Kisan Vikas Patra (KVP) is a deposit scheme by Government of India and available in all the post offices & major banks across country. KVB was launched in 1988 to encourage savings and financial discipline with a focus on farmers and hence the name. It was discontinued briefly since 2011 and relaunched in 2014. In case of KVB, the investor deposits the money and gets back double of the same at the time of maturity. For e.g. if the deposit is made for Rs 5,000 he would get back Rs 10,000 at the time of maturity.

KVP – Investment Rules

- The minimum investment limit is Rs 1,000

- There is NO upper limit for investment in KVP

- Aadhar number is compulsory for investing in KVP

- PAN card is required if the investment is more than Rs 50,000

- In case the deposit is more than Rs 10 Lakhs, investors need to submit income proof like Salary slips, bank statement, Income tax return, etc

- KVP is available in denominations of Rs. 1000, Rs. 5000, Rs. 10,000 and also Rs. 50,000 for investment.

Download: Free ebook for Income Tax Planning for FY 2019-20

Who can Invest in KVP?

- Any Indian citizen with age of more than 18 years can buy Kisan Vikas Patra.

- A parent/guardian may also invest on behalf of a minor.

- KVB can also be purchased in joint name

- HUFs and NRIs are not eligible to buy KVP. However trusts can buy

KVP Post Office

KVB – Features

Sovereign Guaranteed: KVP is part of “Small Savings Scheme” like PPF, SCSS, etc and is guaranteed by Government of India. This means full safety of capital.

Guaranteed returns: The maturity amount and period are fixed. The interest rate is fixed through the entire duration of investment.

Taxation: The interest income is fully taxable and taxed at your marginal income tax rates.

TDS: There is NO TDS (Tax Deducted at Source) for KVP

Tax Benefit: There is NO tax benefit on purchase of KVP

Also Read: Best Tax Saving Investments u/s 80C

Loan against KVP: Banks give loan against KVP certificates. These loans are cheaper than personal loans.

Nomination Facility: You can fill the relevant nomination form and submit it to the relevant post office.

Transfer: KVP can be transferred from one post office to another and also from one person to another.

KVP Certificate Issuance: In case of cash payment the KVP certificates are issued immediately. For Cheque or demand draft the certificates are issued after the clearance.

KVP Identity Slip: along with the KVP certificate a KVP identity slip is also issued to investors. This includes the the KVP serial number, the amount, the maturity date and the amount to be received on the date of maturity.

KVP Maturity Period:

Interest Rate: Government of India declares the interest rates every quarter. The interest rates for Jan to Mar 2020 is 7.6% compounded annually

Maturity Period: Depending on the interest rate the maturity tenure changes as its dependent on the months it takes to double the money. For Jan to Mar 2020 the maturity tenure is 113 months with interest rate of 7.6%

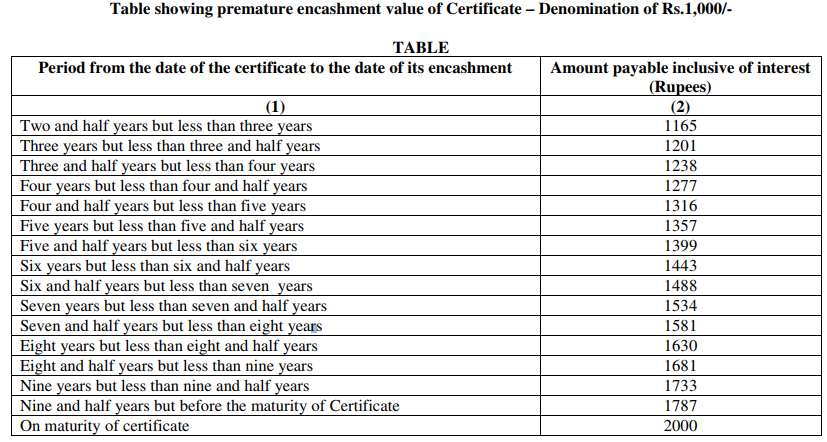

KVP Premature Withdrawal before Maturity: KVP has lock-in of 30 months from the date of investment which means you cannot withdraw before 30 months (Two and half years). After that premature withdrawal is allowed.

The table below shows the value for Rs 1,000 KVP certificate.

Premature encashment value of KVP Certificate

Also Read: PPF – A Must Have Investment

How to Invest in KVP?

The investment process of KVP is still offline. You need to visit the post office/bank and submit filled Form A.

- For the KYC process you need to submit ID proof copy (PAN, Aadhaar, Voter’s ID, Driving License or Passport)

- On verification, KVP certificates are issued to the investor.

- You should handle KVP certificates carefully as that would be required while redeeming the same on maturity.

Also Read: NSC – Tax Benefit, Interest Rates & more

Should you invest in KVP?

I have listed the pros and cons for KVP below:

KVP – The good thing:

- Safe: KVP is part of “Small Savings Scheme” like PPF, SCSS, etc and is guaranteed by Government of India. This means that there is no chance of losing capital and its safe.

- Loan: can be used as collateral for securing loans

- Higher Interest Rate: As of today, SBI is offering 6.85% (compounded quarterly) for 10-year fixed deposit as compared to 7.7% by KVP (compounded annually

Also Read: Highest Interest Rate on Bank FD – updated every month

KVP – The bad part:

- Physical Investment: You need to visit post office physically for investment or redemption. There is no online option available.

- Paper Work for Transfer, Redemption: As its offline process you still need to do paperwork in case you want to transfer KVP from one bank/post office to other.

- Fixed Deposit Tenure: The tenure of KVP is fixed – it’s the time it would take to double the money at offered interest rates. In case of Bank FD you can select tenure as per your wish.

Invest in KVP if you are looking for sovereign guarantee and slightly higher rates than government banks offer. However, do remember that you do not have flexibility selecting your tenure.

Leave a Reply