. In 2013, corporate houses like Anil Ambani’s Reliance Capital, L&T, Birlas and Bajaj Group were among the 27 players who applied for licences, which were given to microfinance company Bandhan and infrastructure financier IDFC.

“One of the entry barriers for professionals is coming up with starting capital of Rs 500 crore to Rs 1,000 crore,” said the founder. “But Bansal doesn’t face this issue.”

Bansal is also applying through Chaitanya India, which will give RBI comfort, considering that the last licence issued in personal capacity, to Yes Bank’s Rana Kapoor, has not panned out well. Kapoor’s term ended in early 2019 as RBI didn’t favour giving him a longer rope because of governance and compliance issues. He has sold all his shares in the bank.

“While Bansal has not built a financial services business, he was behind a large consumer business (Flipkart). The sanctity of capital is critical. He seems clean on that count and his investments in Ola and Ather are not classified as promoter bets,” a senior banker said, who has previously advised tech companies on banking licences.

Industry experts say Bansal’s decision to rope in former RBI director and ICICI Bank executive Nachiket Mor as an independent director will inspire confidence among regulators examining Bansal’s application. He has also brought on board Paresh Sukthankar, a former deputy to HDFC Bank CEO Aditya Puri.

Bansal’s bid to enter the banking space comes at a sensitive time: RBI’s plate is full as it deals with a slowing economy, management of high non-performing assets and consolidation of public sector banks. The factors may have an impact, according to the experts.

“Though Bansal’s application won’t be turned down because of these issues, they can increase the timeline,” said AP Hota, former RBI executive and managing director of National Payments Corporation of India. “Just because large players are there, it would be wrong to presume there is no space for new entrants. In a digital world, you never know who will come out with a brilliant product.”

Leave a Reply